ASX October winners: The 50 best ASX stocks as Israel-Hamas escalation adds further pressure to fragile markets

There were plenty of reasons for investors to feel jittery in October. Pic: Getty Images

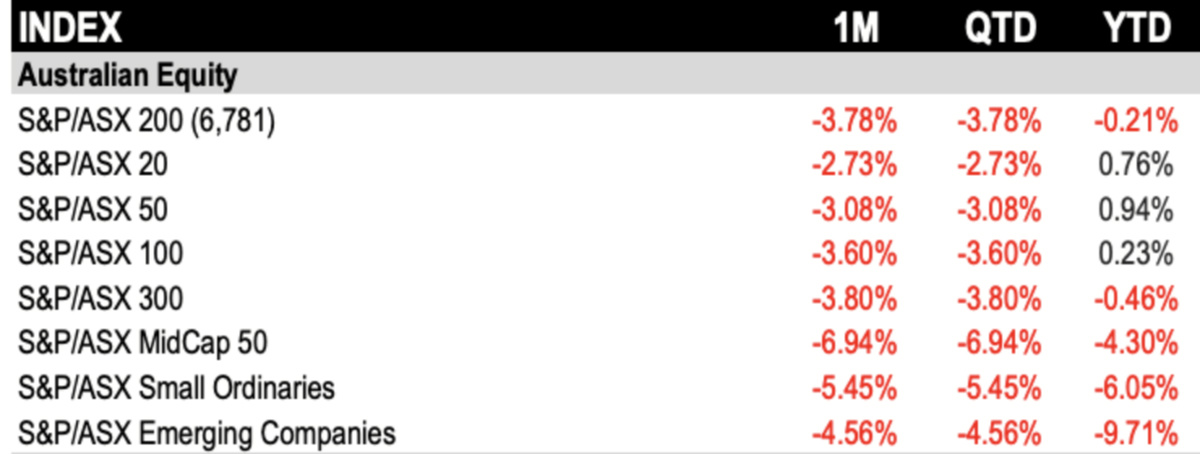

- The S&P ASX 200 fell -3.8% in October with mid-caps falling -6.94% and small-caps down -5.45% for the month

- S&P ASX 200 Energy was the only sector that closed October in the black with all Australian equity factors in red

- Dimerix surges after announcing it will receive $230m in payments following licensing deal with ADVANZ PHARMA

In what is a traditionally a stronger month heading towards the year end, October was anything but for the Australian bourse. Australian large caps plunged -3.8% for the month, with YTD gains now in negative territory at -0.21%.

Mid-caps and small-caps did even worse than the blue chips, with the S&P ASX MidCap 50 and the S&P ASX Small Ordinaries plunging 6.9% and 5.5%, respectively.

The S&P ASX Mid-Cap 50, the S&P ASX Small Ordinaries and the S&P ASX Emerging Companies index are now all in the red for 2023, according to S&P Dow Jones Indices.

Middle East conflict adds further pressure to fragile markets

It seems like global markets just can’t catch a break in 2023. With central banks hiking interest rates in response to sticky inflation there’s been fears of a global recession.

Continued war in Ukraine, concerns about a slowdown and lacklustre recovery post opening from prolonged Covid-19 lockdowns in the world’s second largest economy China have added further pressure to jittery markets.

And then taking Israel and much of the world by surprise on October 7 Hamas launched an attack from the Gaza strip onto bordering areas in the country.

Since then the world has been on tenterhooks as Israel vowed a response, with the conflict and associated humanitarian crisis intensifying throughout October.

Red Leaf Securities CEO John Athanasiou told Stockhead higher interest rates and poor performing markets mean investors are looking elsewhere in 2023.

“The combination of geopolitical instability and global inflation has made the equities unappealing,” he says.

“You can make 5% p.a. by leaving your cash at the bank.

“Not surprising equities have been struggling this year.”

Equity factors in red, energy only sector in black

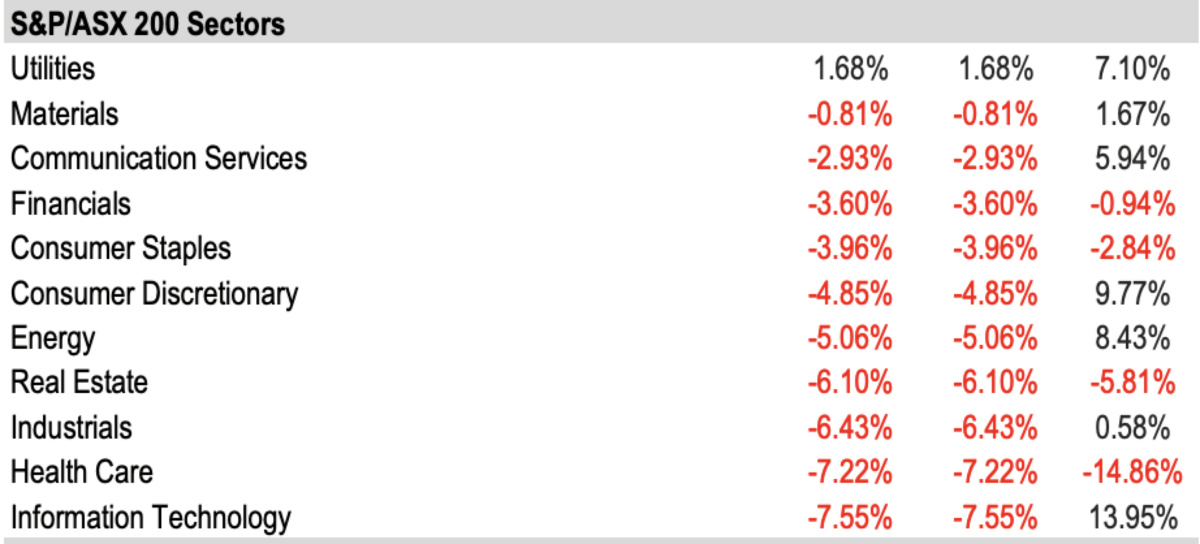

All reported Australian equity factor indices closed in the red for October. Enhanced value was down the most, while dividend opportunities was the most successful in limiting losses in a tough month for markets.

Like September, the S&P/ASX 200 Energy was the only sector that closed October in the black. Information technology was the biggest laggard, followed by healthcare and industrials.

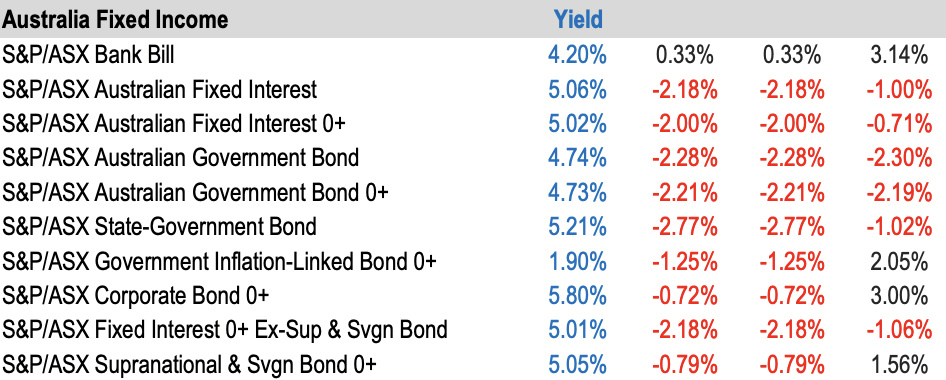

Fixed income also down in October, while ‘fear gauge’ climbs

Australian fixed income indices were also down in October, as they were in September after being big winners in August.

And with all the uncertainty Australian equity implied volatility increased in October. The S&P ASX 200 VIX Index , known as the ”fear gauge’ closed October at 14, which is two points above its level at the end of September.

Here are the 50 best performing ASX stocks for October:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | SEPTEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| HAL | Halo Technologies | 0.215 | 258% | $25,251,567 |

| TG6 | TG Metals | 0.33 | 251% | $14,911,570 |

| DXB | Dimerix Ltd | 0.18 | 195% | $72,005,979 |

| DCN | Dacian Gold Ltd | 0.28 | 167% | $352,872,272 |

| FIN | FIN Resources Ltd | 0.031 | 158% | $17,388,990 |

| NOX | Noxopharm Limited | 0.1 | 156% | $29,223,795 |

| DTC | Damstra Holdings | 0.245 | 145% | $60,602,292 |

| WCG | Webcentral Ltd | 0.265 | 112% | $90,509,713 |

| EGR | Ecograf Limited | 0.23 | 109% | $95,044,294 |

| BNR | Bulletin Res Ltd | 0.16 | 103% | $46,974,576 |

| KRR | King River Resources | 0.019 | 100% | $26,409,924 |

| IND | Industrial Minerals | 0.96 | 96% | $64,380,000 |

| SUH | Southern Hemisphere Mining | 0.046 | 92% | $26,572,784 |

| B4P | Beforepay Group | 0.63 | 73% | $17,599,099 |

| PIM | Pinnacle Minerals | 0.145 | 71% | $3,964,125 |

| TIE | Tietto Minerals | 0.56 | 67% | $637,145,105 |

| TOY | Toys R Us | 0.015 | 67% | $10,807,099 |

| WA1 | WA1 Resources | 8.49 | 65% | $362,310,444 |

| BPH | BPH Energy Ltd | 0.029 | 61% | $31,784,033 |

| WC8 | Wildcat Resources | 0.705 | 58% | $895,130,574 |

| BAT | Battery Minerals Ltd | 0.047 | 57% | $5,262,598 |

| IVZ | Invictus Energy Ltd | 0.235 | 57% | $322,443,378 |

| VN8 | Vonex Limited | 0.02 | 54% | $6,512,915 |

| BMR | Ballymore Resources | 0.13 | 53% | $19,005,644 |

| FND | Findi Limited | 0.67 | 52% | $22,852,339 |

| RVS | Revasum | 0.175 | 52% | $18,535,414 |

| STK | Strickland Metals | 0.105 | 52% | $160,114,610 |

| TNY | Tinybeans Group Ltd | 0.19 | 52% | $15,510,140 |

| BLG | Bluglass Limited | 0.059 | 51% | $90,154,694 |

| BOC | Bougainville Copper | 0.46 | 51% | $176,467,500 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | $8,737,021 |

| BUY | Bounty Oil & Gas NL | 0.009 | 50% | $12,334,509 |

| CT1 | Constellation Tech | 0.003 | 50% | $4,413,601 |

| CZN | Corazon Ltd | 0.018 | 50% | $11,080,762 |

| MTL | Mantle Minerals Ltd | 0.003 | 50% | $18,442,338 |

| RIM | Rimfire Pacific | 0.009 | 50% | $18,947,203 |

| AX8 | Accelerate Resources | 0.037 | 48% | $20,970,099 |

| AWJ | Auric Mining | 0.062 | 48% | $7,720,716 |

| AMA | AMA Group Limited | 0.062 | 48% | $113,427,142 |

| BIT | Biotron Limited | 0.1 | 47% | $84,802,528 |

| GRV | Greenvale Energy Ltd | 0.11 | 47% | $47,603,297 |

| LPI | Lithium Power International | 0.525 | 46% | $330,349,719 |

| ZAG | Zuleika Gold Ltd | 0.016 | 45% | $7,845,759 |

| OBM | Ora Banda Mining Ltd | 0.16 | 45% | $272,871,179 |

| XTE | Xtek Limited | 0.465 | 45% | $44,775,149 |

| BTC | BTC Health Ltd | 0.058 | 45% | $17,826,782 |

| CI1 | Credit Intelligence | 0.21 | 45% | $18,049,268 |

| FGR | First Graphene Ltd | 0.078 | 44% | $47,639,682 |

| FL1 | First Lithium Ltd | 0.35 | 43% | $25,568,858 |

| TPC | TPC Consolidated Ltd | 7.5 | 43% | $87,793,713 |

Topping the winners list in October was HALO Technologies (ASX:HAL) on no real news. The stock was up more than 200% when the ASX issued the company with a please explain.

“It has come to our attention that Pitt Street Research has issued an equities research report. For transparency, HALO has not commissioned the report,” HAL responded on October 25.

TG Metals (ASX:TG6) was up after announcing first drill holes into the Burmeister lithium soil anomaly within the Lake Johnson Project intersected high grade mineralisation up to 2.28% Li2O.

Dimerix (ASX:DXB) surged after announcing it will receive $230m in upfront and milestone payments following a licensing deal with ADVANZ PHARMA to commercialise DMX-200 for treatment of rare kidney disease focal segmental glomerulosclerosis (FSGS).

Dacian Gold (ASX:DCN) rose after Raleigh Finlayson’s $1.47b market capped gold miner Genesis Minerals (ASX:GMD) put together an off-market takeover bid for the remaining worth of DCN shares it didn’t already own. By October 30 GMD had acquired a relevant interest in 1,157,212,857 DCN shares and has voting power of 95.1%.

Here are the 50 worst performing ASX stocks for October:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | SEPTEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| C1X | Cosmos Exploration | 0.115 | -69% | $5,114,625 |

| AMD | Arrow Minerals | 0.001 | -60% | $6,047,530 |

| KZA | Kazia Therapeutics | 0.07 | -58% | $18,907,950 |

| INL | Innlanz Limited | 0.011 | -54% | $3,445,900 |

| NXS | Next Science Limited | 0.2 | -54% | $49,181,155 |

| AHN | Athena Resources | 0.003 | -50% | $4,281,870 |

| AVM | Advance Metals Ltd | 0.003 | -50% | $1,765,676 |

| BP8 | BPH Global Ltd | 0.001 | -50% | $1,615,563 |

| GSM | Golden State Mining | 0.018 | -50% | $3,630,677 |

| ICN | Icon Energy Limited | 0.005 | -50% | $5,376,096 |

| MXCDA | MGC Pharmaceuticals | 0.001 | -50% | $4,427,969 |

| RGS | Regeneus Ltd | 0.004 | -50% | $1,532,185 |

| RB6 | Rubix Resources | 0.13 | -48% | $7,364,250 |

| RHY | Rhythm Biosciences | 0.185 | -46% | $38,699,953 |

| WOA | Wide Open Agriculture | 0.175 | -46% | $30,281,915 |

| ME1 | Melodiol Global Health | 0.003 | -45% | $11,427,311 |

| S3N | Sensore Ltd | 0.115 | -45% | $4,185,222 |

| TOR | Torque Metals | 0.195 | -43% | $25,341,752 |

| TMB | Tambourah Metals | 0.115 | -43% | $9,538,141 |

| DAL | Dalaroo Metals | 0.03 | -42% | $2,448,000 |

| TMR | Tempus Resources Ltd | 0.015 | -42% | $5,658,226 |

| NMT | Neometals Ltd | 0.215 | -42% | $127,260,826 |

| JAN | Janison Education Group | 0.24 | -41% | $60,578,647 |

| 1AE | Aurora Energy Metals | 0.094 | -41% | $15,124,658 |

| AKN | Auking Mining Ltd | 0.038 | -41% | $8,572,356 |

| MTM | MTM Critical Metals | 0.022 | -41% | $2,284,753 |

| EMU | EMU NL | 0.0015 | -40% | $1,667,521 |

| G88 | Golden Mile Res Ltd | 0.018 | -40% | $5,599,622 |

| LVT | Livetiles Limited | 0.006 | -40% | $7,062,664 |

| ZEU | Zeus Resources Ltd | 0.009 | -40% | $4,133,529 |

| KNO | Knosys Limited | 0.025 | -39% | $7,780,993 |

| XPN | Xpon Technologies | 0.033 | -39% | $6,341,101 |

| TMK | TMK Energy Limited | 0.008 | -38% | $40,244,634 |

| MAP | Microba Life Sciences | 0.21 | -38% | $81,212,722 |

| INR | Ioneer Ltd | 0.14 | -38% | $316,653,948 |

| CCP | Credit Corp Group | 12.07 | -38% | $820,205,615 |

| KPO | Kalina Power Limited | 0.005 | -38% | $6,060,783 |

| AVH | Avita Medical | 2.88 | -37% | $175,343,820 |

| LLI | Loyal Lithium Ltd | 0.415 | -37% | $35,825,292 |

| TYR | Tyro Payments | 0.86 | -37% | $446,530,964 |

| CR1 | Constellation Res | 0.105 | -36% | $5,240,070 |

| GTR | Gti Energy Ltd | 0.007 | -36% | $15,374,603 |

| ODE | Odessa Minerals Ltd | 0.008 | -36% | $7,576,895 |

| DY6 | DY6 Metals | 0.087 | -36% | $3,432,062 |

| OCN | Oceana Lithium | 0.145 | -36% | $7,165,328 |

| BMM | Balkan Mining and Minerals | 0.13 | -35% | $8,600,897 |

| REC | Recharge Metals | 0.13 | -35% | $12,248,717 |

| 3DP | Pointerra Limited | 0.058 | -35% | $64,960,858 |

| RFT | Rectifier Technologies | 0.032 | -35% | $49,751,422 |

| M2R | Miramar | 0.023 | -34% | $3,870,608 |

Oncology-focused drug development company Kazia Therapeutics (ASX:KZA) announced its intention to de-list from the ASX, saying its board ultimately determined that the costs, administrative burden and commercial disadvantages of remaining listed on the bourse outweigh any benefits.

Several resources stocks were also down in October with lithium junior Cosmos Exploration (ASX:C1X) topping the list.

CX1 released its quarterly update in October but also provided positive updates on its exploration activities at its prospective Corvette Far East Lithium project and Lasalle project, in the prolific James Bay district in Quebec, Canada.

At Stockhead, we tell it like it is. While Dimerix is a Stockhead advertiser, it did not sponsor this article.</em

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.