ASX May Winners: No walking away in May for Dateline Resources, which rocketed 978pc

DTR made a date with the moon in May. Pic via Getty Images

- Australia’s S&P/ASX 200 rallied 4.20% in May along with global markets as US-tariff tensions eased

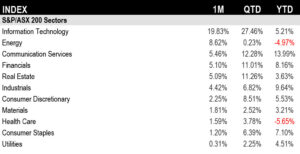

- All of 11 sectors gained in May, led by tech up almost 20% followed by energy and communication services

- Dateline Resources surged 978% in May with its gold and rare earths Colosseum project in California getting a shoutout from US President Donald Trump

The Aussie bourse joined global equities to rally for the second consecutive month in May, driven by relief from US tariff-related risk, according to S&P Dow Jones Indices (S&P DJI).

Australia’s S&P/ASX 200 rose 4.20% in May and is up 4.95% YTD, in what has been a volatile year for equity markets.

Smaller stocks outperformed larger caps in May, with the S&P/ASX Small Ordinaries climbing 5.76%.

Fears around escalating US tariffs eased in May bringing relief to global markets. Investor sentiment improved as trade tensions between the US and China showed signs of de-escalation, with diplomatic rhetoric softening.

Starting May 14, the US reduced tariffs on Chinese imports from as high as 145% to 30%, while China lowered its tariffs on US goods from 125% to 10%. The agreement aimed to create a window for further negotiations.

However, by the end of May Trump was accusing China of breaking the tariff truce and China responded with accusations of American misconduct, reigniting concerns of trade war between the world’s two largest economies.

May also saw legal challenges to existing US tariffs gain momentum. Several US courts began reviewing cases contesting the legality of specific tariffs imposed, signalling that some could be rolled back or revised.

Back at home the Reserve Bank of Australia board announced on May 20 that it had decided to lower the cash rate by 25 basis points to 3.85% as inflation fell to within the central bank’s 2-3% target range.

Trimmed mean inflation, the RBA’s preferred measure of underlying inflation, was 2.9% over the year to the March quarter.

However, the RBA said it was continuing to manage expectations for future interest rate cuts, pointing to ongoing uncertainty around tariffs and the domestic labour market.

“The Monetary Policy Board judged that the risks to inflation had become more balanced but that the outlook is uncertain and depends heavily on unpredictable developments in global trade policy,” the RBA said.

Tech tops winning sectors

All sectors within the S&P/ASX 200 posted gains in May, led by Information Technology, which was up 20%, followed by Energy, up 9%.

Defensive sectors including Utilities, Consumer Staples and Health Care ended May in the green but were the month’s underperformers.

Factor indices in positive territory, while fix income mixed

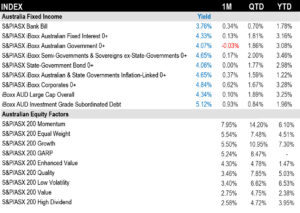

All reported Australian factor indices remained in positive territory in May with Momentum – the best-performing factor in 2024 – outperforming along with Equal Weight, and Growth.

S&P DJI said High Dividend and Value trailed, consistent with the trends observed at the sectoral level.

Volatility declined across the board, with Australia’s S&P/ASX 200 VIX falling to a 10-handle and the US VIX dropping below 20 – both lower than levels seen prior to US President Donald Trump’s Liberation Day tariff announcement on April 2.

Fixed income indices were mixed as long-term rates remained volatile globally.

The 50 best performing ASX stocks in May

| CODE | COMPANY | LAST SHARE PRICE | MAY RETURN % | MARKET CAP |

|---|---|---|---|---|

| DTR | Dateline Resources | 0.097 | 978% | $262,956,021 |

| RMI | Resource Mining Corp | 0.028 | 460% | $21,299,147 |

| RPG | Raptis Group Limited | 0.038 | 389% | $6,136,985 |

| LKY | Locksley Resources | 0.08 | 321% | $9,680,000 |

| EDE | Eden Innovations | 0.003 | 200% | $12,329,643 |

| SMM | Somerset Minerals | 0.024 | 140% | $9,722,874 |

| PUA | Peak Minerals Ltd | 0.021 | 133% | $56,146,426 |

| OCN | Oceana lithium | 0.059 | 119% | $7,837,294 |

| MKL | Mighty Kingdom Ltd | 0.013 | 117% | $5,347,559 |

| RML | Resolution Minerals | 0.017 | 113% | $7,361,016 |

| LOC | Locate Technologies | 0.115 | 109% | $14,083,568 |

| PEK | Peak Rare Earths Ltd | 0.255 | 108% | $89,789,736 |

| HRE | Heavy Rare Earths | 0.041 | 105% | $8,529,389 |

| FRS | Forrestania Resources | 0.079 | 103% | $25,772,734 |

| DVL | Dorsavi Ltd | 0.014 | 100% | $9,506,093 |

| HIO | Hawsons Iron Ltd | 0.026 | 100% | $25,412,534 |

| LLI | Loyal Lithium Ltd | 0.13 | 97% | $13,095,298 |

| 4DS | 4Ds Memory Limited | 0.059 | 97% | $126,146,384 |

| NWC | New World Resources | 0.047 | 96% | $168,210,882 |

| EDU | EDU Holdings Limited | 0.27 | 93% | $42,154,954 |

| TMG | Trigg Minerals Ltd | 0.081 | 88% | $75,757,331 |

| MM1 | Midas Minerals | 0.28 | 87% | $38,837,399 |

| MPW | Metal Powdworks Ltd | 0.875 | 86% | $81,567,403 |

| VTM | Victory Metals Ltd | 0.88 | 85% | $101,837,524 |

| SPD | Southern Palladium | 0.415 | 84% | $35,470,500 |

| BTM | Breakthrough Minerals | 0.125 | 84% | $5,264,545 |

| ELS | Elsight Ltd | 0.77 | 83% | $123,584,023 |

| VRL | Verity Resources | 0.029 | 81% | $7,742,283 |

| YAR | Yari Minerals Ltd | 0.009 | 80% | $4,992,403 |

| D3E | D3 Energy Limited | 0.115 | 80% | $10,331,751 |

| RNT | Rent.Com.Au Limited | 0.032 | 78% | $24,735,277 |

| MEG | Megado Minerals Ltd | 0.014 | 75% | $5,875,566 |

| G50 | G50Corp Ltd | 0.19 | 73% | $28,907,579 |

| CDT | Castle Minerals | 0.1 | 72% | $11,020,909 |

| CDR | Codrus Minerals Ltd | 0.034 | 70% | $6,822,235 |

| RLT | Renergen Limited | 0.96 | 70% | $28,051,528 |

| CCE | Carnegie Cln Energy | 0.061 | 69% | $20,873,598 |

| ERD | Eroad Limited | 1.39 | 67% | $253,004,353 |

| TAS | Tasman Resources Ltd | 0.025 | 67% | $3,314,567 |

| BMR | Ballymore Resources | 0.165 | 65% | $27,393,241 |

| FML | Focus Minerals Ltd | 0.385 | 60% | $101,728,319 |

| ANX | Anax Metals Ltd | 0.008 | 60% | $7,062,461 |

| JAL | Jameson Resources | 0.04 | 60% | $23,207,866 |

| MGU | Magnum Mining & Exp | 0.008 | 60% | $7,851,556 |

| WTM | Waratah Minerals Ltd | 0.32 | 60% | $74,723,925 |

| NYR | Nyrada Inc | 0.165 | 57% | $32,692,141 |

| ESK | Etherstack PLC | 0.44 | 57% | $58,155,681 |

| STK | Strickland Metals | 0.145 | 56% | $316,730,372 |

| PPY | Papyrus Australia | 0.014 | 56% | $8,590,226 |

| FG1 | Flynn Gold | 0.031 | 55% | $11,348,178 |

Dateline Resources (ASX:DTR) rose a staggering 978% in May, reaching a market cap of ~$262 million [at the time of publishing on June 2, its market cap has surged further to $414m] with much of the investor interest sparked by a shoutout from Trump on his social media platform Truth Social.

DTR owns the 1.1Moz Colosseum gold project in California, with Trump highlighting its rare earths potential given its close proximity to the Mountain Pass rare earths mine.

The company also announced an updated scoping study with little changed except an assumed gold price moving from US$2200/oz to US$2900/oz, still well below spot.

Annual gold production remains at 71,000ozpa, but net revenue before tax is projected to jump 208%, from US$398m to US$827 million.

The internal rate of return before tax – a measure of profitability – climbs from 31% to 61%, while pre-tax discounted cashflow rises 234% to US$550m.

DTR was up another ~50% on Monday after painting more details on upcoming field work and drilling to find new sources of gold and rare earths at Colosseum.

Resource Mining Corporation (ASX:RMI) saw its share price surge 460% in May, driven by a series of exploration updates from its Mpanda copper-gold project in Tanzania.

The share climb triggered an ASX price and volume query on May 16. The company also announced it had received firm commitments from professional and sophisticated investors for a placement to raise $2m.

Locksley Resources (ASX:LKY) also had a strong May up 321% in what Kristie Batten described as a “transformational month” for the company thanks to its Mojave rare earth and antimony project in California.

Geologist Allister Caird joined the company in May as Head of Critical Minerals, while Donald Trump’s push to boost local mineral production is seen as a major tailwind for LKY. Its Mojave project is located just 1.4km from MP Materials’ Mountain Pass mine — the only producing rare earths mine in the US.

LKY closed more than 30% higher on Monday with its share price ~1.8 cents at the start of May and now 10.5 cents.

Eden Innovations (ASX:EDE) was up 200% in May after issuing a positive update on sales of its EdenCrete Pz7 concrete additive, a product that makes standard concrete mixes stronger and reduces the need for carbon-intensive Portland Cement.

Over the past three months, EDE said sales topped US$567k. In April and May sales were 86% higher than the whole of Q4 FY24.

EDE said it had experienced rapid growth in sales of Pz7 for commercial applications in the US, Ecuador, Mexico, and Canada.

The 50 worst performing ASX stocks in May

| CODE | COMPANY | LAST SHARE PRICE | MAY RETURN % | MARKET CAP |

|---|---|---|---|---|

| LSR | Lodestar Minerals | 0.006 | -65% | $2,069,755 |

| DUB | Dubber Corp Ltd | 0.016 | -62% | $41,973,880 |

| OSL | Oncosil Medical | 0.002 | -56% | $13,819,747 |

| HCF | H&G High Conviction | 0.025 | -55% | $504,568 |

| CRN | Coronado Global Resources | 0.11 | -51% | $209,556,716 |

| 1TT | Thrive Tribe Tech | 0.001 | -50% | $2,031,723 |

| BMO | Bastion Minerals | 0.0015 | -50% | $1,807,255 |

| E79 | E79 Gold Mines | 0.018 | -50% | $2,693,015 |

| JAY | Jayride Group | 0.001 | -50% | $1,427,889 |

| LNR | Lanthanein Resources | 0.001 | -50% | $2,443,636 |

| SHP | South Harz Potash | 0.003 | -50% | $3,308,186 |

| 88E | 88 Energy Ltd | 0.026 | -48% | $27,776,410 |

| AON | Apollo Minerals Ltd | 0.009 | -47% | $9,284,569 |

| AR3 | Austrare | 0.058 | -41% | $12,931,229 |

| CAE | Cannindah Resources | 0.032 | -41% | $23,298,558 |

| 1AD | Adalta Limited | 0.003 | -40% | $1,286,446 |

| AVH | Avita Medical | 1.86 | -40% | $136,757,000 |

| FTC | Fintech Chain Ltd | 0.003 | -40% | $1,952,309 |

| OLH | Oldfields Holdings | 0.027 | -40% | $5,752,597 |

| IMU | Imugene Limited | 0.015 | -40% | $119,472,333 |

| NUF | Nufarm Limited | 2.38 | -40% | $896,180,426 |

| ARN | Aldoro Resources | 0.32 | -38% | $56,058,088 |

| ENL | Enlitic Inc | 0.03 | -38% | $24,527,901 |

| IVT | Inventis Limited | 0.01 | -38% | $764,244 |

| KLI | Killi Resources | 0.03 | -38% | $4,346,936 |

| RNX | Renegade Exploration | 0.0025 | -38% | $2,576,727 |

| OFX | OFX Group Ltd | 0.72 | -36% | $178,338,490 |

| IR1 | Irismetals | 0.1 | -35% | $18,970,532 |

| CCM | Cadoux Limited | 0.033 | -35% | $12,982,116 |

| NHE | Noble Helium | 0.011 | -35% | $5,395,725 |

| DTZ | Dotz Nano Ltd | 0.048 | -34% | $28,323,086 |

| BDM | Burgundy D Mines Ltd | 0.025 | -34% | $38,375,971 |

| 3DP | Pointerra Limited | 0.055 | -34% | $44,279,224 |

| AQX | Alice Queen Ltd | 0.004 | -33% | $4,998,560 |

| AVD | Avada Group Limited | 0.2 | -33% | $18,261,030 |

| AXP | AXP Energy Ltd | 0.001 | -33% | $6,684,681 |

| DMG | Dragon Mountain Gold | 0.004 | -33% | $1,578,687 |

| EG1 | Evergreen Lithium | 0.032 | -33% | $6,587,349 |

| KPO | Kalina Power Limited | 0.004 | -33% | $17,597,818 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | $1,733,666 |

| RAN | Range International | 0.002 | -33% | $1,878,581 |

| RAS | Ragusa Minerals Ltd | 0.014 | -33% | $1,996,383 |

| REZ | Resources & Energy Group | 0.016 | -33% | $12,089,504 |

| VML | Vital Metals Limited | 0.002 | -33% | $11,790,134 |

| REE | Rarex Limited | 0.019 | -32% | $16,562,952 |

| PFT | Pure Foods Tas Ltd | 0.015 | -32% | $2,166,810 |

| EWC | Energy World Corporation | 0.015 | -32% | $49,262,740 |

| KEY | KEY Petroleum | 0.041 | -32% | $1,008,640 |

| SRJ | SRJ Technologies | 0.013 | -32% | $9,083,671 |

| TEE | Topend Energy | 0.052 | -32% | $14,243,344 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.