ASX Lunch Wrap: Tech lifts ASX even higher; gold miner Northern Star to buy De Grey for $5bn

The ASX has moved up a gear today. Picture via Getty Images

- ASX nears record high on tech surge

- Northern Star to buy De Grey for $5 billion

- Retail sales Up, housing approvals also rise

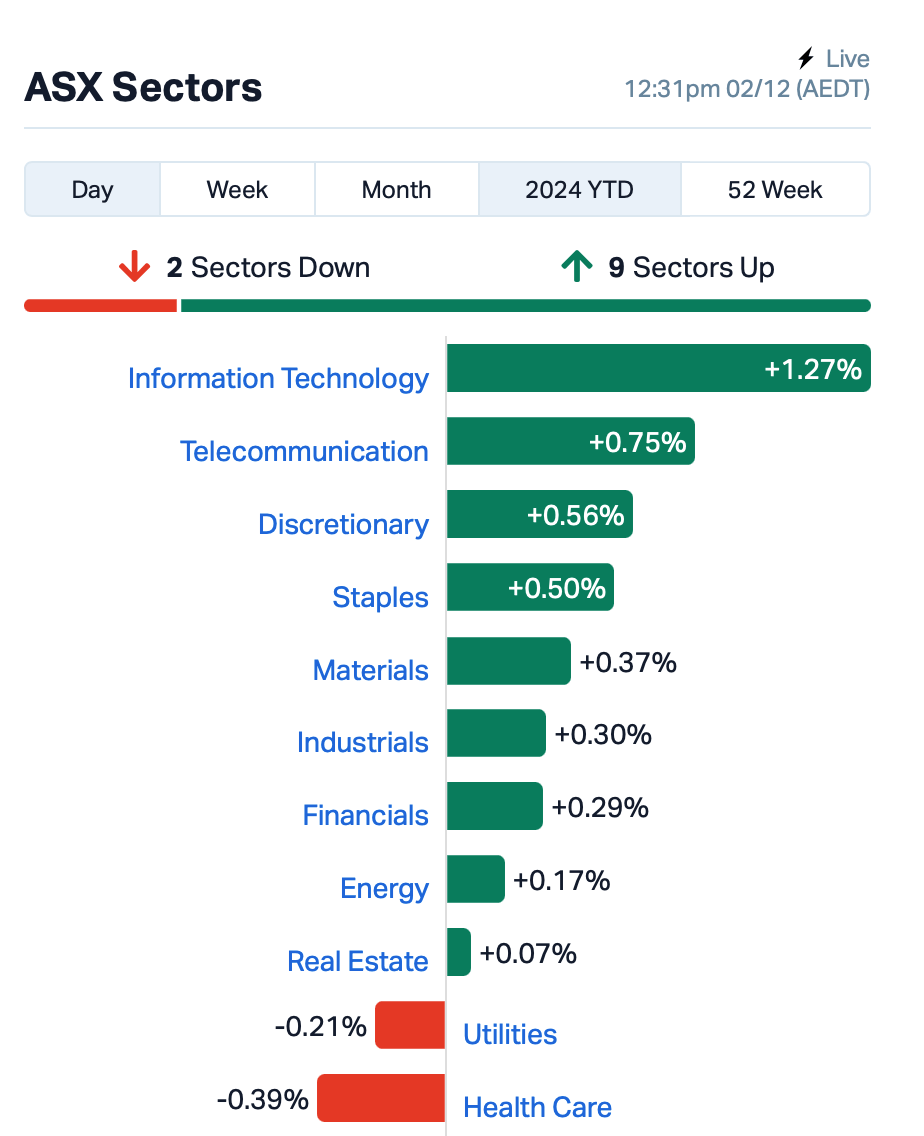

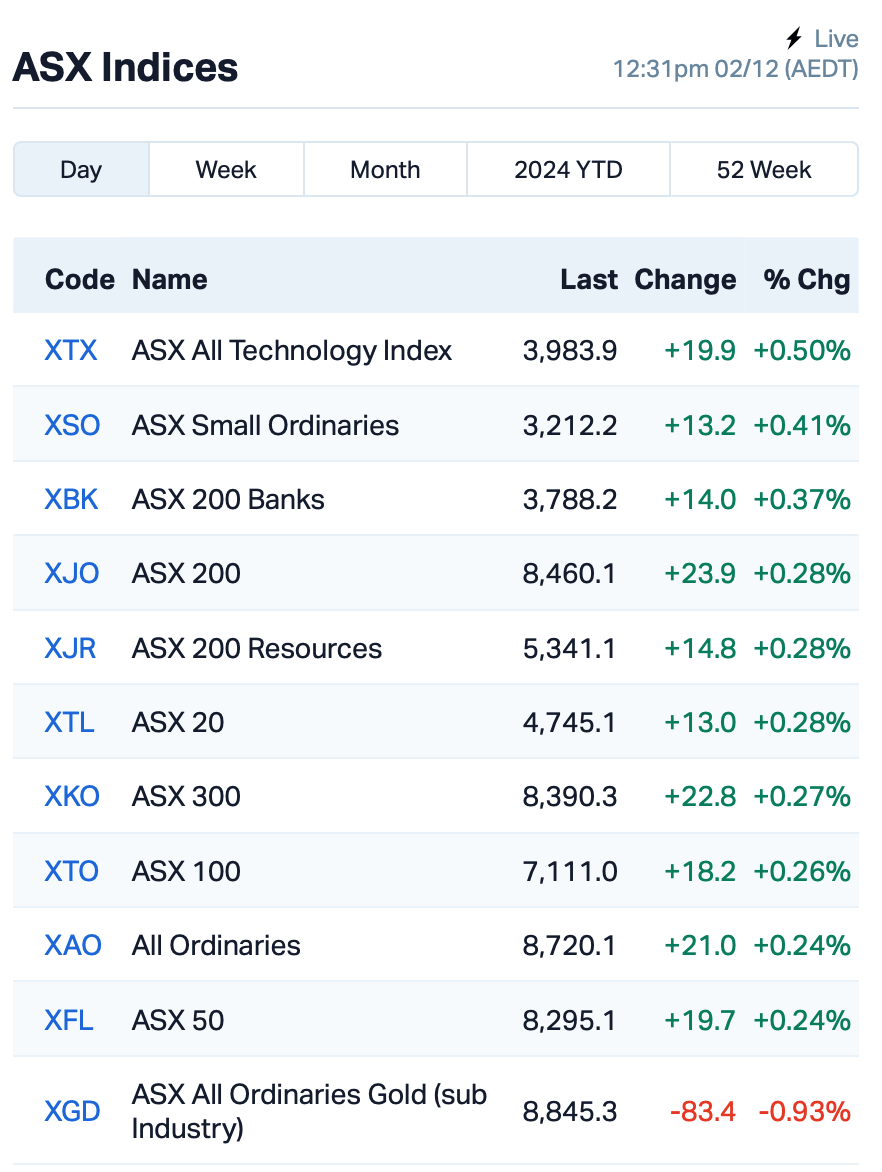

The ASX is on the brink of its third record high in just a week, powered by strong gains in tech stocks.

The S&P/ASX 200 was up by around 0.2% at 1pm AEST on Monday, just shy of the record set last Thursday.

The market’s rally has been fuelled by optimism surrounding US President-elect Donald Trump’s economic plans, which also helped drive the S&P 500 to a new all-time high last Friday.

In the large caps space today, Northern Star Resources (ASX:NST) , Australia’s largest gold miner, has agreed to acquire smaller rival De Grey Mining (ASX:DEG) for $5 billion. The deal gives Northern Star access to De Grey’s Hemi mine in WA, a major new gold project.

De Grey’s shares were up 30%, while NST was down 5%.

Metcash (ASX:MTS), the owner of IGA, reported a slight decline in profits for the six months to October but met market expectations. Shares rose 3.5% as investors were reassured by the company’s 8.5¢ dividend payout.

On the economic data front, retail sales in Australia were stronger than expected in October, rising 0.6% compared to 0.1% in September, according to ABS data today.

Australian housing approvals saw a 4.2% increase in October, largely due to a surge in approvals for apartments and townhouses, which rose 22.4%.

The GDP data will land later this week.

ASX SMALL CAP WINNERS

Here are the best-performing ASX small cap stocks for December 2 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.002 | 100% | 3,796,982 | $2,817,861 |

| TX3 | Trinex Minerals Ltd | 0.002 | 100% | 1,012,267 | $1,828,652 |

| 88E | 88 Energy Ltd | 0.002 | 50% | 1,806,133 | $28,933,812 |

| GGE | Grand Gulf Energy | 0.003 | 50% | 1,000,000 | $4,900,774 |

| AHF | Aust Dairy Limited | 0.051 | 34% | 7,057,754 | $28,246,229 |

| AHN | Athena Resources | 0.004 | 33% | 3,300,000 | $3,211,403 |

| MOM | Moab Minerals Ltd | 0.004 | 33% | 175,000 | $2,678,576 |

| HT8 | Harris Technology Gl | 0.012 | 33% | 916,084 | $2,692,219 |

| DEG | De Grey Mining | 1.975 | 30% | 20,544,327 | $3,643,071,408 |

| ATH | Alterity Therap Ltd | 0.005 | 25% | 10,571,442 | $21,281,344 |

| ATS | Australis Oil & Gas | 0.010 | 25% | 255,474 | $10,312,078 |

| EPM | Eclipse Metals | 0.005 | 25% | 50,000 | $9,111,422 |

| ERA | Energy Resources | 0.003 | 25% | 4,437,182 | $810,792,482 |

| MMR | Mec Resources | 0.005 | 25% | 11,745,592 | $7,327,228 |

| PVT | Pivotal Metals Ltd | 0.010 | 25% | 380,449 | $7,257,807 |

| IVX | Invion Ltd | 0.185 | 23% | 24,915 | $10,308,400 |

| BMG | BMG Resources Ltd | 0.016 | 23% | 17,590,824 | $9,851,363 |

| EUR | European Lithium Ltd | 0.049 | 23% | 4,902,247 | $55,924,906 |

| MTM | MTM Critical Metals | 0.099 | 21% | 9,924,322 | $28,532,114 |

| BLZ | Blaze Minerals Ltd | 0.006 | 20% | 1,864,916 | $3,142,791 |

| C1X | Cosmosexploration | 0.033 | 18% | 58,584 | $2,337,065 |

| CMG | Criticalmineralgrp | 0.165 | 18% | 60,606 | $10,085,235 |

| AZ9 | Asianbatterymet PLC | 0.062 | 17% | 6,449,168 | $16,017,394 |

| VR8 | Vanadium Resources | 0.035 | 17% | 1,180,708 | $16,878,756 |

Pivotal Metals (ASX:PVT) has announced strong preliminary results from its metallurgical testwork at the Horden Lake project in Quebec. Copper recovery rates of 85% to 90% have been achieved, producing high-grade concentrates with no harmful elements. Also, valuable byproducts such as gold, silver, and palladium were recovered in the copper concentrate, enhancing the project’s economic potential. The company is also progressing on the nickel flotation circuit, with further testwork scheduled over the next two months.

European Lithium (ASX:EUR)‘s subsidiary, ECM Lithium AT GmbH, has received confirmation from the Carinthian state government that the Wolfsberg lithium project in Austria does not require an Environmental Impact Assessment (EIA). This paves the way for fast-tracked approval of the project, making it the first new mining initiative in the EU to benefit from such a process. EUR said the Wolfsberg project is positioned to become a key lithium supplier for Europe’s battery supply chain.

Asian Battery Metals (ASX:AZ9) reported another significant “massive” sulphide intercept at its Oval Copper-Nickel-PGE Project on the Yambat property in Mongolia.

The company said drillhole OVD027 has intercepted sulphide mineralisation north of the previous OVD021, suggesting a near-flat orientation of the mineralisation along the strike of the Oval intrusive body. Key intersections include 6.1 metres of massive sulphide and 12.1 metres of net-textured sulphide. The mineralisation spans 91.8 metres, with a high-grade 42.3-metre section containing chalcopyrite, pentlandite, pyrrhotite, and pyrite.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 2 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MHC | Manhattan Corp Ltd | 0.001 | -50% | 105,559 | $8,995,940 |

| BDG | Black Dragon Gold | 0.020 | -38% | 9,627,739 | $9,660,247 |

| ADG | Adelong Gold Limited | 0.004 | -33% | 2,364,413 | $6,707,934 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 1,201,033 | $9,296,169 |

| RIE | Riedel Resources Ltd | 0.001 | -33% | 252,524 | $3,335,753 |

| TMK | TMK Energy Limited | 0.002 | -33% | 2,256,656 | $27,976,695 |

| CTN | Catalina Resources | 0.003 | -25% | 1,928,681 | $4,975,048 |

| CUL | Cullen Resources | 0.004 | -20% | 252,169 | $3,467,009 |

| M2R | Miramar | 0.004 | -20% | 91,381 | $1,984,116 |

| CAE | Cannindah Resources | 0.053 | -16% | 1,637,991 | $44,294,037 |

| SHO | Sportshero Ltd | 0.017 | -15% | 11,417 | $13,356,657 |

| CUF | Cufe Ltd | 0.006 | -14% | 2,783,738 | $9,356,724 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 1,465,446 | $34,088,339 |

| RGL | Riversgold | 0.003 | -14% | 2,884,214 | $5,696,119 |

| TMX | Terrain Minerals | 0.003 | -14% | 4,000,000 | $6,300,101 |

| EQN | Equinoxresources | 0.130 | -13% | 352,101 | $18,577,500 |

| GQG | GQG Partners | 2.045 | -13% | 11,802,088 | $6,940,451,831 |

| IFG | Infocusgroup Hldltd | 0.027 | -13% | 4,706,875 | $4,864,190 |

| NGX | Ngxlimited | 0.170 | -13% | 214 | $17,669,309 |

| AVE | Avecho Biotech Ltd | 0.004 | -13% | 2,870,001 | $12,677,188 |

| BCB | Bowen Coal Limited | 0.007 | -13% | 415,154 | $79,999,473 |

| ENV | Enova Mining Limited | 0.007 | -13% | 373,295 | $7,879,435 |

| PLC | Premier1 Lithium Ltd | 0.007 | -13% | 2,375,314 | $1,606,082 |

| SPQ | Superior Resources | 0.007 | -13% | 633,957 | $17,358,910 |

IN CASE YOU MISSED IT

Strata Minerals (ASX:SMX) is gearing up for a ground-based electromagnetic survey to be carried out across priority targets at its Penny South gold project in Western Australia. The surveys aim to refine the search within the target areas, assisting in the preparation for the planned drilling program at Penny South, which is set to commence in the Q1, 2025.

Legacy Minerals (ASX:LGM) has completed a $3 million capital raise while also securing a strategic investor in the likes of Fleet Fund, Australia’s fastest growing company in 2023, according to the AFR. Funds will be used to drive exploration across its Drake and Thomson projects, with drill mobilisation to commence at Thomson imminently.

Omega Oil and Gas (ASX:OMA) has appointed Peter Stickland as non-executive director, following the departure of Mike Sandy. OMA managing director and CEO says Stickland is a well-known and well-respected member of Australia’s oil and gas sector, bringing with him a deep technical background and extensive experience.

Perpetual Resources (ASX:PEC) is also raising $1 million through a placement at 1.4 cents apiece, with funds to drive exploration at its projects in Minas Gerais, Brazil. The company recently reported significant rock chip results of greater than 5.4% Li2O at the Isabella lithium project, with plenty of news on the way over the next 12 months.

A drilling application has been submitted at Riversgold’s (ASX:RGL) Little Lepreau prospect, targeting highly anomalous surface mineralisation at depth. The company is aiming to carry out a 2,000 metre maiden RC/DD drilling campaign in Canada, going after copper, gold and antimony, following promising rock chip results showing up to 17.6% cu, 10.8% sb, 70.4g/t au and 1500g/t ag.

At Stockhead, we tell it like it is. While Strata Minerals, Legacy Minerals, Omega Oil and Gas, Perpetual Resources and Riversgold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.