ASX Small Cap Lunch Wrap: Is the GameStop party just getting started?

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Local markets have returned from the ‘unofficial’ summer break (Melbourne Cup to Australia Day), and stocks are down.

But most of the action is in the US, where a merry band of 2.1 million Redditors are putting some big instos to the sword.

At the front of the firing line is $US12.5bn investment fund Melvin Capital, which took a short position in games retailer GameStop (NYSE:GME).

GME still sells video games via a network of physical stores, which made it one of the most-shorted stocks on the market amid the post-COVID digital commerce boom.

But r/wallstreetbets has no time for fundamentals.

Instead, they’ve picked up the ball of post-COVID capitalism and ran with it — so far dishing out a lesson in positioning and capital flows.

Generating a community-led avalanche of buy calls in a particular stock is one thing.

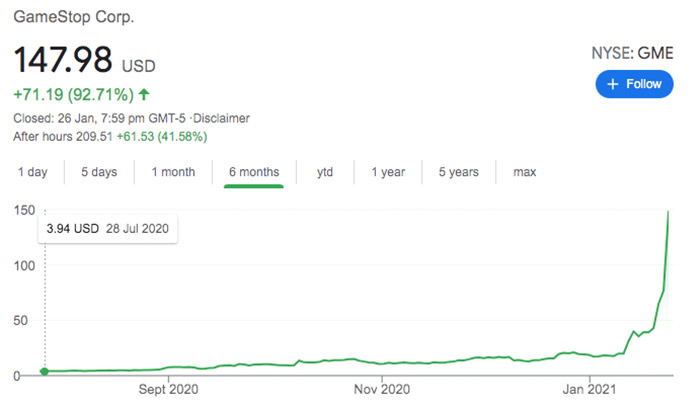

But when it has the effect of squeezing major short positions at the same time, the result looks like this:

At its last closing price of $US147.98, GameStop is now a big enough stock by market cap to be included on the S&P500.

Also, the party hasn’t stopped yet — GME shares surged above $US200 in after-hours trade and Elon Musk has weighed in.

Melvin’s billionaire founder Gabe Plotkin is on the ropes. The fund has already taken a $US2.75bn lifeline from Citadel and Point72 Asset Management to help cover its short positions.

Gabe and just about everyone else are now waiting to see what happens next if the stock keeps mooning.

‘Nearology’ is a common phrase in mining circles, but if you think it applies to r/wallstreetbets as well then GME Resources (ASX:GME) is up more than 15 per cent this morning on no news.

WINNERS

Here are the best performing ASX small cap stocks at 12pm Wednesday January 27:

Swipe or scroll to reveal the full table. Click headings to sort.

Stocks highlighted in yellow made market moving announcements

| CODE | NAME | PRICE | % CHANGE | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| APG | Austpac Resources NL | 0.002 | 100 | 750,000 | $ 3,165,663 |

| MNB | Minbos Resources Ltd | 0.11 | 57 | 19,849,897 | $ 25,876,053 |

| LKE | Lake Resources | 0.39 | 54 | 39,079,790 | $ 223,415,579 |

| ANL | Amani Gold Ltd | 0.0015 | 50 | 19,670,180 | $ 9,386,997 |

| CYQ | Cycliq Group Ltd | 0.003 | 50 | 33,019,805 | $ 4,607,385 |

| AWN | AWN Holdings Limited | 1.45 | 42 | 140,200 | $ 40,314,341 |

| CCE | Carnegie Cln Energy | 0.002 | 33 | 291,558,517 | $ 17,298,103 |

| RNU | Renascor Res Ltd | 0.037 | 32 | 70,847,281 | $ 46,639,875 |

| BPH | BPH Energy Ltd | 0.125 | 32 | 47,514,506 | $ 55,190,001 |

| ELT | Elementos Limited | 0.014 | 27 | 42,668,090 | $ 35,709,591 |

| PLL | Piedmont Lithium Ltd | 0.795 | 27 | 16,828,518 | $ 869,245,860 |

| GRV | Greenvale Mining Ltd | 0.19 | 27 | 3,767,032 | $ 51,214,441 |

| CRS | Caprice Resources | 0.295 | 25 | 739,347 | $ 15,530,759 |

| ARO | Astro Resources NL | 0.005 | 25 | 1,300,000 | $ 11,982,772 |

| POW | Protean Energy Ltd | 0.02 | 25 | 13,281,987 | $ 10,409,807 |

| ROG | Red Sky Energy. | 0.0025 | 25 | 500,000 | $ 4,863,844 |

| AOU | Auroch Minerals Ltd | 0.31 | 24 | 5,136,361 | $ 63,921,283 |

| ANR | Anatara Ls Ltd | 0.24 | 23 | 554,163 | $ 13,737,738 |

| SES | Secos Group Ltd | 0.3 | 22 | 1,786,692 | $ 130,714,081 |

| QEM | QEM Limited | 0.15 | 20 | 849,748 | $ 12,500,000 |

Among stocks with announcements, resources companies topped the winner’s list with gains led by Angola-based explorer Minbos (ASX:MNB).

MNB said it’s now signed the Mineral Investment Contract with Angolan authorities to start exploring at its phosphate project in the country’s Cabinda Province.

Lithium developer Lake Resources (ASX:LKE) also jumped sharply after announcing it will close a new issue of 50,000 shares “forthwith”, after the offer was heavily oversubscribed.

Elsewhere, nanocap bike products manufacturer Cycliq Group (ASX:CYQ) ticked higher following the release of its December 4C filing. You can read up on other notable quarterlies in this Stockhead wrap.

LOSERS

Here are the worst performing ASX small cap stocks at 12pm Wednesday January 27:

Swipe or scroll to reveal the full table. Click headings to sort.

Stocks highlighted in yellow made market moving announcements

| CODE | NAME | PRICE | % CHANGE | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| DTR | Dateline Resources | 0.002 | -20 | 620,589 | $ 20,525,195 |

| MLS | Metals Australia | 0.0025 | -17 | 5,670,082 | $ 12,572,711 |

| AMA | AMA Group Limited | 0.62 | -16 | 2,074,270 | $ 549,097,981 |

| SIH | Sihayo Gold Limited | 0.016 | -16 | 404,960 | $ 70,023,767 |

| CM8 | Crowd Media Limited | 0.049 | -16 | 12,626,126 | $ 31,239,008 |

| EMT | Emetals Limited | 0.042 | -14 | 2,941,838 | $ 19,609,800 |

| BDG | Black Dragon Gold | 0.09 | -14 | 539,543 | $ 14,107,129 |

| DDT | DataDot Technology | 0.006 | -14 | 382,714 | $ 8,693,086 |

| DLC | Delecta Limited | 0.006 | -14 | 1,464,217 | $ 7,060,348 |

| NPM | Newpeak Metals | 0.003 | -14 | 2,709,152 | $ 16,338,569 |

| SRH | Saferoads Holdings | 0.24 | -14 | 30,000 | $ 10,489,299 |

| DAV | Davenport Resources | 0.055 | -14 | 3,099,826 | $ 13,734,030 |

| BSM | Bass Metals Ltd | 0.007 | -13 | 67,676,409 | $ 32,173,406 |

| LNY | Laneway Res Ltd | 0.007 | -13 | 3,836,302 | $ 30,200,527 |

| PWN | Parkway Minls NL | 0.021 | -13 | 67,019,158 | $ 45,618,096 |

| WJA | Wameja Limited | 0.115 | -12 | 2,900 | $ 157,410,586 |

| TPW | Temple & Webster Ltd | 11.93 | -11 | 806,183 | $ 1,620,091,882 |

| BMN | Bannerman Resources | 0.12 | -11 | 2,915,864 | $ 145,105,028 |

| FGO | Fargo Enterprises | 0.004 | -11 | 23,050 | $ 5,335,905 |

| TEM | Tempest Minerals | 0.032 | -11 | 75,938 | $ 9,784,487 |

| ERA | Energy Resources | 0.215 | -10 | 485,009 | $ 885,931,968 |

| MCM | Mc Mining Ltd | 0.13 | -10 | 6,666 | $ 22,390,835 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.