ASX Lunch Wrap: ASX slumps as Rio seals copper deal with Sumitomo

ASX slumps at lunch time Wednesday. Picture via Getty Images

- ASX dips after record ‘Santa rally’ and global market jitters

- Rio Tinto, Sumitomo strike $615m copper deal

- Aussies spend smarter in Black Friday sales, NAB reports

The ASX took a step back this morning after a record-breaking ‘Santa rally’ on Tuesday.

At around lunchtime on Wednesday, the benchmark S&P/ASX 200 had dropped by 0.7% as investors digested mixed signals from global markets.

Overnight, the US S&P 500 even notched its 55th record high of 2024, while the tech-heavy Nasdaq surged on the back of Apple’s continued rally.

But the mood temporarily shifted after South Korea’s president declared martial law in an attempt to curb political opposition and prevent “anti-state forces” from undermining his government. He quickly reversed the decision after lawmakers unanimously rejected it and protesters rallied against it.

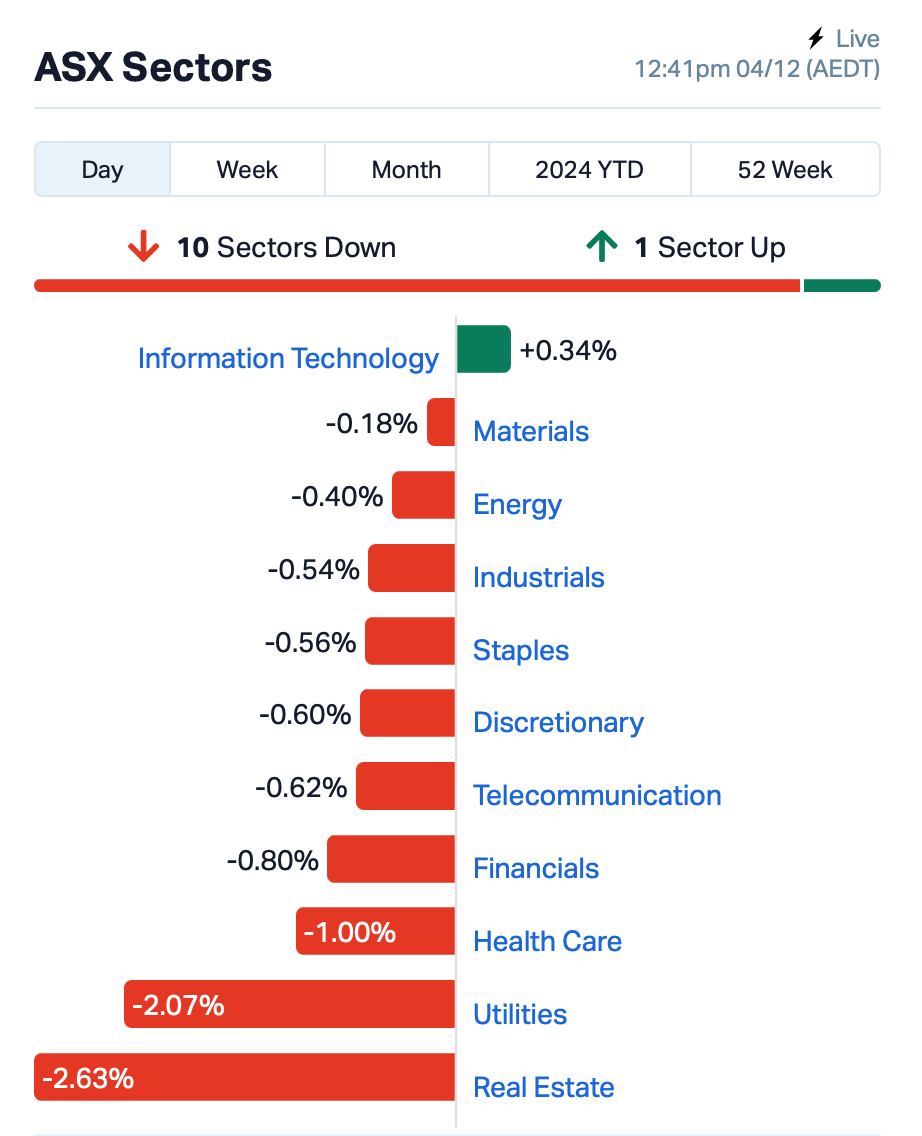

This is where the ASX stood at around 12:40pm AEDT. Real estate, Utilities, as well as lithium stocks were among the biggest laggards.

A notable announcement from the big end of town came from Rio Tinto (ASX:RIO) and Japan’s Sumitomo Metal Mining (SMM) with a major deal in the copper sector.

The two giants have agreed to form a joint venture to develop the Winu copper-gold project in WA’s Great Sandy Desert. As part of the deal, SMM will acquire a 30% stake for $615 million, a move that boosted Rio Tinto’s stock by 0.3%.

Meanwhile, Pro Medicus (ASX:PME), the medical imaging software company, rose by 3% after founders Dr Sam Hupert and Anthony Hall reassured investors they have no plans to sell more shares in the foreseeable future.

And in consumer news, NAB reported a 4% increase in overall spending during Black Friday sales, but with an interesting twist: the number of transactions dropped by 4%.

This suggests that while Aussies are spending less frequently, they’re making more thoughtful purchases, opting for high-ticket items like TVs, cameras and furniture.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for December 4 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GMN | Gold Mountain Ltd | 0.003 | 50% | 730,489 | $7,814,946 |

| NVO | Novo Resources Corp | 0.115 | 37% | 1,425,309 | $9,396,804 |

| CAV | Carnavale Resources | 0.004 | 33% | 21,250 | $12,270,655 |

| YAR | Yari Minerals Ltd | 0.004 | 33% | 26,865 | $1,447,073 |

| BLU | Blue Energy Limited | 0.009 | 29% | 3,065,643 | $12,956,815 |

| NPM | Newpeak Metals | 0.014 | 27% | 361,836 | $3,359,456 |

| CYM | Cyprium Metals Ltd | 0.024 | 26% | 5,789,080 | $28,993,284 |

| ATH | Alterity Therap Ltd | 0.005 | 25% | 39,353,443 | $21,281,344 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 20,000 | $5,296,765 |

| ERA | Energy Resources | 0.003 | 25% | 288,400 | $810,792,482 |

| INP | Incentiapay Ltd | 0.005 | 25% | 323,753 | $5,169,360 |

| M2R | Miramar | 0.005 | 25% | 1,200,953 | $1,587,293 |

| CC5 | Clever Culture | 0.021 | 24% | 10,849,356 | $29,889,622 |

| LDX | Lumos Diagnostics | 0.038 | 23% | 18,111,421 | $23,118,561 |

| ADD | Adavale Resource Ltd | 0.003 | 20% | 250,510 | $3,087,330 |

| EGR | Ecograf Limited | 0.095 | 19% | 671,798 | $36,330,546 |

| YRL | Yandal Resources | 0.285 | 19% | 482,821 | $72,024,873 |

| WNX | Wellnex Life Ltd | 0.820 | 17% | 36,757 | $20,997,124 |

| ESR | Estrella Res Ltd | 0.021 | 17% | 12,248,260 | $34,218,694 |

| RGL | Riversgold | 0.004 | 17% | 813,390 | $4,882,388 |

| ARD | Argent Minerals | 0.023 | 15% | 9,696,777 | $28,912,810 |

| CCO | The Calmer Co Int | 0.008 | 14% | 60 | $15,465,705 |

| WSR | Westar Resources | 0.008 | 14% | 1,245,000 | $2,791,074 |

Petratherm (ASX:PTR) has reported impressive maiden drill results from its Rosewood Prospect in South Australia’s Muckanippie project, confirming a major discovery of heavy mineral sands (HMS). The first five drill holes along a 2km trend returned high concentrations of heavy minerals, with some intercepts showing up to 39.7% HM.

Preliminary analysis suggests valuable minerals like Leucoxene and Rutile are present. A further 45 drill holes are expected to provide more results in the coming weeks. Meanwhile, Hole EL6715 of the project was granted to Leasingham Metals, a, wholly owned subsidiary of Narryer Metals (ASX:NYM) for a period of six years.

Aldoro Resources (ASX:ARN) has confirmed niobium mineralisation over 262 metres at Line 4 of its Kameelburg carbonatite, with an average grade of 0.52% Nb2O5. Highlights include 94 metres at 0.93% Nb2O5, with a 30-metre section showing 1.2% Nb2O5. Niobium is a high-value commodity, currently trading at US$57,000 per tonne.

Micro-X (ASX:MX1) has been awarded a US$8.2m contract by the US Advanced Research Projects Agency for Health (ARPA-H) to develop a lightweight and portable Full Body CT scanner. The contract will fund the first two years of development, with an option for a further US$8.2m over the next three years, contingent on milestones. MX1 said this non-dilutive funding will enable the company to retain full rights to the technology as it works towards FDA approval.

Top End Energy (ASX:TEE) has entered a binding agreement to acquire Serpentine Energy and its 100% owned natural hydrogen project in Kansas, US. The project is located in a prime area with growing exploration activity, and the company has raised $6 million through a placement to fund expansion.

Bravura Solutions (ASX:BVS) has upgraded its FY25 guidance, expecting cash EBITDA between $33m and $36m, EBITDA between $41m and $44m, and revenue between $240m and $245m, following a successful business transformation. The company also plans to restart dividend payments in February 2025, with the first payment in March, alongside a capital return of at least $0.163 per share in January.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for December 4 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CYB | Aucyber Limited | 0.125 | -38% | 931,577 | $32,712,672 |

| HCD | Hydrocarbon Dynamic | 0.002 | -33% | 12,000 | $2,783,525 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 966,541 | $57,867,624 |

| AMD | Arrow Minerals | 0.002 | -25% | 3,786,021 | $26,447,256 |

| LNU | Linius Tech Limited | 0.002 | -25% | 7,496,315 | $12,302,431 |

| SKN | Skin Elements Ltd | 0.003 | -25% | 20,461 | $2,357,944 |

| PIL | Peppermint Inv Ltd | 0.006 | -21% | 432,474 | $15,112,008 |

| MMR | Mec Resources | 0.004 | -20% | 555,334 | $9,159,035 |

| ROG | Red Sky Energy. | 0.009 | -18% | 31,139,963 | $59,644,499 |

| ADD | Adavale Resource Ltd | 0.003 | -17% | 1,000,000 | $3,704,796 |

| BPP | Babylon Pump | 0.005 | -17% | 57,582 | $14,997,294 |

| ERA | Energy Resources | 0.003 | -17% | 3,141,395 | $1,216,188,722 |

| ERL | Empire Resources | 0.003 | -17% | 64,455 | $4,451,740 |

| EVR | Ev Resources Ltd | 0.003 | -17% | 120,000 | $4,188,814 |

| GGE | Grand Gulf Energy | 0.003 | -17% | 600,000 | $7,351,161 |

| ADX | ADX Energy Ltd | 0.040 | -16% | 3,490,838 | $26,923,915 |

| PL3 | Patagonia Lithium | 0.080 | -16% | 11,000 | $6,213,071 |

| VRC | Volt Resources Ltd | 0.003 | -14% | 50,000 | $14,555,373 |

| CSS | Clean Seas Ltd | 0.130 | -13% | 96,906 | $30,196,992 |

| RKT | Rocketdna Ltd. | 0.013 | -13% | 148,018 | $12,717,814 |

| CXM | Centrex Limited | 0.020 | -13% | 5,858,565 | $19,924,119 |

| AQX | Alice Queen Ltd | 0.007 | -13% | 20,097 | $9,175,121 |

| AVE | Avecho Biotech Ltd | 0.004 | -13% | 26,147 | $12,677,188 |

| BCK | Brockman Mining Ltd | 0.014 | -13% | 166,837 | $148,483,714 |

IN CASE YOU MISSED IT

Octava Minerals (ASX:OCT) has reached an agreement with Global Lithium (ASX:GL1) to sell its Talga project in WA’s Pilbara – for $200,000 cash, and $200,000 worth of GL1 ordinary shares.

The transaction makes sense. Global Lithium holds a large tenement adjoining the Talga project, which includes the Archer lithium resource (18Mt at 1% Li2O) and is also prospective for gold and base metals.

OCT managing director Bevan Wakelam says the deal allows the company to focus on its high-grade Yallanlong antimony project and Byro rare earth project in WA, with drilling underway.

At Stockhead, we tell it like it is. While Octava Minerals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.