ASX Lunch Wrap: ASX closes on record high and BTC surges despite Wall Street lead

ASX up and BTC surges on Thursday morning. Pic: Getty Images

- ASX nears record high despite weak Wall Street session

- Bitcoin rebounds above US$96k

- Home builder AV Jennings stuns with private equity takeover bid

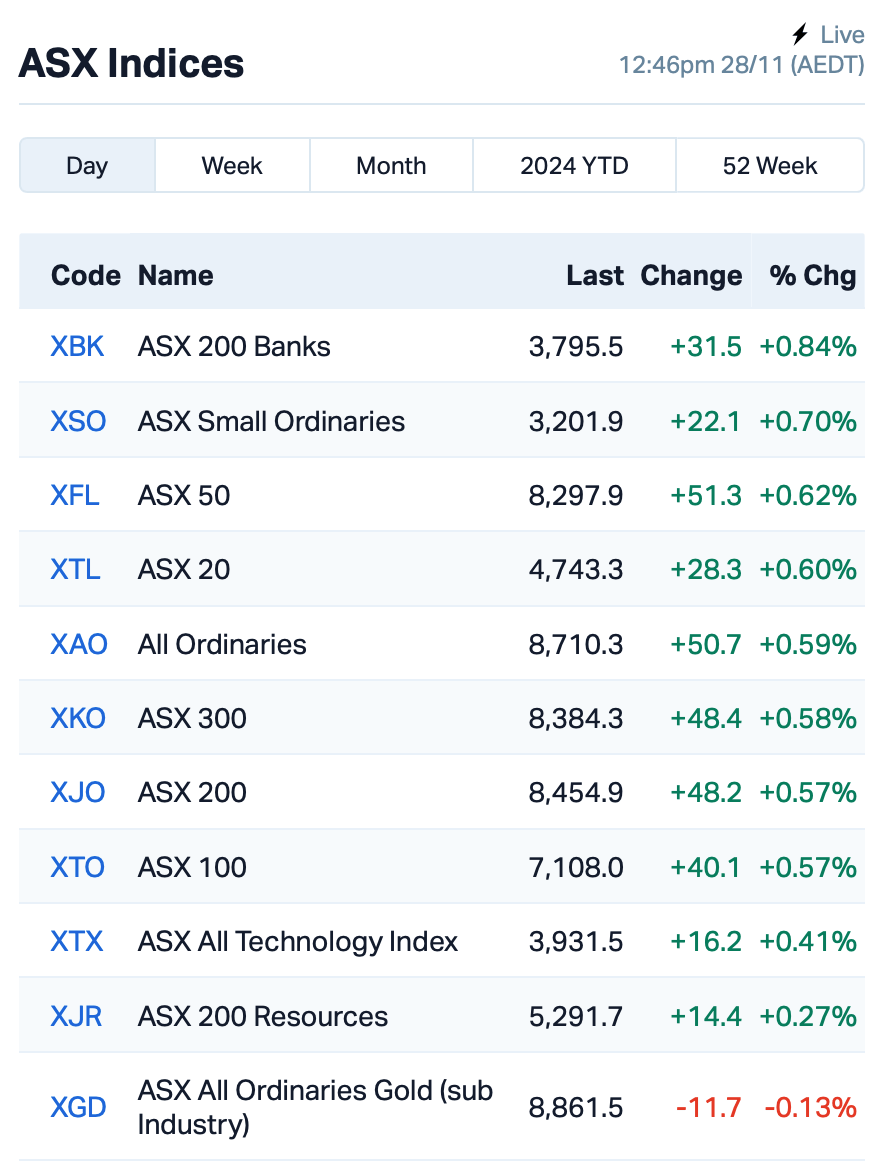

The ASX is on the verge of a new record this morning, with the benchmark S&P/ASX 200 Index climbing by 0.5% to within striking distance.

The surge comes despite a weak session on Wall Street, where major indices Dow Jones, S&P 500, and Nasdaq all fell overnight.

Investor sentiment in the US was dampened by disappointing earnings from tech giants Dell and HP, which saw their stocks tumble by around 12% each.

On top of that, US inflation data came in hotter than expected, sparking fears the Fed Reserve may reverse course and raise interest rates.

Meanwhile, Bitcoin has recovered from yesterday’s dip, jumping back above US$96,000.

On the ASX, here’s what’s happening at around 12:45pm AEST:

Iron ore-related stocks climbed as iron ore futures rose by over 1% in Singapore, driven by improving conditions in China’s steel sector.

A key announcement from the large-cap space today came from insurance giant Insurance Australia (ASX:IAG), which revealed it’s acquiring RACQ’s insurance underwriting business in a deal worth $855 million. IAG’s shares rose by 3%.

Webjet Group (ASX:WJL) said the Australian Competition and Consumer Commission (ACCC) is taking the c0mpany to court. The ACCC alleges that Webjet misled customers by advertising flight prices without including mandatory fees. Shares were down 4%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 28 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | 100% | 423,000 | $703,362 |

| AVJ | AVJennings Limited | 0.625 | 89% | 5,417,983 | $184,229,383 |

| DDT | DataDot Technology | 0.006 | 50% | 7,071,448 | $4,843,811 |

| NTM | Nt Minerals Limited | 0.003 | 50% | 100,000 | $2,421,806 |

| LPD | Lepidico Ltd | 0.002 | 33% | 612,089 | $12,883,778 |

| SP8 | Streamplay Studio | 0.013 | 30% | 26,294,655 | $11,506,238 |

| DM1 | Desert Metals | 0.023 | 28% | 287,655 | $4,777,662 |

| ARV | Artemis Resources | 0.010 | 25% | 2,562,533 | $15,335,059 |

| AUK | Aumake Limited | 0.005 | 25% | 241,848 | $11,812,964 |

| EPM | Eclipse Metals | 0.005 | 25% | 500,000 | $9,111,422 |

| FGH | Foresta Group | 0.010 | 25% | 4,858,773 | $18,843,032 |

| GGE | Grand Gulf Energy | 0.003 | 25% | 119,999 | $4,900,774 |

| TMK | TMK Energy Limited | 0.003 | 25% | 7,404,555 | $18,651,130 |

| VML | Vital Metals Limited | 0.003 | 25% | 170,368 | $11,790,134 |

| EPY | Earlypay Ltd | 0.200 | 21% | 540,927 | $44,914,500 |

| EXL | Elixinol Wellness | 0.006 | 20% | 4,000,000 | $8,767,023 |

| RDS | Redstone Resources | 0.003 | 20% | 2,435,981 | $2,313,446 |

| HAS | Hastings Tech Met | 0.335 | 20% | 1,048,230 | $50,631,318 |

| SRR | Saramaresourcesltd | 0.033 | 18% | 25,000 | $4,745,641 |

| IMR | Imricor Med Sys | 1.260 | 18% | 333,935 | $289,088,070 |

| WA8 | Warriedarresourltd | 0.060 | 18% | 8,453,413 | $39,015,782 |

| NMG | New Murchison Gold | 0.011 | 17% | 12,591,091 | $66,482,576 |

| ATH | Alterity Therap Ltd | 0.004 | 17% | 5,339,037 | $15,961,008 |

| AVE | Avecho Biotech Ltd | 0.004 | 17% | 2,751,754 | $9,507,891 |

AV Jennings (ASX:AVJ) the residential property developer, has received an unsolicited proposal from Proprium Capital Partners and AVID Property Group to acquire all its outstanding shares for $0.67 per share in cash. This offer represents a premium of over 100% compared to AVJennings’ last share price.

NT Minerals (ASX:NTM) has entered into an exclusive exploration agreement with Mine Operations for the Mummaloo Project, located 300 km southeast of Geraldton, WA. The agreement grants NTM the exclusive right to explore the project for an initial 12-month term, with an option to extend for another 12 months. NTM also has the first right of refusal to acquire the project.

Desert Metals (ASX:DM1) has identified a gold anomaly at its King Kong prospect in Côte d’Ivoire, with soil sampling, grab sampling, and geophysics revealing a 2.4km-long gold zone. Peak gold values from soil samples include 3.55g/t, while grab samples from artisanal pits returned up to 8.40g/t. The company has completed eight diamond drill holes, with results expected by December.

Artemis Resources (ASX:ARV) has reported high-grade gold and copper results from rock chip sampling at the Thorpe Prospect, part of its Carlow tenement in WA. Samples returned up to 45.8 g/t gold and 10.3% copper, with significant silver values also detected. The mineralisation is linked to veins along two key structures, each with a 500m strike length.

Earlypay (ASX:EPY) said it expects to achieve FY25 underlying earnings per share (EPS) of 2.2 cents, a 28% increase from FY24. Earnings are expected to be weighted towards the second half of FY25, with a target dividend payout ratio of at least 60%.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 28 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTB | Mount Burgess Mining | 0.001 | -33% | 500,000 | $1,947,220 |

| NES | Nelson Resources. | 0.002 | -33% | 7,142 | $2,115,783 |

| AS2 | Askarimetalslimited | 0.012 | -29% | 978,115 | $2,149,015 |

| AMD | Arrow Minerals | 0.002 | -25% | 3,242,971 | $26,447,256 |

| BNL | Blue Star Helium Ltd | 0.004 | -20% | 234,373 | $13,474,426 |

| HUM | Humm Group Limited | 0.620 | -20% | 3,485,372 | $381,114,661 |

| IXU | Ixup Limited | 0.011 | -19% | 280,589 | $21,722,817 |

| AIV | Activex Limited | 0.009 | -18% | 500,000 | $2,370,528 |

| IFG | Infocusgroup Hldltd | 0.035 | -17% | 20,187,887 | $6,075,693 |

| NIS | Nickelsearch | 0.010 | -17% | 5,093,517 | $6,113,771 |

| DTR | Dateline Resources | 0.003 | -14% | 20,000 | $8,806,912 |

| GLL | Galilee Energy Ltd | 0.012 | -14% | 3,019,990 | $7,800,700 |

| MEG | Megado Minerals Ltd | 0.012 | -14% | 837,137 | $4,094,378 |

| RFA | Rare Foods Australia | 0.024 | -14% | 23,546 | $7,615,531 |

| PAR | Paradigm Bio. | 0.495 | -14% | 4,182,694 | $200,848,663 |

| VNL | Vinyl Group Ltd | 0.100 | -13% | 556,942 | $134,528,412 |

| CAV | Carnavale Resources | 0.004 | -13% | 390,000 | $16,360,874 |

| MKG | Mako Gold | 0.014 | -13% | 180,660 | $15,785,905 |

| TON | Triton Min Ltd | 0.007 | -13% | 1,841,325 | $12,547,110 |

| AKO | Akora Resources | 0.105 | -13% | 20,000 | $15,012,331 |

| SFX | Sheffield Res Ltd | 0.140 | -13% | 215,149 | $63,168,792 |

| 3PL | 3P Learning Ltd | 0.750 | -12% | 794 | $231,970,544 |

| KAI | Kairos Minerals Ltd | 0.015 | -12% | 494,882 | $44,725,507 |

| NSM | Northstaw | 0.015 | -12% | 75,917 | $4,635,501 |

IN CASE YOU MISSED IT

Far East Gold (ASX:FEG) has been given the greenlight from the Foreign Investment Review Board for the second and third tranches of funding under a strategic investment agreement with Xingye Gold.

FEG CEO Shane Menere says this marks another significant milestone for the company this year, partnering with a major Chinese mining company to advance its portfolio of world-class assets and provide a clear pathway toward project development in 2025.

Imricor Medical Systems (ASX:IMR) has inked a license agreement with ADIS, a Swiss-based software company, to integrate AI modules into its NorthStar 3D mapping system.

The agreement sets up terms for upfront license payments and ongoing fees. While the company is still working through regulatory processes, Imricor plans to commercially roll out the NorthStar system and its AI modules across Europe, the USA, and the Middle East in 2025.

At Stockhead, we tell it like it is. While Far East Gold and Imircor Medical Systems are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.