ASX September winners: August was rough. September was brutal

Pic: Getty Images

- The S&P ASX 200 fell 2.8% in September with mid-caps falling 4.6% and small-caps down 4% for the month

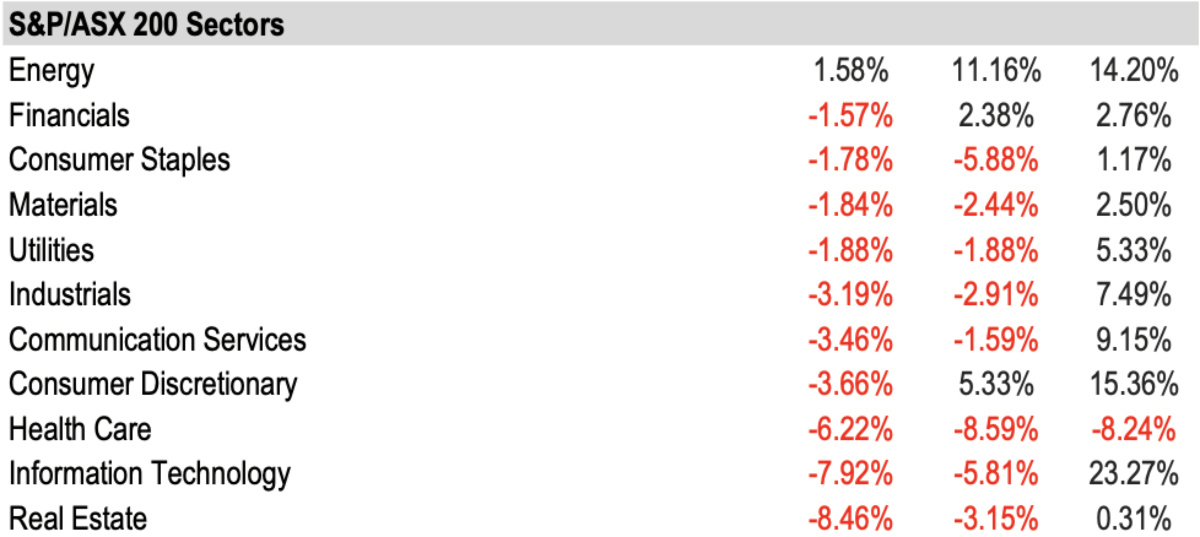

- S&P/ASX 200 Energy was the only sector that closed September in the black with Real Estate down 8.5%

- Firebrick Pharma fell hard in September on poor results of its Phase 3 trial of Nasodine Nasal Spray to treat the common cold

September once again lived up to its reputation as the worst month of the year for the Australian bourse. Australian large caps plunged 2.8% for the month, reducing YTD gains to a meagre 3.7%.

Mid-caps and small-caps did even worse, with the S&P/ASX MidCap 50 down 4.6% and the S&P/ASX Small Ordinaries falling 4% during the month.

The S&P ASX Mid-Cap 50 remains up YTD. However, the S&P ASX Small Ordinaries is now down YTD while the S&P ASX Emerging Companies index has dropped 5.4% in 2023, according to S&P Dow Jones Indices.

Looming US Government shutdown, hawkish Fed prey on markets

Several headwinds faced global markets during September with US economic concerns topping the list. Investors are being confronted with the possibility of a US government shutdown and the likelihood of interest rates remaining at their highest levels in decades.

While the US Federal Reserve held rates in September, it has maintained its hawkish stance. Another rate rise is not off the table by the end of this year if data fails to show inflation slowing as fast as the Fed would like along with tighter monetary policy than previously expected throughout 2024.

“We are in a position to proceed carefully as we assess the incoming data and the evolving outlook and risks,” Fed chair Jerome Powell told a press conference after release of the statement and projections.

“We’re prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we’re confident that inflation is moving down sustainably toward our objective.”

J.P. Morgan global investment strategist Shawn Snyder says the Fed is most likely done with rate hikes, but wants to retain the option for another hike “should inflation and growth reaccelerate more-than-expected.”

“As it stands right now, financial markets are putting the odds of another rate hike in 2023 at about the same as a coin flip,” he said.

A selloff in bonds has also sent longer-term Treasury yields soaring and weighed on US stock markets since mid-year, while elevated energy prices adds to the pressure.

And then there was also continued concerns about the economic slowdown in China, which preyed on global equity markets in August. Key economic data points coming out of China have been spooking markets with a rally widely forecast after prolonged Covid-19 lockdowns in the world’s second largest economy failing to eventuate.

Equity factors in red, energy only sector in black

All reported Australian equity factor indices closed in the red for September. Equal Weight was down the most in September, while Dividend Opportunities was the most successful in limiting its losses.

The S&P/ASX 200 Energy was the only sector that closed September in the black. Real Estate was the biggest laggard, down 8.5%, followed by information technology and healthcare.

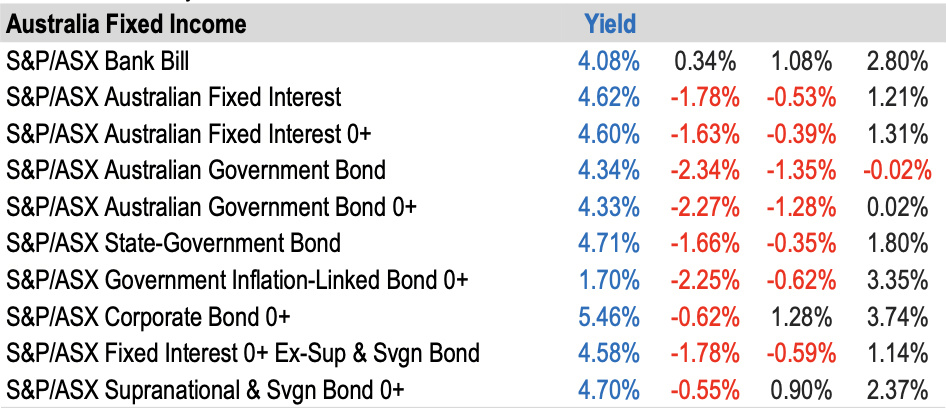

Fixed income also down in September

While being one of the big winners in August, Australian fixed income indices were down in September.

And with the downturn in markets Australian equity implied volatility edged higher in September, with the S&P/ASX 200 VIX Index closing September at 12, 1 point above its level at the previous month-end.

Here are the 50 best performing ASX stocks for September:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | SEPTEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| LV1 | Live Verdure Ltd | 0.34 | 282% | $33,086,922 |

| TOR | Torque Metals | 0.35 | 180% | $42,131,253 |

| OZM | Ozaurum Resources | 0.1 | 133% | $17,462,500 |

| BIT | Biotron Limited | 0.069 | 123% | $45,999,190 |

| CXU | Cauldron Energy Ltd | 0.013 | 117% | $11,418,824 |

| 1AE | Aurora Energy Metals | 0.15 | 114% | $23,085,005 |

| OLI | Oliver'S Real Food | 0.025 | 108% | $10,577,566 |

| LPM | Lithium Plus | 0.46 | 104% | $27,385,103 |

| ICN | Icon Energy Limited | 0.01 | 100% | $7,680,137 |

| MTL | Mantle Minerals Ltd | 0.002 | 100% | $12,294,892 |

| BTC | BTC Health Ltd | 0.04 | 90% | $12,964,932 |

| GCX | GCX Metals Limited | 0.053 | 89% | $10,775,164 |

| HLA | Healthia Limited | 1.75 | 87% | $245,335,960 |

| HAR | Haranga Resources | 0.24 | 85% | $11,179,084 |

| ATP | Atlas Pearls Ltd | 0.076 | 81% | $30,378,895 |

| BCB | Bowen Coal Limited | 0.155 | 80% | $277,678,164 |

| ODE | Odessa Minerals Ltd | 0.0125 | 79% | $12,312,454 |

| OKR | Okapi Resources | 0.17 | 79% | $34,664,193 |

| EME | Energy Metals Ltd | 0.21 | 75% | $35,646,163 |

| RML | Resolution Minerals | 0.007 | 75% | $8,801,043 |

| MHI | Merchant House | 0.054 | 69% | $5,090,391 |

| ELE | Elmore Ltd | 0.005 | 67% | $6,996,919 |

| SXG | Southern Cross Gold | 0.795 | 62% | $70,243,386 |

| EEL | Enrg Elements Ltd | 0.008 | 60% | $7,069,755 |

| STK | Strickland Metals | 0.068 | 58% | $97,614,701 |

| FRX | Flexiroam Limited | 0.036 | 57% | $23,910,901 |

| GLA | Gladiator Resources | 0.022 | 57% | $11,225,140 |

| EML | EML Payments Ltd | 1.15 | 54% | $443,903,686 |

| LPI | Lithium Power International | 0.355 | 54% | $220,233,146 |

| BNR | Bulletin Res Ltd | 0.08 | 54% | $21,725,741 |

| NTI | Neurotech International | 0.069 | 53% | $59,114,735 |

| VTI | Vision Tech Inc | 0.335 | 52% | $10,625,268 |

| KEY | KEY Petroleum | 0.0015 | 50% | $2,951,892 |

| PRX | Prodigy Gold NL | 0.009 | 50% | $15,759,970 |

| SGC | Sacgasco Ltd | 0.0075 | 50% | $5,415,079 |

| WCN | White Cliff Min Ltd | 0.012 | 50% | $15,084,223 |

| BMN | Bannerman Energy Ltd | 2.91 | 48% | $425,945,168 |

| DYL | Deep Yellow Limited | 1.37 | 48% | $978,320,434 |

| SPR | Spartan Resources | 0.415 | 48% | $329,107,513 |

| ALA | Arovella Therapeutic | 0.069 | 47% | $64,941,466 |

| AKN | Auking Mining Ltd | 0.064 | 45% | $13,266,741 |

| AUN | Aurumin | 0.029 | 45% | $8,057,963 |

| EPN | Epsilon Healthcare | 0.032 | 45% | $9,310,974 |

| BUR | Burley Minerals | 0.18 | 44% | $18,233,416 |

| GLB | Globe International | 3.05 | 43% | $126,464,645 |

| PCK | Painchek Ltd | 0.043 | 43% | $59,065,554 |

| MIL | Millennium Grp Ltd | 0.5 | 43% | $21,223,467 |

| ROC | Rocketboots | 0.15 | 43% | $4,880,775 |

| SPX | Spenda Limited | 0.01 | 43% | $36,714,222 |

| SRJ | SRJ Technologies | 0.1 | 43% | $13,352,642 |

Hemp specialist Live Verdure (ASX:LV1) topped the winners list in September up 282%. LV1 announced that CEO Mark Tucker ceased his position effectively immediately on September 8 with chair Gernot Abl assuming an interim executive role.

LV1 says the decision was in line with the evolving direction of the company, and it will keep the market informed of any updates on further appointments.

Torque Metals (ASX:TOR) rose 180% in September after inking a deal to acquire a collection of gold, nickel and lithium-rich tenements, with the expanded holdings to be renamed the Penzance Project.

The site is near its Paris gold camp in the Tier-1 Goldfields mining jurisdiction of WA, including New Dawn, an untapped lithium and tantalum occurrence on granted mining leases, 600m along strike of the established Bald Hill lithium-tantalum operation.

Also on the winners list was genetics cell-focused biotech company Biotron (ASX:BIT), which got a couple of please explains from the ASX over its share price surge.

The company released a letter to investors saying it is in the final stage of three Phase 2 clinical trials for HIV‐1, and COVID‐19.

“This is a pivotal time for the company as it completes data collection and analyses of samples and information collected during the trials ahead of release of headline data in coming weeks,” CEO and managing director Michelle Miller said in a letter to investors.

Here are the 50 worst performing ASX stocks for September:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | SEPTEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| FRE | Firebrick Pharma | 0.052 | -84% | $5,789,224 |

| CYM | Cyprium Metals Ltd | 0.027 | -73% | $42,691,945 |

| SRR | Sarama Resources | 0.02 | -67% | $1,125,064 |

| AMA | AMA Group Limited | 0.042 | -60% | $67,128,443 |

| OAK | Oakridge | 0.072 | -59% | $1,306,872 |

| WYX | Western Yilgarn NL | 0.092 | -58% | $4,618,148 |

| LLL | Leo Lithium | 0.505 | -56% | $498,553,663 |

| BAT | Battery Minerals Ltd | 0.03 | -56% | $3,588,135 |

| CHN | Chalice Mining Ltd | 2.28 | -55% | $859,608,902 |

| VN8 | Vonex Limited | 0.013 | -54% | $5,427,429 |

| RNO | Rhinomed Ltd | 0.036 | -52% | $10,285,909 |

| AXP | AXP Energy Ltd | 0.001 | -50% | $8,737,021 |

| LNR | Lanthanein Resources | 0.008 | -50% | $10,094,180 |

| MSI | Multistack International | 0.003 | -50% | $408,912 |

| PVS | Pivotal Systems | 0.003 | -50% | $2,305,138 |

| NSM | Northstaw | 0.034 | -48% | $4,084,318 |

| AW1 | American West Metals | 0.14 | -46% | $49,980,073 |

| LBT | LBT Innovations | 0.011 | -45% | $4,270,804 |

| M3M | M3 Mining | 0.0765 | -45% | $3,535,011 |

| TML | Timah Resources Ltd | 0.023 | -45% | $2,041,475 |

| WMG | Western Mines | 0.29 | -44% | $16,652,029 |

| YOJ | Yojee Limited | 0.009 | -44% | $9,081,637 |

| CGO | CPT Global Limited | 0.12 | -43% | $5,027,684 |

| CHR | Charger Metals | 0.12 | -43% | $6,832,580 |

| AYA | Artrya Limited | 0.21 | -42% | $13,238,090 |

| FGL | Frugl Group Limited | 0.011 | -42% | $11,472,744 |

| WSI | Weststar Industrial | 0.13 | -41% | $14,399,481 |

| STM | Sunstone Metals Ltd | 0.015 | -40% | $46,229,773 |

| ANX | Anax Metals Ltd | 0.036 | -40% | $15,906,445 |

| MM1 | Midas Minerals | 0.15 | -40% | $14,280,296 |

| HAL | Halo Technologies | 0.06 | -39% | $7,769,713 |

| OM1 | Omnia Metals Group | 0.086 | -39% | $4,010,241 |

| ASO | Aston Minerals Ltd | 0.029 | -38% | $40,815,390 |

| ERD | Eroad Limited | 0.63 | -38% | $93,703,379 |

| EDE | Eden Inv Ltd | 0.0025 | -38% | $6,727,274 |

| MKG | Mako Gold | 0.015 | -38% | $8,064,115 |

| TG1 | Techgen Metals Ltd | 0.029 | -38% | $2,083,544 |

| EXL | Elixinol Wellness | 0.007 | -36% | $5,011,862 |

| MRI | My Rewards International | 0.009 | -36% | $3,839,704 |

| PHL | Propell Holdings Ltd | 0.016 | -36% | $1,925,688 |

| BRN | Brainchip Ltd | 0.1875 | -35% | $319,510,466 |

| ADN | Andromeda Metals Ltd | 0.02 | -35% | $59,090,160 |

| GAL | Galileo Mining Ltd | 0.295 | -35% | $60,275,603 |

| LEG | Legend Mining | 0.024 | -35% | $60,994,021 |

| NXS | Next Science Limited | 0.425 | -35% | $106,337,632 |

| RCE | Recce Pharmaceutical | 0.46 | -35% | $87,590,549 |

| BMR | Ballymore Resources | 0.085 | -35% | $16,081,699 |

| GLL | Galilee Energy Ltd | 0.049 | -35% | $17,603,950 |

| MOB | Mobilicom Ltd | 0.0065 | -35% | $9,286,737 |

| SLM | Solis Minerals | 0.25 | -35% | $19,373,427 |

| TMG | Trigg Minerals Ltd | 0.011 | -35% | $2,992,615 |

Firebrick Pharma (ASX:FRE) fell hard in September on news that its Phase 3 trial of Nasodine Nasal Spray as a treatment for the common cold “did not meet its primary endpoint”.

The trial was measuring Nasodine on overall cold severity (GSS) in subjects with a confirmed viral infection (ITTi). Based on the reported results, the placebo (sterile water) performed better than Nasodine.

Also on the losers list in September was auto parts and repairs player AMA Group (ASX:AMA) which plummeted after coming back to market after a week-long trading halt with news that it was arranging an equity raising to pay off $35 million of senior bank debt.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.