ASX Large Caps: Shares higher as RBA turns hawkish; Fortescue up after announcing green projects

Lithium miners, Star Casino and Fortescue rose. Picture Getty

- ASX up 0.3% as traders parsed through comments by RBA’s Michelle Bullock

- Lithium miners, Star Casino and Fortescue rose

- Large cap losers were Origin Energy and Brickworks

The ASX gained 0.3% on Tuesday, tracking overnight movements in New York where the Nasdaq index hit a 22-month high.

This morning, local traders had to parse through comments from RBA governor Michelle Bullock, Speaking at the ASIC Annual Forum in Melbourne, Bullock said the RBA is ready to hike again if wage rises are not accompanied by productivity gains.

Bullock said wage growth is the biggest challenge to the RBA’s goal of returning inflation back to its 2-3% target (currently at 5.4%).

Separately, the RBA minutes for the November’s meeting were released today, revealing that board members raised the cash rate to 4.35% earlier this month because they were concerned businesses were passing higher inflation costs on to Australian consumers.

On the ASX, stocks were mixed as a rally in Mining and Energy stocks were offset by losses in Utilities and Discretionary stocks.

Lithium miners like Allkem (ASX:AKE) and Pilbara Minerals (ASX:PLS) were some of the best performing large caps today.

Tabcorp (ASX:TAH) and Life360 (ASX:360) meanwhile sat high on the losers’ list.

Regionally, Chinese property stocks rose today after Bloomberg reported that Chinese regulators were drafting a list of 50 developers eligible for a range of financing.

Looking ahead to tonight in the US, Fed Reserve policy meeting minutes are due for release, together with October’s US existing home sales.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CTT | Cettire | 3.35 | 7.03 | 1,518,474 | $1,193,275,629 |

| LFG | Liberty Fin Group | 4.07 | 5.17 | 6,917,194 | $1,175,720,989 |

| LTR | Liontown Resources | 1.54 | 5.14 | 9,595,504 | $3,513,356,863 |

| WC8 | Wildcat Resources | 0.89 | 5.03 | 10,201,338 | $1,009,693,001 |

| SFR | Sandfire Resources | 6.28 | 4.84 | 1,540,652 | $2,737,384,500 |

| CKF | Collins Foods Ltd | 10.24 | 4.49 | 203,028 | $1,151,404,636 |

| PXA | Pexagroup | 11.97 | 4.36 | 242,964 | $2,034,211,072 |

| GMD | Genesis Minerals | 1.64 | 4.29 | 1,587,470 | $1,697,045,093 |

| BOE | Boss Energy Ltd | 4.38 | 4.29 | 993,687 | $1,482,320,969 |

| PDN | Paladin Energy Ltd | 1.04 | 4.25 | 14,337,206 | $2,983,375,533 |

| NST | Northern Star | 11.88 | 3.66 | 2,660,151 | $13,170,073,989 |

| MCY | Mercury NZ Limited | 5.66 | 3.66 | 8,295 | $7,596,100,725 |

| TUA | Tuas Limited | 2.38 | 3.48 | 80,161 | $1,069,407,818 |

| AKE | Allkem Limited | 9.27 | 3.29 | 1,713,397 | $5,734,711,998 |

| NEU | Neuren Pharmaceut. | 15.23 | 3.15 | 270,538 | $1,868,109,378 |

| PLS | Pilbara Min Ltd | 3.67 | 3.09 | 16,330,461 | $10,713,687,070 |

| BGL | Bellevue Gold Ltd | 1.51 | 3.08 | 1,448,979 | $1,677,548,126 |

| MAD | Mader Group Limited | 6.54 | 2.99 | 55,328 | $1,270,000,000 |

Star Entertainment Group (ASX:SGR) rose over 1% after the casino group enters a binding lifeline agreement with the NSW government on casino duty rates.

Under the agreement, The Star’s poker machines will now be taxed at 20.91% until June 30, 2024, before rates increase to 22.91% from July 1, 2027 until 2030. Duty rates for table games are set to rise from 17.91% to 20.25% – but that only applies to local, mostly small-time punters who make up the Non-Rebate Play category.

The Rebate Play category – ie, the high value “whales” attracted to the casino with rebate betting schemes in place to off-set losses (and who, historically, enjoyed complimentary accommodation and other perks) will also see an increase in duty, albeit a much smaller one from 10% to 12.5%, while

The new scheme also implements a new duty, “equal to 35% of all Star Sydney gaming revenue above $1.125 billion for each financial year”, while the venue’s Responsible Gaming Levy will remain precisely where it was when all the issues over how the casino was being run kicked off, at 2.0%.

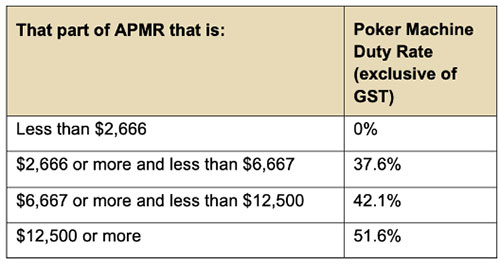

The new arrangements also set out an eye-watering increase in duty for poker machine revenue after 2030, which looks like this:

That represents a solid hike from the current rates, but it does come with an out for future operators of the venue: “The Star may request a good faith review of the Poker Machine Duty Rate and/or the associated thresholds having regard to the trading conditions and EBIT for The Star Sydney in the period 1 July 2023 to 30 June 2030”.

In other words: “Play nice, and you’ll have a chance to negotiate this with whoever’s in charge in Macquarie Street in seven years’ time – but this is what’s ahead if you mess things up again.”

“The formalisation of these arrangements protects our Sydney team’s jobs, and enables us to continue the important ongoing work required to restore The Star Sydney to suitability, and to earn back the trust of our stakeholders,” said Star’s CEO, Robbie Cooke.

Fortescue Metals (ASX:FMG) rose 1.5% after its Board approved a number of green metals and green energy projects across the globe.

Final Investment Decisions (FID) were approved for the Phoenix Hydrogen Hub, USA, the Gladstone PEM50 Project in Queensland, and a Green Iron Trial Commercial Plant in WA.

Other projects selected to be fast tracked by the board were Pecem in Brazil, Project Chui in Kenya and Holmaneset in Norway.

The estimated total investment in the three approved projects is approximately US$750 million over the next three years.

Gold miner Northern Star (ASX:NST) rose 3.5% after the release of an exploration update. NST said that drilling at its lead asset, KCGM, has generated strong results that may provide future potential mill feed sources outside of the current Mineral Resource.

Elsewhere at Kalgoorlie, significant progress at Red Hill, Mt Percy and Hercules may provide meaningful optionality and highlights the potential across the broader region.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HUB | HUB24 Ltd | 32.96 | -3.93 | 144,228 | $2,791,750,422 |

| TAH | TABCORP Holdings Ltd | 0.73 | -3.62 | 2,663,408 | $1,734,632,352 |

| ASK | Abacus Storage King | 1.06 | -3.21 | 291,790 | $1,432,372,229 |

| WPR | Waypoint REIT | 2.29 | -2.97 | 1,121,013 | $1,585,487,051 |

| 360 | Life360 Inc. | 7.69 | -2.90 | 1,141,037 | $1,605,132,746 |

| AD8 | Audinate Group Ltd | 14.68 | -2.59 | 155,972 | $1,252,450,159 |

| LLC | Lendlease Group | 6.58 | -2.52 | 1,000,409 | $4,655,017,667 |

| ELD | Elders Limited | 7.17 | -2.45 | 444,860 | $1,150,102,819 |

| VUK | Virgin Money Uk PLC | 3.06 | -2.40 | 2,233,825 | $2,104,491,576 |

| RGN | Region Group | 2.06 | -2.37 | 2,816,649 | $2,451,392,641 |

| ORG | Origin Energy | 8.34 | -2.29 | 3,843,678 | $14,695,037,634 |

| IPL | Incitec Pivot | 2.85 | -2.23 | 2,628,374 | $5,651,874,834 |

| TNE | Technology One | 16.05 | -2.19 | 930,426 | $5,327,912,286 |

| A2M | The A2 Milk Company | 4.02 | -2.19 | 1,220,719 | $2,971,262,061 |

| GNC | GrainCorp Limited | 7.61 | -2.19 | 1,026,911 | $1,745,341,837 |

| BKW | Brickworks Limited | 25.65 | -2.10 | 188,891 | $3,993,667,703 |

| INA | Ingenia Group | 4.23 | -1.86 | 323,255 | $1,756,683,868 |

Origin Energy (ASX:ORG) tumbled 2% after providing an update on the proposed acquisition by a Brookfield-led consortium of investors and EIG.

Origin told shareholders tat they will receive $9.43 per share, which is at the top end of the independent expert’s valuation range of $8.45 to $9.48 per share as of 30 June. Origin’s Board said shareholders should vote in favour of the scheme at the Scheme Meeting.

Technology One (ASX:TNE) fell 2% after reporting full year Profit Before Tax of $129.9m, up 16%, beating guidance of 10%-15% growth. The company also said it was on track to surpass $500m ARR (annual recurring revenue) by FY25. Total dividend was 19.52 cps, including a special dividend of 3.0 cps, up 15%.

Brickworks (ASX:BKW) was also down 2% after reporting Underlying NPAT of $508 million in FY23, and full year dividend 65 cents (fully franked).

“Although macroeconomic conditions may cause some short-term challenges across our portfolio, each of our businesses have a strong long-term outlook,” said Brickworks’ CEO, Lindsay Partridge.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.