ASX Lunch Wrap: Trump’s tariff news smacks the ASX; but EML catches fire with 24pc jump

ASX falls after Trump’s new tariff announcement. Picture via Getty Images

- ASX falls after Trump’s new tariff announcement

- Wall Street hits record high amid Treasury pick news

- EML Payments soars on Q1 results

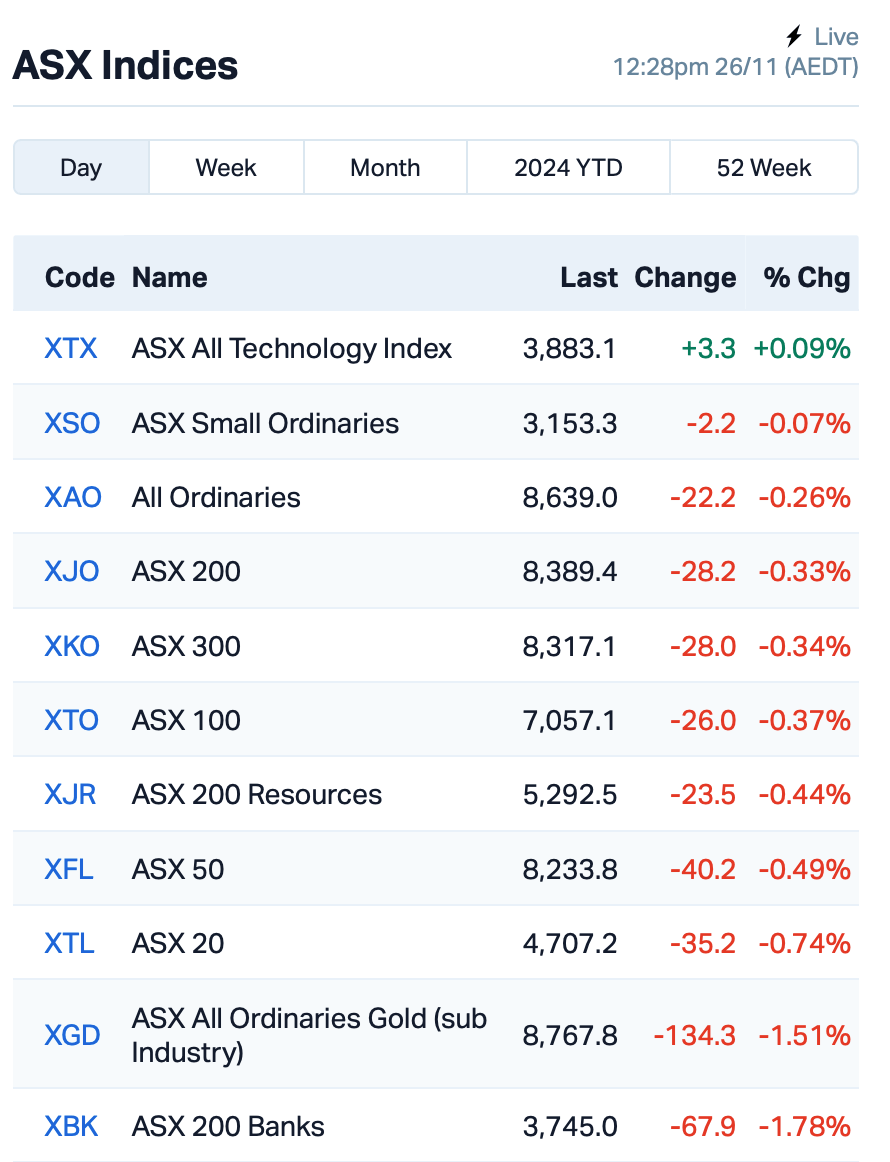

The ASX reversed early gains and turned lower by 0.4% at 1pm on Tuesday following Donald Trump’s announcement of a new 10% tariff on Chinese goods, triggering a sell-off in ASX energy stocks and banks.

In a Truth Social post made within the last hour or so, Trump announced he would impose a 25% tariff on all products from Mexico and Canada, along with an extra 10% tariff on goods from China.

Trump believes that China has a role in stopping illegal drugs from reaching the US because a significant portion of illicit drugs, particularly synthetic opioids like fentanyl, are produced in China.

“Until such time as they stop, we will be charging China an additional 10% Tariff, above any additional Tariffs, on all of their many products coming into the United States of America,” read Trump’s post (below).

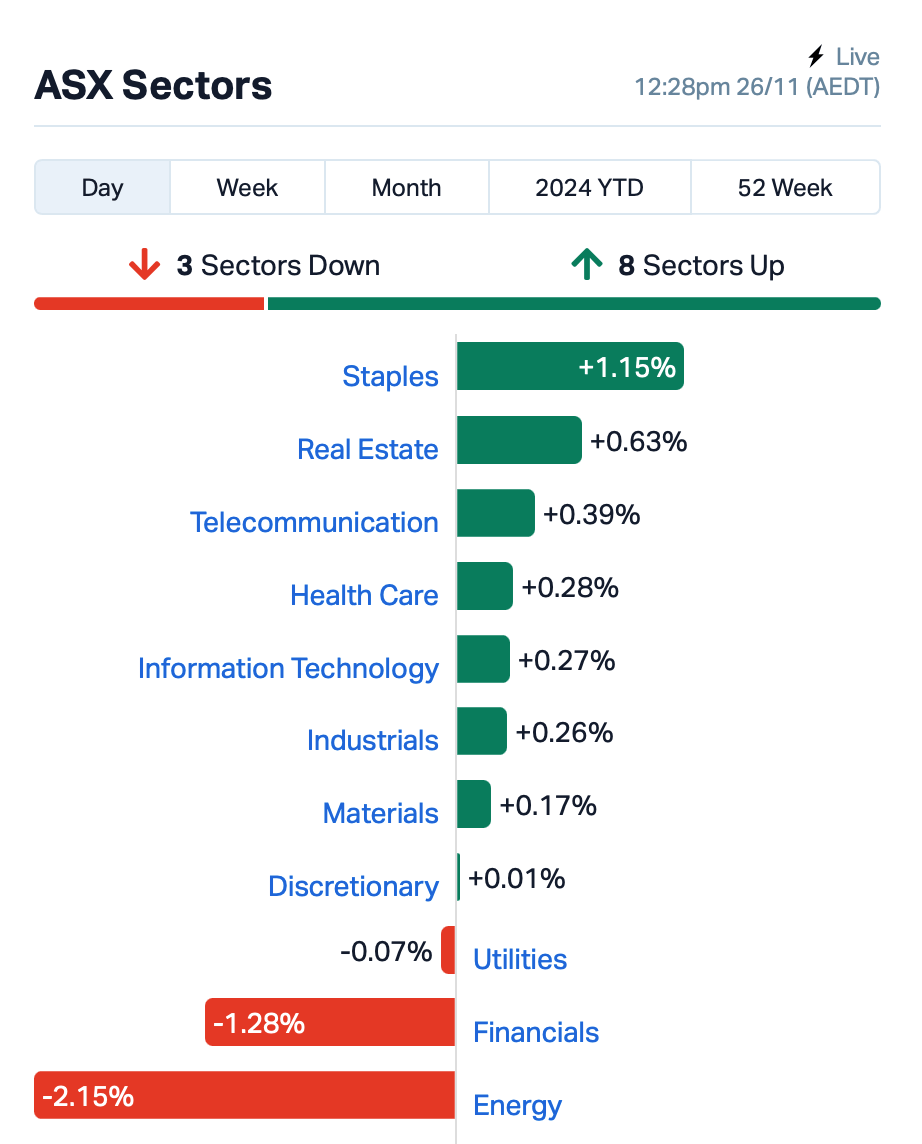

Here’s what the ASX sectors were doing at around 12:30pm AEST…

Overnight, Wall Street saw strong gains, with the Dow rising over 400 points to a new record high, driven by Trump’s nomination of Scott Bessent for Treasury Secretary.

Bessent is a billionaire hedge fund manager, former CIO at Soros Fund Management and founder of Key Square Group.

Elsewhere, gold and oil prices fell as tensions in the Middle East showed signs of easing after reports of a possible ceasefire agreement between Israel and Lebanon.

Notable ASX announcements this morning came from EML Payments (ASX:EML), which soared 24% after reporting a 46% increase in underlying earnings for the first quarter of FY25.

Webjet Group Limited (ASX:WJL) reported a decline in bookings and revenue for the first half of FY25, reflecting challenging market conditions, particularly in domestic flight bookings. Shares fell 0.4%.

Still in large caps, market operator ASX (ASX:ASX) also fell 3% after announcing its plan to implement the second phase of the CHESS project by 2029, with projected costs of up to $320 million.

And, giant miner Newmont Corporation (ASX:NEM) is selling its Éléonore gold mine in Quebec to Dhilmar for $795 million, part of its broader effort to raise over $3.6 billion by selling non-essential assets. Shares were up 0.4%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 26 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap PHO Phosco Ltd 0.065 63% 25,000 $11,269,927 AVE Avecho Biotech Ltd 0.003 50% 168,770 $6,338,594 MTB Mount Burgess Mining 0.002 50% 16,560,263 $1,298,147 TKL Traka Resources 0.002 50% 24,000,000 $1,945,659 PLN Pioneer Lithium 0.215 34% 104,705 $5,085,470 AMD Arrow Minerals 0.002 33% 1,400,000 $19,835,442 BP8 Bph Global Ltd 0.004 33% 35,779,544 $1,189,924 SFG Seafarms Group Ltd 0.002 33% 763,361 $7,254,899 TYX Tyranna Res Ltd 0.004 33% 72,500 $9,863,776 NSM Northstaw 0.014 27% 110,799 $2,999,442 8IH 8I Holdings Ltd 0.010 25% 222,441 $2,785,287 CTO Citigold Corp Ltd 0.005 25% 507,085 $12,000,000 TMK TMK Energy Limited 0.003 25% 5,463,422 $18,651,130 EML EML Payments Ltd 0.855 25% 6,978,943 $259,146,111 KNI Kunikolimited 0.210 20% 86,585 $15,184,622 GTK Gentrack Group Ltd 11.230 19% 249,612 $974,612,464 NGX Ngxlimited 0.190 19% 59,078 $14,497,894 PAR Paradigm Bio. 0.540 17% 5,420,335 $160,678,931 CTN Catalina Resources 0.004 17% 129,009 $3,715,461 ENV Enova Mining Limited 0.007 17% 503,711 $5,909,576 LNR Lanthanein Resources 0.004 17% 562,500 $7,330,908 NRX Noronex Limited 0.014 17% 1,147,672 $5,956,853 ODE Odessa Minerals Ltd 0.007 17% 4,635,036 $7,609,695 RGL Riversgold 0.004 17% 11,965,868 $4,882,388 PEB Pacific Edge 0.115 15% 2,692 $81,191,597

Gentrack Group (ASX:GTK) a software provider for utilities and airports, has reported strong growth in its full-year results for FY24, with a 25.5% revenue increase to $213.2 million. The utilities division saw a 23% rise in revenue. The airports division, Veovo, posted a 45.5% revenue increase, benefiting from new contracts in the UK and Middle East.

Noronex (ASX:NRX) has identified new drilling targets at its Damara Copper Project in Namibia, following a recent gravity survey. The survey uncovered several gravity-magnetic anomalies in the Damara Basement, on the edge of the Kalahari Copper Belt, which are similar to major copper deposits in Zambia and Congo. The drilling is funded through an earn-in agreement with South32.

Frontier Energy (ASX:FHE) said it welcomes recent changes to Western Australia’s energy policy that will enhance the economics of its Waroona Renewable Energy Project. A 54% increase in the Benchmark Reserve Capacity Price (BRCP) to $354,000/MW for the 2027/28 capacity year, along with the introduction of a price floor, strengthens long-term revenue certainty. These changes, including a higher BRCP and a minimum reserve capacity price, will improve the project’s financial outlook, said FHE.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 26 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CDE | Codeifai Limited | 0.001 | -50% | 20,573 | $5,842,590 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 201,351 | $8,737,021 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 2,275,166 | $9,296,169 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 11,269,295 | $57,867,624 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 26,214 | $8,216,419 |

| IXR | Ionic Rare Earths | 0.007 | -22% | 27,135,082 | $43,827,864 |

| GML | Gateway Mining | 0.023 | -18% | 33,600 | $11,072,864 |

| GTE | Great Western Exp. | 0.025 | -17% | 3,422,452 | $16,600,775 |

| TMB | Tambourahmetals | 0.025 | -17% | 1,006,407 | $3,317,701 |

| MEM | Memphasys Ltd | 0.005 | -17% | 830,841 | $10,578,489 |

| SP8 | Streamplay Studio | 0.010 | -17% | 29,025,985 | $13,807,485 |

| LIN | Lindian Resources | 0.090 | -14% | 4,189,962 | $121,056,835 |

| 1AI | Algorae Pharma | 0.006 | -14% | 139,901 | $11,811,763 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 368,000 | $8,246,534 |

| HHR | Hartshead Resources | 0.006 | -14% | 1,518,522 | $19,660,775 |

| TEG | Triangle Energy Ltd | 0.006 | -14% | 272,700 | $14,624,638 |

| SRR | Saramaresourcesltd | 0.033 | -13% | 75,954 | $6,440,512 |

| AAM | Aumegametals | 0.034 | -13% | 1,932,922 | $22,663,783 |

| RNV | Renerve Limited | 0.175 | -13% | 2,063,354 | $21,756,304 |

| ARD | Argent Minerals | 0.022 | -12% | 2,077,950 | $36,141,012 |

| TOK | Tolu Minerals | 0.825 | -12% | 22,656 | $105,950,573 |

| ARI | Arika Resources | 0.030 | -12% | 3,206,157 | $21,031,873 |

| TAT | Tartana Minerals Ltd | 0.039 | -11% | 242,027 | $8,036,419 |

| NAE | New Age Exploration | 0.004 | -11% | 5,000,000 | $9,647,545 |

IN CASE YOU MISSED IT

Recce Pharmaceuticals (ASX:RCE) has secured patent protection for its new class of synthetic anti-infectives in all major pharmaceutical markets globally, with the Australian Patent Office granting the latest approval.

The Australian patent expires in 2037 and covers Recce 327 (R327) and Recce 529 (R529), their manufacturing processes, use in treating infections, and methods of administration via oral, injection, inhalation and transdermal applications.

RCE CEO James Graham said the company was thrilled by the formal recognition of its synthetic anti-infectives.

“This milestone underscores our commitment to addressing critical viral threats with innovative therapies and ensures we are well positioned to deliver meaningful solutions for patients worldwide,” he said.

An 11-hole Phase 1 RC drilling program is complete, testing the historic high-grade silver-polymetallic Endowment Mine within Sierra Nevada Gold’s (ASX:SNX) Blackhawk epithermal project in Nevada.

Drilling intersected argillic alteration with sulphides in a number of holes, while historic workings were also intersected in three holes. Assays are due in around a month’s time. Follow-up drilling is being planned to begin in Q2, 2025.

At Stockhead, we tell it like it is. While Recce Pharmaceuticals and Sierra Nevada Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.