ASX Lunch Wrap: China-driven mining rally offset by tech slump on Nvidia probe

ASX200 slips despite mining rally. Picture via Getty Images

- The ASX200 slips despite mining rally

- Mining stocks surge as China signals stimulus

- Life360 drops after index miscalculation, drags tech sector down

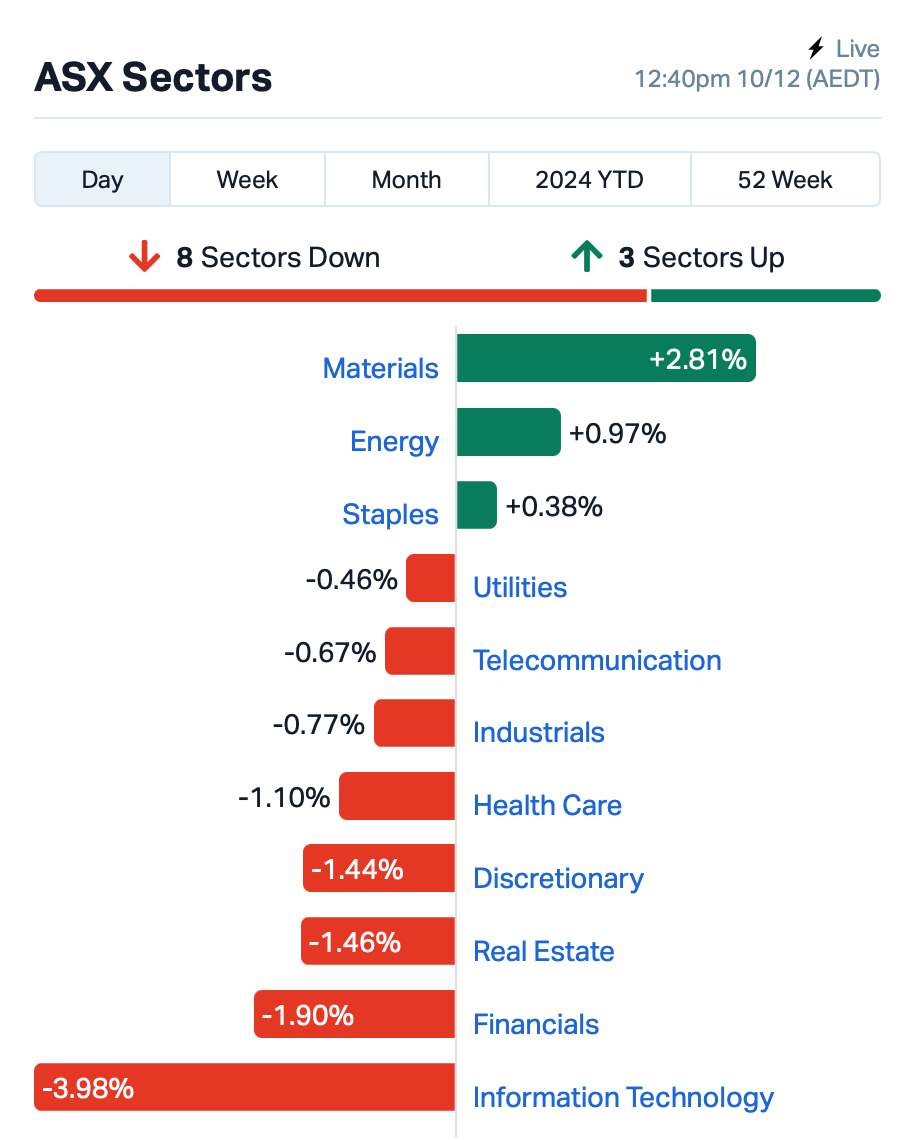

The benchmark ASX200 index fell by around 0.6% at Tuesday lunchtime, despite a promising rally in the mining sector.

While hopes for new stimulus measures in China have provided some optimism, a sell-off in the Tech sector is putting a drag on the market.

The ASX Materials sector surged by almost 3% after China’s Politburo signalled plans for a “moderately loose” monetary policy in 2025.

This comes after Beijing’s top officials discussed adopting a “more proactive” fiscal policy to support economic growth.

However, tech stocks mostly dropped this morning, weighed down by Wall Street after China launched an antitrust investigation into Nvidia.

Beijing said Nvidia violated the country’s anti-monopoly laws in 2020, a move seen as retaliation against US restrictions on the Chinese chip sector. Nvidia’s shares fell 2.55%.

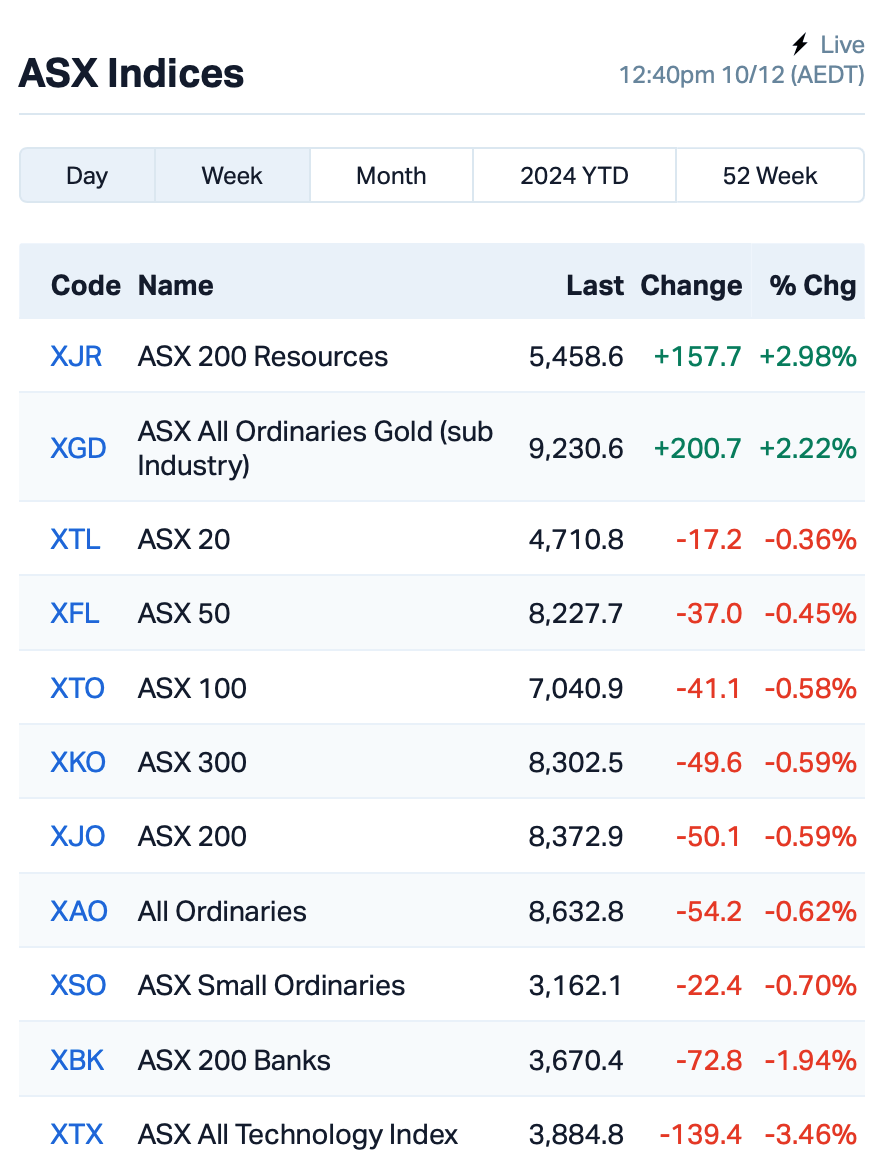

Here’s where the ASX stood at around 12:40pm AEDT:

Notable announcements in the large caps space came from Perpetual (ASX:PPT), which is facing a potentially huge tax bill after the Australian Taxation Office (ATO) raised concerns over its recent sale of assets to private equity giant KKR.

Perpetual’s wealth management and trust business sale to KKR now faces a tax liability of $493–529 million, up from the initial estimate of $106–227 million after further discussions with the ATO. Shares were down 6%.

Dual-listed Life360 (ASX:360) fell by 5% after the company revealed that a miscalculation of its stock’s weighting in the US Russell indexes had led to passive funds needing to adjust down their positions. This followed an 8% drop yesterday.

On a more positive note, the Australian Competition and Consumer Commission (ACCC) has approved a merger between Integral Diagnostics (ASX:IDX) and Capitol Health (ASX:CAJ), creating a $1 billion diagnostics imaging group.

And, at 2.30pm AEDT today, the RBA is expected to announce its last interest rate decision for 2024. The central bank is widely expected to keep the cash rate on hold at 4.35%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 10 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 50% | 4,951,989 | $28,933,812 |

| ERL | Empire Resources | 0.003 | 50% | 1,212,074 | $2,967,826 |

| MOM | Moab Minerals Ltd | 0.003 | 50% | 1,694,660 | $3,133,999 |

| PRX | Prodigy Gold NL | 0.003 | 50% | 183,333 | $6,350,111 |

| TKL | Traka Resources | 0.002 | 50% | 200,000 | $1,945,659 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 354,986 | $7,254,899 |

| MQR | Marquee Resource Ltd | 0.018 | 29% | 1,658,441 | $5,829,381 |

| ERA | Energy Resources | 0.003 | 25% | 622,487 | $810,792,482 |

| SMX | Strata Minerals | 0.022 | 22% | 181,123 | $3,434,673 |

| BML | Boab Metals Ltd | 0.158 | 21% | 1,756,972 | $30,341,364 |

| AON | Apollo Minerals Ltd | 0.015 | 15% | 1,035,715 | $9,052,458 |

| SMM | Somerset Minerals | 0.015 | 15% | 2,115,192 | $2,680,602 |

| FFM | Firefly Metals Ltd | 1.150 | 14% | 1,740,117 | $569,465,191 |

| BRN | Brainchip Ltd | 0.250 | 14% | 16,050,860 | $433,942,955 |

| MTC | Metalstech Ltd | 0.125 | 14% | 254,892 | $21,729,343 |

| AM7 | Arcadia Minerals | 0.025 | 14% | 40,000 | $2,575,102 |

| SPA | Spacetalk Ltd | 0.175 | 13% | 72,934 | $9,885,336 |

| 1AI | Algorae Pharma | 0.009 | 13% | 2,238 | $13,499,158 |

| CMD | Cassius Mining Ltd | 0.009 | 13% | 500,000 | $4,336,036 |

| DOU | Douugh Limited | 0.009 | 13% | 22,000 | $8,656,551 |

| LRS | Latin Resources Ltd | 0.163 | 12% | 14,545,834 | $406,205,822 |

88 Energy (ASX:88E) has received initial 2D seismic data from Monitor Exploration, confirming 10 significant structural leads in its PEL 93 licence area in Namibia’s Owambo Basin. The seismic data reveals large closures, some up to 100 km², with hydrocarbon charge potential.

88 Energy plans to independently validate these findings and, in partnership with the Joint Venture, integrate additional data for a prospective resource estimate, expected in the first half of 2025. The company holds a 20% interest in PEL 93, with the option to increase its stake to 45% by funding exploration costs.

Boab Metals (ASX:BML) has secured a US$30 million prepayment facility and a binding offtake agreement with global commodities trader Trafigura for lead-silver concentrate from its Sorby Hills project in WA.

The prepayment will support the project’s development and has a five-year term, with repayments starting after an 18-month interest-only period. If the financial close is achieved, Trafigura will purchase 75% of the concentrate produced, but this will drop to 25% if the prepayment conditions are not met.

Somerset Minerals (ASX:SMM) has agreed to acquire the high-grade Coppermine project in Nunavut, Canada, adjacent to White Cliff Minerals’ (ASX:WCN) Rae project. The acquisition will give Somerset control of a 1,208 km² land package, hosting multiple high-grade copper lodes, including rock chip results of up to 45.4% copper.

BrainChip Holdings (ASX:BRN) has secured a US$1.8 million contract with the Air Force Research Laboratory (AFRL) to develop radar signalling algorithms for neuromorphic hardware. The project will focus on micro-Doppler signature analysis, using BrainChip’s proprietary TENNs algorithm optimised for its Akida 2.0 hardware.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 10 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VTI | Vision Tech Inc | 0.062 | -54% | 315,745 | $7,429,923 |

| 1TT | Thrive Tribe Tech | 0.001 | -50% | 259,445 | $1,406,723 |

| LYN | Lycaonresources | 0.095 | -50% | 6,540,687 | $10,067,116 |

| MTL | Mantle Minerals Ltd | 0.001 | -50% | 177,452 | $12,394,892 |

| IBG | Ironbark Zinc Ltd | 0.003 | -38% | 5,175 | $7,334,591 |

| LNU | Linius Tech Limited | 0.001 | -33% | 34,500 | $9,226,824 |

| NES | Nelson Resources. | 0.002 | -33% | 387,370 | $6,515,783 |

| ASR | Asra Minerals Ltd | 0.003 | -25% | 3,500,000 | $9,250,410 |

| TMX | Terrain Minerals | 0.003 | -25% | 1,018,765 | $7,200,115 |

| VEN | Vintage Energy | 0.005 | -25% | 7,987,663 | $10,017,188 |

| CCO | The Calmer Co Int | 0.006 | -21% | 7,995,514 | $15,465,705 |

| ADD | Adavale Resource Ltd | 0.002 | -20% | 282 | $3,087,330 |

| ARV | Artemis Resources | 0.008 | -20% | 4,823,373 | $19,168,824 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 290,023 | $13,474,426 |

| CDT | Castle Minerals | 0.002 | -20% | 8,517,866 | $4,182,035 |

| FGH | Foresta Group | 0.008 | -20% | 2,375,956 | $25,773,791 |

| MPR | Mpower Group Limited | 0.008 | -20% | 993,604 | $3,437,033 |

| TMK | TMK Energy Limited | 0.002 | -20% | 110,000 | $23,313,913 |

| SVL | Silver Mines Limited | 0.093 | -20% | 19,824,127 | $173,424,170 |

| VRX | VRX Silica Ltd | 0.047 | -18% | 1,231,430 | $35,810,573 |

| AUG | Augustus Minerals | 0.033 | -18% | 301,465 | $4,767,657 |

| EVG | Evion Group NL | 0.024 | -17% | 1,219,351 | $10,061,932 |

| RAD | Radiopharm | 0.034 | -17% | 26,309,494 | $89,091,391 |

IN CASE YOU MISSED IT

Lanthanein Resources (ASX:LNR) ) has extended its farm-in agreement with Gondwana Resources by six months to earn a 50% interest in tenement E77/2143, agreeing to pay $200,000 in cash.

The extension accommodates delays in regulatory approvals and allows time to complete drilling, receive assay results and evaluate the project’s potential for the next farm-in stage.

At Stockhead, we tell it like it is. While Lanthanein Resources is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.