ASX Lunch Wrap: ASX flattens as Webjet, Accent tumble; Nvidia disappoints

Bit of a pain – Nvidia misses its bullish sales forecast. Picture via Getty Images

- ASX starts strong with US market bounce, then fizzles out

- Nvidia misses sales forecast, shares drop; but Bitcoin nears US$95k

- Web Travel Group slumps as auditor asks for more time in closing books

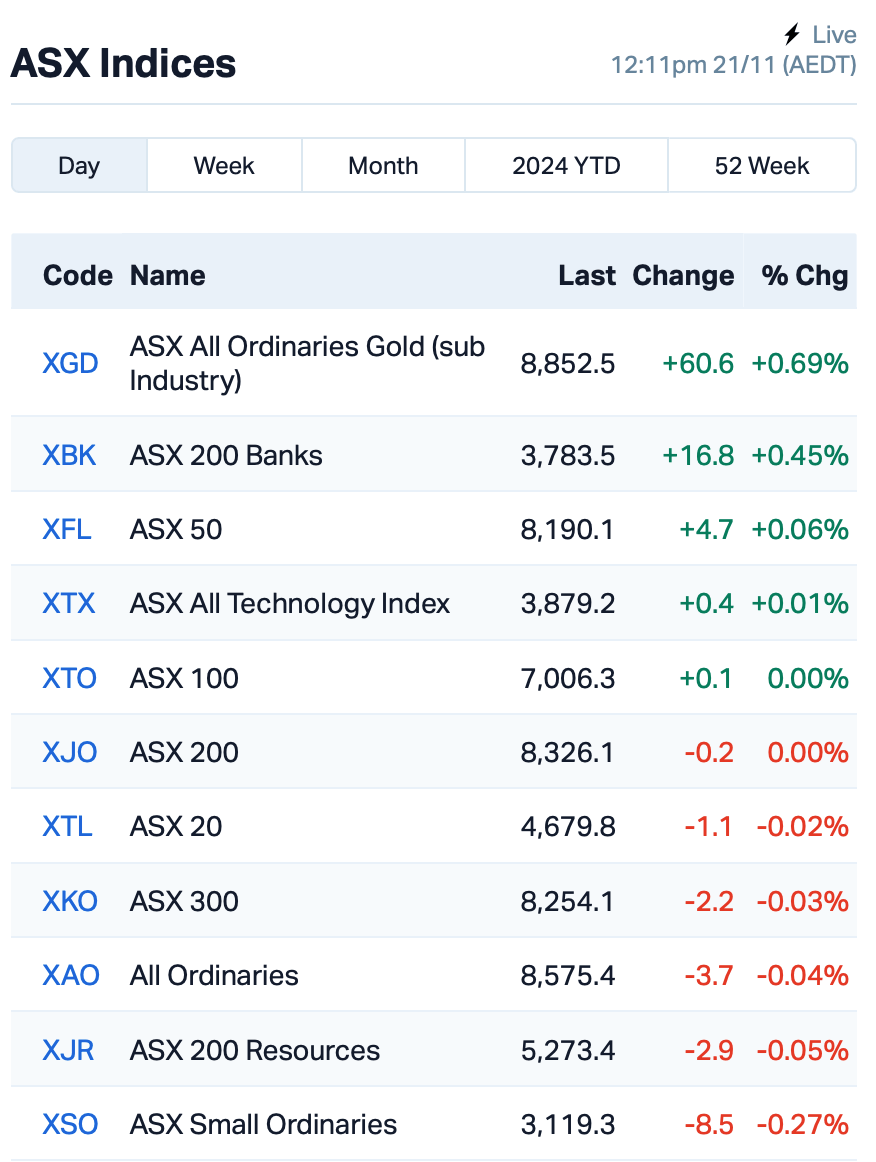

The ASX started Thursday strong but flattened out by about midday.

This followed a late bounce in US markets overnight as Nvidia’s results came in mostly in line with expectations. But its share price fell 2% after hours as investors were hoping for even stronger numbers.

Nvidia’s sales forecast of US$37.5 billion for the next quarter fell short of some high predictions, with one as high as US$41 billion. The company reported 94% revenue growth to US$35.1 billion in Q3, surpassing analysts’ predictions of US$33.25 billion.

Meanwhile, Bitcoin keeps climbing, nearing $95,000 as post-election optimism grows.

Nigel Green, CEO of deVere Group, has raised his forecast, predicting Bitcoin could hit US$120,000 by March 2025.

“The US$100,000 milestone, which once seemed bold, now looks conservative. The growing narrative of Bitcoin as digital gold is becoming impossible to ignore,” he said.

On the ASX today, Energy led the way and Discretionary lagged.

Web Travel Group (ASX:WEB) came out of trading halt and instantly dropped almost 5%. The company announced yesterday that the release of its 1H25 results, originally scheduled for Wednesday, has been postponed as it works with auditor Deloitte to finalise the books.

Footwear retailer Accent Group (ASX:AX1), the owner of Athlete’s Foot, Hype DC and Platypus, plunged 14% as it warned that most retailers are slashing prices to attract shoppers, hurting margins.

Sayona Mining (ASX:SYA) also had a rough day, down 10% after announcing a $40 million equity raise at a low price of 3.2 cents per share ahead of its merger with Piedmont Lithium (ASX:PLL).

And, Chris Ellison and the board of Mineral Resources (ASX:MIN) are likely to face a protest vote at today’s AGM over their pay report, following the recent scandal that has upset shareholders.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | 33% | 2,818,823 | $19,835,442 |

| LNU | Linius Tech Limited | 0.002 | 33% | 5,195,420 | $9,226,824 |

| IFG | Infocus Group | 0.028 | 87% | 26,522,550 | $1,631,640 |

| PTR | Petratherm Ltd | 0.175 | 52% | 9,223,583 | $34,900,465 |

| RIE | Riedel Resources Ltd | 0.002 | 50% | 1,100,000 | $3,335,753 |

| T3D | 333D Limited | 0.010 | 43% | 47,951 | $1,233,284 |

| AAU | Antilles Gold Ltd | 0.004 | 33% | 6,819,874 | $5,567,228 |

| AHN | Athena Resources | 0.004 | 33% | 125,000 | $3,746,636 |

| BYH | Bryah Resources Ltd | 0.004 | 33% | 255,000 | $1,509,861 |

| GCR | Golden Cross | 0.004 | 33% | 36,016 | $3,291,768 |

| JAV | Javelin Minerals Ltd | 0.004 | 33% | 1,125,000 | $15,568,189 |

| OAR | OAR Resources Ltd | 0.002 | 33% | 1,354,169 | $4,951,252 |

| AXN | Alliance Nickel Ltd | 0.049 | 32% | 824,171 | $26,856,066 |

| QEM | QEM Limited | 0.047 | 31% | 752,079 | $6,870,013 |

| CDT | Castle Minerals | 0.003 | 25% | 2,166,681 | $3,345,628 |

| ERA | Energy Resources | 0.003 | 25% | 2,556,401 | $44,296,598 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 806,000 | $12,314,111 |

| POS | Poseidon Nick Ltd | 0.005 | 25% | 1,001,832 | $16,815,502 |

| WML | Woomera Mining Ltd | 0.003 | 25% | 4,371,529 | $4,333,180 |

| AIV | Activex Limited | 0.016 | 23% | 275,086 | $2,801,534 |

InFocus Group (ASX:IFG), a retail intelligence tech company, has secured a US$2.5 million contract with GBO Assets to develop a new digital social gaming platform, VigoBet Tech. The project will be completed over 24 months, with $1.1 million expected in revenue within the first three months. CEO Ken Tovich sees this as a major step into new markets.

Petratherm (ASX:PTR) held its AGM today as chairman Derek Carter highlighted the company’s exciting copper/gold projects at Woomera and Mabel Creek, where drill-ready targets for Tier 1 IOCG deposits have been identified. At Muckanippie, the team discovered high-grade titanium mineralisation, with 28% of surface samples showing over 30% TiO2. Initial results have exceeded expectations, leading to a successful capital raise and a 100-hole drilling program.

Energy Resources of Australia (ASX:ERA) said Rio Tinto (ASX:RIO) has taken up its full entitlement in ERA’s rights issue, increasing its ownership to over 98%. The $766.5 million raised will fund the rehabilitation of the Ranger Project Area in the NT. Rio intends to compulsorily acquire the remaining ERA shares at $0.002 each, in line with its earlier plans.

Encounter Resources (ASX:ENR) said the first RC drilling results at Green have confirmed high-grade niobium mineralisation, extending from the nearby Luni discovery. Key intercepts include 116m at 1.7% Nb2O5 and 81m at 1.5% Nb2O5. These results, along with previous aircore drilling, show significant niobium potential over a large area, the company said.

Miramar Resources (ASX:M2R) has extended the strike length of copper, lead, silver and gold mineralisation at the Joy Helen prospect within the Chain Pool project in WA. Recent rock chip sampling has confirmed high-grade mineralisation over 400m, with potential for a 1km strike. Also, copper sulphide mineralisation has been found in dolerite dykes of the Mundine Well Suite.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VML | Vital Metals Limited | 0.002 | -33% | 1,815,257 | $17,685,201 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 78,383,342 | $57,867,624 |

| POD | Podium Minerals | 0.031 | -21% | 5,254,396 | $17,735,124 |

| ADX | ADX Energy Ltd | 0.048 | -20% | 13,137,386 | $34,370,955 |

| NXD | Nexted Group Limited | 0.125 | -19% | 103,270 | $34,335,100 |

| EE1 | Earths Energy Ltd | 0.014 | -18% | 48,896 | $9,009,392 |

| AON | Apollo Minerals Ltd | 0.015 | -17% | 3,968,281 | $12,534,172 |

| WC1 | Westcobarmetals | 0.015 | -17% | 336,955 | $2,745,006 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 300,000 | $9,399,133 |

| PUR | Pursuit Minerals | 0.003 | -17% | 206,000 | $10,906,200 |

| BUY | Bounty Oil & Gas NL | 0.004 | -17% | 200,000 | $7,192,805 |

| OD6 | Od6Metalsltd | 0.038 | -16% | 355,607 | $5,791,058 |

| AHX | Apiam Animal Health | 0.390 | -15% | 539,143 | $83,960,022 |

| IG6 | Internationalgraphit | 0.056 | -15% | 157,485 | $12,774,850 |

| KP2 | Kore Potash PLC | 0.058 | -15% | 905,377 | $46,378,581 |

| TEG | Triangle Energy Ltd | 0.006 | -14% | 99,780 | $14,624,638 |

| FSG | Field Solu Hldgs Ltd | 0.025 | -14% | 102 | $22,429,892 |

| XGL | Xamble Group Limited | 0.019 | -14% | 5,302 | $6,515,456 |

| CAZ | Cazaly Resources | 0.013 | -13% | 744,850 | $6,919,545 |

| 1TT | Thrive Tribe Tech | 0.004 | -13% | 3,464,241 | $2,813,446 |

| AYT | Austin Metals Ltd | 0.004 | -13% | 35,000 | $5,296,765 |

| GTR | Gti Energy Ltd | 0.004 | -13% | 2,948 | $11,851,799 |

| IMU | Imugene Limited | 0.035 | -13% | 40,096,317 | $297,532,426 |

| LPM | Lithium Plus | 0.105 | -13% | 237,044 | $15,940,800 |

| AX1 | Accent Group Ltd | 2.220 | -12% | 3,190,472 | $1,431,977,417 |

IN CASE YOU MISSED IT

Bevis Yeo and Jessica Cummins reported that:

Burrendong Minerals, which has the right to earn an interest in Impact Minerals’ (ASX:IPT) highly prospective Commonwealth project in the highly prolific Lachlan Fold Belt in NSW, has made its IPO prospectus available.

IPT’s shareholders have a priority entitlement of $2 million in the IPO, which seeks to raise $5m at 20c per share with a free attaching option exercisable at 25 cents within 36 months of listing for every two shares subscribed. Should Burrendong list on the ASX, IPT will retain a 49% interest in the Commonwealth project, receive a $275,000 cash payment, and be the largest shareholder in the new company with a 12.5% interest.

Managing director Dr Mike Jones, who will sit on Burrendong’s board, said the IPO was an opportunity to participate in one of Australia’s most prolific mineral belts – the Lachlan copper-gold belt.

“Once listed, Burrendong will take control of our exceptional Commonwealth gold-silver-copper project, which has been on hold due to our focus on the Lake Hope high purity alumina project,” he added.

Omega Oil and Gas (ASX:OMA) has appointed Milton Cooper, an energy professional with more than 30 years’ experience, to the role of chief commercial officer effective from February 2025. Milton will be responsible for commercial, finance, business development, investor relations, government relations and other corporate functions.

He joins OMA from Galilee Energy (ASX:GLL) where he has held the roles of chief financial officer and chief commercial officer since 2018.

“Milton’s deep industry experience and strong strategic management capabilities will greatly assist us in achieving our near term objectives and delivering our longer-term growth strategy,” OMA managing director Trevor Brown said.

At Stockhead, we tell it like it is. While Impact Minerals and Omega Oil and Gas are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should really consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.