ASX Lunch Wrap: ASX slides as Fed rate cut hopes vanish; retailers Myer and Premier sink

ASX slips as rate cut hopes vanish. Picture via Getty Images

- ASX slips as Fed rate cut hopes fade

- Myer, Premier tank as sales slump

- Energy stocks rise, Woodside jumps

The ASX slid this morning after stronger-than-expected US jobs data dimmed hopes for US Federal Reserve rate cutting.

The ASX 200 index dropped by about 1.3% – mirroring the 1.5% plunge in the S&P 500 and the Nasdaq after US payrolls showed 256,000 new jobs in December, blowing past expectations of 164,000.

With rate cut dreams dashed, traders across nearly every sector rushed for the exits.

“Investors must adapt to a reality where rates remain elevated, presenting both challenges and opportunities,” said deVere Group’s Nigel Green.

Wall Street was also hit with fresh data that showed US consumers are more pessimistic about future inflation pressures.

Back to the ASX, tech stocks lagged the most with sector leaders WiseTech Global (ASX:WTC) and Technology One (ASX:TNE) down over 2% each.

The retail sector, meanwhile, was dragged down heavily by Myer (ASX:MYR) and Premier Investments (ASX:PMV).

Myer’s shares nosedived by 17% as sales fell 0.8% to $1.59 billion on a year-to-date basis, hit by tough trading conditions and store closures.

PMV also plunged 16% after the company said H1 FY25 sales are tracking flat at $855-865m, with apparel brands expecting a drop in EBIT by up to $20m.

As a reminder, PMV’s Apparel Brands is set for a major merger with Myer, but that depends on shareholder approval at the meeting on 23 January.

Not all was doom and gloom this morning, however.

Energy stocks shone as Brent crude spiked after some fresh US sanctions on Russia. Woodside Energy Group (ASX:WDS) shares rallied 2%.

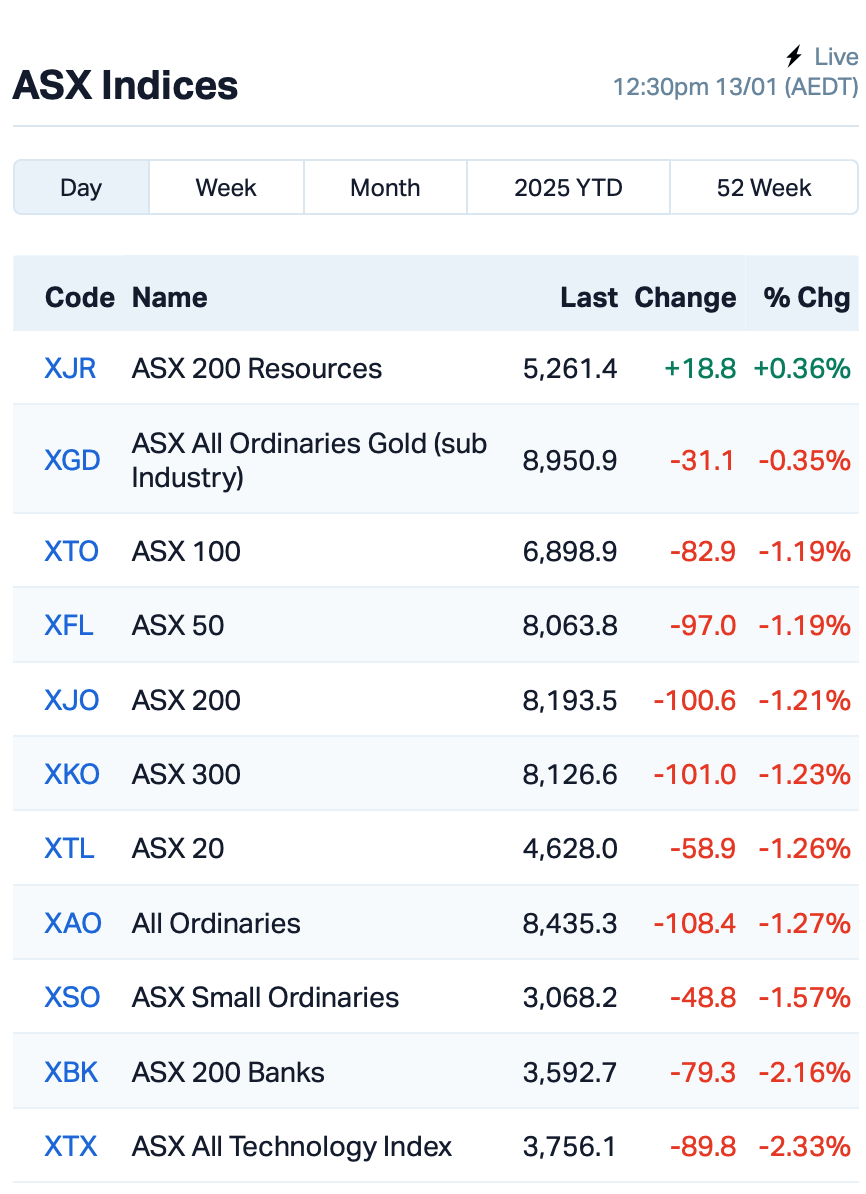

This is how things stood at 12:30pm AEDT:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 13 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EQN | Equinoxresources | 0.150 | 50% | 2,152,231 | $12,385,000 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 2,712,961 | $5,573,628 |

| NAE | New Age Exploration | 0.004 | 33% | 1,509,260 | $6,431,697 |

| VPR | Voltgroupltd | 0.002 | 33% | 500,211 | $16,074,312 |

| CDT | Castle Minerals | 0.003 | 25% | 698,084 | $3,793,628 |

| H2G | Greenhy2 Limited | 0.005 | 25% | 214,807 | $2,392,737 |

| MMR | Mec Resources | 0.005 | 25% | 859,359 | $7,327,228 |

| RAN | Range International | 0.005 | 25% | 3,516,520 | $3,757,161 |

| ETM | Energy Transition | 0.087 | 21% | 10,318,409 | $101,427,025 |

| LMS | Litchfield Minerals | 0.120 | 20% | 341,534 | $2,821,135 |

| WGR | Westerngoldresources | 0.048 | 17% | 72,642 | $6,984,557 |

| IPB | IPB Petroleum Ltd | 0.007 | 17% | 250,000 | $4,238,418 |

| PXX | Polarx Limited | 0.007 | 17% | 8,100 | $14,253,006 |

| SPQ | Superior Resources | 0.007 | 17% | 1,464,285 | $13,019,183 |

| TZL | TZ Limited | 0.058 | 16% | 9,606 | $13,264,038 |

| HCF | Hghighconviction | 0.880 | 15% | 93,400 | $18,651,644 |

| CTO | Citigold Corp Ltd | 0.004 | 14% | 261,016 | $10,500,000 |

| EPM | Eclipse Metals | 0.008 | 14% | 122,500 | $16,014,989 |

| REZ | Resourc & En Grp Ltd | 0.032 | 14% | 2,213,024 | $18,805,895 |

| VTI | Vision Tech Inc | 0.064 | 14% | 14,000 | $3,082,042 |

Equinox Resources (ASX:EQN)’s Mata da Corda’s latest drilling results have hit high-grade titanium, with standout intercepts like 61.2m at 11.89% TiO2 from surface. Over 1,900 samples reveal an average of 10.23% TiO2, with multiple intercepts above 10%. The project also has niobium and rare earth elements as valuable co-products.

Antilles Gold (ASX:AAU)’s pre-feasibility study for the Nueva Sabana mine in Cuba shows a four-year life at 500,000tpa, starting with a 100m pit. The company said plans to drill deeper in 2026-27 could extend it. Off-take talks are in progress, and early gold sales should cover debt. First shipments might start in Q1 2026, with more exploration to boost resources.

Energy Transition Minerals (ASX:ETM) has brought in Julie Bishop & Partners for strategic advice, stakeholder engagement, and government relations. Julie Bishop, Australia’s former Foreign Minister, will use her deep knowledge of geopolitics to support the company’s Kvanefjeld Rare Earth Project in Greenland.

Litchfield Minerals (ASX:LMS) is gearing up to explore the Oonagalabi project in early 2025, with an exploration plan in place. New data has pinpointed a 3km mineralised strike and revealed a large pipe-like structure that’s now top priority. Soil and rock samples confirm the extension of the mineralisation.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 13 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TNC | True North Copper | 0.440 | -85% | 281,521 | $377,517,048 |

| PEB | Pacific Edge | 0.057 | -59% | 238,957 | $113,668,236 |

| CT1 | Constellation Tech | 0.001 | -50% | 7,692 | $2,949,467 |

| RDN | Raiden Resources Ltd | 0.009 | -43% | 85,191,675 | $51,763,372 |

| GMN | Gold Mountain Ltd | 0.002 | -33% | 32,032,424 | $13,737,670 |

| T3D | 333D Limited | 0.010 | -29% | 850,663 | $2,466,569 |

| CTN | Catalina Resources | 0.003 | -25% | 1,042,724 | $4,975,048 |

| ERW | Errawarra Resources | 0.045 | -25% | 440,745 | $5,755,240 |

| W2V | Way2Vatltd | 0.007 | -22% | 100,000 | $8,393,990 |

| FRS | Forrestaniaresources | 0.011 | -21% | 3,237,060 | $3,373,659 |

| X2M | X2M Connect Limited | 0.027 | -21% | 130,564 | $12,815,984 |

| BLZ | Blaze Minerals Ltd | 0.004 | -20% | 17,500 | $7,834,739 |

| CAV | Carnavale Resources | 0.004 | -20% | 1,260,000 | $20,451,092 |

| LNR | Lanthanein Resources | 0.002 | -20% | 948,511 | $6,109,090 |

| YRL | Yandal Resources | 0.145 | -19% | 1,013,386 | $55,662,297 |

| MYR | Myer Holdings Ltd | 0.950 | -17% | 4,620,006 | $959,002,791 |

| ADD | Adavale Resource Ltd | 0.003 | -17% | 1,020,606 | $4,622,496 |

| ASO | Aston Minerals Ltd | 0.010 | -17% | 757,214 | $15,540,771 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 450,126 | $9,507,891 |

| MOM | Moab Minerals Ltd | 0.003 | -17% | 39,920 | $4,700,998 |

| PMV | Premier Investments | 27.830 | -16% | 279,170 | $5,271,363,100 |

| AJL | AJ Lucas Group | 0.006 | -14% | 650 | $9,630,107 |

Novonix (ASX:NVX) fell after hitting a bump with its US Department of Energy loan plans. The company was hoping for tax credits under the 48C Program to help fund its new Tennessee facility, but it hasn’t been selected for that just yet. Still, the DOE’s conditional commitment for a US$754.8 million loan stands, and Novonix is working through what this means for its project. More updates will come as talks continue.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.