Lunch Wrap: Trump’s tariff delay sparks ASX bounce; Seek’s deal with Xref collapses

ASX bounced back after Trump’s tariff delay. Picture via Getty Images

- ASX bounces back after Trump delays tariffs

- Tech stocks lead the charge

- Seek’s $42 million deal falls apart, Xref tanks

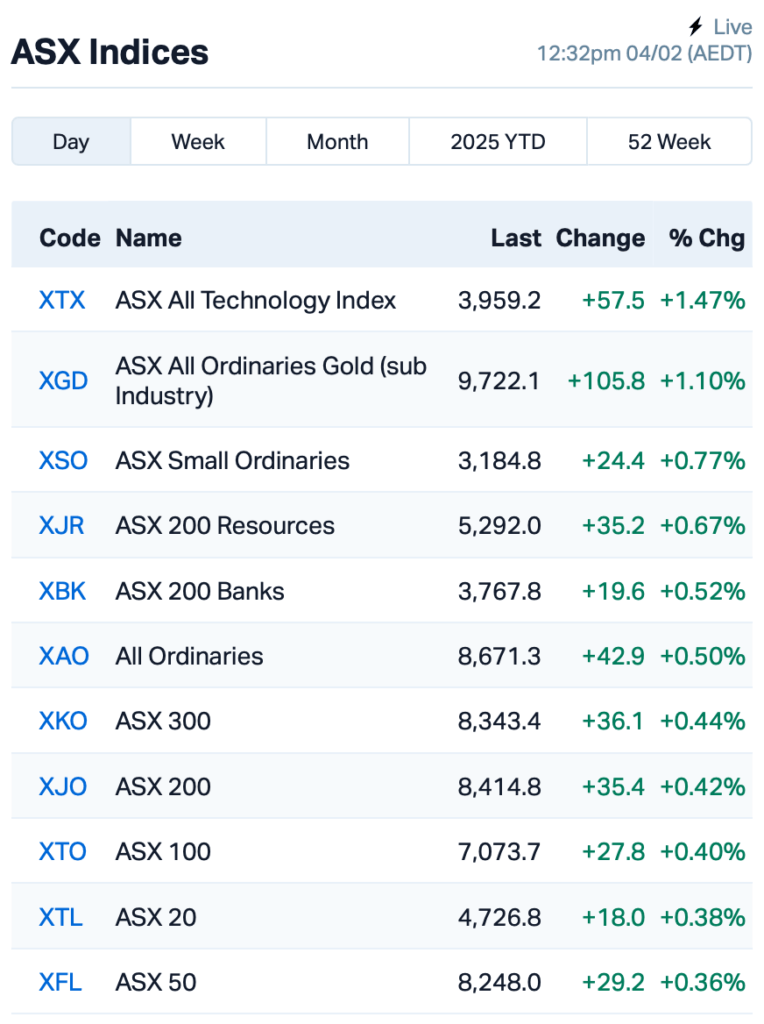

After getting battered yesterday, the ASX found some momentum to bounce back on Tuesday, with the benchmark S&P/ASX 200 Index lifting by 0.4% at around lunch time.

This follows US President Trump’s decision to delay tariffs on Canada and Mexico last night.

Trump had been set to slap a 25% tariff on those countries, but after a chat with Mexican President Claudia Sheinbaum and Canadian Prime Minister Justin Trudeau, he agreed to hold off for now.

Trump even hinted that he’d probably have a word with China about their tariffs in the next day or so, further lifting spirits.

But despite his softer stance, the Wall Street session was still marked by volatility and investors seemed to be on edge, with defensive stocks getting more love while the tech stocks struggled.

The S&P 500 managed to trim most of its big losses, closing down just 0.8% after a shaky start. The Nasdaq ended lower by 1.2%, while the Dow Jones dropped 0.3%.

Gold had a bit of a rollercoaster ride, hitting a record high but dropping back to $US2,820 at the time of writing. Bitcoin surged right back, rallying 9% to after taking a hit on Monday.

“With selling pressure likely pick up, leading to further market falls, we could expect more traders to ‘buy the dip’,” said Moomo’s Jessica Amir.

“They are bracing for big swings in markets and will remain on edge for perhaps the next couple of weeks, adjusting portfolios to a more defensive stance.”

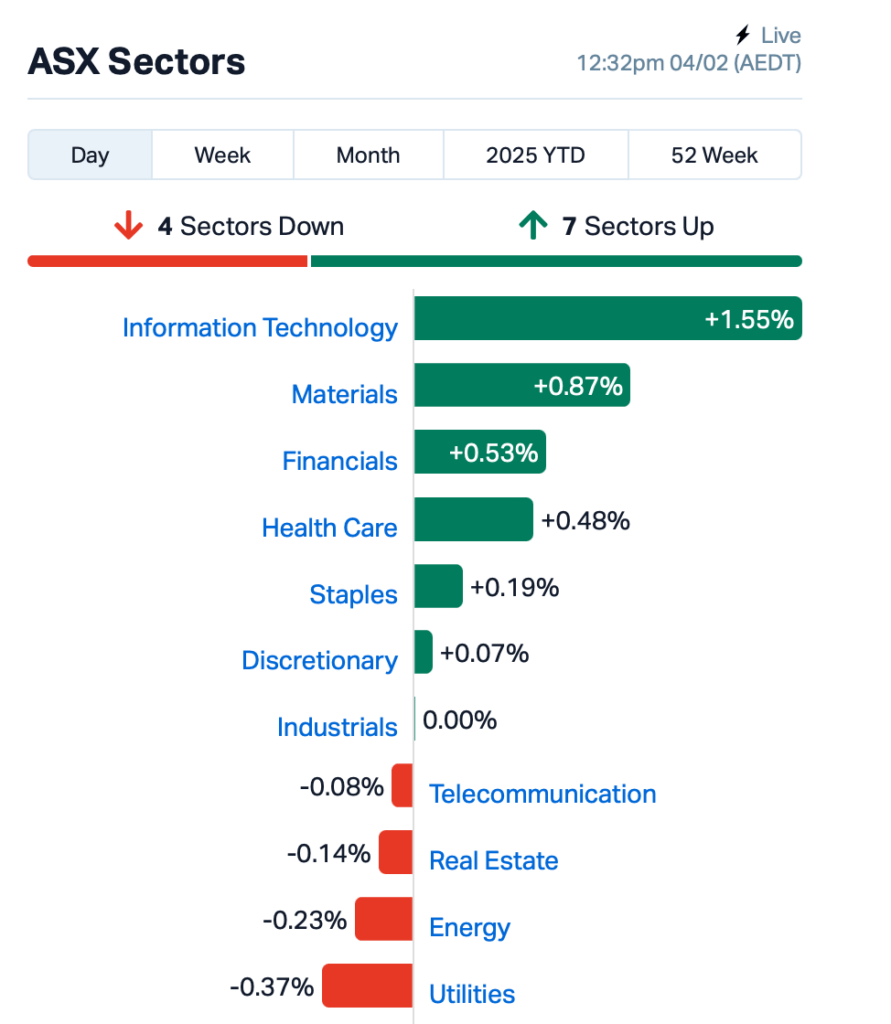

On home soil, 7 out of the 11 sectors were back in the green this morning, with technology stocks leading the way.

WiseTech Global (ASX:WTC) moved back up by 1.7%, and Xero (ASX:XRO) lifted 1.2%.

Even miners bounced back, with Fortescue Metals Group (ASX:FMG) jumping 1.5% after Trump said he’d likely chat to China about tariffs.

In large caps news, Seek’s (ASX:SEK) plan to acquire Xref (ASX:XF1) for $42.1 million came crashing down after it failed to get enough support from Xref’s shareholders.

Only 67.6% of the votes were in favour of the deal, well short of the 75% threshold needed. Seek shares took a 1% hit, while Xref was sent tumbling by 22%.

Over at ProMedicus (ASX:PME), the imaging tech company secured a $53 million contract with a US healthcare network, sending its shares up 4.5%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 4 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.002 | 100% | 532,500 | $6,151,216 |

| AYM | Australia United Min | 0.003 | 50% | 256,001 | $3,685,155 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 127,400 | $3,253,779 |

| MM1 | Midasmineralsltd | 0.120 | 43% | 901,167 | $10,426,893 |

| ALR | Altairminerals | 0.004 | 40% | 13,965,344 | $10,741,860 |

| OSL | Oncosil Medical | 0.007 | 40% | 13,956,521 | $23,032,901 |

| SRN | Surefire Rescs NL | 0.004 | 33% | 837,995 | $7,248,923 |

| PNT | Panthermetalsltd | 0.009 | 29% | 1,846,083 | $1,737,195 |

| REM | Remsensetechnologies | 0.069 | 25% | 568,458 | $9,122,283 |

| GMN | Gold Mountain Ltd | 0.003 | 25% | 1,197,851 | $9,158,446 |

| M2R | Miramar | 0.005 | 25% | 20,000 | $1,587,293 |

| PIL | Peppermint Inv Ltd | 0.005 | 25% | 1,671,661 | $8,635,433 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 266,612 | $3,220,998 |

| ASP | Aspermont Limited | 0.006 | 20% | 200,000 | $12,350,058 |

| ASR | Asra Minerals Ltd | 0.003 | 20% | 2,615,623 | $5,781,575 |

| WOA | Wide Open Agricultur | 0.006 | 20% | 178,000 | $2,668,433 |

| E79 | E79Goldmineslimited | 0.020 | 18% | 402,295 | $1,736,765 |

| MIO | Macarthur Minerals | 0.036 | 16% | 60,000 | $6,189,631 |

| DCC | Digitalx Limited | 0.062 | 16% | 7,471,932 | $58,650,697 |

| SPG | Spc Global Holdings | 0.740 | 16% | 4,094 | $123,508,404 |

Altair Minerals’ (ASX:ALR) shares doubled after announcing that it was acquiring the high-grade Venatica Copper Project in Peru, a major expansion of its portfolio. Located on the prolific Andahuaylas-Yauri Porphyry Belt, Venatica spans 337km² and sits near major mines like Las Bambas, which produces 2% of global copper.

The project features large-scale copper targets, with surface samples showing grades up to 7% copper, and a history of small-scale mining with high-grade ore. With strong local support and established infrastructure, Altair said Venatica offers significant potential for high-grade discoveries.

OncoSil Medical (ASX:OSL) has scored a big win in Germany, with 120 hospitals now able to negotiate funding for its pancreatic cancer treatment device under the country’s innovation funding program. That’s a 43% jump from last year, showing growing demand and recognition for OncoSil. The device, which was given “Positive Status 1” in 2021, recently got the green light for clinical testing, and the German Ministry of Health has published the coverage directive.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 4 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PRM | Prominence Energy | 0.003 | -25% | 24,500 | $1,556,706 |

| VPR | Voltgroupltd | 0.002 | -25% | 5,609,588 | $21,432,416 |

| XF1 | Xref Limited | 0.120 | -23% | 5,043,439 | $29,758,488 |

| PUA | Peak Minerals Ltd | 0.012 | -20% | 19,153,721 | $38,281,654 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 1,300,000 | $15,392,639 |

| MEL | Metgasco Ltd | 0.004 | -20% | 436,914 | $7,287,934 |

| MOH | Moho Resources | 0.004 | -20% | 10,002 | $3,582,373 |

| BM8 | Battery Age Minerals | 0.080 | -18% | 2,240,691 | $10,017,592 |

| ERA | Energy Resources | 0.003 | -17% | 267,995 | $1,216,188,722 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 798,897 | $24,001,094 |

| CAV | Carnavale Resources | 0.003 | -14% | 383,333 | $14,315,764 |

| CTN | Catalina Resources | 0.003 | -14% | 31,578 | $4,606,917 |

| MRQ | Mrg Metals Limited | 0.003 | -14% | 1,750,000 | $9,542,815 |

| SER | Strategic Energy | 0.006 | -14% | 7,901,339 | $4,697,233 |

| STM | Sunstone Metals Ltd | 0.006 | -14% | 1,686,375 | $36,050,025 |

| RKT | Rocketdna Ltd. | 0.010 | -14% | 7,053,735 | $9,732,294 |

| GNM | Great Northern | 0.013 | -13% | 991,031 | $2,319,436 |

| VMM | Viridismining | 0.345 | -13% | 571,683 | $29,670,139 |

| CMD | Cassius Mining Ltd | 0.014 | -13% | 150,037 | $10,272,712 |

| CNJ | Conico Ltd | 0.007 | -13% | 300,000 | $1,899,898 |

| HTG | Harvest Tech Grp Ltd | 0.014 | -13% | 1,098,098 | $14,176,783 |

| MRR | Minrex Resources Ltd | 0.007 | -13% | 329,485 | $8,678,940 |

IN CASE YOU MISSED IT

New World Resources (ASX:NWC) has secured the services of experienced permitting specialist John Stefka as its environment and community manager, based in Kingman, Arizona. Stefka previously led permitting at the Moss gold mine near New World’s Antler copper project, and now his appointment will support the company’s efforts to secure state and federal permits in 2025, with early construction set to begin later this year.

At Stockhead, we tell it like it is. While New World Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.