ASX Lunch Wrap: ASX closes in on 8,500; Livehire and Selfwealth targeted in takeover bids

ASX touches new high, with the ASX 200 eyeing 8,500 mark. Picture Getty

- ASX touches new high, with the ASX 200 eyeing 8,500 mark

- Oil prices surge as Ukraine-Russia conflict intensifies

- SG Fleet shares soar on takeover bid

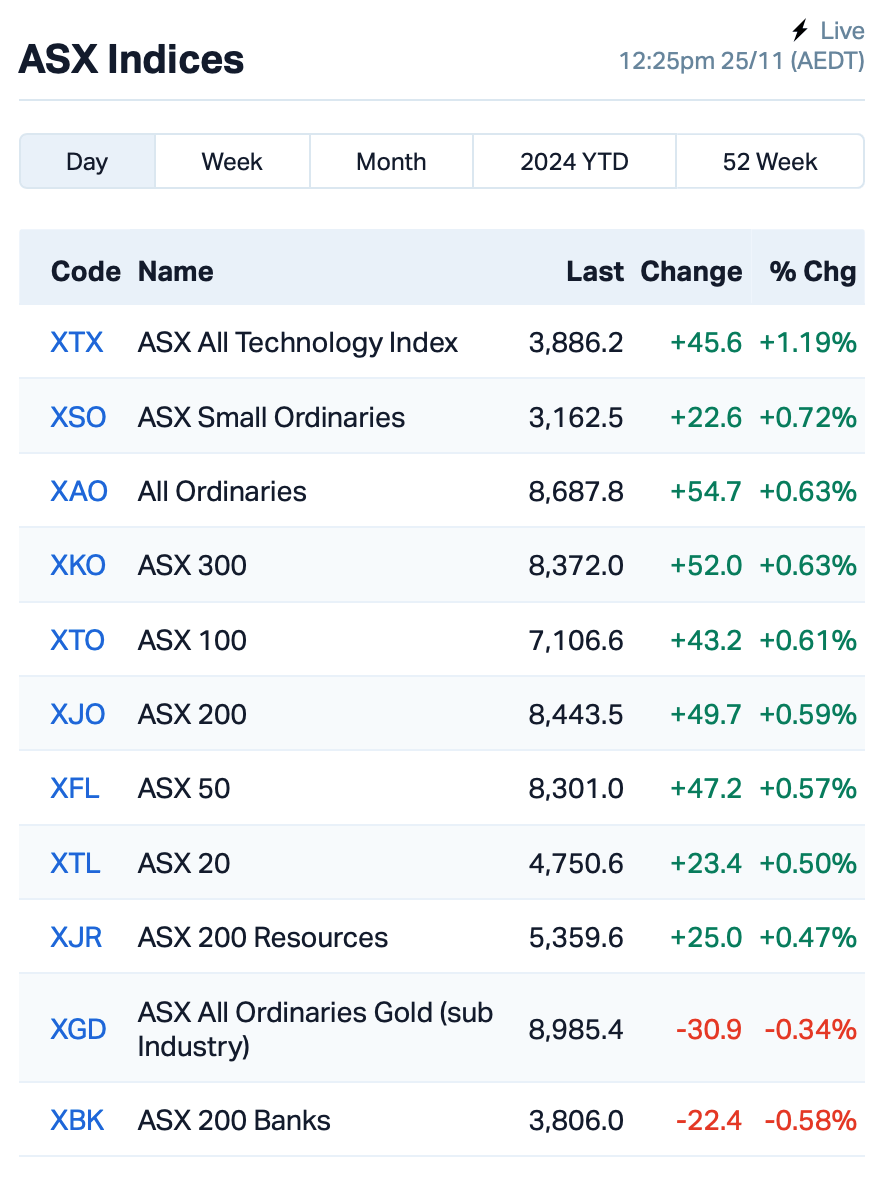

The ASX kicked off the week on a high note, with the benchmark ASX 200 index reaching a fresh record, rising 0.66% and eyeing the 8,500 mark.

Local traders took their cue from Wall Street, where the Dow Jones hit a record high and both the S&P 500 and Nasdaq posted strong gains on Friday.

The US small caps gauge, the Russell 2000, also outperformed with a 4% rise.

“This suggests investors are feeling bullish, aggressive and ready to take on risk,” said moomoo Australia’s Jessica Amir.

Nvidia’s stock, however, dipped 3%, as investor enthusiasm for AI stocks seemed to cool; while Bitcoin rose to near US$100,000. It’s cooled a tad at time of writing, trading at about US$97,400.

On the ASX today, Real Estate and Discretionary gained the most.

In the large caps space, Air New Zealand (ASX:AIZ) is starting to turn things around after a tough year so far, with the airline forecasting positive first-half earnings. The airline said it expects to make between NZ$120 million and NZ$160 million. Shares rose 1.5%.

And car-leasing giant SG Fleet (ASX:SGF) saw its stock soar by 22% after a takeover bid at $3.50 per share from Pacific Equity Partners.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for November 25 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap LVH Livehire Limited 0.046 69% 24,989,996 $12,425,832 SP8 Streamplay Studio 0.017 55% 46,558,466 $12,656,861 MTL Mantle Minerals Ltd 0.002 50% 1,181,906 $6,197,446 ERW Errawarra Resources 0.091 49% 1,298,562 $5,851,161 CRB Carbine Resources 0.004 33% 220,000 $1,655,213 EDE Eden Inv Ltd 0.002 33% 56,592 $6,162,314 GMN Gold Mountain Ltd 0.002 33% 2,000 $5,861,210 JBY James Bay Minerals 0.765 28% 864,250 $20,515,500 CYQ Cycliq Group Ltd 0.005 25% 11,800 $1,782,067 TMK TMK Energy Limited 0.003 25% 1,862,188 $18,651,130 TSL Titanium Sands Ltd 0.005 25% 103,200 $8,846,989 PAR Paradigm Bio. 0.400 23% 3,236,312 $113,523,157 SGF SG Fleet Group Ltd 3.250 22% 1,264,697 $913,099,736 ADG Adelong Gold Limited 0.006 20% 9,100,000 $5,589,945 ALM Alma Metals Ltd 0.006 20% 171,581 $7,832,611 AUK Aumake Limited 0.006 20% 144,089 $14,066,205 ERL Empire Resources 0.003 20% 149,068 $3,709,783 SBR Sabre Resources 0.012 20% 719,508 $3,929,619 NVX Novonix Limited 0.875 18% 6,747,071 $365,385,595 AKG Academies Aus Grp 0.130 18% 101 $14,587,591 ION Iondrive Limited 0.013 18% 635,066 $7,793,583 BTR Brightstar Resources 0.027 17% 34,600,112 $164,052,676 VEE Veem Ltd 1.300 17% 140,296 $150,704,092 MBK Metal Bank Ltd 0.021 17% 180,197 $7,028,267 ASR Asra Minerals Ltd 0.004 17% 1,296,062 $6,756,339

Livehire (ASX:LVH), a recruitment tech company, jumped after Humanforce Holdings, an Accel-KKR portfolio firm, made an all-cash, unconditional takeover bid for LiveHire at $0.045 per share. Humanforce already owns 87.76% of LiveHire. Independent Director Andrew Rutherford has recommended that shareholders accept the offer.

Selfwealth (ASX:SWF) also jumped after Bell Financial sweetened its takeover offer to 25 cents per share. Bell had received a competing offer from AxiCorp Financial Services, which made a non-binding bid of 23 cents per share.

Streamplay Studio (ASX:SP8) has agreed to acquire Noodlecake Studios, a profitable Canadian indie gaming company known for its 60+ games and 270 million downloads. The deal expands Streamplay’s reach in North America and strengthens its global gaming presence. Noodlecake’s successful monetisation strategies have generated more than $42 million.

Mantle Minerals (ASX:MTL) has confirmed gold mineralisation at Mount Berghaus following its first reverse circulation drilling program. The best intersections include 5m at 1.1g/t Au and 32m at 0.16g/t Au. The company said the new drilling suggests potential for commercial-grade gold mineralisation within Hemi-style igneous rocks.

Novonix (ASX:NVX) has signed a binding offtake agreement with PowerCo SE for a minimum of 32,000 tonnes of high-performance synthetic graphite material, to be supplied from 2027 to 2031. Novonix is currently developing its Riverside facility in North America, which will begin commercial production in 2025 and expand to meet customer demand.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for November 25 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap EM2 Eagle Mountain 0.022 -44% 11,150,717 $15,322,122 YRL Yandal Resources 0.225 -40% 5,292,583 $112,538,864 AXP AXP Energy Ltd 0.001 -33% 1,371,126 $8,737,021 ERA Energy Resources 0.002 -33% 3,150,093 $1,216,188,722 RIE Riedel Resources Ltd 0.001 -33% 660,000 $3,335,753 VML Vital Metals Limited 0.002 -33% 624,807 $17,685,201 VPR Voltgroupltd 0.001 -33% 259,814 $16,074,312 PPY Papyrus Australia 0.009 -31% 314,757 $6,766,115 IFG Infocusgroup Hldltd 0.034 -26% 13,420,208 $5,003,697 ECT Env Clean Tech Ltd. 0.002 -25% 1,248,963 $6,343,621 LNU Linius Tech Limited 0.002 -25% 1,203,047 $12,302,431 NRZ Neurizer Ltd 0.002 -25% 63,612,074 $4,362,239 VRC Volt Resources Ltd 0.003 -25% 1,580,457 $16,634,713 YAR Yari Minerals Ltd 0.003 -25% 4,987 $1,929,431 BNL Blue Star Helium Ltd 0.004 -20% 1,086,534 $13,474,426 CDT Castle Minerals 0.002 -20% 2,322 $4,182,035 EFEDA Eastern Resources 0.032 -20% 27,504 $4,967,786 WML Woomera Mining Ltd 0.002 -20% 3,393,203 $5,416,475 FGR First Graphene Ltd 0.026 -19% 830,685 $21,439,664 VKA Viking Mines Ltd 0.009 -18% 7,851,350 $11,688,509 SW1 Swift Networks Group 0.010 -17% 468,099 $7,848,258 RHY Rhythm Biosciences 0.110 -15% 375,829 $32,317,578 EPX Ept Global Limited 0.018 -14% 16,000 $12,730,368 CRR Critical Resources 0.006 -14% 12,660,795 $17,023,742

IN CASE YOU MISSED IT

Aspiring near-term graphite producer Green Critical Minerals (ASX:GCM) has fulfilled the Stage 3 earn-in requirements to hold an 80% interest in the WA-based McIntosh graphite project, having spent over $4 million on exploration and development across the past two years.

GCM and Hexagon Energy Materials (ASX:HXG) are now working to set up a joint venture for the exploration and evaluation of graphite within the project area.

American West Metals (ASX:AW1) has wrapped up a broad spectrum, regional exploration program across its Storm copper project on Somerset Island in Nunavut, Canada.

Numerous new copper targets were defined across the 110km-long copper belt, highlighting the large-scale regional exploration potential. The prospects: Seabreeze, Hailstorm, Tornado and Tempest.

Up next? The company says it will focus on testing areas where the mineralisation has been focussed, and where deposits may have formed, with plenty of news flow to come as it works to complete a resource upgrade and development study.

With its sights set on a resource update early next year, Besra Gold (ASX:BEZ) has kicked off a drilling program comprising deep diamond drillholes.

Newly appointed North Barneo Gold managing director Matthew Antill led a review of the Jugan project, coming up with a new mining strategy that incorporates a smaller open pit at Jugan, followed up by up to a 400-metre-deep underground development using modern mining techniques.

The company believes advantages of this, compared to the 2013 feasibility study, are:

- smaller area of surface disturbance required for open pit mine area, waste dumping area and tailings storage facility area;

- much lower volume of tailings storage required with tailings utilised in cemented stope fill underground;

- lower impact on local community landowners;

- reduced environmental impact; and

- less land acquisition required to execute the mining activities.

At Stockhead, we tell it like it is. While Green Critical Minerals, American West Metals, and Besra Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.