ASX Small Cap Lunch Wrap: ASX higher as hungry, grumpy cats fed late after Optus outage

Pic: Getty Images

The local benchmark has risen on Wednesday AM, tracking Wall Street higher with lower bond yields. Markets are showing resilience on the day after the day before – in this case the race that stops the nation – the Melbourne Cup – coinciding with a 13th interest rate hike since May 2022. The cash rate is now 4.35%.

Odds were in favour of another interest rate rise with new RBA governor Michele Bullock saying “the board judged an increase in interest rates was warranted today to be more assured that inflation would return to target in a reasonable timeframe.”

She says CPI inflation is now expected to be around 3.5% by the end of 2024 and at the top of the central bank’s target range of 2 to 3% by the end of 2025.

And it’s not a good day for Optus or customers with nationwide services only just coming back online since being out early this morning.

The telecommunications company says it’s been working “urgently” to get back up and running as millions of customers go without mobile data and network access.

“We’re aware of an issue impacting Optus mobile and nbn services and are working to restore services as quickly as possible,” Optus says.

“We understand connectivity is important and apologise for any inconvenience caused.”

The outage has been the longest, and largest in recent times, reportedly caused by a fault in the provider’s core network. It has wide ramifications for services and the economy causing delays in transport, impacting hospitals, GPs, businesses and phone lines around Australia.

Also there’s plenty of grumpy pets around Australia today with some owners saying they first knew about the outage when their wifi-connected pet feeder didn’t work.

A woman who rang ABC Sydney radio said she found out about the Optus outage from her cat.

The cat has an automatic wi-fi feeder (connected to Optus) & when breakfast wasn’t delivered at 6:10 am, the cat went to the bedroom to lodge a complaint with management.

— Denise C. (@SpudBenBean) November 7, 2023

Already there is talk about compensation for the outage with customers boycotting Australia’s second largest telco. Optus is still recovering from the data of 10 million customers exposed in a cyber hack, just over a year ago.

Optus’s competitor Telstra (ASX:TLS) has seen its share price rise more than 2% today following the outage and has reported an influx of customers trying to sign up.

Meanwhile, iron ore, gold and oil stocks on the ASX were trending lower today after Chinese data published yesterday evening showed that China’s exports fell by 6.4% year-on-year in October.

That hit all levels from energy to iron ore with big players BHP (ASX:BHP), Fortescue Metals Group (ASX:FMG) and Rio Tinto (ASX:RIO) all trending lower today.

Crude oil prices plunged 4% on the sluggish Chinese data to their lowest since July.

“Traders will also remain on high alert for signs of a wider conflict emerging in the [Middle East] region that could disrupt supplies, but it seems those fears are subsiding,” OANDA analyst Craig Erlam says.

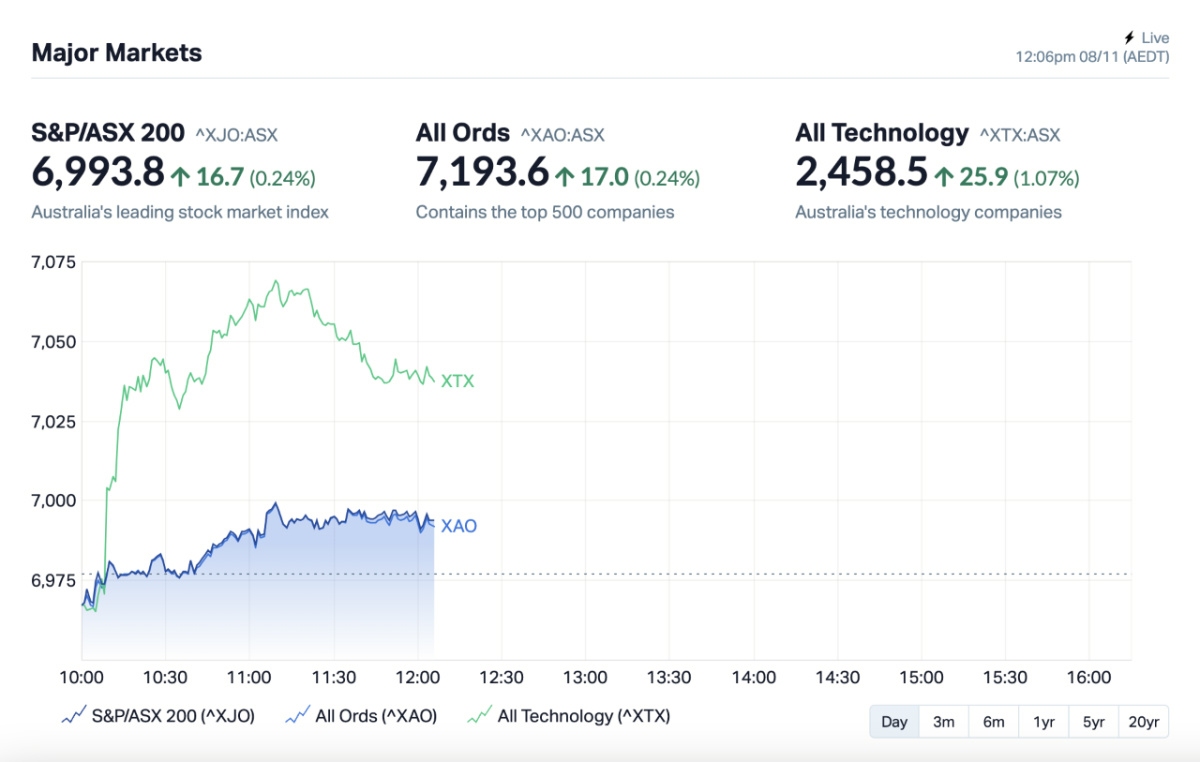

At 12pm (AEDT) on Wednesday, the S&P/ASX 200 Index is up by 16.7 points, or 0.24%, to 6,993.8.

The All Ords was also trending up along with the All Technology index at midday.

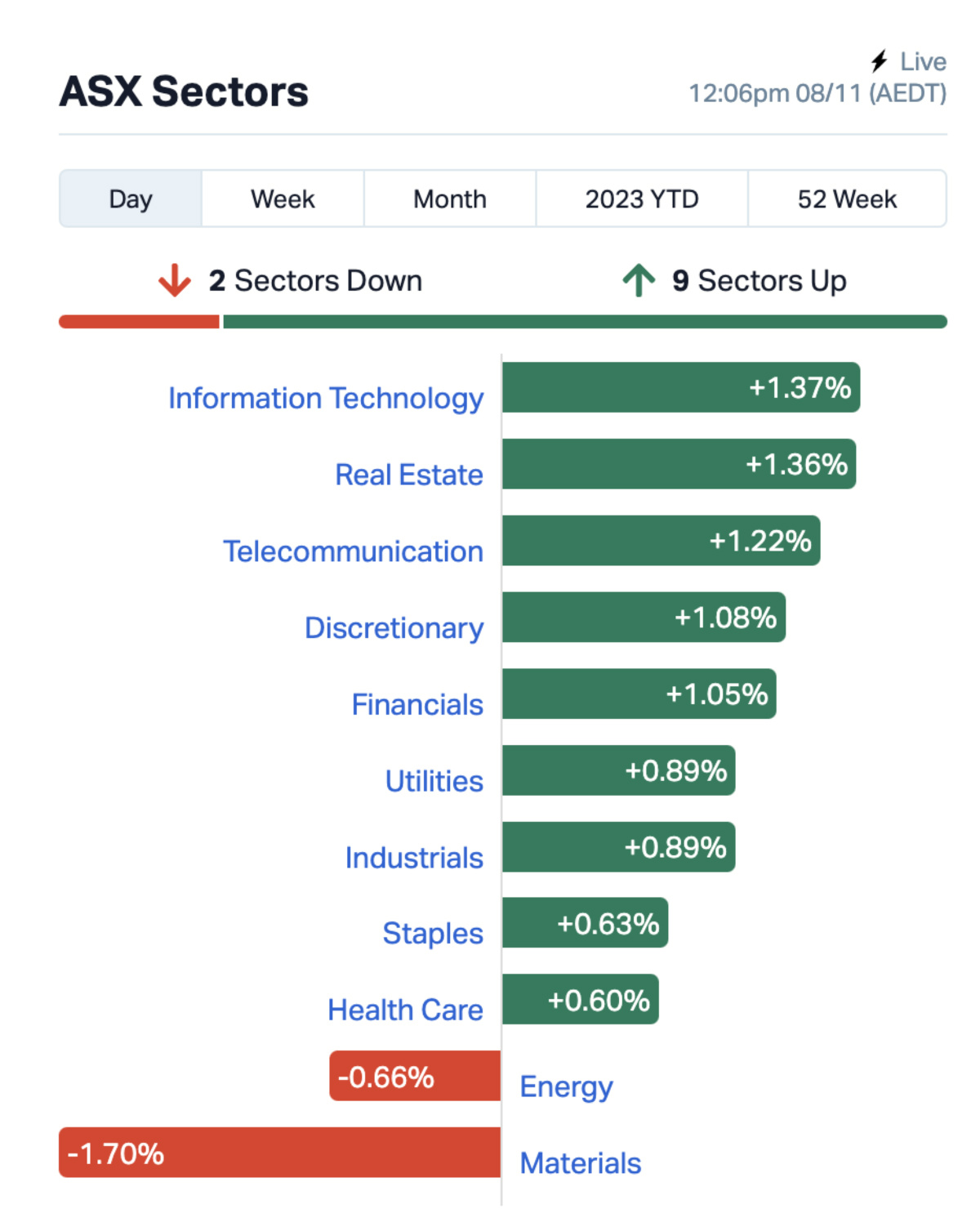

ASX Sectors at midday on Wednesday

Nine of the 11 sectors were in the green today, with Information Technology leading the winners followed by real estate and telecommunications. Energy and Materials led the laggards.

Not the ASX

Overnight, the S&P 500 fell by -0.69%, the blue chips Dow Jones index was up by +0.17%, and the tech-heavy NASDAQ climbed by +0.90%.

NASDAQ notched its eighth straight day of gains, as the Magnificent Seven stocks advanced and pacing the session with Amazon leading as it rose by 2%.

The best performer overnight was cybersecurity stock Datadog, which rose 28% after stronger-than-expected Q3 earnings and a bullish full-year guidance.

US Treasury yields fell overnight, with the yield on the 10-years last trading 9 basis points lower at 4.573%. The 2-year treasury yield fell 3 basis points to 4.911%.

The US Federal Reserve last week left interest rates unchanged but took a hawkish tone noting resilience from the economy despite a prolonged period of higher rates.

Chair Jerome Powell has not ruled out potential for further interest rate hikes and says cuts were not yet on the table.

ASX small cap winners

Here are the best performing ASX small cap stocks for November 8 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BTE | Botala Energy | 0.09 | 20% | 84,719 | $4,669,583 |

| WBE | Whitebark Energy | 0.026 | 13% | 249,471 | $3,394,656 |

| TMK | TMK Energy Limited | 0.01 | 11% | 1,000 | $45,275,214 |

| COE | Cooper Energy Ltd | 0.1075 | 10% | 1,377,207 | $257,890,063 |

| IVZ | Invictus Energy Ltd | 0.235 | 9% | 6,017,898 | $277,385,871 |

| NAE | New Age Exploration | 0.0065 | 8% | 25,608,352 | $10,763,393 |

| NHE | Noble Helium | 0.21 | 8% | 1,511,954 | $50,383,993 |

| 92E | 92Energy | 0.38 | 7% | 457,908 | $37,763,161 |

| SHE | Stonehorse Energy | 0.016 | 7% | 120,000 | $10,266,526 |

| MAY | Melbana Energy Ltd | 0.065 | 5% | 6,493,182 | $208,952,654 |

| ATS | Australis Oil & Gas | 0.019 | 6% | 1,496,669 | $22,803,580 |

| TEG | Triangle Energy Ltd | 0.019 | 6% | 549,591 | $24,766,519 |

| BME | Black Mountain Energy | 0.025 | 4% | 72,029 | $4,397,380 |

| BKY | Berkeley Energia Ltd | 0.375 | 4% | 268,534 | $160,486,817 |

| HHR | Hartshead Resources | 0.027 | 4% | 77,050 | $73,025,735 |

| YAL | Yancoal Aust Ltd | 4.74 | 4% | 1,324,635 | $6,034,408,227 |

| TPD | Talon Energy Ltd | 0.19 | 3% | 51,468 | $119,694,610 |

| KKO | Kinetiko Energy Ltd | 0.084 | 2% | 30,001 | $110,558,003 |

| MRM | MMA Offshore | 1.24 | 1% | 350,150 | $458,633,232 |

| EMC | Everest Metals Corp | 0.088 | 1% | 23,663 | $11,595,630 |

| BPT | Beach Energy Limited | 1.515 | 1% | 2,050,975 | $3,433,407,152 |

| NXG | Nexgen Enenergy Canada | 9.09 | 1% | 389,209 | $262,502,840 |

Oil and gas company Whitebark Energy (ASX:WBE) says the formal process to explore monetisation of all or part of its wholly owned Wizard Lake assets in Canada has attracted significant early interest.

Managed by Canadian firm Sayer Energy Advisors, the process has led to 17 parties signing confidentiality agreements with WBE.

New Age Exploration (ASX:NAE) says it has completed a cultural heritage survey with the Kariyarra Aboriginal Corporation (KAC) at the drill ready Quartz Hill project in the Central Pilbara of WA.

NAE has now established the project timetable and secured the necessary heritage clearances to facilitate a substantial expansion of the lithium, caesium, tantalum (LCT) focused exploration program at Quartz Hill.

ASX small cap losers

Here are the most-worst performing ASX small cap stocks for November 8 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ALM | Alma Metals Ltd | 0.007 | -13% | 200,000 | $8,912,006 |

| EPM | Eclipse Metals | 0.01 | -9% | 286,722 | $22,481,847 |

| TOE | Toro Energy Limited | 0.01 | -9% | 40,768,346 | $52,594,274 |

| LAM | Laramide Res Ltd | 0.62 | -9% | 742 | $882,063 |

| MEL | Metgasco Ltd | 0.011 | -8% | 137,382 | $12,766,641 |

| ROG | Red Sky Energy. | 0.0055 | -8% | 553,583 | $31,813,363 |

| PV1 | Provaris Energy Ltd | 0.055 | -7% | 130,037 | $32,434,023 |

| PCL | Pancontinental Energy | 0.015 | -6% | 1,396,384 | $128,963,565 |

| GHY | Gold Hydrogen | 0.435 | -5% | 137,242 | $26,184,591 |

| DYL | Deep Yellow Limited | 1.145 | -5% | 2,998,782 | $917,686,950 |

| AJQ | Armour Energy Ltd | 0.105 | -5% | 1 | $11,343,213 |

| PEN | Peninsula Energy Ltd | 0.115 | -4% | 1,818,961 | $150,935,782 |

| TEE | Topend Energy | 0.115 | -4% | 84,500 | $5,344,500 |

| KAR | Karoon Energy Ltd | 2.31 | -4% | 1,954,369 | $1,359,648,022 |

| CRD | Conradasia Energy | 1.32 | -4% | 5,862 | $134,545,608 |

| TBN | Tamboran | 0.135 | -4% | 849,444 | $240,334,160 |

| BRU | Buru Energy | 0.14 | -3% | 91,623 | $86,426,247 |

| AEE | Aura Energy | 0.29 | -3% | 160,270 | $173,234,179 |

| VEN | Vintage Energy | 0.031 | -3% | 1,625,650 | $27,827,144 |

| PH2 | Pure Hydrogen Corp | 0.155 | -3% | 51,496 | $56,825,942 |

| TER | Terracom Ltd | 0.315 | -3% | 375,168 | $260,314,026 |

| BLU | Blue Energy Limited | 0.017 | -3% | 515,920 | $32,392,038 |

| AGE | Alligator Energy | 0.051 | -2% | 1,602,844 | $200,840,068 |

| STX | Strike Energy Ltd | 0.3875 | -2% | 1,185,748 | $1,003,022,467 |

| WHC | Whitehaven Coal | 6.685 | -2% | 3,413,863 | $5,688,885,331 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.