ASX May Winners: The best 50 stocks as inflation continues to weigh on markets

Pic: Getty Images

- S&P/ASX 200 rose 1% in May with large caps leading the gains and small caps lagging

- S&P/ASX 200 information and utilities were the top performing sectors in May

- Resources stocks dominated the May winners table with Australian Gold and Copper surging

Australia’s benchmark equity index, the S&P/ASX 200, remained range-bound and closed the month up ~1%, led by large-cap companies as small caps lagged. Emerging companies extended gains, up ~10% YTD, according to S&P Dow Jones Indices (S&P DJI).

Looking at key economic points released in May and Australian CPI climbed to its highest point in five months, making it unlikely that interest rates will be cut soon and instead has raised the possibility of an RBA rate hike.

The CPI for the year ending in April was 3.6%, higher than the expected 3.4%. In comparison, monthly inflation for the year ending in March was 3.5%.

In the US inflation as measured by the change in the Personal Consumption Expenditures (PCE) Price Index, remained steady at 2.7% on a yearly basis in April, the US Bureau of Economic Analysis reported on May 31.

The reading matched the increase seen in March and aligned with market expectations. As forecast the PCE Price Index rose 0.3% month-over-month.

Wealth Within chief analyst Dale Gillham told Stockhead the key message he is getting from the Reserve Bank of Australia (RBA) is that the restrictive environment caused by high interest rates is working, albeit more slowly than they expect.

“Moving forward they still expect demand to be subdued as it comes into line with supply, when this occurs, we may see inflation and interest rates ease,” he says.

“To me whilst we would all like to see interest rates come down sooner rather than later, it seems the RBA is happy with the current rate at least for now.

“With these economic challenges we are facing, it has been surprising that the Australian stock market has been so resilient during May.”

The All Ordinaries Index (ASX:XAO), which contains the 500 largest ASX listed companies and accounts for 97% of Australia’s equity market, closed the month up 0.49%.

“Over the last 40 years typically May and June are bearish months for the All Ordinaires Index, with June on average being the second most bearish month in our market,” Gillham says.

“Given this it would not be surprising to see our market fall for a few more weeks.”

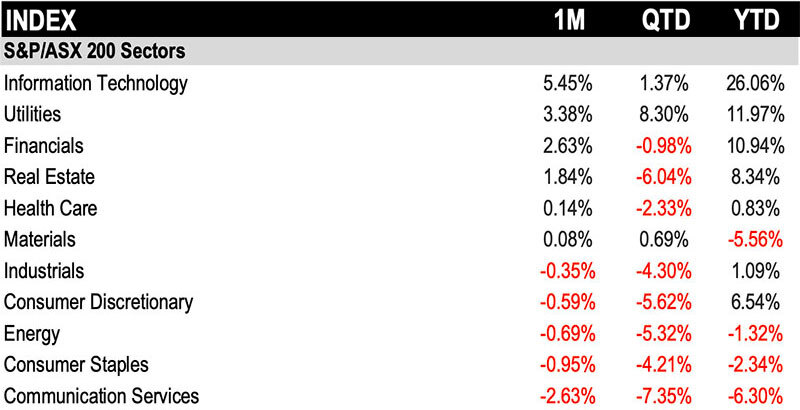

Tech takes out first place in May

Five of the 11 sectors finished in the red in May. The S&P/ASX 200 information and utilities were among the performing sectors with 5.45% and 3.38% gains in May, extending their YTD gains to 26% and 12%, respectively. The tech sector is the top performer for 2024, up 26% YTD.

Communication Services had the biggest fall of 2.63% in May to become the worst performing sector YTD.

Fear gauge falls slightly in May

The S&P/ASX 200 VIX moved lower from its April hike and closed the month at 11.5, near its one-year average. VIX (short for volatility index) is known as the “fear gauge” and reflects investor expectations about volatility over the next 30 days in the S&P/ASX 200.

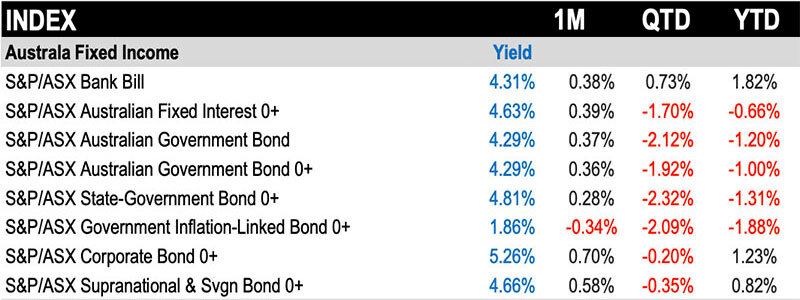

Fixed income mostly back in positive territory

Fixed income indices in Australia finished May mostly marginally up, with signals the RBA may need to stay restrictive for longer on interest rates.

Here are the 50 best performing ASX stocks for May:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | MAY RETURN % | MARKET CAP |

|---|---|---|---|---|

| CAQ | CAQ Holdings Ltd | 0.065 | 713% | $46,656,108 |

| AGC | AGC Ltd | 0.465 | 447% | $103,333,333 |

| KP2 | Kore Potash PLC | 0.038 | 245% | $25,014,051 |

| DY6 | DY6 Metals | 0.12 | 173% | $4,849,300 |

| ERW | Errawarra Resources | 0.115 | 161% | $11,030,877 |

| FRS | Forrestania Resources | 0.046 | 156% | $7,442,144 |

| ICL | Iceni Gold | 0.066 | 154% | $18,002,229 |

| FAL | Falcon Metals | 0.32 | 137% | $56,640,000 |

| LTP | Ltr Pharma Limited | 0.605 | 133% | $42,595,320 |

| BUR | Burley Minerals | 0.14 | 115% | $21,051,932 |

| CRS | Caprice Resources | 0.036 | 112% | $10,053,912 |

| RC1 | Redcastle Resources | 0.025 | 108% | $8,207,104 |

| M4M | Macro Metals Limited | 0.035 | 106% | $125,946,867 |

| IS3 | I Synergy Group Ltd | 0.014 | 100% | $4,957,125 |

| SER | Strategic Energy | 0.02 | 100% | $11,959,939 |

| BDX | Bcal Diagnostics | 0.175 | 90% | $44,151,575 |

| CBH | Coolabah Metals | 0.077 | 83% | $9,271,283 |

| NVU | Nanoveu Limited | 0.031 | 82% | $13,816,564 |

| PH2 | Pure Hydrogen Corp | 0.2 | 82% | $71,696,164 |

| CU6 | Clarity Pharma | 5.08 | 81% | $1,579,950,104 |

| EMU | EMU NL | 0.032 | 78% | $2,159,775 |

| ILT | Iltani Resources Lim | 0.335 | 72% | $11,393,519 |

| A3D | Aurora Labs Limited | 0.064 | 68% | $21,996,034 |

| SVY | Stavely Minerals Ltd | 0.047 | 68% | $17,951,184 |

| ENT | Enterprise Metals | 0.005 | 67% | $4,423,605 |

| IND | Industrial Minerals | 0.25 | 67% | $16,846,200 |

| PEC | Perpetual Resources | 0.015 | 67% | $9,600,441 |

| EQN | Equinox Resources | 0.355 | 65% | $43,842,501 |

| IRI | Integrated Research | 0.71 | 65% | $123,972,127 |

| BM8 | Battery Age Minerals | 0.165 | 65% | $15,348,983 |

| BMR | Ballymore Resources | 0.205 | 64% | $36,229,770 |

| FTZ | Fertoz Ltd | 0.05 | 61% | $12,512,444 |

| CCZ | Castillo Copper Ltd | 0.008 | 60% | $10,396,043 |

| PPY | Papyrus Australia | 0.016 | 60% | $7,883,081 |

| PUA | Peak Minerals Ltd | 0.004 | 60% | $4,165,506 |

| CYP | Cynata Therapeutics | 0.335 | 60% | $60,176,648 |

| MDX | Mindax Limited | 0.053 | 56% | $108,585,540 |

| MHI | Merchant House | 0.056 | 56% | $5,278,924 |

| RR1 | Reach Resources Ltd | 0.014 | 56% | $12,242,039 |

| GIB | Gibb River Diamonds | 0.048 | 55% | $10,152,453 |

| KOB | Koba Resources | 0.15 | 55% | $23,784,242 |

| AQD | Ausquest Limited | 0.017 | 55% | $14,027,537 |

| TOR | Torque Met | 0.2 | 54% | $36,645,760 |

| SUM | Summit Minerals | 0.23 | 53% | $10,961,139 |

| GBE | Globe Metals & Mining | 0.058 | 53% | $39,200,320 |

| OZZ | OZZ Resources | 0.05 | 52% | $4,626,506 |

| 8IH | 8I Holdings Ltd | 0.015 | 50% | $5,360,340 |

| AOA | Ausmon Resorces | 0.003 | 50% | $3,176,998 |

| CNJ | Conico Ltd | 0.0015 | 50% | $1,805,095 |

| FGL | Frugl Group Limited | 0.09 | 50% | $8,938,649 |

Resources stocks stood out on the May winners table. Australian Gold and Copper (ASX:AGC) was one of the big winners for May after earlier in the month hitting a 5m intersection at 16.9g/t gold, 1,473g/t silver and 15% lead+zinc in a drilling campaign.

During May AGC announced firm commitments have been received for an $11 million placement at 32 cents/share. Funds will be applied towards the company’s portfolio of exploration assets including the South Cobar Project and for general working capital.

Kore Potash (ASX:KP2) got hit with a price and volume in relation to change in the price of its share from a low of $0.014 to an intraday high of $0.022 on May 23 and “the significant increase in the volume of KP2’s securities” traded from May 16-23 May 2024.

KP2 responded the recent increase trading price and volume could be linked to market expectation in finalising the engineering, procurement and construction (EPC) proposal and contract with PowerChina International Group.

“The company confirms that no further or formal legal agreements have been entered into with work and negotiations on these matters continuing,” KP2 says in an announcement.

Critical minerals company DY6 Metals (ASX:DY6) was up in May after receiving additional historical drilling data supporting the Tundulu rare earth elements project in southern Malawi.

Known as a gold, lithium and nickel hunter, Forrestania Resources’ (ASX:FRS) focus is in the Eastern Goldfields of WA, but also Canada (lithium).

However, FRS rose strongly during the month on news related to iron ore, in the Yilgarn region. The company announced it’s entered into an option agreement with shareholders of Netley Minerals to acquire 100% of issued shares in Netley, which is the holder of highly prospective iron ore tenements right next to Mineral Resources’ (ASX:MIN) Koolyanobbing operations.

Here are the 50 worst performing ASX stocks for May:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | MAY RETURN % | MARKET CAP |

|---|---|---|---|---|

| OSX | Osteopore Limited | 0.053 | -85% | $6,020,959 |

| JTL | Jayex Technology Ltd | 0.001 | -80% | $281,279 |

| WOA | Wide Open Agriculture | 0.02 | -79% | $4,470,468 |

| APC | Australian Potash | 0.001 | -75% | $6,030,284 |

| ICU | Investor Centre Ltd | 0.007 | -67% | $2,131,579 |

| ENL | Enlitic Inc. | 0.25 | -58% | $19,678,657 |

| MPP | Metro Perf.Glass Ltd | 0.072 | -56% | $13,347,222 |

| SHP | South Harz Potash | 0.011 | -56% | $9,099,035 |

| MCL | Mighty Craft Ltd | 0.006 | -54% | $2,397,910 |

| GLL | Galilee Energy Ltd | 0.026 | -51% | $8,833,361 |

| CLZ | Classic Min Ltd | 0.004 | -50% | $1,634,340 |

| HCT | Holista CollTech Ltd | 0.005 | -50% | $1,394,000 |

| ME1 | Melodiol Global Health | 0.002 | -50% | $1,646,275 |

| TKL | Traka Resources | 0.001 | -50% | $1,750,659 |

| VBS | Vectus Biosystems | 0.13 | -48% | $6,917,368 |

| AMS | Atomos | 0.021 | -48% | $25,486,908 |

| AAU | Antilles Gold Ltd | 0.007 | -46% | $6,975,745 |

| LU7 | Lithium Universe Ltd | 0.018 | -45% | $9,120,844 |

| FTC | Fintech Chain Ltd | 0.01 | -44% | $6,507,696 |

| BEL | Bentley Capital Ltd | 0.023 | -43% | $1,750,942 |

| CGR | CGN Resources | 0.195 | -42% | $17,701,747 |

| MKR | Manuka Resources | 0.044 | -41% | $33,430,738 |

| CHM | Chimeric Therapeutic | 0.018 | -40% | $15,415,319 |

| ECT | Environmental Clean Technologies | 0.003 | -40% | $12,687,242 |

| IMI | Infinity Mining | 0.045 | -40% | $5,343,903 |

| NGS | NGS Ltd | 0.003 | -40% | $753,682 |

| NYR | Nyrada Inc | 0.057 | -39% | $10,226,296 |

| DTI | DTI Group Ltd | 0.011 | -39% | $4,934,066 |

| ATV | Active Port Group | 0.054 | -39% | $17,125,985 |

| WYX | Western Yilgarn NL | 0.033 | -38% | $3,032,948 |

| WLD | Wellard Limited | 0.025 | -38% | $13,281,258 |

| VRX | VRX Silica Ltd | 0.044 | -37% | $27,643,249 |

| MPR | Mpower Group Limited | 0.012 | -37% | $4,124,439 |

| DMG | Dragon Mountain Gold | 0.007 | -36% | $2,762,702 |

| MSI | Multistack International | 0.009 | -36% | $1,226,735 |

| HAS | Hastings Tech Metals | 0.22 | -35% | $38,802,749 |

| THL | Tourism holdings | 1.75 | -35% | $381,892,716 |

| LV1 | Live Verdure Ltd | 0.415 | -35% | $51,815,155 |

| ADS | Adslot Ltd | 0.002 | -33% | $6,448,991 |

| AUH | Austchina Holdings | 0.002 | -33% | $4,200,767 |

| AYM | Australia United Mining | 0.002 | -33% | $5,527,732 |

| BFC | Beston Global Ltd | 0.004 | -33% | $7,988,188 |

| INP | Incentiapay Ltd | 0.004 | -33% | $4,975,720 |

| LNR | Lanthanein Resources | 0.004 | -33% | $9,774,545 |

| RIE | Riedel Resources Ltd | 0.002 | -33% | $4,447,671 |

| RLG | Roolife Group Ltd | 0.004 | -33% | $3,129,527 |

| RMX | Red Mount Min Ltd | 0.001 | -33% | $3,423,577 |

| RTR | Rumble Resources | 0.044 | -33% | $32,137,348 |

| SHO | Sportshero Ltd | 0.004 | -33% | $2,471,331 |

| TMR | Tempus Resources Ltd | 0.004 | -33% | $2,923,995 |

Regenerative food and agriculture company Wide Open Agriculture (ASX:WOA)was asked a couple of times to explain a few things by the ASX, and dropped 79% in May.

Craft beer accelerator with a nationally diversified portfolio of craft beverages Mighty Craft (ASX:MCL) fell in 54% May. MCL has built an infrastructure and distribution offering that enables the company to scale production, distribution, and sales.

MCL announced in May it was selling 7.5% of the shares in Better Beer to its senior debt provider PURE Asset Management for ~$6.1 million, as parts of its plan to reduce debt.

At Stockhead, we tell it like it is. While DY6 Metals is a Stockhead advertiser, the company did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.