You might be interested in

Health & Biotech

Cardiex launches app, begins US Deliveries of flagship CONNEQT Pulse

Stockhead TV

Tony's Takeaway: New year nuggets for biotech-hungry investors

Health & Biotech

News

Local markets are rebounding from a really unpleasant previous session of losses, led higher by a strong night on Wall Street.

The blue chip Dow Jones lifted +1.6%, enjoying what looks like its best day of business in about six months.

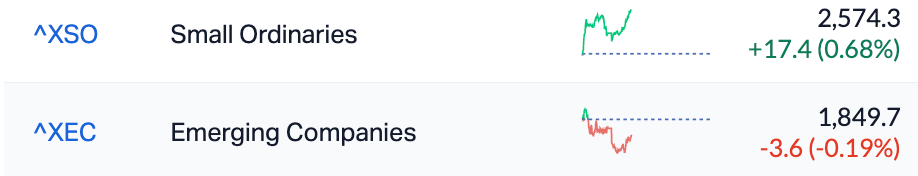

The ASX200 is up 33 points or +0.48% to 6,805.6 at 12.15pm on Tuesday.

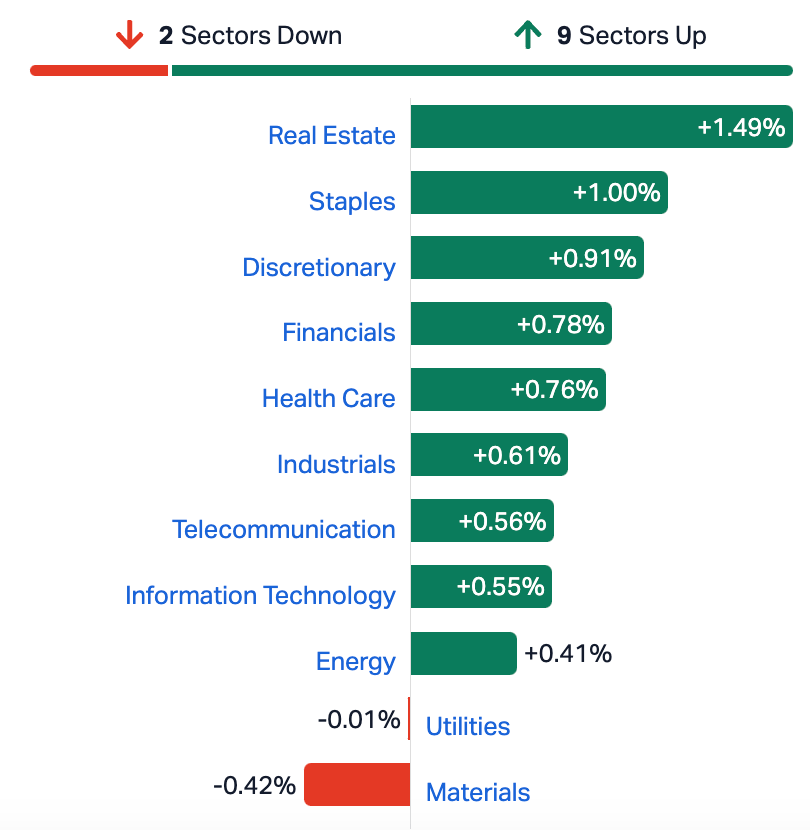

Local investors have responded positively after the Nasdaq also led gains in New York, with almost all ASX sectors getting involved in a broad-based rally.

With oil prices some 3% lower and a slew of central bank decisions ahead of us this week, traders know they’re still in immensely volatile waters. Pop round to where the bond buyers are for a closer look at that – reports this morning of another rally in local bonds, which has seen the yield on the Aussie 10-year rise to a 12-year high of 4.951%.

Local investors have turned to consumer names. Here’s my favourite: Inghams (ASX:ING) the Aussie producer of so much that is poultry related.

Shares in the nugget expert leapt out of the box this morning after offering some sterling guidance for a chook business. ING forecasts EBITDA of circa $250mn in 1H24, a significant boost on the PCP.

Elsewhere property stocks and investment trusts (REITs), helped lift the Real Estate and Consumer Staples Sectors this morning as almost all other ASX sectors joined the mission of lifting the local market off its 12-month nadir ahead of a what will be a crucial week of global economic data, led by central bank decisions from Brazil to Jakarta.

Meanwhile, over in Ontario…

In company news, Patriot Lithium (ASX:PAT) is pleased to announce that it has secured multiple claim packages in the lithium rich “Electric Avenue” region in Ontario, Canada.

This region is already renowned for high-grade lithium deposits, containing the world-class PAK-Spark Project, owned by Frontier Lithium (TSXV: FL).

Patriot’s new claims now adjoin and partially surround Frontier Lithium’s claims to the southeast and in combination with the Gorman Project, PAT now has more than 70km of strike over the highly prospective Bearhead Lake Fault Zone.

Patriot already has confirmed high grade lithium mineralisation at Gorman within a 5.2km trend of outcropping pegmatites (including rock chip samples up to 3.71% Li2O and sawn channel samples of 12.8m @ 1.3% Li2O, 5.0m @ 2.0% Li2O and 5.0m @ 2.0% Li2O).

With identified pegmatites on the new ground that are consistent with the Bearhead Lake Fault Zone, our geologists believe that the outcropping pegmatites identified to date may only be the ‘tip of the iceberg’. The team is incredibly excited about the upcoming exploration programs on Gorman and the new Berens and Borland ground.

And back in Bali…

Nickel Industries (ASX:NIC) MD Justin Werner says record September quarter earnings results were ‘highly pleasing’, and go a long way to capturing NIC’s financial muscle.

Justin told the ASX the company continues to deliver sustainable growth and value creation as Australia’s largest listed diversified nickel producer.

NIC hit record EBITDA for the quarter, led by a strong uplift in production, earnings, sales and cash generation.

Increased production and lower costs also contributed to the record US$120.7mn.

“We are delighted to report another record quarter of 33,852 tonnes of nickel metal as we enjoyed the first full quarter of contribution from our ramped-up Oracle Nickel (ONI) operations,’’ Werner said.

“This quarterly production number equates to 135,408 tonnes on an annualised basis and makes us easily Australia’s largest listed diversified nickel producer well ahead of our nearest peers BHP’s Nickel West (83,000 tonnes pa) and Independence Group (36,000 tonnes pa).

“We saw a significant increase in EBITDA across all our operations with our Hengjaya Mine enjoying a record quarter of US$23.1M in EBITDA, a 93.6% increase on the June quarter and our RKEF operations delivering US$97.6M in EBITDA, a 122.3% increase on the June quarter. This combined to deliver US$120.7M of EBITDA from operations.”

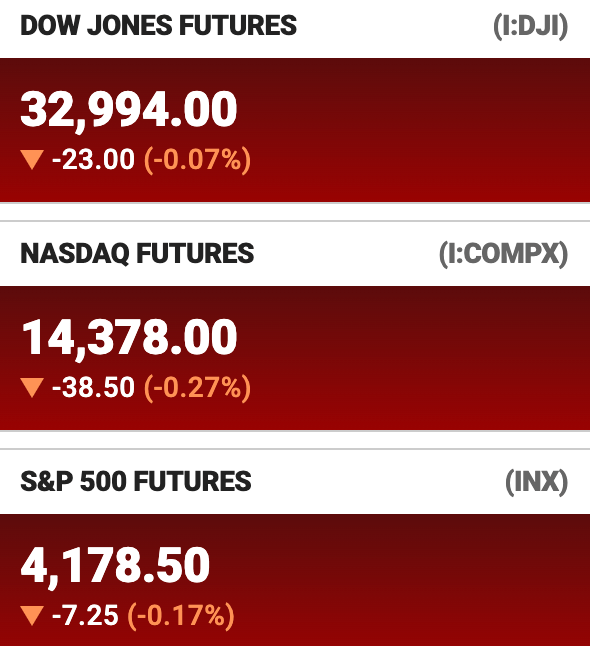

Wall Street rallied but good on Monday.

Suddenly the S&P 500 is already out of correction territory after entering into it late last week. The benchmark US index gave away -2.5% for the week pushing it beyond the -10% correction threshold off its most recent closing high.

It’s off 2.8% for October, on pace for its third-straight negative month which would be its first such streak since 2020 as the pandemic struck.

The Dow Jones lifted +1.6%, and the Nasdaq Composite found +1.2%.

The Mega-cap buds – Amazon and Meta – jumped +4% and circa +2%, each, although the Federal Reserve rate decision and Apple’s earnings still overshadow the week ahead.

Here are the best performing ASX small cap stocks for 31 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CHM Chimeric Therapeutic 0.041 58% 40,968,568 $13,889,277 FZR Fitzroy River Corp 0.15 36% 15,000 $11,874,968 ENT Enterprise Metals 0.004 33% 2,387,948 $2,398,413 MTH Mithril Resources 0.002 33% 78,334 $5,053,207 SP8 Streamplay Studio 0.009 29% 1,735,404 $7,966,866 TOY Toys R Us 0.014 27% 4,657,388 $10,807,099 B4P Beforepay Group 0.625 25% 76,813 $17,599,099 KPO Kalina Power Limited 0.005 25% 792,642 $6,060,783 SIS Simble Solutions 0.005 25% 77,000 $2,411,803 XGL Xamble Group Limited 0.036 24% 31,000 $8,240,531 ADG Adelong Gold Limited 0.008 23% 3,830,061 $3,876,095 NNG Nexion Group 0.016 23% 1,297,073 $2,630,002 EDE Eden Inv Ltd 0.003 20% 101,374 $8,409,092 ENR Encounter Resources 0.355 18% 1,787,473 $118,657,734 HAL Halo Technologies 0.23 18% 243,107 $25,251,567 KRR King River Resources 0.02 18% 4,407,102 $26,409,924 SPQ Superior Resources 0.027 17% 3,528,326 $42,194,736 KIN KIN Min NL 0.062 17% 1,079,645 $62,441,979 AMM Armada Metals 0.035 17% 66,000 $5,177,042 NTU Northern Min Ltd 0.035 17% 6,459,305 $177,329,377 RAS Ragusa Minerals Ltd 0.042 17% 695,986 $5,133,556 HTG Harvest Tech Grp Ltd 0.028 17% 219,915 $16,955,120 LNR Lanthanein Resources 0.007 17% 221,874 $6,729,453 LRL Labyrinth Resources 0.007 17% 720,174 $7,125,262 PLN Pioneer Lithium 0.315 17% 434,096 $7,674,750

Way out in front on Tuesday mornong in small cap land is Chimeric Therapeutics (ASX:CHM), which has announced that the US Food and Drug Administration (FDA) has cleared its Investigational New Drug (IND) application of CHM 2101.

The Australian firm which says it’s among the leaders in cell therapy, plans to investigate CHM 2101 in a multi-centre, open label Phase 1A/B clinical trial for patients with advanced colorectal cancer, gastric cancer and neuroendocrine tumours.

Xianxin Hua, MD, PhD, and his team at the Abramson Family Cancer Research Institute at the University of Pennsylvania said it was “exciting to see the advancement from discovery of the CDH17 target and CAR T therapy in preclinical studies to the initiation of clinical trials in patients with GI-cancers and neuroendocrine tumors.”

Everyone hates cancer. Up 75%.

Here are the most-worst performing ASX small cap stocks for 31 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap 3DP Pointerra Limited 0.066 -27% 4,256,330 $ 64,960,858 CCE Carnegie Cln Energy 0.0015 -25% 276,544 $ 31,285,147 ASH Ashley Services Grp 0.39 -24% 509,538 $ 74,147,591 MNS Magnis Energy Tech 0.057 -23% 16,044,002 $ 88,762,863 ALM Alma Metals Ltd 0.007 -22% 360,556 $ 10,026,007 MDI Middle Island Res 0.018 -22% 1,661,169 $ 3,235,139 JAY Jayride Group 0.064 -21% 343,718 $ 18,222,690 SFG Seafarms Group Ltd 0.004 -20% 9,388 $ 24,182,996 MKG Mako Gold 0.013 -19% 1,193,463 $ 9,216,131 BSE Base Res Limited 0.115 -18% 3,814,910 $ 164,921,659 CRB Carbine Resources 0.005 -17% 988,294 $ 3,310,427 RAD Radiopharm 0.085 -15% 825,811 $ 23,931,304 AHI Advanced Health 0.115 -15% 422,385 $ 29,390,036 BML Boab Metals Ltd 0.115 -15% 489,472 $ 23,552,474 WC8 Wildcat Resources 0.735 -15% 17,805,716 $ 895,130,574 FME Future Metals NL 0.03 -14% 844,600 $ 14,462,141 ICN Icon Energy Limited 0.006 -14% 577,140 $ 5,376,096 BM8 Battery Age Minerals 0.215 -14% 273,629 $ 22,284,222 AX8 Accelerate Resources 0.039 -13% 3,700,020 $ 20,970,099 MTM MTM Critical Metals 0.02 -13% 1,827,767 $ 2,284,753 CTN Catalina Resources 0.0035 -13% 1,126,667 $ 4,953,948 IEC Intra Energy Corp 0.0035 -13% 94,594 $ 6,643,126 XPN Xpon Technologies 0.035 -13% 500 $ 6,341,101 BTR Brightstar Resources 0.0105 -13% 3,658,485 $ 22,990,001 ARV Artemis Resources 0.022 -12% 2,541,749 $ 39,435,459