ASX Lunch Wrap: ASX takes historic leap to 8500 level; Zip co-founder Larry Diamond exits

ASX hits record high, surpassing 8500 points. Picure via Getty Images

- ASX hits record high, surpassing 8500 points

- Zip co-founder steps down, shares dip

- Aussie consumer confidence jumps to highest since May 2022

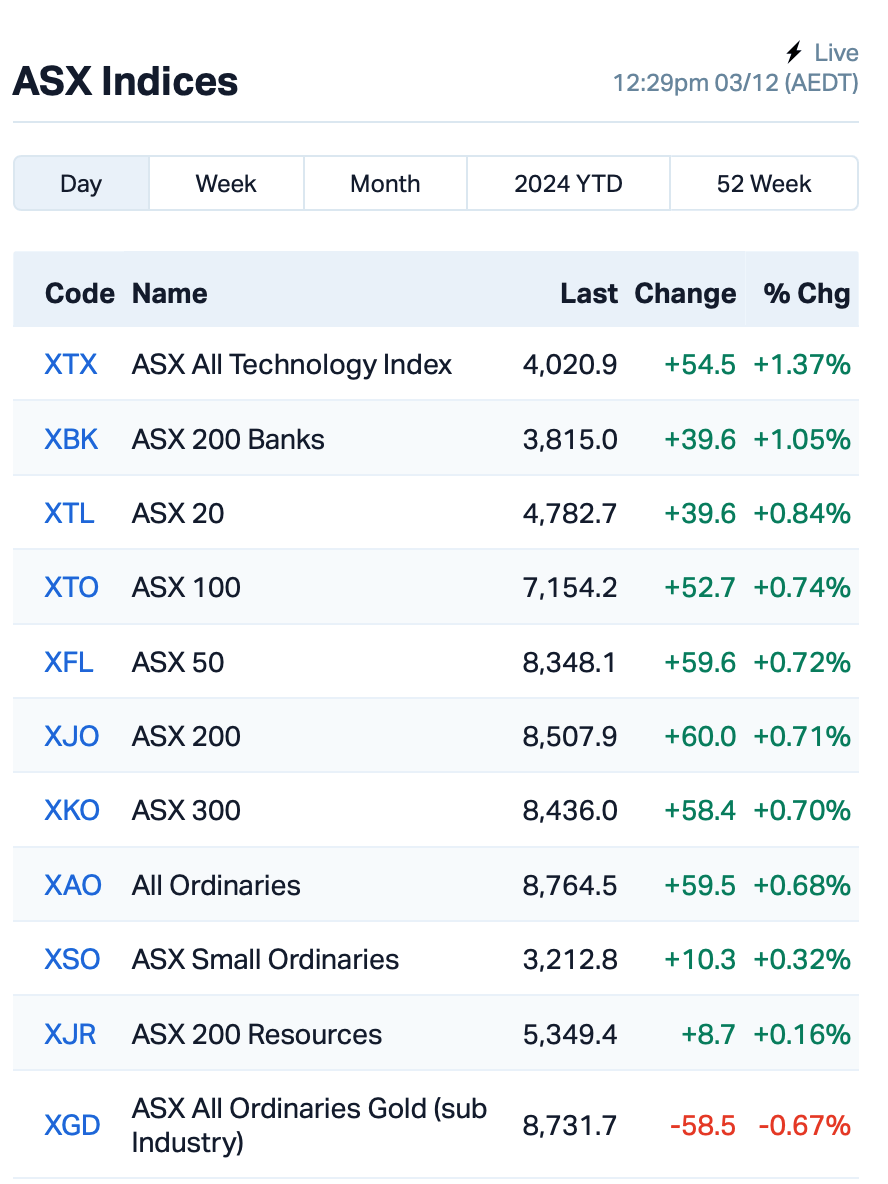

The ASX has hit a new record on Tuesday morning, with the S&P/ASX 200 benchmark rising by 0.7% and climbing past 8500 points for the first time in history.

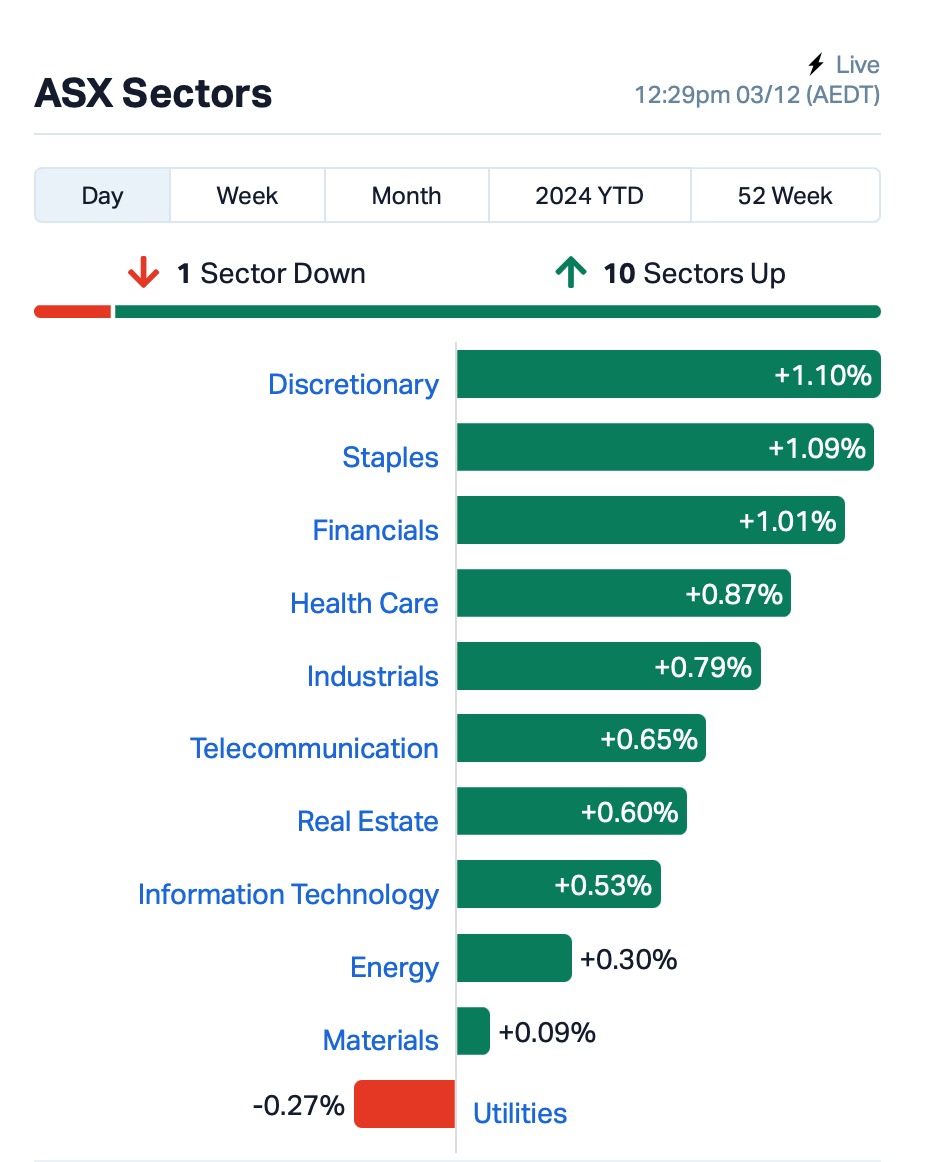

The surge is driven by gains across almost all sectors, with consumer staples and technology stocks leading the way.

This comes after the US S&P 500 index marked its 54th record close of the year overnight.

Despite the record high, analysts believe there’s still room for growth, with some expecting the S&P 500 to hit even higher levels in 2025.

“We believe the outlook for next year remains favourable despite the known risks, and stocks could grind higher if fundamental conditions stay on track,” said Anthony Saglimbene at Ameriprise.

Back to the ASX, this is what it looked like at about 12.30pm AEDT on Tuesday:

In the large end of town, one of the biggest announcements came from BNPL stock Zip Co (ASX:ZIP), which said that its co-founder and US chairman, Larry Diamond, is stepping down to focus on charitable work.

Diamond and Peter Gray started Zip in 2013, a year before Afterpay. He will remain a shareholder and may give advice on the company’s strategy, but will no longer be involved in day-to-day management. Zip’s shares were down 1%.

Woolworths (ASX:WOW) rose 0.3% despite reporting a loss of $50 million in sales due to ongoing strikes. The retailer said two weeks of industrial action have disrupted operations, and warned it could impact its full-year performance.

Positive factory data from China has helped iron ore mining stocks this morning. Rio Tinto (ASX:RIO) and Fortescue (ASX:FMG) both saw gains.

And, in the latest economic data released today, Australian consumer confidence has surged by 2.7%, reaching 88.4 – its highest level since May 2022.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 3 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IVX | Invion Ltd | 0.360 | 100% | 774,715 | $12,370,080 |

| RIE | Riedel Resources Ltd | 0.002 | 100% | 1,000,637 | $2,223,836 |

| ION | Iondrive Limited | 0.021 | 75% | 54,291,979 | $8,502,090 |

| ERL | Empire Resources | 0.003 | 50% | 6,674,567 | $2,967,826 |

| 1TT | Thrive Tribe Tech | 0.002 | 33% | 1,600,000 | $1,055,042 |

| AVE | Avecho Biotech Ltd | 0.004 | 33% | 899,422 | $9,507,891 |

| H2G | Greenhy2 Limited | 0.004 | 33% | 498,138 | $1,794,553 |

| TAS | Tasman Resources Ltd | 0.004 | 33% | 1,043,931 | $2,415,749 |

| BDG | Black Dragon Gold | 0.024 | 33% | 3,603,375 | $5,433,889 |

| EUR | European Lithium Ltd | 0.061 | 33% | 9,361,804 | $64,313,641 |

| NC6 | Nanollose Limited | 0.029 | 32% | 18,326 | $3,784,140 |

| BUS | Bubalusresources | 0.140 | 27% | 697,399 | $4,000,068 |

| MX1 | Micro-X Limited | 0.069 | 25% | 4,305,039 | $31,988,207 |

| CUL | Cullen Resources | 0.005 | 25% | 280,000 | $2,773,607 |

| CZN | Corazon Ltd | 0.003 | 25% | 499,662 | $1,535,811 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 1,200,021 | $12,314,111 |

| MEL | Metgasco Ltd | 0.005 | 25% | 121,100 | $5,830,347 |

| OLI | Oliver'S Real Food | 0.010 | 25% | 710,000 | $3,525,855 |

| PRM | Prominence Energy | 0.005 | 25% | 434,958 | $1,556,706 |

| TMK | TMK Energy Limited | 0.003 | 25% | 3,949,071 | $18,651,130 |

| VML | Vital Metals Limited | 0.003 | 25% | 18,906,180 | $11,790,134 |

| CRS | Caprice Resources | 0.022 | 22% | 3,348,452 | $7,415,162 |

| FRX | Flexiroam Limited | 0.011 | 22% | 855,195 | $7,070,794 |

| MTM | MTM Critical Metals | 0.110 | 22% | 20,507,875 | $36,594,790 |

Invion (ASX:IVX) rallied after the biotech announced the dosing of its first patient in a phase I/II trial for non-melanoma skin cancer (NMSC) using its drug INV043. The trial, conducted in Brisbane, aims to test the drug’s safety and effectiveness in treating skin cancer, a condition that makes up over 98% of all skin cancers globally. INV043 has shown promise in preclinical studies, potentially offering treatment with minimal scarring and pain, unlike current methods.

Read also Tim Boreham’s Let there be light (therapy). Invion up 160pc on skin cancer trial news

Iondrive (ASX:ION) has completed a $6 million capital raise through the issue of new shares, priced at a 16.7% premium. The funds will be used to build a pilot plant for its battery recycling technology, which extracts critical minerals from old lithium-ion batteries using an environmentally sustainable process. Strong participation from institutional investors and key shareholders, including Terra Capital, Strata Investment Holdings, and Ilwella, has boosted confidence in Iondrive’s commercial prospects.

Corazon Mining (ASX:CZN) has started an aerial geophysical survey at its MacBride base and precious metals project in Canada, aiming to identify drill targets for early 2025. The survey will focus on areas with potential for copper-zinc-gold-silver deposits, including extensions of known deposits and new unexplored areas. The data from this modern, high-tech survey will help define precise drilling targets and could speed up exploration. The project is located in Manitoba’s Lynn Lake district, a historically rich mining area with potential for significant mineral discoveries.

Micro-X (ASX:MX1) has responded to a US government website publication stating that its US subsidiary, Micro-X Inc, has been awarded an $8.15 million development contract. The company confirms it is in advanced discussions with a US agency but has not yet received a fully executed contract.

Caprice Resources (ASX:CRS) has started exploration at its Cuddingwarra gold project in WA’s Murchison Gold Fields, where visible gold has been found in quartz reefs above a high-priority target, CUD-GPX01. This target shares similar structural features with nearby gold deposits, such as Westgold’s Cue gold mines. The project covers a 10km mineralised corridor, with drilling planned after further surface sampling.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 3 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 4,126,776 | $11,649,361 |

| GMN | Gold Mountain Ltd | 0.002 | -33% | 2,050,675 | $11,722,420 |

| VPR | Voltgroupltd | 0.001 | -33% | 32,505 | $16,074,312 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 687,500 | $2,013,147 |

| MOM | Moab Minerals Ltd | 0.003 | -25% | 212,333 | $3,571,435 |

| NRZ | Neurizer Ltd | 0.002 | -25% | 6,444,944 | $5,635,721 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 209,831 | $9,673,198 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 257,497 | $13,151,701 |

| AKN | Auking Mining Ltd | 0.004 | -20% | 693,249 | $1,956,751 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 15,484 | $13,474,426 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 41,000 | $5,884,982 |

| AS2 | Askarimetalslimited | 0.010 | -17% | 5,427,986 | $2,560,254 |

| ERA | Energy Resources | 0.003 | -17% | 1,535,300 | $1,216,188,722 |

| FIN | FIN Resources Ltd | 0.005 | -17% | 1,152,219 | $3,895,612 |

| IXU | Ixup Limited | 0.010 | -17% | 3,772,041 | $20,051,831 |

| TIG | Tigers Realm Coal | 0.003 | -17% | 103,123 | $39,200,107 |

| MTC | Metalstech Ltd | 0.105 | -16% | 379,620 | $24,667,435 |

| FME | Future Metals NL | 0.016 | -16% | 99,353 | $10,925,769 |

| NHE | Nobleheliumlimited | 0.043 | -16% | 6,494,833 | $27,910,839 |

| TMG | Trigg Minerals Ltd | 0.038 | -16% | 34,752,648 | $28,920,631 |

| T92 | Terrauraniumlimited | 0.045 | -15% | 145,000 | $4,232,571 |

| ERW | Errawarra Resources | 0.053 | -15% | 908,976 | $5,947,081 |

| CRR | Critical Resources | 0.006 | -14% | 1,808,882 | $17,023,742 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 76,179,970 | $35,819,339 |

IN CASE YOU MISSED IT

Sunshine Metals (ASX:SHN) has kicked off geophysical surveys at the Coronation and Coronation South prospects within its Ravenswood Consolidated project in North Queensland, in an effort to ready-up Au-Cu targets to drill.

Soil sampling and field mapping have already been completed, with the geochemical and geophysical data to provide high-quality drill targets for testing in the new year.

Trigg Minerals (ASX:TMG) is utilising advanced UAV geophysical technology in its exploration efforts for antimony-gold mineralisation along the Bielsdown Fault, hosting the Wild Cattle Creek deposit, where the company is finalising a revised MRE.

The company believes the UAV surveys will help reduce drilling costs by minimising exploratory drilling in low-priority areas and ensuring resources are allocated efficiently and effectively.

At Stockhead, we tell it like it is. While Sunshine Metals and Trigg Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.