ASX Small Cap Lunch Wrap: Markets on ice ahead of RBA’s big rates decision

Via Getty

Aussie markets are treading water on Tuesday morning ahead of the Reserve Bank of Australia’s interest rate decision this arvo.

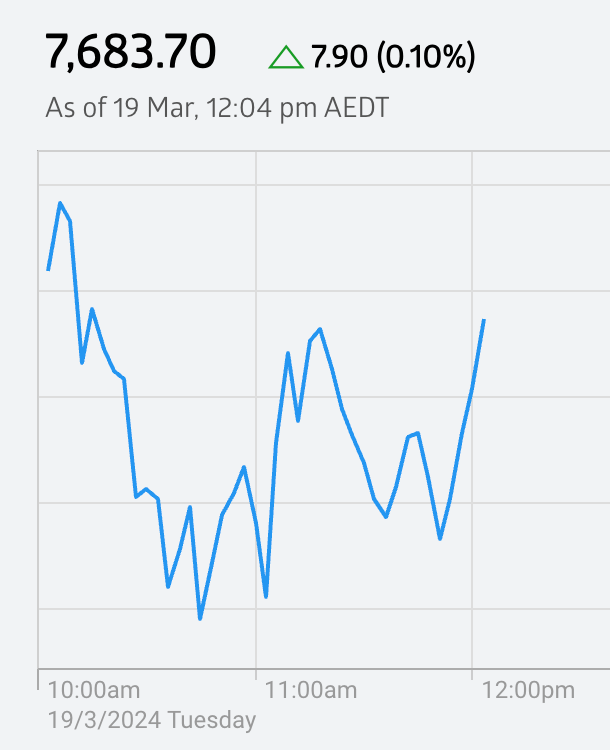

At 12pm (AEDT) on Tuesday, March 19, the S&P/ASX 200 was thus:

The RBA and the Bank of Japan (BoJ) drop their cash rate decisions this afternoon.

The RBA is expected to keep rates steady. It’ll drop the policy decision at 2.30pm Sydenham time.

RBA Guv’nah M. Bullock will get chatty at a press conference an hour afterwards at 3.30pm AEST.

eToro analyst Josh Gilbert says markets still see June as the first meeting when the RBA is likely to cut interest rates for the first time in 2024.

“This meeting will be the last meeting until May, and before then, the RBA will receive a wealth of data, including February and March monthly inflation indicators, as well as the all-important Q1 figure.

“That pens May as the meeting where we may begin to hear some softening in the language from the RBA, given a cut may be just around the corner. The board’s hiking cycle is having evident effects on the Australian economy, and that’s why markets are penning June for the first cut.”

Then there’s the Federal Reserve’s two-day policy Federal Open Market Committee meeting which begins tonight in New York and ends with the chair’s announcement Wednesday.

The ASX…

The Big Four banks are mixed ahead of the RBA decision.

The CBA is the laggard, down 0.2%.

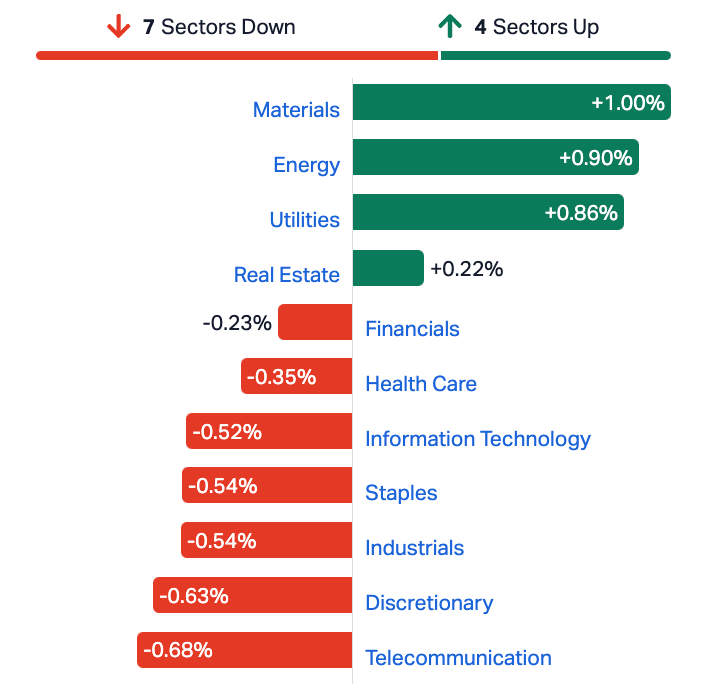

Materials is the best peformer – the iorn ore trio are all ahead over 1% after iron ore prices rallied over 4% to finish back above $100 per tonne.

On Monday, China reported stronger-than-expected numbers for retail and fixed asset investment for the first two months of 2024.

The other notable move on Tuesday morning was from the very small capped local telco and cloud gaming outfit Pentanet (ASX:5GG) which doubled down on its landmark partnership with artificial intelligence beauty queen Nvidia (NVDA) after soaring on Friday when it extended to New Zealand the relationship with the world’s fourth-largest company.

On Friday Pentanet jumped 80% on that announcement and this morning the Perth-based scale-up revealed further details of NVDA’s role in the company’s infrastructure model and cloud gaming tech – GeForce NOW (GFN).

GFN reportedly sidesteps the usual expensive gaming hardware helping gamers to use supported titles in the cloud, streaming gameplay directly from the company’s RTX Blade Servers.

This morning, the resources corner of the benchmark drove gains.

Local sectors at 12pm on Tuesday

Not the ASX…

Wall Street moved higher on Monday in New York, with optimistic money flowing back into the big tech names.

Nvidia is wowing traders at its headline artificial intelligence conference while anxiety simmers for later in the week, when the Fed outlines the next month of monetary policy.

The Dow Jones Industrial Average climbed 0.2%.

The S&P500 added 0.6%, and the tech heavy Nasdaq Composite found 0.8%.

Most US sectors ended higher overnight, with Comms Services jumping 3%.

Real Estate and Energy were the worst on field.

In the states, retail sales rose 5.5% and industrial production was up 7%, both beating analysts’ expectations and reaffirming the brute strength of the US economy.

Nvidia shares gained 1.3% on day 1 of its GTC Conference where CEO Jensen Huang is presenting the keynote speech.

Shares in Alphabet jumped 5% following news that Apple was conspiring with Google to include its Gemini AI in Apple’s iPhones.

Still there’s hesitation on Wall Street after February’s slightly toasty US CPI and PPI inflation reads put the pause on US equities and brought us back the fear and jittery central bank watching of last year.

At halftime in Sydney, US futures are mixed.

ASX small cap winners

Here are the best performing ASX small cap stocks for March 19 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DVL | Dorsavi Ltd | 0.024 | 60% | 54,512,916 | $8,949,924 |

| ADX | ADX Energy Ltd | 0.155 | 35% | 8,721,319 | $49,315,806 |

| AN1 | Anagenics Limited | 0.015 | 25% | 150,000 | $5,029,594 |

| ESR | Estrella Res Ltd | 0.005 | 25% | 58,284 | $7,037,487 |

| OSX | Osteopore Limited | 0.066 | 23% | 4,000 | $554,031 |

| CLU | Cluey Ltd | 0.086 | 23% | 34,888 | $14,112,950 |

| ANX | Anax Metals Ltd | 0.024 | 20% | 427,940 | $10,848,959 |

| SIS | Simble Solutions | 0.006 | 20% | 319,166 | $3,495,195 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 50,000 | $20,650,533 |

| CLA | Celsius Resource Ltd | 0.0155 | 19% | 10,639,063 | $29,198,672 |

| HXG | Hexagon Energy | 0.02 | 18% | 1,885,981 | $8,719,570 |

| AML | Aeon Metals Ltd. | 0.007 | 17% | 71,500 | $6,578,404 |

| AYT | Austin Metals Ltd | 0.007 | 17% | 922 | $7,711,148 |

| EPM | Eclipse Metals | 0.007 | 17% | 1,151,479 | $12,450,325 |

| OAU | Ora Gold Limited | 0.007 | 17% | 158,080 | $34,440,005 |

| GLV | Global Oil & Gas | 0.029 | 16% | 15,195,558 | $13,933,342 |

| ASP | Aspermont Limited | 0.015 | 15% | 1,035,000 | $31,923,251 |

| KOR | Korab Resources | 0.008 | 14% | 1,663 | $2,569,350 |

| PEC | Perpetual Res Ltd | 0.008 | 14% | 1,342,177 | $4,480,206 |

| FLN | Freelancer Ltd | 0.2 | 14% | 102,070 | $78,910,104 |

| APL | Associate Global | 0.08 | 14% | 22,733 | $3,954,470 |

| RAC | Race Oncology Ltd | 1.77 | 14% | 342,573 | $254,960,723 |

| E25 | Element 25 Ltd | 0.25 | 14% | 326,160 | $47,856,674 |

| MIO | Macarthur Minerals | 0.11 | 13% | 18,000 | $16,126,588 |

| ATH | Alterity Therap Ltd | 0.0045 | 13% | 446,939 | $20,952,072 |

Back to Pentanet (ASX:5GG), which just told the market that it’s been working with US AI-darling Nvidia (NVDA) to upgrade its Gen 3 cloud infrastructure with NVDA’s L40 GPUs, to bring Pentanet into the NVIDIA Graphics Delivery Network (GDN).

GDN’s already available in some 130 countries and 5GG says it taps directly into Nvidia’s global cloud-to-edge streaming infrastructure “to deliver smooth, high-fidelity, interactive experiences.”

According to Pentanet’s MD, Stephen Cornish, becoming part of NVIDIA GDN will help expand 5GG’s compute capabilities beyond just GeForce NOW cloud gaming (GFN) and enable it to “take advantage of additional industrial and commercial opportunities with its NVIDIA cloud infrastructure.”

“Joining the NVIDIA global Graphics Delivery Network will open a pathway to new commercial opportunities beyond gaming. The L40 GPU infrastructure brings the most advanced NVIDIA RTX capabilities to help power next-generation graphics and 3D interactive experiences.”

Aussie Tanzanian-focused graphite developer Black Rock Mining (ASX:BKT) has confirmed it now has the key approvals in place for the US$153m in debt facilities required to develop the Mahenge Graphite Project.

BKT says it’s received the key approvals for US$40m in facilities from Tanzanian lender CRDB, comprising a US$20m working capital facility and a US$20m cost overrun facility.

“Several other Tanzanian lenders have also expressed interest in participating in these facilities but are yet to receive credit approval and discussions are ongoing,” the company says.

“Ultimately, funding for the Project to reach production will require both debt and equity.”

According to a 4th September BKT announcement, Black Rock signed an MOU with its Strategic Alliance Partner, POSCO International Corporation (POSCO) for a potential cornerstone equity position in Black Rock of up to US$40m and final approvals for this investment are expected near term.

The Company is targeting first production from Module 1 in 2026.

ASX small cap losers

Here are the most-worst performing ASX small cap stocks for March 19 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 10,200 $11,649,361 JAV Javelin Minerals Ltd 0.001 -50% 207,851 $4,352,462 AOA Ausmon Resorces 0.002 -33% 459,968 $3,176,998 BP8 Bph Global Ltd 0.001 -33% 500,000 $2,931,174 SIH Sihayo Gold Limited 0.001 -33% 13 $18,306,384 AUK Aumake Limited 0.003 -25% 1,501,227 $7,657,627 PIQ Proteomics Int Lab 0.985 -21% 713,297 $163,615,770 MXO Motio Ltd 0.023 -21% 97,032 $7,777,752 AEE Aura Energy 0.175 -20% 1,420,086 $130,346,627 PRX Prodigy Gold NL 0.004 -20% 227,335 $8,755,539 TMK TMK Energy Limited 0.004 -20% 924,634 $30,612,897 VAL Valor Resources Ltd 0.002 -20% 38,810 $11,472,533 OZM Ozaurum Resources 0.0595 -18% 942,577 $11,588,750 STG Straker Limited 0.355 -18% 57,651 $27,987,595 NVO Novo Resources Corp 0.14 -18% 265,800 $14,918,270 BIM Bindimetalslimited 0.1 -17% 184,059 $3,471,300 KGD Kula Gold Limited 0.0075 -17% 501,028 $4,162,157 INP Incentiapay Ltd 0.005 -17% 190,147 $7,463,580 ASH Ashley Services Grp 0.22 -15% 534,843 $37,433,735 HPR High Peak Royalties 0.05 -15% 10,000 $12,275,523 CTQ Careteq Limited 0.017 -15% 2,602,914 $4,710,946 RTG RTG Mining Inc. 0.017 -15% 750,957 $21,702,690 1TT Thrive Tribe Tech 0.023 -15% 34,898 $8,008,781 AHN Athena Resources 0.003 -14% 3,249,938 $3,746,636 BCK Brockman Mining Ltd 0.025 -14% 8 $269,126,732

In case you missed it

Dateline Resources (ASX:DTR) has been buoyed by the findings of an independent study which determined the zircons at its Colosseum project in California were “indistinguishable” from those at the nearby Mountain Pass rare earths mine.

A zircon ageing analysis completed by the United States Geological Survey found the Colosseum zircons have much lower uranium and thorium content (~20-50ppm each) than the Mountain Pass zircons (~100-800ppm uranium and 100-1,400ppm thorium).

Dateline is currently focused in drilling the gold deposit at Colosseum, about 10km from Mountain Pass, but continues to progress planning and studies on the project’s rare earth potential.

Impact Minerals (ASX:IPT) has formally signed an agreement to sell up 75% of its non-core Commonwealth gold project in New South Wales to upcoming IPO company Burrendong Minerals.

The transfer of an initial 51% interest of the project is conditional on Burrendong completing its proposed IPO and listing on the ASX within nine months of signing the share sale and purchase agreement. Other terms include Impact being issued not less than 12.5% of the issued capital in the new float.

Burrendong will be able to acquire a further 24% interest in the project by spending $5 million on exploration within 36 months of the agreement being completed, or a decision to mine is made by the unincorporated joint venture.

With its focus now on developing the Lake Hope HPA project in Western Australia, Impact is also fielding interest from a number of parties for its Broken Hill project.

Godolphin Resources (ASX:GRL) has received a $585,000 tax refund for R&D activities at its Narraburra rare earths project in central-west NSW.

Metallurgical programs completed during FY2023 were considered eligible expenditure under the Australian Government’s Research & Development Tax Incentive.

Godolphin plans to deploy the new funds into additional work at Narraburra, as well as the company’s other rare earths prospects.

At Stockhead, we tell it like it is. While Dateline Resources, Godolphin Resources and Impact Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.