ASX Small Cap Lunch Wrap: Local markets limp as Delta and Voltaic make lithium love at Ti Tree

Via Getty

Australian markets have taken the panic and run with it on Monday morning. Wall Street scuttled itself during the Friday session in New York and local traders have had all weekend to think about their first move.

At 12pm on Monday, March 11, the S&P/ASX200 was down 115 points, or 1.56%, to 7,734.

But first…

I don’t mind giving the ABC a plug. And I also generally support Queenslanders and their God given right to scare the rest of us.

Both are after all, the home of Bluey.

Aunty knows news and Queensland knows so much the rest of us don’t.

For example, this startling nugget of information every Australian should be aware of:

Crocodiles – those great big cold blooded reptiles with nary a hair between them, actually “hock up hairballs – or bezoars as they’re known – with just as much abandon as does your furry domestic feline.

“And a handful of Queenslanders collect them,” the ABC tells us, before introducing Marc McC, below.

Mr McConnell described his first bezoar as a “tight mat of feral pig and wallaby hair” — but the fantastic news is there can apparently be an almost endless variation in the bezoar composition.

Here’s one…

Ye gads.

Here’s another one.

Being of sound mind and body, I also happen to know that Ox bezoars (niu-huang 牛黃)) are used in Chinese medicine for all sorts of fun and to treat all sorts of diseases, allegedly remove toxins from the body.

And there are definitely no current tariffs on crocodile bezoars…

The ASX…

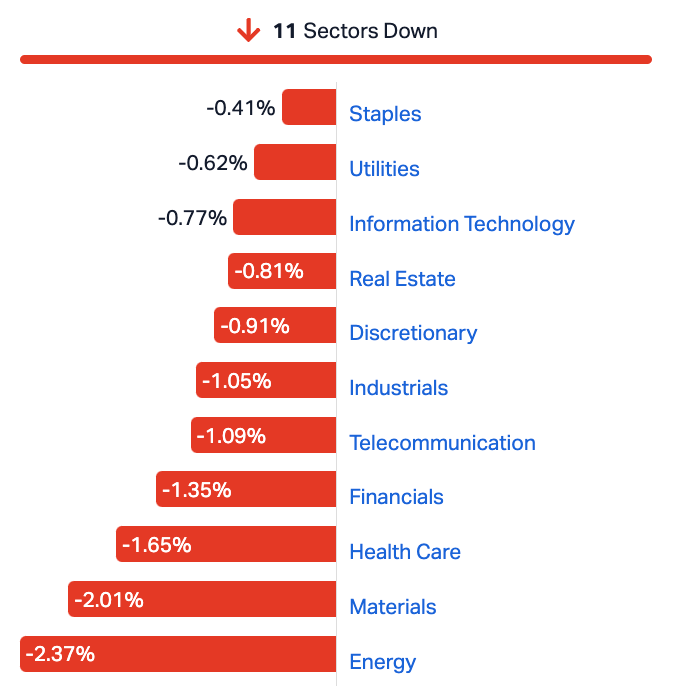

All 11 ASX sectors are lower at lunchtime.

Energy, Materials and Healthcare were way out front leading the bleeding.

The goldies aren’t doing badly – in fact Newmont Corporation (ASX:NEM) looks like it’s the strongest in blue chip land on a dark day for the top 200 Australian companies so far.

Iron ore lifted briefly over the weekend but has given away those gains on Monday as price gains continue to be capped by atepid and uncertain Chinese steelmakers market amidst a broader, incremental downstream demand recovery.

Brent crude was down 1.3 per cent to $US81.86 a barrel with Meridian (ASX:MEZ) among the worst of the local energy names down almost 10% at lunchtime.

This week’s local economic calendar is economic-lite flavoured.

We’ve the NAB Business index survey thingy and then daylight.

Last month (January), the NAB Business Confidence index increased to 1.

“Business Confidence remains subdued but is expected to rise as the focus shifts towards RBA rate cuts during the second half of 2024, and inflationary cost pressures continue to ease.”

Ok.

Sectors at midday on Monday

I’m going Ex-Dividend (so are these stocks)…

Adairs (ASX:ADH) is paying 5 cents fully franked

Consolidated Operations Group (ASX:COG) is paying 4 cents fully franked

Coronado Global Resources (ASX:CRN) is paying 0.5348 cents fully franked

CSL (ASX:CSL) is paying 182.5713 cents unfranked

Dusk Group (ASX:DSK) is paying 2.5 cents fully franked

Generation Development Group (ASX:GDG) is paying 1 cent 50 per cent franked

Joyce Corporation (ASX:JYC) is paying 11 cents fully franked

Perpetual (ASX:PPT) is paying 4 cents fully franked

Ramsay Health Care (ASX:RHC) is paying 40 cents fully franked

Seven Group Holdings (ASX:SVW) is paying 23 cents fully franked

Turners Automotive Group (ASX:TRA) is paying 5.6286 cents 85 per cent franked

Not the ASX…

Wall Street finished a choppy week with a few less fingers after a very choppy Friday session which featured Nvidia (NVDA) shedding circa US$130bn in market cap.

The all-consuming artificial intelligence darling dropped more than 5% in its worst session since late May.

But don’t shed a tear, Nvidia still finished up more than 6% for the week and despite Friday’s losses is still about US$1 trillion more valuable than it was on New Year’s Eve.

Nvidia dragged and Apple rose.

The former tech darling finally snapped its longest losing streak since almost 2021 with a 1% gain, ending seven sessions of losses.

Don’t laugh, APPL still lost 5% last week – the standout loser on the 30-stock Dow.

The jobs report was mixed for US traders on Friday. The American economy added a stonking 275K jobs in February, wowing analyst estimates of just circa 190K.

But then conflicting signals emerged with the unexpected rise in the unemployment rate to 3.9%, lighter-than-feared wage growth, and a downward revision of January’s job growth, potentially indicating a cooling inflation rate that might influence the Federal Reserve’s decision on interest rate cuts.

For the week, the Nasdaq slipped 1.2%, while the Dow Jones and S&P500 fell 0.9% and 0.3%, respectively.

The 30-stock Dow is still the laggard, down 0.11%.

The jobs report showed enough elements of moderation to keep intact for new expectations of three Fed rate cuts this year, in line with the Fed’s dot plots, says IG markets analyst Tony Sycamore.

“However, whether the Fed dots continue to show three rate cuts in the Fed’s March SEP will likely come down to Tuesday’s CPI report.”

Tony says the expectation is for headline CPI to rise by 0.4% MoM in February, which would see the annual rate remain stable at 3.1%.

“Core CPI is expected to rise by 0.3% MoM, which would see the annual rate cool to 3.7%. If the CPI number is much hotter than outlined above, there is a good chance that three dots could become two dots (cuts).”

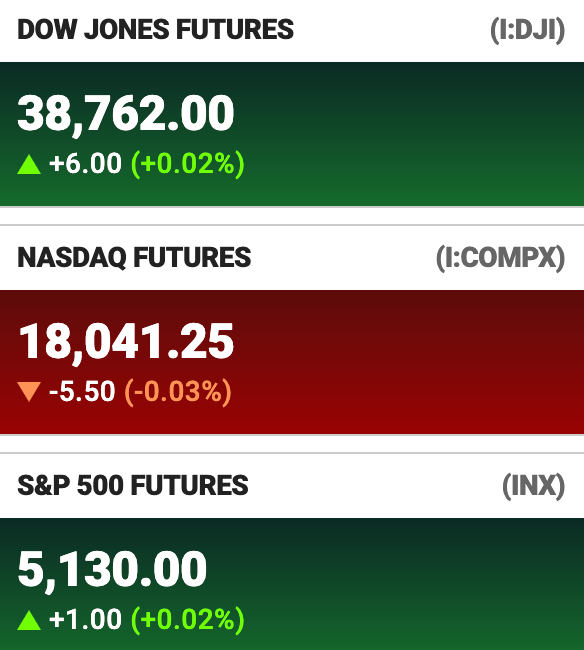

US Futures aren’t giving away too much on Monday at lunch in Sydney:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 11 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap TSK Task Group Holdings 0.77 93% $7,043,610 $142,515,309 RR1 Reach Resources Ltd 0.0035 75% $49,373,817 $6,420,594 AHN Athena Resources 0.004 33% $379,907 $3,211,403 IS3 I Synergy Group Ltd 0.012 33% $1,678,276 $2,736,723 MCT Metalicity Limited 0.0025 25% $400,000 $8,970,108 NAE New Age Exploration 0.005 25% $400,000 $7,175,596 BTN Butn Limited 0.12 24% $27,850 $17,752,804 1TT Thrive Tribe Tech 0.027 23% $990,839 $6,525,673 REZ Resourc & En Grp Ltd 0.011 22% $338,335 $4,498,252 LGM Legacy Minerals 0.17 21% $22,222 $14,763,700 OLH Oldfields Holdings 0.12 20% $206,519 $19,975,595 TX3 Trinex Minerals Ltd 0.006 20% $1,000,000 $7,435,123 NYR Nyrada Inc. 0.095 19% $5,854,053 $12,480,696 CR1 Constellation Res 0.13 18% $60,000 $5,489,597 NGS NGS Ltd 0.013 18% $819,814 $2,763,501 SPQ Superior Resources 0.013 18% $7,214,293 $22,013,425 AML Aeon Metals Ltd. 0.007 17% $40,000 $6,578,404 EXL Elixinol Wellness 0.007 17% $664,184 $3,797,230 HLX Helix Resources 0.0035 17% $125,286 $6,969,438 G50 Gold50Limited 0.1 16% $16,775 $9,398,940 ANR Anatara Ls Ltd 0.036 16% $266,685 $5,204,706 MAG Magmatic Resrce Ltd 0.072 16% $2,241,250 $18,952,953 SHN Sunshine Metals Ltd 0.015 15% $2,310,680 $15,912,110 TRE Toubani Res Ltd 0.115 15% $80,000 $13,386,567 CRS Caprice Resources 0.023 15% $30,000 $4,468,406

Up and at ’em early is Task Group Holdings (ASX:TSK) where the stock is off and soaring as it price doubles after local retail-tech player gave a consenting nod to a $310m takeover from US firm PAR Technologies.

PARTech has lobbed an 81c a pop offer at TSK which is easily double its closing price of just under 39c on Friday last week.

The US bid values Task at $140.7m.

TASK shares jumped out of the blocks this morning when the news dropped and are almost skirting the offer price.

PARTech meanwhile, has offered TASK investors two options: an all cash offer of 81 cents or a 50% scrip alternative, which implies an equity value of $343m.

The agreement isn’t the first US takeover to come Task’s way. Four years earlier a deal fell through as COVID took over, but this time TSK’s board looks to be taking no risks – unanimously recommending it to shareholders “in the absence of a superior proposal.”

And we’ve got a bit of Aussie semiconductor action on Monday with Archer Materials (ASX:AXE) revealing it has designed a miniaturised version of its Biochip graphene field effect transistor (“gFET”) chip.

“The Archer Biochip contains a sensing region of which the gFET is the core component. Each gFET chip contains multiple gFETs, each of which is a transistor, which acts as a sensor,” the company says.

Archer says it’s miniaturised the total chip size by redesigning the layout of the circuits creating these gFET transistors.

“The new miniaturised design has been sent to a foundry partner for a whole-wafer fabrication of reduced size gFET chips, which Archer intends to integrate with other parts of the Biochip technology.”

Magmatic Resources (ASX:MAG) is still soaring after executing a Farm-in and Joint Venture agreement with FMG Resources on Friday – they’re a wholly owned subsidiary of Fortescue (ASX:FMG).

The new best buds plan to explore the Myall Project in central west NSW which consists of a contiguous 244km2 tenement covering the northern extension of the Junee-Narromine Volcanic Belt.

“The project hosts significant porphyry-associated copper-gold mineralisation within a similar geological setting to the Northparkes copper-gold mine 50km to the south,” the company says.

Finally, big news on the lithium front as Voltaic Strategic Resources (ASX:VSR)and Delta Lithium (ASX:DLI) have joined forces to go hard at in the next phase of exploration at Ti Tree Lithium Project, ”through a significant and strategic $12 million Farm-in and Joint Venture“.

Voltaic says the executed agreement is binding and follows a period of due diligence already undertaken by Delta.

CEO Michael Walshe told the ASX on Monday that entering a “mutually advantageous strategic partnership with Delta Lithium is an excellent outcome for both companies.”

Walshe says Voltaic will receive an immediate payment of $1.25 million that further bolsters its “already robust proforma cash reserves” to more than $7m.

“This enables Voltaic to undertake considered and cost-effective exploration at the Paddys Well and Meekatharra projects and provides a platform to pursue transformative growth opportunities.

Delta has already advanced Yinnetharra, completing >115,000m of drilling and delivery of a significant maiden resource within just over a year since acquiring it.

“This transformative deal positions Voltaic for substantial near-term project development catalysts, and leveraging Delta’s robust balance sheet, offers a significantly de-risked route to production and cashflow.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 8 March [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% $200,000 $11,649,361 VPR Volt Power Group 0.001 -50% $32,739 $21,432,416 NAG Nagambie Resources 0.014 -44% $3,596,428 $19,915,892 FAU First Au Ltd 0.002 -33% $1,000,000 $4,985,980 LRL Labyrinth Resources 0.004 -33% $1,870,619 $7,125,262 MRD Mount Ridley Mines 0.0015 -25% $995,624 $15,569,766 NES Nelson Resources. 0.003 -25% $4,285,277 $2,454,377 EXT Excite Technology 0.007 -22% $71,348 $11,963,176 EDE Eden Inv Ltd 0.002 -20% $14,020 $9,195,678 ROG Red Sky Energy. 0.004 -20% $1,100,249 $27,111,136 VML Vital Metals Limited 0.004 -20% $383,293 $29,475,335 88E 88 Energy Ltd 0.005 -17% $14,203,539 $150,744,375 AQX Alice Queen Ltd 0.005 -17% $69,469 $4,145,905 ABE Ausbondexchange 0.026 -16% $52,405 $3,492,712 DXN DXN Limited 0.021 -16% $1 $4,622,234 CKA Cokal Ltd 0.08 -16% $753,699 $102,500,153 NFL Norfolkmetalslimited 0.11 -15% $207,517 $4,611,007 LSA Lachlan Star Ltd 0.046 -15% $68,100 $11,208,953 DBO Diabloresources 0.018 -14% $634,789 $2,164,500 1MC Morella Corporation 0.003 -14% $63,208 $21,625,798 BME Blackmountainenergy 0.006 -14% $135,063 $2,682,569 RNX Renegade Exploration 0.007 -13% $1,480,224 $8,013,790 CPM Coopermetalslimited 0.28 -13% $1,091,642 $25,073,808 HAV Havilah Resources 0.15 -12% $49,908 $53,828,666 ICU Investor Centre Ltd 0.015 -12% $88,000 $5,154,367

ICYMI at midday

Sunshine Metals (ASX:SHN) has resumed drilling at the Liontown prospect, near Charters Towers in North Queensland, where it is targeting footwall extensions of the pumice breccia horizon east of the Main Feeder Zone and into the ~400m-long Gap Zone.

Nine RC/diamond holes will be drilled across ~250m of strike in the Gap Zone where only two gold-focused holes have previously been drilled into the footwall, returning 1.75m @ 16.4g/t gold and 6.3% copper and 6.4m @ 3.2g/t gold.

High-grade gold was previously confirmed via recent drilling into the 1.6km Liontown footwall proximal to the interpreted feeder fault zones.

Best results include 17m @ 22.1g/t gold, 8m @ 11.7g/t gold and 0.9% copper, 8.1m @ 10.7g/t gold and 2.6m @ 15.3g/t gold and 2.3% copper.

According to SHN managing director Damien Keys, the 1.6km gold-copper- rich footwall at Liontown was last a focus when it was being mined in the early 1900s.

At Stockhead, we tell it like it is. While Sunshine Metals is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.