ASX Large Caps: Weebit Nano and Collins Foods stumble as more rate-hiking pain looms

Getty Images

- S&P ASX 200 dips 0.022%, closing today’s overall proceedings in the red.

- ABS retail sales figures and job vacancies data point to more RBA rate hiking.

- Weebit down 12% amid a string of mixed but not overly negative announcements.

It’s been another frantically, all-over-the-shop busy arvo here on the Stockhead ASX 200 round-up desk. Which is a pretty tightly crammed desk at that, what with Gregor’s near-empty packet of Iced Vo-Vos, coffee cups and leaky plastic bag of not-sure-what-but-we’re-not-going-anywhere-near-it taking up some of the space.

But it’s a confluence of complementary bits and pieces of info and a privilege to see its gears grinding up close and personal. Keep an “Eye On Lithium” and then read Closing Bell, Monsters of Rock and more. And in case you (or the rest of us) missed anything of major significance: Emma’s In Case You Missed It is a quick must-read.

But onto some of the main bits and pieces of news to round up this piece, then drilling into what’s doing in the larger end of Market Cap Town…

Retail sales figs jump, RBA puts on its hiking boots

Perhaps the biggest broad headline of the day was the fact the May retail sales figures came in from the Australian Bureau of Statistics, and they’ve jumped quite a bit more than widely expected. To the tune of 0.7 per cent versus the anticipated 0.1 per cent.

“Retail turnover was supported by a rise in spending on food and eating out, combined with a boost in spending on discretionary goods,” ABS head of retail statistics, Ben Dorber, said.

“This latest rise reflected some resilience in spending with consumers taking advantage of larger than usual promotional activity and sales events for May.”

What does this mean for markets, then?

Well, Goldman Sachs Australia chief Andrew Boak reckons it gives the RBA just enough ammo to load in three more rate-hike cannisters this year. Tops, eh?

As The Australian‘s David Rogers reports, “retail sales excluding food rose 0.9 per cent on-month, driven by a rebound in hospitality and other retailing sales, and households goods sales rose per cent on-month after three consecutive monthly declines.

“The latter gives ‘tentative evidence that the recent rebound in house prices is starting to support spending’, according to Mr Boak.”

Aust May retail sales +0.7%/4.2%yoy, stronger than exp & may have been boosted by earlier than normal end of fin yr discounting.Retail sales have stalled since Nov & r falling in real terms but their relative resilience may embolden the RBA in terms of more rate hikes

ABS charts pic.twitter.com/Rif7YwCREk— Shane Oliver (@ShaneOliverAMP) June 29, 2023

Oh yeah – job vacancies data came in, too

The ABS also revealed today that job vacancies in Australia fell in the three months to May, making it the fourth straight quarter of decline for that particular stat/metric.

Job vacancies in the May quarter dropped by 2% from the previous quarter, to 431,600.

Upshot? Demand for labour is still high, and a strong labour market also contributes to the likelihood of further RBA rate hiking, when it makes up its mind on exactly that again next week.

And just quickly, in overseas markets?

Gregor covered most of this energetically earlier in the day, but here’s a recap:

“Wall Street couldn’t get its story straight last night, barfing out a mixed bag of results despite our local markets showing them how it’s done during yesterday’s session.

“The lacklustre display by investors in New York left the Dow lower by 0.22%, the S&P flat and the Nasdaq slightly higher on +0.27%, according to some loud-mouth know-it-all who looked those numbers up this morning.”

In further US stonks news, EV maker Lucid Motors led the table on a 5.2% gain off the back of its recent deal with Aston Martin to provide EV batteries and drivetrain tech.

Meanwhile, despite what you might think of its new, ridonculously overpriced metaversey, mixed martial reality headset, Apple is once again very close to becoming a US$3 trillion company.

Aping further off Gregor’s earlier good work today… “In Japan, the Nikkei is up a surprisingly high [updated and amended] 0.47%, as the nation deals with the shame of making a major faux pas at a G7 conference in the Japanese city of Nikko on the weekend.”

You’ll need to read his Lunch Wrap for the full details there.

Elsewhere in Asia, at the time of writing: Hong Kong’s Hang Seng Index was down -1.32%, while in China, the Shanghai was also drooping into the CCP red, but not by much: -0.06%.

Also, Fed boss Jerome Powell was at a European banking conference and was, according to some observers, in a slightly unconvincingly hawkish mood.

“We started at negative real interest rates,” said JPow, adding: “We’ve since moved up to where we are actually in restrictive territory, but we haven’t been there very long, so we believe there’s more restriction coming.”

Fighting inflation with easing financial conditions:

Stock Bulls Are Now Free to Fight the Federal Reserve

“Chair Jerome Powell had the opportunity to put the market in its place. His demurral may just signal an all-clear for equities.”

— Sven Henrich (@NorthmanTrader) June 28, 2023

More importantly, how did the ASX close?

After a pretty decent start to the day, The S&P ASX 200 fizzled out, closing down to the tune of 0.022% to finish on 7,193.90 points.

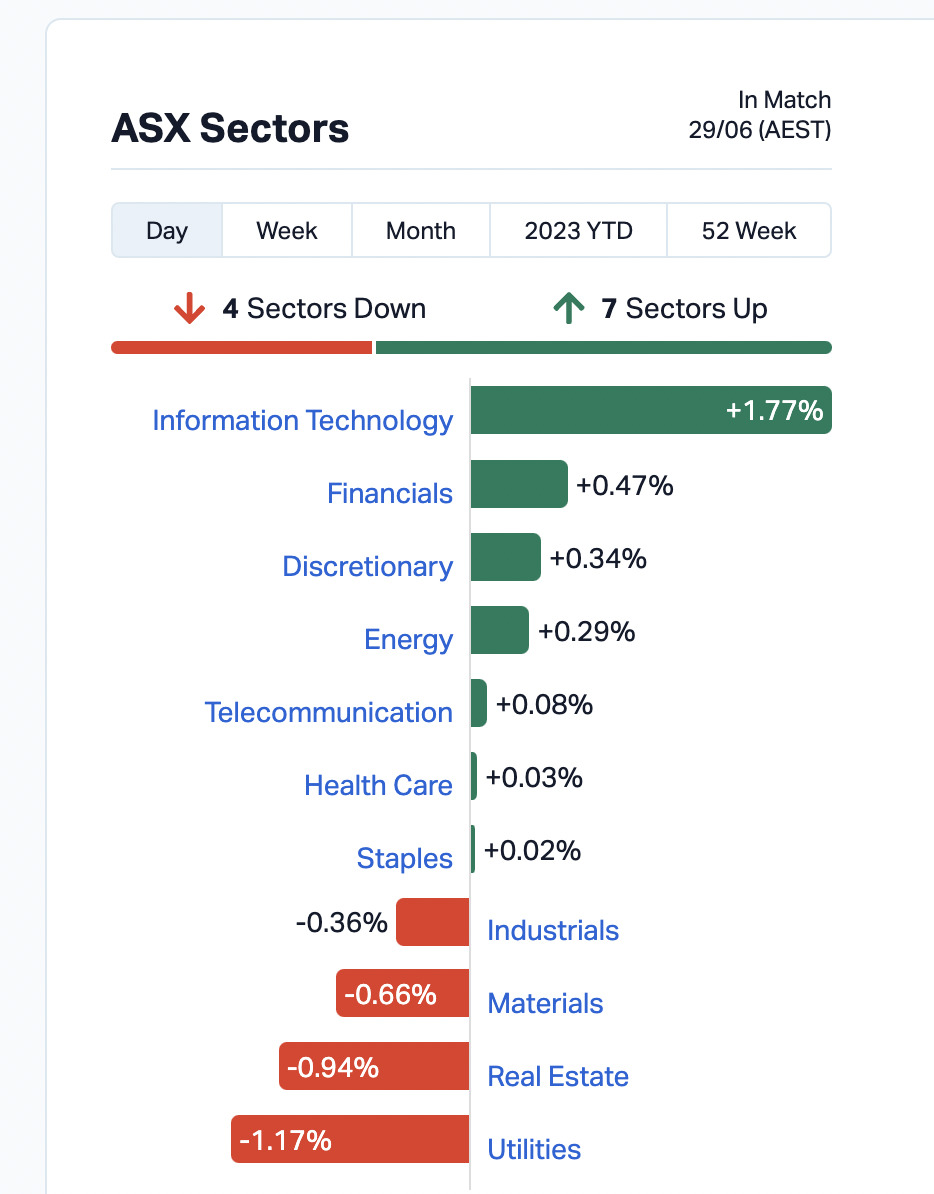

Seven of the 11 sectors were in the green today with IT leading the way by some considerable margin (+1.77%). Utilities, meanwhile, had a bit of a shocker. Details below…

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| DHG | Domain Holdings Aus | 3.645 | 3% | 567,924 | $2,229,749,750 |

|---|---|---|---|---|---|

| PDN | Paladin Energy Ltd | 0.7325 | 5% | 15,170,789 | $2,086,102,513 |

| LOV | Lovisa Holdings Ltd | 19.61 | 3% | 456,793 | $2,052,040,353 |

| SNZ | Summerset Grp Holdings | 8.9 | 3% | 128 | $2,015,215,369 |

| SYA | Sayona Mining Ltd | 0.175 | 3% | 13,565,829 | $1,706,653,464 |

| MFG | Magellan Fin Grp Ltd | 9.48 | 3% | 735,163 | $1,672,802,109 |

| WAM | WAM Capital Limited | 1.49 | 5% | 1,822,275 | $1,562,857,358 |

| PNV | Polynovo Limited | 1.5525 | 3% | 1,956,607 | $1,042,251,454 |

| MAD | Mader Group Limited | 5.35 | 3% | 138,615 | $1,040,000,000 |

Standouts:

• WAM Capital (ASX:WAM) : +5% on no fresh announcements.

• Lovisa Holdings (ASX:LOV) +3% on no fresh announcements.

And in the leading sector, IT:

• WiseTech Global (ASX:WTC): +2.25% on no fresh news, although standby, as our very own Nadine McGrath is working on a related story… She tells me: “The Founder and CEO of Wisetech Richard White last week became a substantial shareholder of music credits database and technology company Jaxsta (ASX:JXT) and today it’s announced a new CEO, who Richard has endorsed.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % change | Volume | Market cap |

|---|---|---|---|---|---|

| WBT | Weebit Nano Ltd | 5.01 | -12% | 4,080,854 | $1,068,524,502.30 |

| LFG | Liberty Financial Group | 3.76 | -7% | 15,746 | $1,233,443,724.38 |

| CKF | Collins Foods Ltd | 9.55 | -4% | 422,084 | $1,166,186,365.68 |

| CQR | Charter Hall Retail | 3.55 | -4% | 687,856 | $2,144,737,257.21 |

| SGP | Stockland | 4 | -3% | 3,793,392 | $9,859,018,964.06 |

| GOZ | Growthpoint Property | 2.77 | -3% | 519,852 | $2,155,142,343.64 |

| RGN | Region Group | 2.27 | -3% | 2,277,563 | $2,688,411,938.94 |

| APA | APA Group | 9.725 | -3% | 1,618,455 | $11,822,536,356.96 |

| CLW | Chtr H Lwr | 3.99 | -3% | 972,294 | $2,971,346,965.26 |

| GPT | GPT Group | 4.13 | -3% | 2,380,301 | $8,141,204,077.50 |

| MGR | Mirvac Group | 2.25 | -3% | 6,721,557 | $9,114,937,101.27 |

| BWP | BWP Trust | 3.595 | -3% | 463,778 | $2,370,396,233.07 |

| BOE | Boss Energy Ltd | 3.08 | -3% | 1,001,460 | $1,114,149,203.92 |

| NIC | Nickel Industries | 0.8725 | -3% | 4,376,180 | $2,706,710,259.34 |

| GOR | Gold Road Res Ltd | 1.5075 | -2% | 3,051,528 | $1,666,161,049.10 |

| TCL | Transurban Group | 14.15 | -2% | 2,147,584 | $44,667,936,575.00 |

| NSR | National Storage | 2.345 | -2% | 2,095,629 | $3,236,118,220.80 |

A bit like the English sporting press after the first Ashes Test, it seems there’s more to talk about on the losing side of the ledger.

Plenty of large caps in the red today, but Weebit Nano is a particular standout:

• Weebit Nano (ASX:WBT): -12% on various announcements that investors, for reasons that aren’t immediately clear, aren’t gelling with today. There’s been an appointment of a new non-executive director – Mark Licciardo; a reinstatement to quotation following suspension of trading; an announcement that Weebit Nano’s ReRAM IP is now fully qualified in SkyWater Technology’s S130 process; and a response to the ASX regarding the resignation of Fred Bart as a director of the company.

Only the latter seems to carry any hint of negativity as far as we can tell, but “WBT does not consider Mr Bart’s resignation price sensitive”.

• Collins Foods (ASX:CKF): -4% on no fresh news.

• Liberty Financial Group (ASX:LFG) : -7% after going ex-div today.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.