ASX Lunch Wrap: ASX wobbles despite mining gains, and Goldman warns of correction

ASX wobbles again on Friday morning. Picture via Getty Images

- ASX wobbles but mining bucks the trend

- Goldman warns: 30% chance of market crash in 2025

- Aussie dollar slumps to two-year low after retail sales flop

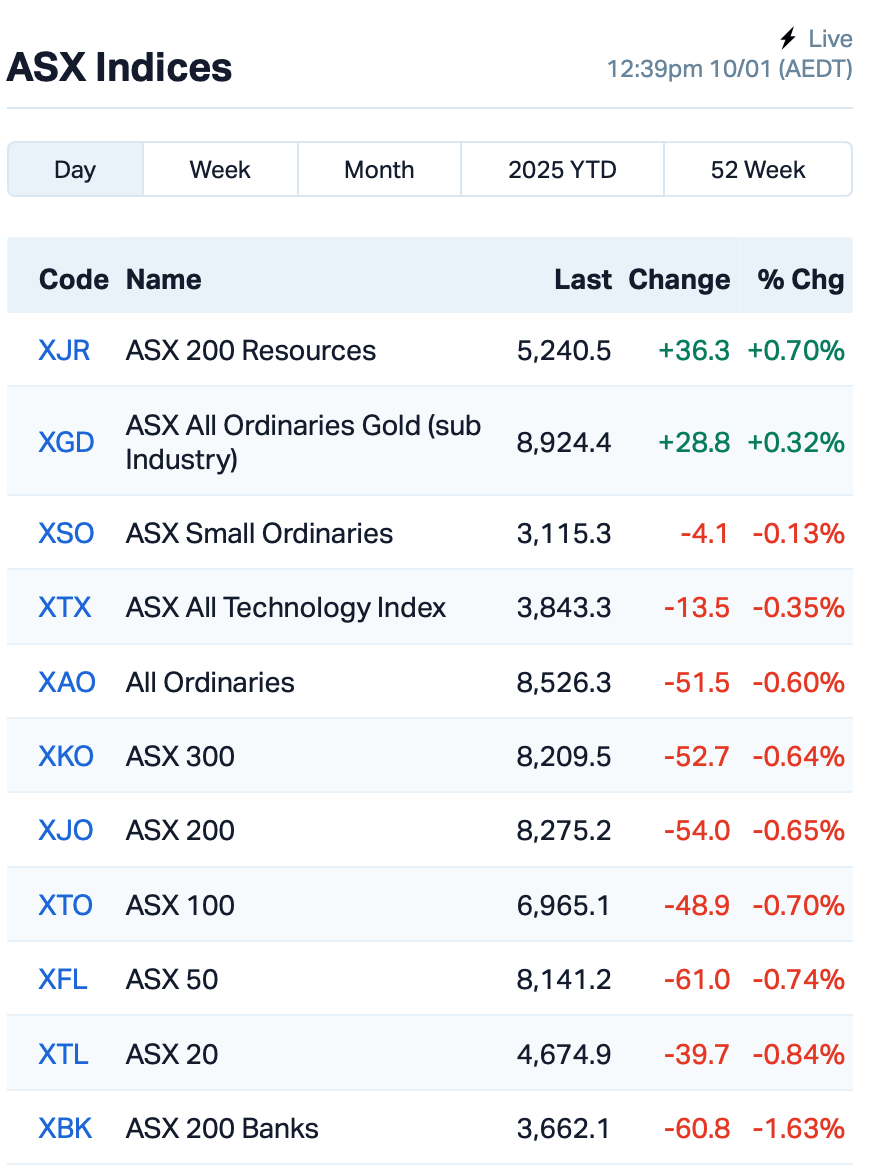

The ASX seesawed at the start of Friday’s morning session. The S&P/ASX 200 index started strong, but it was deep in the red by 12:40pm AEDT, down 0.6%.

On Wall Street overnight, it was a mixed bag, too, as traders took some comfort in US jobless claims coming in better than expected.

But investors were given a wake-up call by Goldman Sachs, who warned of a 30% chance of a major Wall Street correction in 2025.

With sky-high valuations, inflation still lingering, and Trump’s political wildcard, Goldman believes US stocks are “priced for perfection” – leaving little room for error.

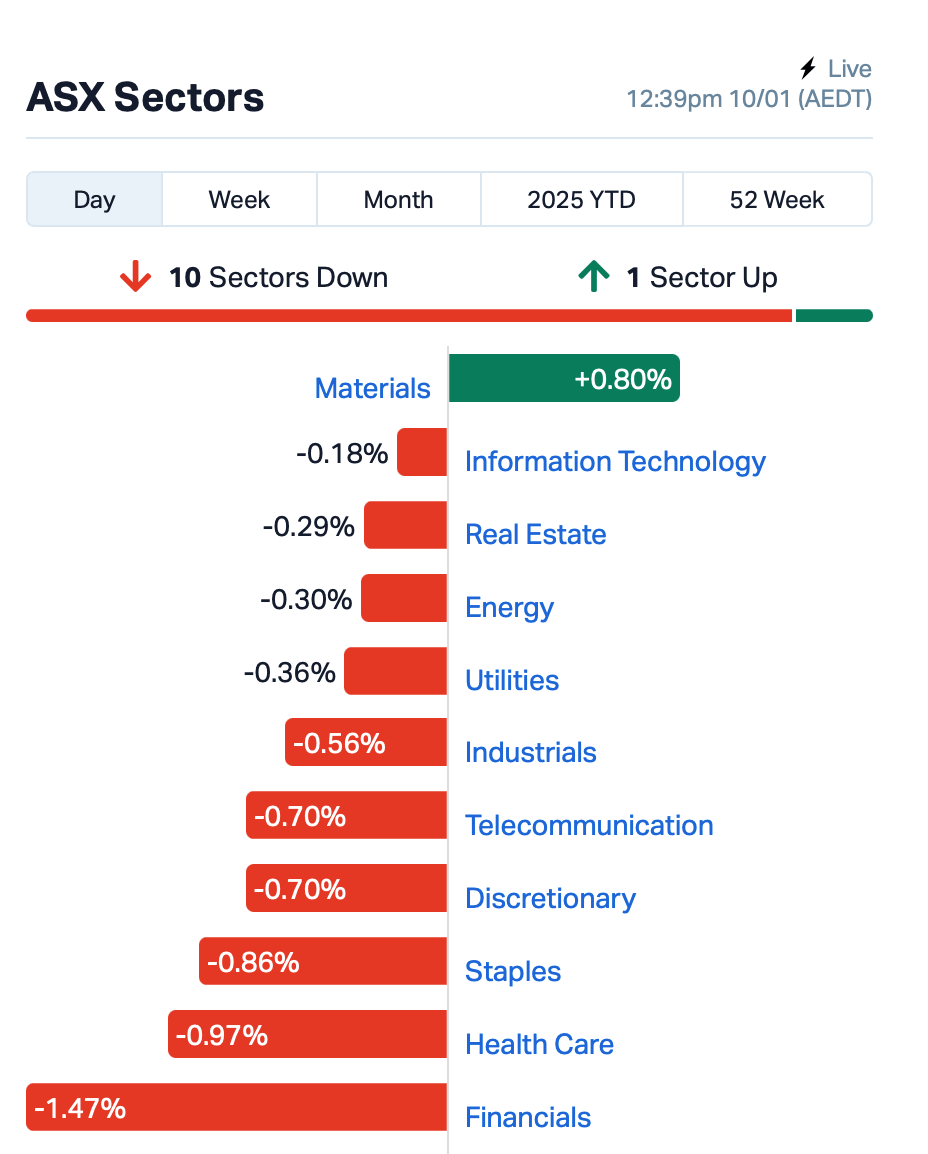

Back to the ASX, ten of the 11 sectors were in the negative this morning.

The bright spot today was mining, which rose thanks to the rise in iron ore prices; while goldies also saw decent gains.

The Aussie dollar, meanwhile, hit a fresh two-year low at US61.80 cents.

Weak retail sales data, which landed yesterday, has effectively raised expectations the RBA could cut rates soon, which spells trouble for the AUD/USD currency pair.

In the large caps space, Star Entertainment Group (ASX:SGR) tanked a further 14%, extending yesterday’s 27% loss. The casino operator’s future is looking grim, with fears it could go into voluntary administration unless it can get a deal to save itself pretty soon.

And Novonix (ASX:NVX), the battery tech company, has struck a licensing deal with Harper International for exclusive rights to its graphitisation furnace tech, aimed at boosting production of synthetic graphite for lithium-ion batteries. Shares, however, were down 0.7%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 10th [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.002 | 100% | 4,405,894 | $2,964,861 |

| RAD | Radiopharm | 0.037 | 54% | 53,783,449 | $52,815,523 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 500,000 | $6,164,814 |

| RAN | Range International | 0.004 | 33% | 591,428 | $2,817,871 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 299,974 | $3,081,664 |

| TMK | TMK Energy Limited | 0.003 | 25% | 270,000 | $18,651,130 |

| VEN | Vintage Energy | 0.005 | 25% | 204,614 | $6,678,125 |

| WGR | Westerngoldresources | 0.046 | 21% | 3,820,972 | $6,473,492 |

| 1TT | Thrive Tribe Tech | 0.003 | 20% | 170,000 | $5,079,308 |

| MTB | Mount Burgess Mining | 0.006 | 20% | 140,628 | $1,697,687 |

| STM | Sunstone Metals Ltd | 0.006 | 20% | 3,497,575 | $25,749,518 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 21,400 | $4,026,248 |

| HCT | Holista CollTech Ltd | 0.026 | 18% | 311,153 | $6,286,868 |

| TM1 | Terra Metals Limited | 0.027 | 17% | 538,404 | $9,136,081 |

| PGM | Platina Resources | 0.021 | 17% | 1,226,861 | $11,217,246 |

| AIV | Activex Limited | 0.007 | 17% | 200 | $1,293,015 |

| OLL | Openlearning | 0.022 | 16% | 304,853 | $9,170,818 |

| AUZ | Australian Mines Ltd | 0.015 | 15% | 20,640,102 | $18,180,658 |

| T3D | 333D Limited | 0.015 | 15% | 622,625 | $2,290,385 |

| NTD | Ntaw Holdings Ltd | 0.195 | 15% | 524,189 | $28,510,294 |

Radiopharm Theranostics (ASX:RAD) surged after securing a US$5 million private placement with Lantheus, a leader in the radiopharmaceutical industry. Lantheus is now the largest shareholder, holding 12.16% of the company after buying 133 million shares at $0.060 each – a 150% premium on the last closing price. The funds will support Radiopharm’s clinical pipeline.

Western Gold Resources (ASX:WGR) has completed an above-market placement, raising $720,000 before costs to advance its Gold Duke project in Western Australia. The placement was priced at 4 cents per share, a 28% premium to the 30-day VWAP of 3.12 cents. The funds will be used for general working capital and to support Gold Duke toward production, including metallurgical work, grade control and infill planning, securing approvals, and covering corporate costs.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 10th [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AGD | Austral Gold | 0.023 | -30% | 58,625 | $20,206,275 |

| CDT | Castle Minerals | 0.002 | -20% | 250,000 | $4,742,035 |

| DMG | Dragon Mountain Gold | 0.004 | -20% | 80,720 | $1,973,358 |

| GES | Genesis Resources | 0.004 | -20% | 100,000 | $3,914,206 |

| RLT | Renergen Limited | 0.420 | -18% | 85,195 | $15,466,248 |

| ABE | Ausbondexchange | 0.020 | -17% | 43,192 | $2,704,035 |

| ENV | Enova Mining Limited | 0.005 | -17% | 100,000 | $5,909,576 |

| ERA | Energy Resources | 0.003 | -17% | 5,220,667 | $1,216,188,722 |

| HHR | Hartshead Resources | 0.005 | -17% | 249,523 | $16,852,093 |

| LNR | Lanthanein Resources | 0.003 | -17% | 584,647 | $7,330,908 |

| SIS | Simble Solutions | 0.005 | -17% | 250,000 | $5,017,982 |

| SGR | The Star Ent Grp | 0.110 | -15% | 79,432,854 | $372,928,514 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 91,070 | $8,246,534 |

| PLC | Premier1 Lithium Ltd | 0.006 | -14% | 250,000 | $2,576,424 |

| SRN | Surefire Rescs NL | 0.003 | -14% | 18,500 | $8,457,077 |

| SPQ | Superior Resources | 0.007 | -13% | 674,000 | $17,358,910 |

| SPN | Sparc Tech Ltd | 0.250 | -12% | 219,277 | $27,323,790 |

| KLI | Killiresources | 0.047 | -11% | 215,003 | $7,431,858 |

| LU7 | Lithium Universe Ltd | 0.008 | -11% | 3,928 | $7,073,817 |

| PER | Percheron | 0.008 | -11% | 858,718 | $9,786,939 |

| LOM | Lucapa Diamond Ltd | 0.018 | -10% | 1,329,490 | $6,672,806 |

| UBN | Urbanise.Com Ltd | 0.390 | -9% | 2,222 | $27,738,872 |

IN CASE YOU MISSED IT

Belararox (ASX:BRX) is about to kick off drilling at the high-priority Malambo and Tambo South targets within its TMT project in San Juan, Argentina. Despite minor setbacks causing delays, drilling is planned to begin in the second half of January, with completion by April.

Mithril Resources (ASX:MTH) has called on the expertise of highly experienced technical consultants Daniel Kunz and Associates to aid in the advancement of its Copalquin property in Mexico. Drilling is already underway, with a target of 35,000 metres by year’s end. Kunz is the former CEO of Ivanhoe Mines and founding CEO of TSX-listed Prime Mining Corp, which operates a property in the same geologic region as Copalquin.

In Argentina, Challenger Gold (ASX:CEL) has finalised a $6.6 million strategic placement with Eduardo Elsztain, making him the company’s largest shareholder with a 12.7% stake. The company aims for Elsztain to step into the role of non-executive chair, with Saul Zang joining as a non-executive director. Challenger also confirmed it has received the US$2 million upfront payment as part of its recently announced toll processing agreement with Casposo Argentina Mining.

At Stockhead, we tell it like it is. While Belararox, Mithril Silver and Gold, Western Gold Resources and Challenger Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.