ASX Small Cap Lunch Wrap: ASX felled by September CPI burst

Via Getty

Well. At about 11am Australian September quarter inflation came screaming up the ASX driveway significantly hotter than expected.

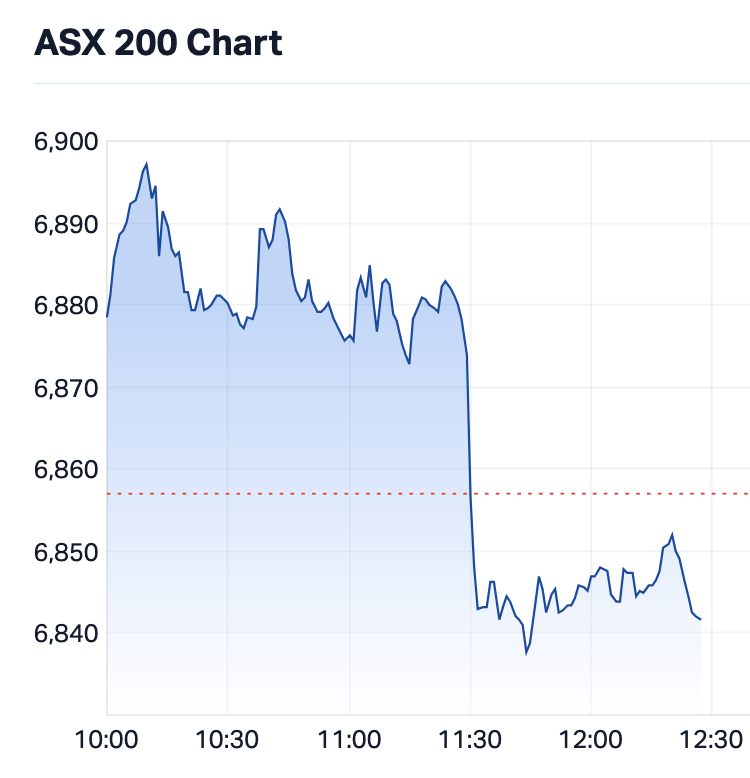

Previously gallivanting happily about the bourse and up some 0.3%, the benchmark ASX 200 (XJO) index had lost about 45 points to be under water -0.22% to 6,841.0 at 1230 (AEDT).

The monthly Consumer Price Index (CPI) indicator rose 5.6% in the 12 months to September 2023, hitting its highest level in 5 months and snapping economist forecasts for a 5.4% increase.

September’s figure also accelerated for the second straight month following a 5.2% gain in August. Headline inflation fell to 5.4% YoY from 6% previously, but still above the consensus forecast of 5.3%.

Over at the Reserve Bank’s preferred measure of inflation, the Trimmed Mean, we copped a fall to 5.2% YoY from 5.9%, that too was above the consensus forecast of 5%.

“Yields on AU bills and bonds have rallied sharply, and we are now about 56% priced for a 25bp RBA rate hike in November, which would take the cash rate to 4.35%, says IG Markets’ Tony Sycamore.

“We think a Melbourne Cup Day rate rise is likely a formality after today’s inflation overshoot, and given the RBA’s more hawkish communique, as stated in the October RBA meeting minutes – ‘The Board has a low tolerance for a slower return of inflation to target than currently expected.‘”

Blame lies with – fuel costs up 7.2 per cent after two quarters of price falls. Tony says this is the largest quarterly rise in fuel prices since March 2022 and is thanks to by higher global oil prices.

Yikes. And thank you the Australian Bureau of Statistics.

The ASX200 at midday on Wednesday

THE ASX SO FAR

Well, the local market got the shock of its ill-prepared week when some much, much higher-than-expected CPI data dropped for September.

Stocks, as one can note above, went off a cliff as traders did the math and understood numbers like these and a new RBA boss like M. Bullock all but promise another cash rate hike when the board goes to meet on Melbourne Cup Day in early November.

The benchmark turned down 0.3% to 6840 after being up 0.2% ahead of the CPI drop.

The Aussie dollar is up around 63.80 US cents, jumping on the CPI drop, while the local 10-year bond yield and the 3-year bond yield spiked as well.

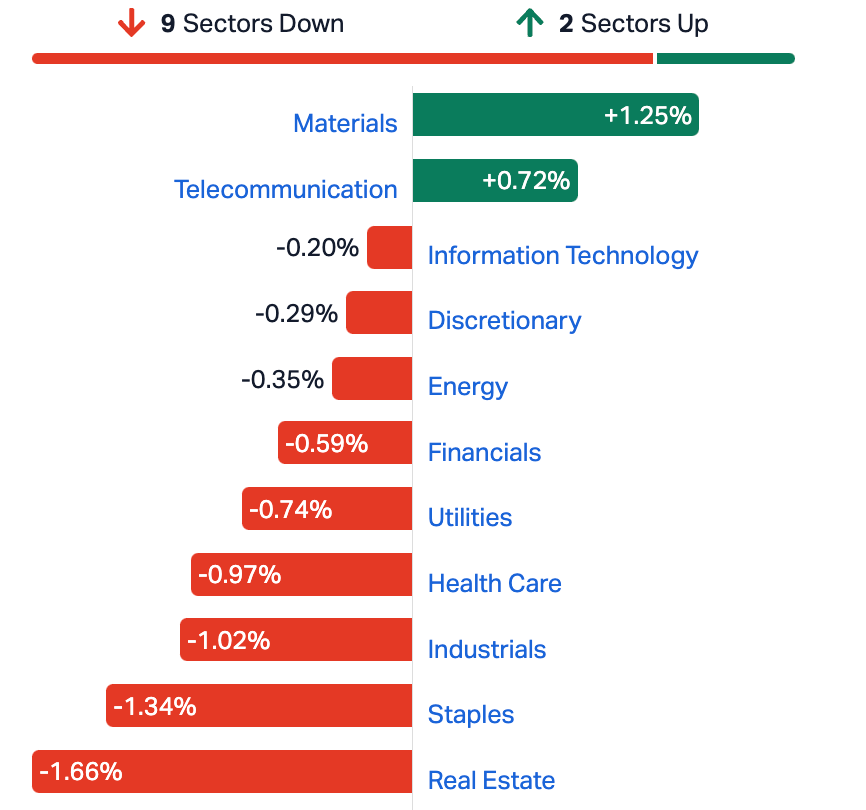

The ASX Sectors at Noon

NOT THE ASX

US stock futures are moving mostly lower during the Sydney AM on Wednesday.

Fickle US investors reacted with typical abandon to a mixed bag of overnight earnings results from a few of our fave mega tech firms.

The S&P 500 and Nasdaq 100 futures are down, but the Dow futures are up. I know not how that works, because during regular trading hours in New York on Tuesday, the Dow rose 0.6%, the S&P 500 climbed 0.75% and the Nasdaq Composite jumped a good 0.95%. I mean 10 out of a possible 11 S&P sectors finished with a healthy green glow.

Those gains came on the back of strong corporate earnings reports and some welcome easing in stonking US Treasury yields.

In the States, winners in the earnings game included Spotify (+10%), Vanilla Coca-Cola (+3%), Verizon (+9%) and General Electric (+6.5%).

In extended trading, Google-daddy Alphabet crashed more than -6% as its cloud business missed analysts’ estimates, despite beats with strong revenue and earnings.

Mega-tech of the moment, Microsoft jumped +4.2% on better-than-expected quarterly results and its Azure cloud game is top.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 25 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap DTC Damstra Holdings 0.26 160% 3,425,168 $25,788,209 HAL Halo Technologies 0.18 150% 243,474 $9,323,655 RRR Revolver Resources 0.135 42% 225,796 $23,239,305 DVL Dorsavi Ltd 0.014 40% 486,348 $5,566,616 SBR Sabre Resources 0.046 39% 5,390,825 $9,619,044 IEC Intra Energy Corp 0.004 33% 630,000 $4,982,345 SIH Sihayo Gold Limited 0.002 33% 265,024 $18,306,384 NIM Nimy Resources 0.24 33% 1,095,777 $13,944,178 PKO Peako Limited 0.0075 25% 35,819,058 $3,162,508 ATV Active Port Group 0.125 25% 10,000 $31,564,787 1ST 1St Group Ltd 0.01 25% 2,500,000 $11,335,930 CNJ Conico Ltd 0.005 25% 37,506 $6,280,380 FIN FIN Resources Ltd 0.027 23% 13,753,346 $13,662,778 PIM Pinnacle Minerals 0.15 20% 1,822,904 $3,196,875 SKN Skin Elements Ltd 0.006 20% 366,250 $2,847,430 IVZ Invictus Energy Ltd 0.185 19% 19,891,918 $192,225,860 AI1 Adisyn Ltd 0.02 18% 50,023 $2,222,174 HYT Hyterra Ltd 0.02 18% 126,315 $8,187,178 RAS Ragusa Minerals Ltd 0.04 18% 333,292 $4,848,359 BFC Beston Global Ltd 0.007 17% 303,333 $11,982,281 CAV Carnavale Resources 0.007 17% 155,000 $20,541,310 EXT Excite Technology 0.007 17% 965,418 $7,255,450 NNG Nexion Group 0.014 17% 50,527 $2,427,694 POD Podium Minerals 0.037 16% 439,067 $11,658,771 DEL Delorean Corporation 0.03 15% 122,964 $5,608,744

Damstra Holdings (ASX:DTC) has absolutely and resolutely confirmed this morning it’s recieved ‘conditional, non-binding, indicative proposals from multiple parties to acquire 100% of Damstra’s shares by way of a scheme of arrangement.’

Somebody wants the workplace management solutions provider big time.

DTC told shareholders:

“After assessing the proposals, the Board of Damstra has agreed to grant one of the interested parties the opportunity to conduct due diligence for four weeks on an exclusive basis (including an initial two week period during which the exclusivity provisions are not subject to a fiduciary carve out).

“Exclusivity has been granted on the basis of an indicative offer price of 30 cents per Damstra share.”

A few riders…

- There is no certainty that any binding transaction will proceed or eventuate.

- No action is required by shareholders at this time.

- Damstra will continue to keep the market informed in accordance with its continuous disclosure obligations.

- The company has appointed Jefferies Australia as financial adviser and Gilbert + Tobin as legal adviser.

Up 160%.

Sabre Resources (ASX:SBR) stock is up around 40% after revealing it’s just added two ‘highly prospective tenement applications to its ground holding in the northwest Pilbara region of WA, along strike.’

And yes: ‘Only 5km to the northeast of the Andover lithium discovery of Azure Minerals (ASX:AZS)‘.

These new tenements take SBR’s tenement holding to >235sqkm in what is emerging as a world-class lithium region. The Andover discovery has produced drilling intersections which include up to 209.4m @ 1.42% Li2O

The two new Sabre Tenements lie only 5km along strike to the northeast of Andover and cover a target zone ‘where there is a bend in the structural corridor associated with a magnetic intrusion – a similar setting to the Andover lithium discovery.’

Sabre Resources CEO Jon Dugdale says the geology of the new tenements ‘appears similar to Andover – the only difference being the extent of cover over our target areas.’

“Following grant of the new tenement applications, the next steps will include detailed geophysical programs including gravity measurements to locate buried pegmatites which will then be tested with bedrock aircore drilling.

“The drilling will test for buried lithium bearing pegmatites within this highly prospective tenement package within what is now recognised as a world class lithium pegmatite region.”

Meanwhile, up 150% is HALO Technologies (ASX:HAL). It’s a momentary mystery, so pls stand by.

I can tell you Halo’s a Sydney-based provider and developer of FinTech products.

“The Group is led by a dynamic management team with decades of experience in financial markets. We combine our knowledge and superior technology to bring institutional-grade investment tools to everyday investors,” says the blurb.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 25 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MTH Mithril Resources 0.001 -33% 26,315 $5,053,207 MTL Mantle Minerals Ltd 0.002 -33% 1,169,251 $18,442,338 CHM Chimeric Therapeutic 0.03 -27% 3,112,828 $21,902,321 CCE Carnegie Clean Energy 0.0015 -25% 122,614 $31,285,147 PAM Pan Asia Metals 0.15 -25% 417,378 $31,764,287 ICN Icon Energy Limited 0.008 -20% 52 $7,680,137 LBT LBT Innovations 0.004 -20% 2,262,999 $1,779,502 BCA Black Canyon Limited 0.125 -17% 4,452 $9,846,657 ICI Icandy Interactive 0.03 -17% 3,968,053 $48,319,405 AQD Ausquest Limited 0.011 -15% 710,182 $10,726,940 PFE Pantera Minerals 0.057 -15% 16,875 $6,567,761 M2R Miramar 0.029 -15% 29,791 $5,061,564 AYT Austin Metals Ltd 0.006 -14% 408,050 $7,111,123 DES Desoto Resources 0.12 -14% 113,333 $8,389,710 RNO Rhinomed Ltd 0.03 -14% 2,500 $10,000,189 EOL Energy One Limited 4.29 -14% 16,501 $150,132,925 XRG Xreality Group Ltd 0.037 -14% 358,121 $19,350,483 NWF Newfield Resources 0.13 -13% 50,000 $132,307,086 DY6 Dy6 Metalsltd 0.1 -13% 6,238 $4,434,687 OD6 Od6 Metals 0.17 -13% 158,811 $10,728,022 1AG Alterra Limited 0.007 -13% 517,999 $5,572,420 VAL Valor Resources Ltd 0.0035 -13% 256,000 $15,493,339 M2M Mt Malcolm Mines 0.022 -12% 183,790 $2,558,588 AHI Advanced Health 0.12 -11% 192,911 $29,390,036 CCO The Calmer Co International 0.004 -11% 5,838,609 $3,677,037

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.