ASX Lunch Wrap: Xero lifts ASX higher; Selfwealth skyrockets after attracting another suitor

Selfwealth attracts another suitor. Picture via Getty Images

- ASX rises on US inflation data

- Xero up 5pc, Mesoblast jumps 18pc, Selfwealth attracts AxiCorp

- Aussie dollar drops, Bitcoin hits US$93k before retreating

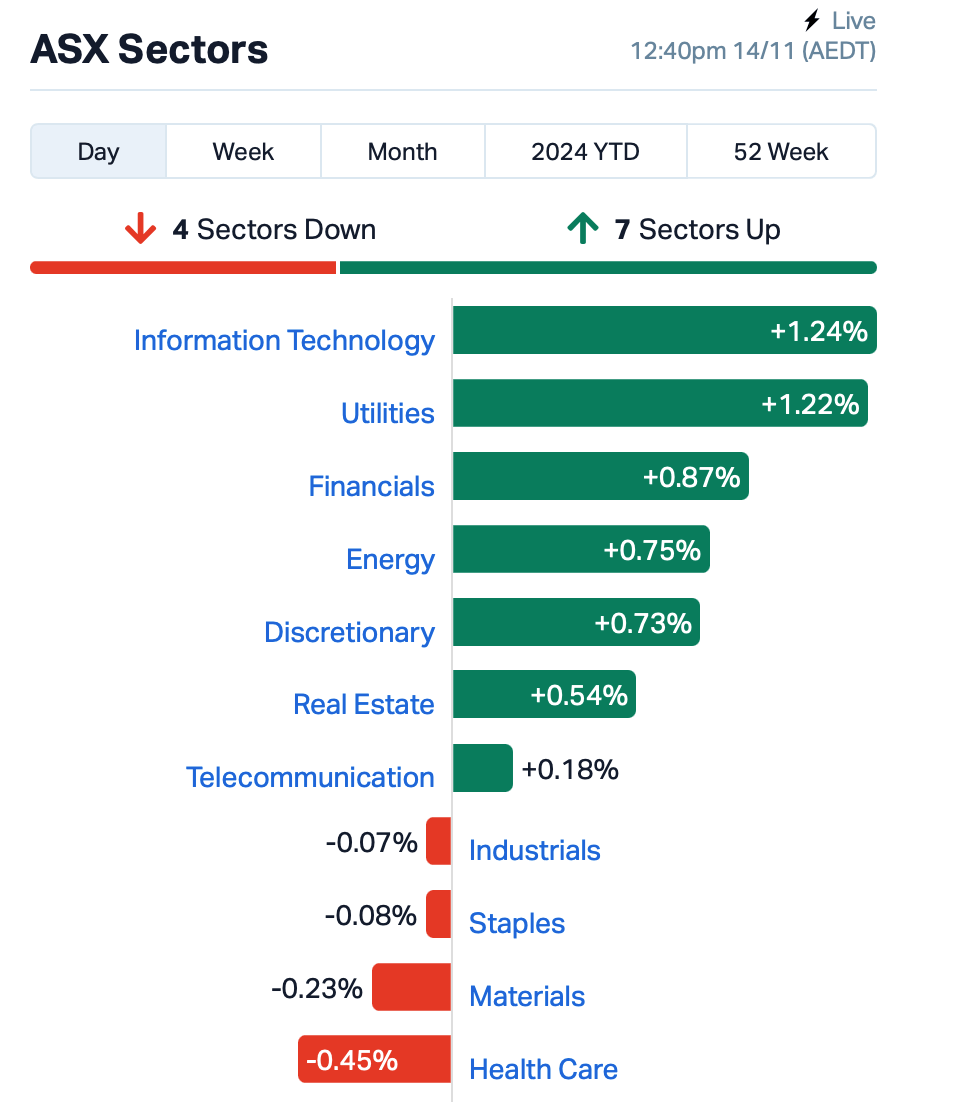

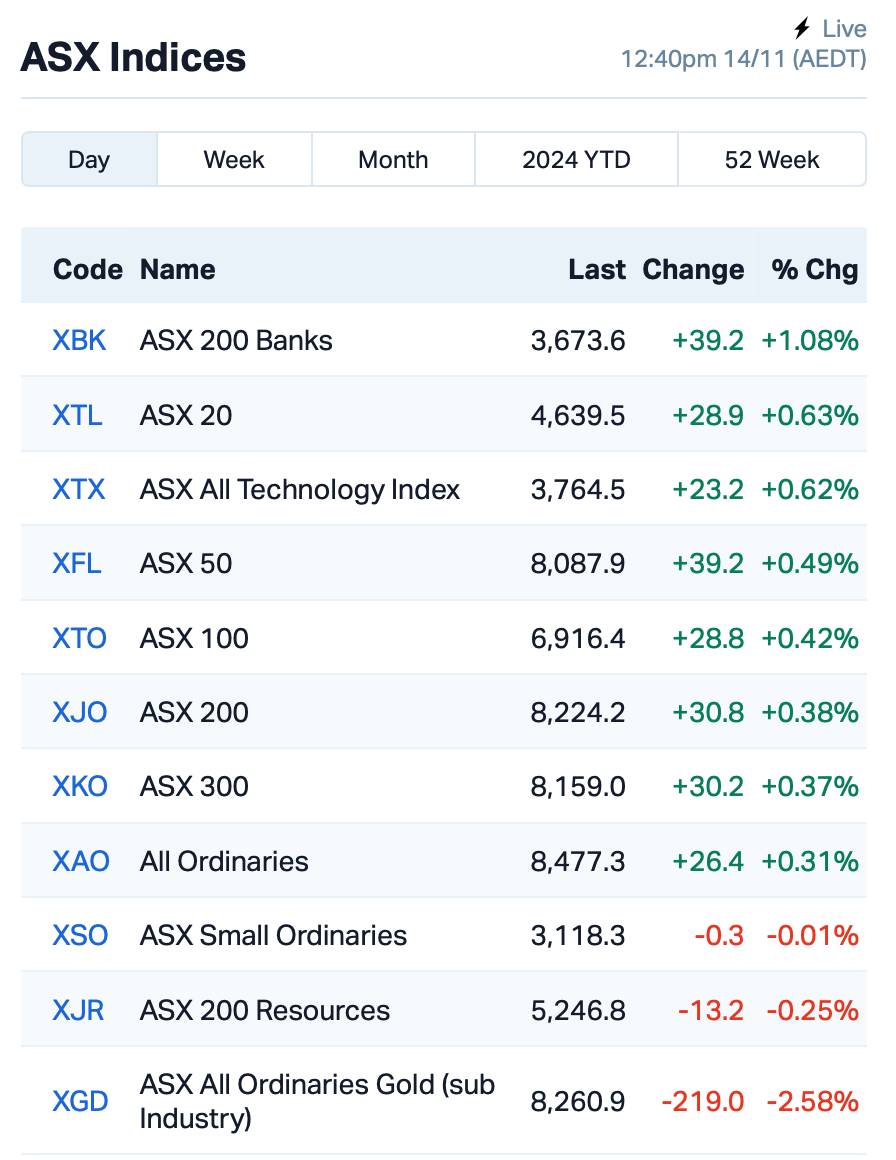

The ASX opened higher on Thursday following a mixed session on Wall Street overnight. At about 1pm AEST, the benchmark S&P/ASX 200 Index was up by 0.3%.

The rally came in the wake of US inflation data for October released last night, which showed that consumer prices had risen by nearly 0.50% as expected, bringing the annual inflation rate to 3.6%.

The data has reinforced expectations that the Federal Reserve may cut interest rates next month.

On the ASX, technology stocks led after Xero’s (ASX:XRO) 5% jump. Xero reported strong half-year earnings, a 51% increase in EBITDA along with a 76% rise in net profit.

Mesoblast (ASX:MSB) surged by almost 18% on no specific news.

Still in large caps, Nufarm (ASX:NUF), a manufacturer of agricultural chemicals, saw its share price jump by 9% despite a sharp decline in earnings.

Another company facing challenges is Graincorp (ASX:GNC), which saw its net profit slump 75%, from $250 million last year to $62 million for FY24. The company declared a final dividend of 24 cents per share, and shares fell 4% this morning.

In other news, Cleanaway (ASX:CWY) rose by 5% after the ACCC said the company’s proposed acquisition of the City of Melbourne’s waste business, Citywide, could further increase Cleanaway’s already dominant position in the Melbourne market.

NOT THE ASX

The Aussie dollar also saw some movement this morning, sliding below US65¢ during the session as investors continued to digest the US dollar’s strength following the US inflation report.

Meanwhile, Bitcoin reached another milestone, climbing above $US93,000 for the first time before paring gains and trading at US$90,239 at the time of writing,

Wall Street saw mixed trading last night, with stocks fluctuating as investors weighed the potential for further Federal Reserve rate cuts.

The S&P 500 closed flat, while the Nasdaq 100 fell by 0.2%, and the Dow Jones rose 0.1%.

The market appeared to lose momentum in the final hours of trading, as some traders questioned whether the rally had gone too far.

This was partly offset by data showing inflation in line with expectations, which offered some relief for investors fearing a hotter-than-expected reading.

The Fed remains a focal point as swap traders raised the probability of a rate cut in December to 80%.

The big corporate news on Wall Street came from Cisco, which offered an optimistic outlook but a more cautious long-term forecast.

Investors are also focused on other upcoming events, such as Nvidia’s earnings report, which is expected to be a major market mover next week.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 14 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AUH | Austchina Holdings | 0.002 | 100% | 137,500 | $2,400,384 |

| MWY | Midway Ltd | 1.225 | 60% | 1,634,721 | $66,812,210 |

| MTB | Mount Burgess Mining | 0.002 | 50% | 2,063,753 | $1,298,147 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 900,000 | $9,296,169 |

| ATV | Activeportgroupltd | 0.026 | 30% | 12,122,742 | $9,673,488 |

| VAR | Variscan Mines Ltd | 0.009 | 29% | 12,396,459 | $4,610,032 |

| MEM | Memphasys Ltd | 0.005 | 25% | 8,363,894 | $7,052,326 |

| MOM | Moab Minerals Ltd | 0.005 | 25% | 472,000 | $3,571,435 |

| VML | Vital Metals Limited | 0.003 | 25% | 587,656 | $11,790,134 |

| XPN | Xpon Technologies | 0.016 | 23% | 1,034,764 | $4,711,739 |

| SWF | Selfwealth | 0.250 | 22% | 6,097,227 | $47,300,000 |

| FSG | Field Solu Hldgs Ltd | 0.030 | 20% | 1,361,902 | $19,336,114 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 17,314 | $5,589,945 |

| MDR | Medadvisor Limited | 0.295 | 18% | 801,677 | $137,826,909 |

| FFG | Fatfish Group | 0.020 | 18% | 31,892,066 | $23,911,741 |

| E79 | E79Goldmineslimited | 0.027 | 17% | 480,803 | $2,349,741 |

| MSB | Mesoblast Limited | 1.790 | 17% | 9,800,615 | $1,741,220,774 |

| QPM | Queensland Pacific | 0.048 | 17% | 12,793,554 | $103,368,333 |

| CDX | Cardiex Limited | 0.140 | 17% | 273,966 | $35,300,948 |

| MKR | Manuka Resources. | 0.028 | 17% | 670,089 | $18,714,424 |

| RGL | Riversgold | 0.004 | 17% | 153,040 | $4,882,388 |

| UNT | Unith Ltd | 0.015 | 15% | 5,220,398 | $15,974,210 |

| WHK | Whitehawk Limited | 0.015 | 15% | 4,233,928 | $6,733,731 |

Forest products supplier, Midway (ASX:MWY), surged after the company announced it had entered into a binding agreement with River Capital for the acquisition of all its shares.

Under the deal, Midway shareholders will receive $1.19 per share in cash, which includes a special dividend of $0.38 per share.

This offer represents a 56% premium over Midway’s closing price the day before the announcement. Also, shareholders have the option to receive the offer in cash or a combination of cash and shares.

ActivePort Group (ASX:ATV) and Radian Arc have signed a binding agreement for a $4m licence deal.

Under the agreement, Radian Arc will acquire a perpetual licence for cloud gaming software, paying Activeport a one-time upfront fee of $4m. This will also offset other agreements between the two companies.

Activeport will use the funds to focus on expanding its network orchestration software in the telecommunications and data centre sectors. Activeport said the deal marks a shift, allowing it to concentrate on its core business, while Radian Arc takes cloud gaming development in-house.

Variscan Mines (ASX:VAR) announced the start of underground drilling at the Udias Mine in northern Spain, marking the first drilling at the site.

The mine is connected to the San Jose Mine along the 12km Novales-Udias Trend, and historical data shows high-grade zinc-lead mineralisation, much of which is outside the current resource estimate.

Drilling is targeting new areas, including parts of the mine never drilled before, with the aim of expanding the mineral resource.

Variscan recently secured an exploration licence for the central Udias area, and said it was optimistic about unlocking additional high-grade zinc resources. The company expects to update its resource inventory following the drilling programme.

Immutep (ASX:IMM) rose after two major announcements showing promising data from its clinical trials.

Firstly, the company revealed INSIGHT-003 trial results in non-small cell lung cancer, which demonstrated that its drug eftilagimod alpha (efti), combined with immunotherapy treatment KEYTRUDA and chemotherapy, significantly improved overall survival (OS) and progression-free survival compared to historical controls.

The median OS was 32.9 months, and the 24-month survival rate was 81%, both impressive outcomes for a population that traditionally responds less well to immunotherapy.

Secondly, Immutep presented positive phase II data from the EFTISARC-NEO trial in soft tissue sarcoma.

The trial showed that combining efti with radiotherapy and KEYTRUDA led to a three-fold increase in tumour hyalinisation (a key predictor of survival) compared to standard radiotherapy.

SelfWealth (ASX:SWF) rose another 20% today after yesterday’s 70% jump, following a non-binding proposal from AxiCorp to acquire the company for $0.23 per share.

This follows a similar proposal from Bell Financial at $0.22 per share. Both offers are contingent on conditions, including approval from the Selfwealth board and no major changes to the business.

Axi has expressed a willingness to move quickly and bypass due diligence or financing conditions. Selfwealth shareholders don’t need to take any action yet, and there’s no certainty that either proposal will proceed.

MedAdvisor (ASX:MDR) rose after announcing it is reviewing strategic options to maximise shareholder value, believing its current market valuation doesn’t reflect the full value of its Australian and US businesses.

The review will consider various initiatives to address this, but there is no guarantee of any changes.

MedAdvisor intends to continue with its current plans, including the Transformation 360° project, during the review, which is expected to take up to three months. The company does not plan to make acquisitions or raise capital during this period.

And, per the resolution passed at the recent Annual General Meeting today, Queensland Pacific Metals’ (ASX:QPM) name has now been formally changed to QPM Energy Limited (ASX:QPM).

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SCP | Scalare Partners | 0.250 | -77% | 171,053 | $38,510,609 |

| FAU | First Au Ltd | 0.001 | -50% | 101,000 | $3,623,987 |

| EDE | Eden Inv Ltd | 0.001 | -33% | 600,000 | $6,162,314 |

| GMN | Gold Mountain Ltd | 0.001 | -33% | 251,050 | $5,861,210 |

| WEL | Winchester Energy | 0.002 | -33% | 333,333 | $4,089,057 |

| DTZ | Dotz Nano Ltd | 0.065 | -25% | 345,818 | $47,216,822 |

| AOK | Australian Oil. | 0.003 | -25% | 5,000,000 | $4,007,132 |

| EE1 | Earths Energy Ltd | 0.012 | -25% | 2,014,087 | $8,479,427 |

| AJL | AJ Lucas Group | 0.007 | -22% | 895,708 | $12,381,567 |

| RDG | Res Dev Group Ltd | 0.014 | -22% | 1,966,795 | $53,115,446 |

| STG | Straker Limited | 0.370 | -22% | 145,265 | $30,561,167 |

| PGD | Peregrine Gold | 0.120 | -20% | 112,944 | $10,181,763 |

| SRN | Surefire Rescs NL | 0.004 | -20% | 1,015,519 | $9,931,539 |

| DUB | Dubber Corp Ltd | 0.023 | -18% | 8,279,381 | $58,662,610 |

| LPM | Lithium Plus | 0.115 | -18% | 179,230 | $18,597,600 |

| GTE | Great Western Exp. | 0.028 | -18% | 502,007 | $18,814,212 |

| HMD | Heramed Limited | 0.019 | -17% | 2,328,982 | $18,113,933 |

| ERA | Energy Resources | 0.003 | -17% | 467,176 | $66,444,898 |

| FIN | FIN Resources Ltd | 0.005 | -17% | 452,270 | $3,895,612 |

| PRM | Prominence Energy | 0.005 | -17% | 3,071,555 | $2,335,058 |

| PUA | Peak Minerals Ltd | 0.005 | -17% | 894,000 | $14,982,662 |

| LEG | Legend Mining | 0.011 | -15% | 300,000 | $37,823,203 |

| AS2 | Askarimetalslimited | 0.018 | -14% | 476,739 | $2,160,273 |

| ALM | Alma Metals Ltd | 0.006 | -14% | 500,000 | $10,965,656 |

IN CASE YOU MISSED IT

Prodigy Gold (ASX:PRX) has sent representative samples of reverse circulation drill core from the Hyperion and Tethys lodes at the Hyperion gold deposit in the NT to contractor Independent Metallurgical Operations for metallurgical testing.

This will support work completed in early 2024 on the Suess lodes. Samples from Hyperion and Tregony North have also been sent for PhotonAssay analysis to verify these higher grades and assess the possibility of coarse gold in the Hyperion and Tregony mineralisation.

Managing director Mark Edwards said outstanding drill results from Hyperion and Tregony North have generated strong optimism for the 2025 field season and that results from metallurgical testing will support the understanding of future development pathways for the flagship Hyperion deposit.

Clinical stage biotech company Recce Pharmaceuticals (ASX:RCE) has received a $6.75m R&D Tax Incentive Program cash refund from the Australian Taxation relating to its research and development activities in FY2024.

Proceeds will be used to repay advances from Endpoints Capital, which had enabled the company to leverage its R&D benefits of the past, present and future R&D applicable expenditure.

Chief executive officer James Graham adds that the funding “strengthens our ability to drive forward our R&D initiatives both domestically and internationally, accelerating our mission to develop cutting-edge anti-infective solutions”.

Likewise Suvo Strategic Minerals (ASX:SUV) has received a $380,236 cash refund from the R&D Tax Incentive Program on eligible research and development activities that it carried out.

It relates specifically to the company’s expenditure on development of its licensed intellectual property, namely a low carbon cement and concrete formulation known as ‘Colliecrete’, which achieved a 28-day compressive strength ranging from 31 to 35Megapascals (MPa) that far exceeds the 15MPa required for hardscaping at a major government project.

The company added that with the establishment of the EcoCast joint venture entities with PERMAcast, it was now evaluating potential state and federal grants which may be available to assist in funding research, development and commercialisation activities with respect to potential new low carbon cement and concrete products.

At Stockhead, we tell it like it is. While Prodigy Gold, Recce Pharmaceuticals, Suvo Strategic Minerals and Queensland Pacific Metals Ltd (now QPM Energy Limited) are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.