ASX Lunch Wrap: Shares free-fall on Trump’s tariffs, as traders await China’s ‘countermeasures’

ASX free falls to four-month low after Trump's tariffs. Picture via Getty Images

- ASX crashes to four-month low after Trump’s tariffs

- Oil surges, crypto plummets on trade war fears

- Novonix rises as ITC backs China’s graphite dumping case

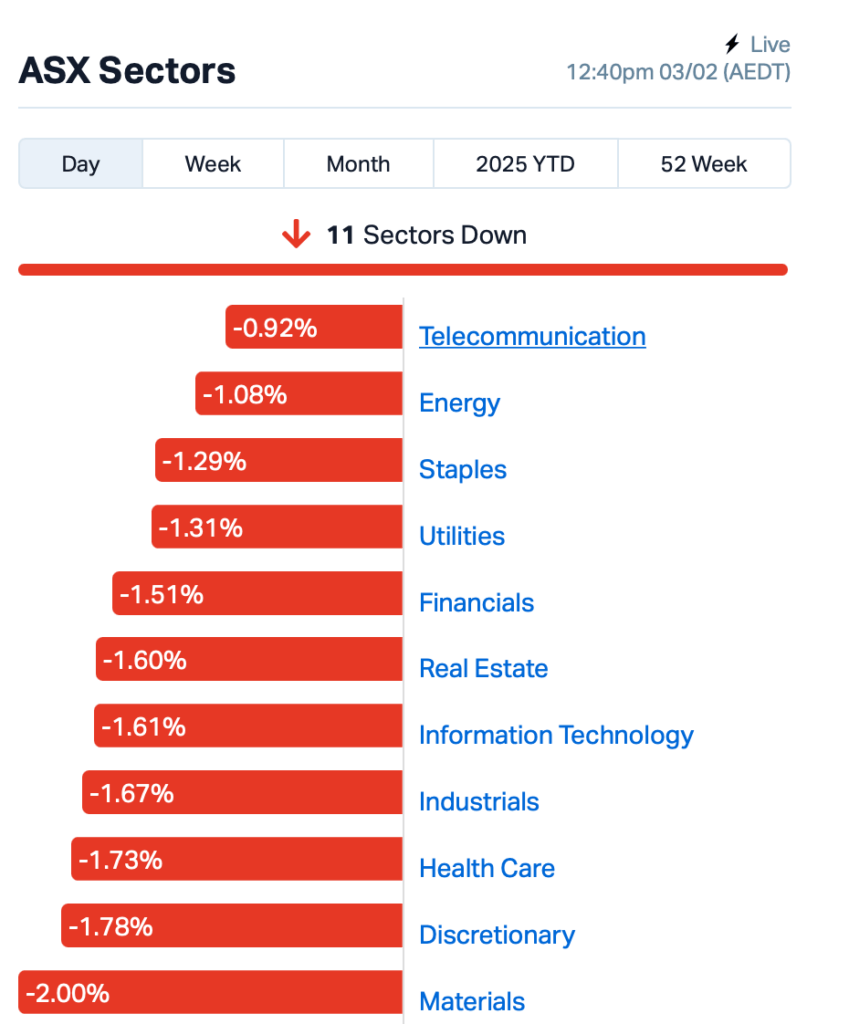

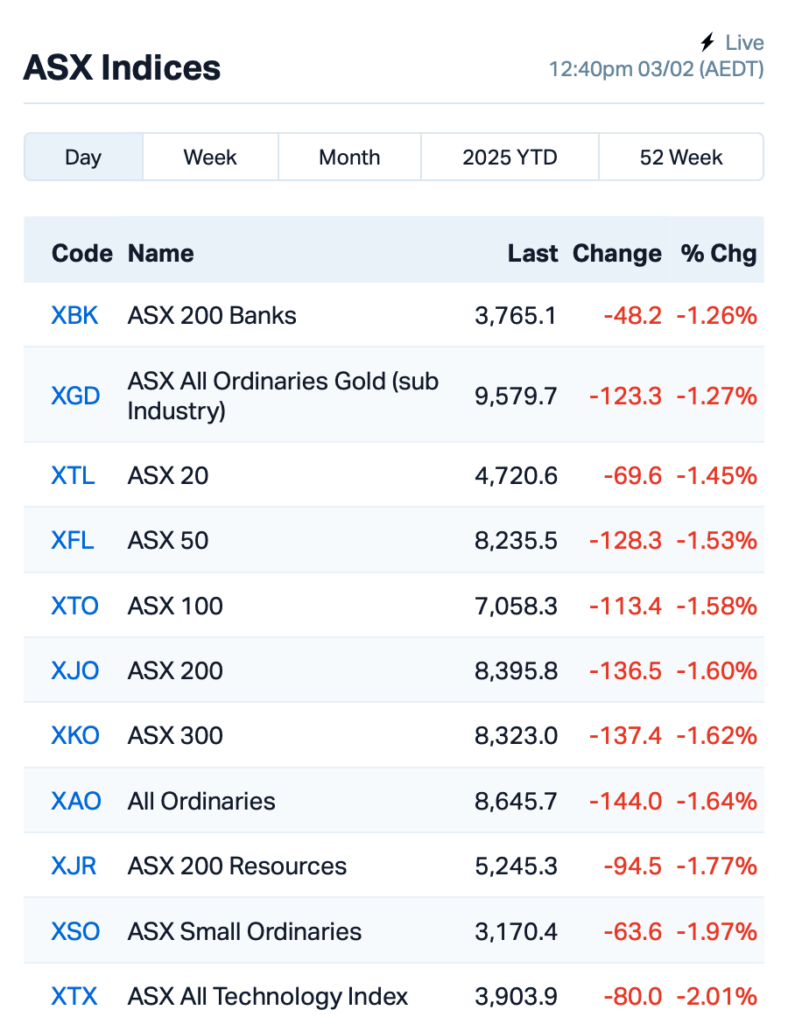

It’s a rough start to the week for the ASX200, with shares free-falling this morning, down by around 1.6% to a four-month low.

The selloff was triggered by President Trump’s sign-off on hefty tariffs over the weekend – 10% on China, 25% on Canada and Mexico – and it didn’t take long for the ripples to spread like wildfire.

Oil prices shot up as the tariffs sparked a supply crunch concern from two of the US’s top oil suppliers (Canada and Mexico). West Texas crude jumped over 2% to as high $74.30 a barrel.

The US dollar surged, while the Canadian dollar dropped to its lowest point since 2003.

In the crypto market, it was a classic “risk-off” knee-jerk reaction with Bitcoin dropping 4% and Ethereum sliding 10% in the last 24 hours. As for other “altcoins”, it’s a bloodbath right now for many/most.

“The market needs to structurally and significantly reprice the trade war risk premium,” George Saravelos, head of FX research at Deutsche Bank, wrote.

And of course, China has already warned of “corresponding countermeasures”.

“How much the market fallout continues to deteriorate depends on whether the new tariffs are quickly rescinded because an agreement is reached, or whether this devolves into a tit-for-tat cycle,” added Saxo’s Chief Macro Strategist, John J. Hardy.

Back to the ASX, all sectors opened in the red, but mining, discretionary and healthcare copped the worst of it.

In large caps news, the Australian Securities and Investments Commission (ASIC) kicked off an investigation into the ASX’s (ASX:ASX) CHESS platform failure just before Christmas, which caused a major settlement mess for a few days. ASX’s shares were down 2%.

Novonix (ASX:NVX) rose 0.5% after the US International Trade Commission (ITC) ruled that China has been undercutting the US graphite market with cheap exports.

The ruling supports Novonix’s case, filed with other US producers, against China’s unfair pricing tactics, which have been hurting the local graphite industry. As you may already know, Novonix is set to open its massive Riverside facility in Tennessee by 2026.

Meanwhile, Westgold Resources (ASX:WGX) crashed 12% after cutting its full-year production guidance as the ramp-up of its Beta Hunt and Bluebird-South Junction mines took longer than expected. Now, WGX is aiming for 330,000 to 350,000 ounces, down from the previous target of 400,000 to 420,000.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 3 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| OZM | Ozaurum Resources | 0.089 | 147% | 28,291,108 | $7,099,615 |

| HCD | Hydrocarbon Dynamics | 0.003 | 50% | 5,075,519 | $2,085,683 |

| AKN | Auking Mining Ltd | 0.004 | 33% | 252,454 | $1,544,336 |

| NES | Nelson Resources. | 0.004 | 33% | 20,000 | $6,515,783 |

| BB1 | Blinklab Limited | 0.340 | 28% | 1,793,813 | $16,227,582 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 1,163,968 | $4,546,558 |

| MVP | Medical Developments | 0.805 | 21% | 715,637 | $74,917,785 |

| VFX | Visionflex Group Ltd | 0.003 | 20% | 166,700 | $8,419,651 |

| ROC | Rocketboots | 0.075 | 19% | 75,032 | $7,164,543 |

| MM8 | Medallion Metals. | 0.125 | 19% | 263,427 | $42,988,719 |

| UCM | Uscom Limited | 0.025 | 19% | 50,000 | $5,260,017 |

| YOJ | Yojee Limited | 0.130 | 18% | 188,568 | $30,316,424 |

| EVR | Ev Resources Ltd | 0.004 | 17% | 1,634,603 | $5,437,510 |

| ICG | Inca Minerals Ltd | 0.007 | 17% | 1,250,000 | $6,160,335 |

| IPB | IPB Petroleum Ltd | 0.007 | 17% | 132,518 | $4,238,418 |

| PUA | Peak Minerals Ltd | 0.014 | 17% | 7,727,260 | $30,625,323 |

| CLU | Cluey Ltd | 0.072 | 16% | 18,332 | $21,875,072 |

| PLC | Premier1 Lithium Ltd | 0.008 | 14% | 51,640 | $2,576,424 |

| HPR | High Peak Royalties | 0.085 | 13% | 50,000 | $15,604,479 |

| IBX | Imagion Biosys Ltd | 0.017 | 13% | 58,823 | $3,020,121 |

OzAurum Resources’ (ASX:OZM) shares more than doubled after hitting a new high-grade gold discovery at its Mulgabbie North Project in WA’s Eastern Goldfields. Aircore drilling nailed multiple shallow, high-grade gold zones, with standout intercepts like 20m at 3.57g/t and 10m at 6.59g/t. The new target is just 1.3km south of previous drilling and lines up with old data, suggesting big potential said OZM.

Medallion Metals (ASX:MM8) has raised $6.5 million through a placement to back its push to acquire assets from the Forrestania Nickel Operation. The funds will help progress its Ravensthorpe Gold Project and support a targeted Final Investment Decision by late 2025. New and existing investors, including Alkane Resources, backed the placement, giving Medallion a strong cash position of $9.5 million post-settlement.

Logistics tech company, Yojee (ASX:YOJ), has secured a 51% joint venture (JV) with SmartClear to integrate its customs tech into Yojee’s MOSAIC platform. This partnership will speed up the development of MOSAIC and cut costs, initially targeting the freight and customs markets in the ANZ. On top of that, Yojee raised $3.5 million through an oversubscribed placement to fuel this growth.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 3 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMS | Atomos | 0.004 | -43% | 21,256,191 | $8,505,129 |

| AOK | Australian Oil. | 0.002 | -33% | 2,000,000 | $3,005,349 |

| AYM | Australia United Min | 0.002 | -33% | 256,614 | $5,527,732 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 2,122,014 | $4,880,668 |

| H2G | Greenhy2 Limited | 0.002 | -33% | 2,500,000 | $1,794,553 |

| LNU | Linius Tech Limited | 0.001 | -33% | 5,742,767 | $9,226,824 |

| NRZ | Neurizer Ltd | 0.002 | -33% | 53,168,157 | $9,194,612 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 3,775,098 | $57,867,624 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | 2,714,004 | $12,677,188 |

| PKO | Peako Limited | 0.003 | -25% | 266,666 | $4,380,566 |

| PRM | Prominence Energy | 0.003 | -25% | 202,000 | $1,556,706 |

| XF1 | Xref Limited | 0.160 | -22% | 2,568,045 | $39,358,000 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 617,710 | $13,474,426 |

| MEL | Metgasco Ltd | 0.004 | -20% | 1,230,225 | $7,287,934 |

| PIL | Peppermint Inv Ltd | 0.004 | -20% | 709,507 | $10,794,292 |

| RAN | Range International | 0.004 | -20% | 736 | $4,696,452 |

| TMK | TMK Energy Limited | 0.002 | -20% | 215,832 | $23,313,913 |

| ODA | Orcoda Limited | 0.093 | -19% | 140,000 | $19,625,563 |

| FUL | Fulcrum Lithium | 0.130 | -19% | 33,125 | $12,080,000 |

| 1TT | Thrive Tribe Tech | 0.003 | -17% | 6,737,762 | $6,095,169 |

| ERA | Energy Resources | 0.003 | -17% | 423,219 | $1,216,188,722 |

| MSI | Multistack Internat. | 0.005 | -17% | 8,418 | $817,824 |

Terry Holohan is stepping down as CEO of Resolute Mining (ASX:RSG), effective immediately. Holohan’s departure follows his highly publicised kidnapping by the Mali government last year. Chris Eger, who’s been acting as CEO, will take on the role full-time. Shares were down 7%.

IN CASE YOU MISSED IT

St George Mining (ASX:SGQ) has strengthened its in-country management team in Minas Gerais, Brazil, with the appointment of Ricardo Maximo Nardi, a world-leading expert in niobium ore processing. Formerly head of mineral processing at CBMM, Nardi’s 30+ years of experience is a major boost for SGQ as it looks to optimise processing options at its high-grade niobium-REE Araxá project and fast-track development plans.

Top End Energy (ASX:TEE) has finalised its acquisition of Serpentine Energy and its natural hydrogen project in Kansas, USA, following shareholder approval on January 28. TEE is now expanding its lease holdings and conducting geological evaluations ahead of exploration drilling planned for the second half of 2025.

Explorer Antares Metals (ASX:AM5) has its eye on several uranium targets at its Mt Isa North project in Queensland. The company shared with the market today that ten priority targets have been generated at the project, part of a total 49 targets now on the books.

Antares say the targets bare similarities to Paladin Energy’s (ASX:PDN) Odin-Valhalla-Skal cluster of uranium deposits in the vicinity. Antares will undertake ground truthing of its high-priority targets during the next field season at Mt Isa North.

At Stockhead, we tell it like it is. While St George Mining, Antares Metals and Top End Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.