ASX Small Cap Lunch Wrap: Flat local markets seek direction on Wednesday

Via Getty

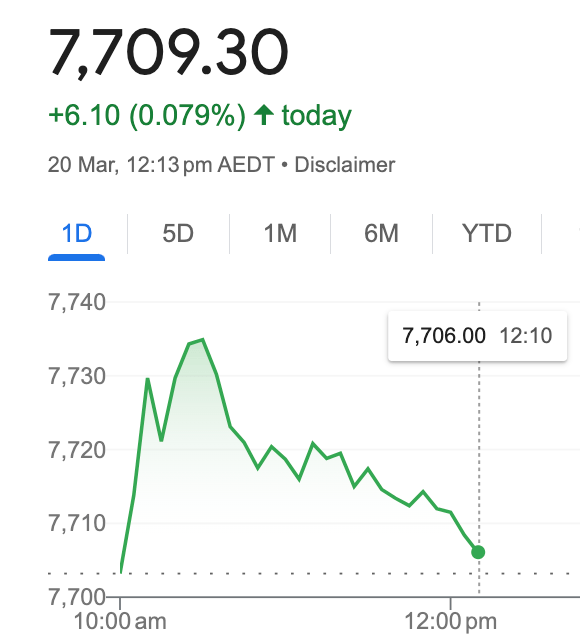

Aussie markets are slightly ahead at lunchtime on Wednesday following the Reserve Bank of Australia’s decision to keep interest rates steady on Tuesday.

At lunchtime in Sydney on Wednesday March 20, the S&P/ASX 200 was thusly:

Aside from the Energy sector which is driving the morning gains, ahead more than 1%, all other ASX sectors are trading within a fairly tight range of parity. It really does look like anyone’s game at half-time.

US markets kicked ahead overnight. Wall Street will be struggling with their own pre-interest rate decision butterflies as the boffins at the US Federal Reserve emerge from their two-day brain jam. Bets point toward a pause, despite the impressive resilience of the US economy.

The benchmark closed 27.40 points, or 0.36% higher on Tuesday to 7,703.20 to cross above its 20-day moving average, after the Reserve Bank of Australia (RBA) kept rates on hold.

Our cash rate’s been steady at 4.35% since November last, tho, that’s a 12-year high.

The central bank’s inflation target range of 2-3% is decently higher than the Americans who’re aiming at 2%, but remember – we started raising later than most other adult economies and while January’s CPI of 3.4% beat consenus as the lowest annual rate in almost three years, last week’s February CPI looked stickier than expected.

This is your only take home really:

“The Board expects that it will be some time yet before inflation is sustainably in the target range.”

Not the ASX

On Wall Street overnight, the S&P 500 closed 0.65% higher, the tech-focused NASDAQ index gained 0.4% and the Dow Jones was up 0.8%.

The Fed’s decisive statement drops at 5am (AEDT) on Thursday and I’m going to watch it while I do my 35-minute morning plank.

It’s my date with trusty US Fed Chair J. Powell.

Meanwhile the US corporate story is a familiar one.

Mega Tech drove gains.

This time it was Apple (APPL), Nvidia (NVDA), Microsoft (MSFT) and the other one… while Tesla (TSLA), Alphabet (GOOGL), and Meta (META) all missed a trick.

Nvidia’s highly anticipated chip launch, led by CEO Jensen Huang at its ‘AI Woodstock’ event on Monday night has been soemthing of a fizzle so far.

The AI chipmaker was supposed to drop all sorts of revelations over the new AI chip generation, but judging by the volatility overnight – down 3% before lunch, ahead 1% by the close – the punters are still trying to read the momentum.

Oil prices are higher.

Iron ore has lifted overnight.

Gold is flat and copper down.

The Aussie dollar fell after the RBA weren’t hawkish.

Bitcoin is down 10% after hitting its records high last week. Ask Robert.

Small caps we’ve been watching

A few shares we tracked from before the open on Wednesday:

This morning the Hemsworths of Aussie Rare earth hunting – Ragnar Metals (ASX:RAG) – released geophysical results from its Olserummm North Heavy Rare Earth Project in Sweden, including multiple highly magnetic trends over “a well-defined corridor measuring 4.5km long and 500m-1km wide,” where no previous sampling has been completed.

RAG says six new magnetic trends indicate high-density targets and that’s what’s highly prospective for HREE mineralisation… so the next step will be reconnaissance field sampling which RAG says kicks off shortly.

Eh. There’s an enterprise loyalty and rewards company called Gratifii (ASX:GTI) – they’ve inked two new agreements with the (always in the headlines) payments firm EML Payments (ASX:EML).

GTI says the deal will deliver prepaid debit cards to GTI’s Australian clients and access the range of rewards available to EML’s clients.

And the quirky medtech, Doctor Care Anywhere Group PLC (ASX:DOC) says it’s launched a partnership with home health test provider Medichecks to become its preferred provider of GP consultations for customers wanting advice on test results.

DOC says basically the partnership funnels Medichecks’ customers with a Doctor Care Anywhere GP to follow up.

At half-time in Sydney, US futures are mixed.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for March 20 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LRD | Lord Resources | 0.11 | 116% | 13,855,639 | $1,893,738 |

| JAV | Javelin Minerals Ltd | 0.002 | 100% | 250,000 | $2,176,231 |

| ADS | Adslot Ltd. | 0.003 | 50% | 3,000,000 | $6,448,991 |

| LIO | Lion Energy Limited | 0.037 | 48% | 19,034,792 | $10,924,444 |

| SRX | Sierra Rutile | 0.105 | 35% | 4,744,297 | $33,090,443 |

| C29 | C29 Metals | 0.091 | 30% | 4,025,834 | $3,777,684 |

| PBL | Parabellum Resources | 0.07 | 30% | 30,000 | $3,364,200 |

| SOV | Sovereign Cloud Holdings | 0.042 | 28% | 2,721 | $11,126,776 |

| PEK | Peak Rare Earths Ltd | 0.235 | 27% | 1,592,964 | $49,199,226 |

| AVD | Avada Group Limited | 0.62 | 25% | 125,772 | $42,042,837 |

| SGC | Sacgasco Ltd | 0.01 | 25% | 986,272 | $6,237,497 |

| AQX | Alice Queen Ltd | 0.006 | 20% | 1,359,205 | $3,454,921 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 58,262 | $3,142,791 |

| LPD | Lepidico Ltd | 0.006 | 20% | 5,003,108 | $38,191,540 |

| TGN | Tungsten Mining NL | 0.1 | 18% | 38,796 | $66,845,213 |

| ACS | Accent Resources NL | 0.007 | 17% | 293 | $2,838,764 |

| AVE | Avecho Biotech Ltd | 0.0035 | 17% | 400,000 | $9,507,891 |

| EXL | Elixinol Wellness | 0.007 | 17% | 195,028 | $3,797,230 |

| TMG | Trigg Minerals Ltd | 0.007 | 17% | 72,500 | $2,511,296 |

| CCM | Cadoux Limited | 0.074 | 16% | 550,405 | $23,482,726 |

| ASV | Asset Vision Co | 0.016 | 14% | 513,010 | $10,161,712 |

| TG6 | TG Metals | 0.25 | 14% | 570,298 | $11,898,957 |

| LBT | LBT Innovations | 0.025 | 14% | 5,456,124 | $29,123,192 |

| WNX | Wellnex Life Ltd | 0.025 | 14% | 364,609 | $24,611,178 |

| ICU | Investor Centre Ltd | 0.026 | 13% | 257,566 | $6,973,555 |

Out front on Wednesday morning is lithium hopeful Lord Resources (ASX:LRD) which now has a strategic partnership with high-flying Mineral Resources (ASX:MIN) after securing a farm-in agreement out at the Horse Rocks Lithium Project.

MD Barnaby Egerton-Warburton is stoked.

“The agreement validates the strong work Lord has already completed at the Horse Rocks Lithium Project and provides the opportunity to collaborate with a world-class exploration team drawing on their knowledge and expertise of this highly prospective lithium region,” Egerton-Warburton says.

Subject to the satisfaction of conditions – including MinRes completing satisfactory due diligence on the tenement – MinRes will spend $1m in exploration, to earn 40% of the project.

Lord says the Farm-in Agreement will let it maintain exposure to a high-value project while also going in hard on the exploration at its Jingjing Lithium Project.

It’s a lithium pincer movement.

Meanwhile, Lion Energy (ASX:LIO) has development approval for its hydrogen generation and refuelling hub project at the Port of Brisbane, with construction to kick off Q2 this year.

As you can see from this excellent visual, it’s close to 70+ bus depots… wait for it…

… which is handy because LIO says the strategic location will allow the hub to initially focus on supplying hydrogen to domestic public bus fleets, truck fleets and fuel cell gensets and other customers across the construction and mining industry.

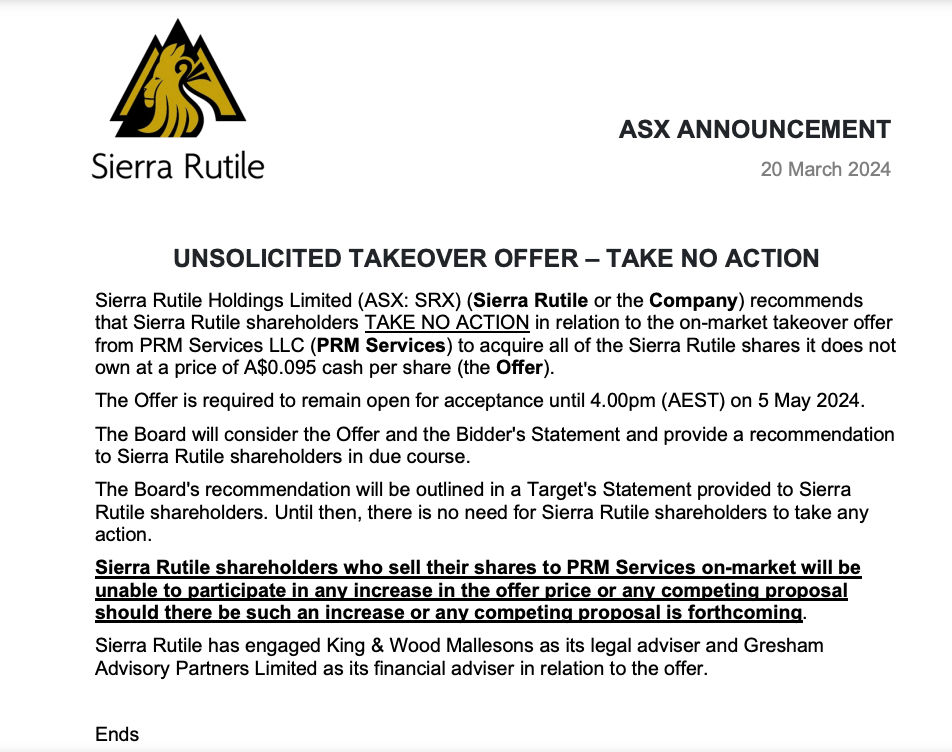

And Sierra Rutile (ASX:SRX) has had a busy morning, although in the rutile game an unsolicited takeover offer is always a welcome hassle.

A quick refresher – Sierra runs multi-deposit mineral sands mining in Sierra Leone a gig which has made it “the largest producer of natural rutile in the world.”

And rutile?

Well. Rutile is the highest-grade naturally occurring TiO2 feedstock used to make pigments, laminates, plastic stuff and packaging, inks, clothing, sunscreen, toothpaste… it’s all over the cosmetic industry.

It’s handy for a welding electrode as well as being used to make titanium.

PRM Services made the bid and this is what the SRX Board suggests should be done with it…

ASX SMALL CAP LAGGARDS

Here are the most-worst performing ASX small cap stocks for March 20 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLZDC Classic Minerals 0.009 -82% 9,380,507 $12,890,085 AXP AXP Energy Ltd 0.001 -50% 640,000 $11,649,361 NGS NGS Ltd 0.009 -25% 461,587 $3,014,729 CLV Clover Corporation 0.615 -24% 165,409 $134,434,470 PLC Premier1 Lithium Ltd 0.028 -22% 320,000 $6,284,667 S66 Star Combo 0.12 -20% 4,467 $20,262,447 AL8 Alderan Resource Ltd 0.004 -20% 396,039 $5,534,307 MTB Mount Burgess Mining 0.002 -20% 139,851 $2,612,034 PUR Pursuit Minerals 0.004 -20% 57,437 $14,719,857 ROG Red Sky Energy 0.004 -20% 46,999 $27,111,136 CG1 Carbonxt Group 0.071 -19% 276,917 $28,593,105 GSM Golden State Mining 0.01 -17% 210,029 $3,352,448 OMX Orange Minerals 0.023 -15% 100,000 $2,315,255 LYN Lycaon Resources 0.15 -14% 18,854 $7,709,844 AML Aeon Metals Ltd. 0.006 -14% 369,212 $7,674,804 HHR Hartshead Resources 0.006 -14% 2,378,579 $19,660,775 WBE Whitebark Energy 0.019 -14% 75,601 $3,602,327 ALA Arovella Therapeutic 0.135 -13% 3,131,984 $143,399,217 AUH Austchina Holdings 0.0035 -13% 250,000 $8,311,535 GMN Gold Mountain Ltd 0.0035 -13% 5,619,055 $9,111,514 OSL Oncosil Medical 0.007 -13% 5,553,927 $15,796,329 UBI Universal Biosensors 0.215 -12% 1,322,058 $52,030,512 BM8 Battery Age Minerals 0.11 -12% 179,952 $11,470,040 CCO The Calmer Co International 0.004 -11% 18,585,653 $5,322,135

In Case You Missed It

Eagle Mountain Mining (ASX:EM2) has collected $4.18 million from a renounceable entitlement offer which closed last Friday.

Funds will put towards upcoming field work at both of the company’s projects in Arizona, but predominately focused at Silver Mountain where significant uranium, thorium and rare earths mineralisation was recently discovered.

A scoping study is also planned for the Oracle Ridge copper project using a simplified processing flowsheet void of smelting and refining beyond the mine gate.

EM2 managing director Charlie Bass subscribed to $1.25 million as the partial underwriter of the offer.

At Stockhead, we tell it like it is. While Eagle Mountain Mining is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.