ASX Large Caps: Shares advance 3pc for the week; Aussies are better renting than buying says Corelogic

Renting is better of than buying in 90pc of Aussie suburbs. Picture Getty

- ASX climbed 0.7% on Friday, 3% for the week

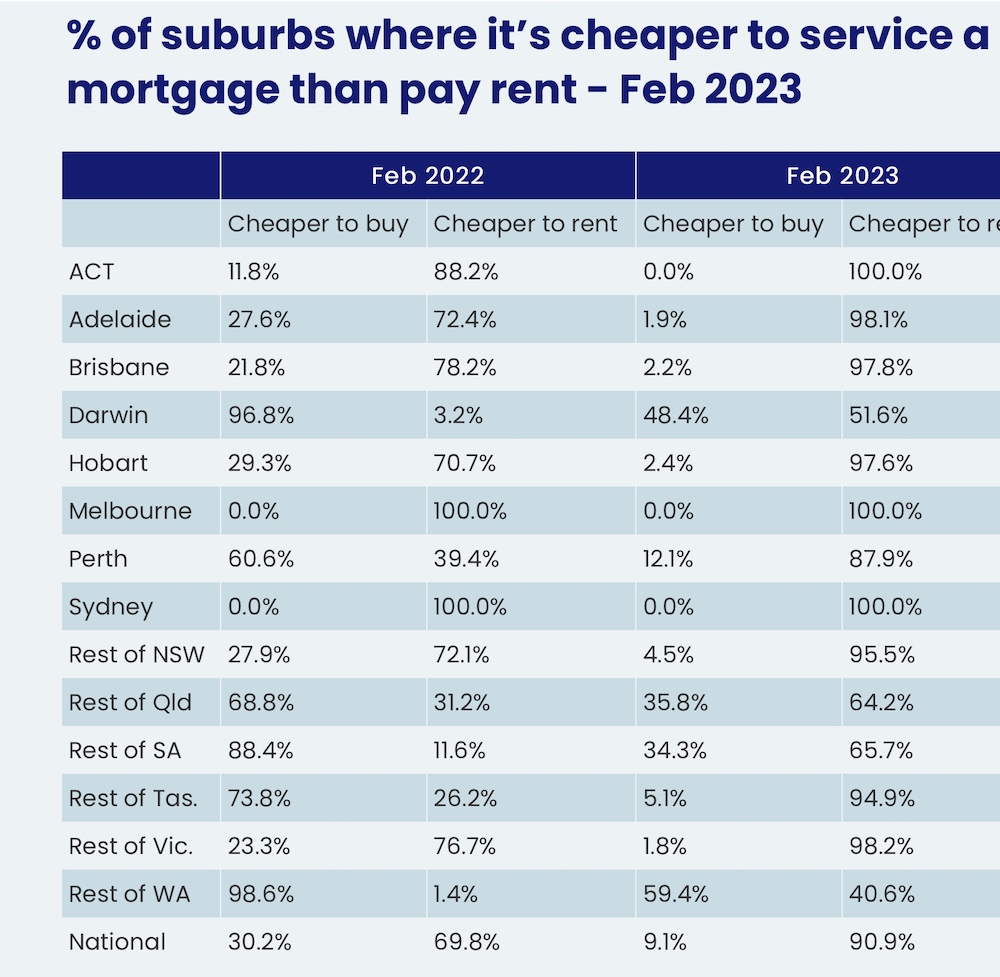

- Aussies are better off renting than buying in 90% of suburbs – Corelogic

- Trump to be arraigned next week

The ASX 200 rallied 0.75% on Friday for a 3% weekly increase. The Mining sector led, while Energy lagged.

It was the best week for local shares since early January as risk sentiment improves significantly.

Among the biggest advancers today was Syrah Resources (ASX:SYR), which was up 7%.

Mega capped miners like Fortescue (ASX:FMG) and BHP (ASX:BHP) also rallied by around 3%.

Wealth manager AMP (ASX:AMP) held its annual general meeting today where its board faced a potential first strike from shareholders over exec compensation. Share price was down 1.85%.

Comm Bank (ASX:CBA) raised its home loan rates for new customers by up to 20bp. Share price was up 0.3%.

A CoreLogic March residential property prices report overnight showed an overall average increase of ~0.8% in capital city prices.

The data shows that it’s cheaper to rent than buy a house in 90% of Australian suburbs.

Houses are cheaper to rent than buy in every suburb in the ACT, Melbourne and Sydney, while 100% of suburbs in Hobart, Sydney, regional South Australia and regional Tasmania were cheaper to rent than buy a unit in February.

Elsewhere…

Former President Donald Trump is expected to be arraigned as early as next Tuesday on charges related to the payment of hush money to a porn star during his 2016 campaign.

— Alvin Bragg (@ManhattanDA) March 30, 2023

Taiwan’s president Tsai Ing-wen will be visiting the US this coming week, potentially angering the CCP.

China’s official manufacturing purchasing managers’ index (PMI) fell to 51.9 in March from 52.6 in February, according to data today.

The non-manufacturing index however rose 1.9% from the previous month, and is at one of the highest levels in recent years pointing to a potential economic recovery.

Bitcoin is trading at US$28,191 at 3.30pm AEDT after briefly breaking the US$29k mark yesterday.

Over US$4 billion worth of Bitcoin options on Deribit, the world’s biggest Bitcoin and Ethereum options exchange, are set to expire later tonight US time.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SYR | Syrah Resources | 1.83 | 8.61 | 3,264,739 | $1,133,084,822 |

| GOR | Gold Road Res Ltd | 1.69 | 4.66 | 3,149,084 | $1,736,258,440 |

| RRL | Regis Resources | 2.08 | 4.26 | 5,108,469 | $1,506,276,720 |

| BGL | Bellevue Gold Ltd | 1.28 | 4.08 | 3,075,410 | $1,383,194,148 |

| CEN | Contact Energy Ltd | 7.28 | 4.00 | 2,399 | $1,752,248,239 |

| ING | Inghams Group | 3.12 | 4.00 | 489,123 | $1,115,038,803 |

| DEG | De Grey Mining | 1.55 | 3.86 | 3,434,283 | $2,326,138,703 |

| SQ2 | Block | 102.61 | 3.84 | 82,187 | $3,052,695,362 |

| SLR | Silver Lake Resource | 1.17 | 3.54 | 3,852,703 | $1,050,611,096 |

| DBI | Dalrymple Bay | 2.65 | 3.52 | 1,292,165 | $1,269,149,868 |

| CMM | Capricorn Metals | 4.74 | 3.49 | 339,426 | $1,720,972,442 |

Gold Road (ASX:GOR) climbed another 4%.

Block Inc (ASX:SQ2) rose 3%, both on no specific news.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ARU | Arafura Rare Earths | 0.50 | -2.94 | 8,333,864 | $1,077,663,570 |

| HMC | HMC Capital Limited | 3.57 | -2.86 | 2,253,994 | $1,103,852,122 |

| HLI | Helia Group Limited | 2.89 | -2.69 | 946,411 | $1,031,916,470 |

| HVN | Harvey Norman | 3.62 | -2.69 | 3,414,147 | $4,635,144,753 |

| SYA | Sayona Mining Ltd | 0.20 | -2.44 | 35,960,037 | $1,821,518,999 |

| CXO | Core Lithium | 0.85 | -2.01 | 8,889,136 | $1,613,864,611 |

| MEZ | Meridian Energy | 4.90 | -2.00 | 48,607 | $6,322,472,340 |

| FBU | Fletcher Building | 4.08 | -1.92 | 982,788 | $3,257,749,510 |

| MFG | Magellan Fin Grp Ltd | 8.65 | -1.87 | 622,162 | $1,599,102,069 |

| IMD | Imdex Limited | 2.24 | -1.75 | 641,470 | $1,148,988,597 |

| WDS | Woodside Energy | 33.25 | -1.74 | 2,643,615 | $64,253,692,251 |

| SMR | Stanmore Resources | 3.41 | -1.73 | 514,994 | $3,127,828,970 |

| BLD | Boral Limited | 3.52 | -1.68 | 218,719 | $3,949,056,540 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.