ASX Large Caps: RBA whips up another 50bp hike as lithium stocks rally on Tuesday

ASX large caps roundup 6 Sep 2022. Picture Getty

- The ASX 200 finishes 0.40% lower

- The RBA increases its cash rate by another 50bp

- Australia records another trade surplus

Local shares were relatively muted today following the interest rates decision by the RBA, closing Tuesday just 0.40% lower.

At its meeting today, the RBA Board decided to increase the cash rate target by 50 basis points to 2.35 per cent.

At its meeting today, the Board decided to increase the cash rate target by 50 basis points to 2.35 per cent. It also increased the interest rate on Exchange Settlement balances by 50 basis points to 2.25 per cent – https://t.co/7SpNu8FKJQ

— Reserve Bank of Australia (@RBAInfo) September 6, 2022

In a released statement, the RBA said:

“The Board is committed to returning inflation to the 2–3 per cent range over time. It is seeking to do this while keeping the economy on an even keel.”

“The path to achieving this balance is a narrow one and clouded in uncertainty, not least because of global developments.

“The outlook for global economic growth has deteriorated due to pressures on real incomes from high inflation, the tightening of monetary policy in most countries, Russia’s invasion of Ukraine, and the COVID containment measures and other policy challenges in China.”

The note ended by emphasising that the central bank will do “what is necessary to ensure that inflation in Australia returns to target over time.”

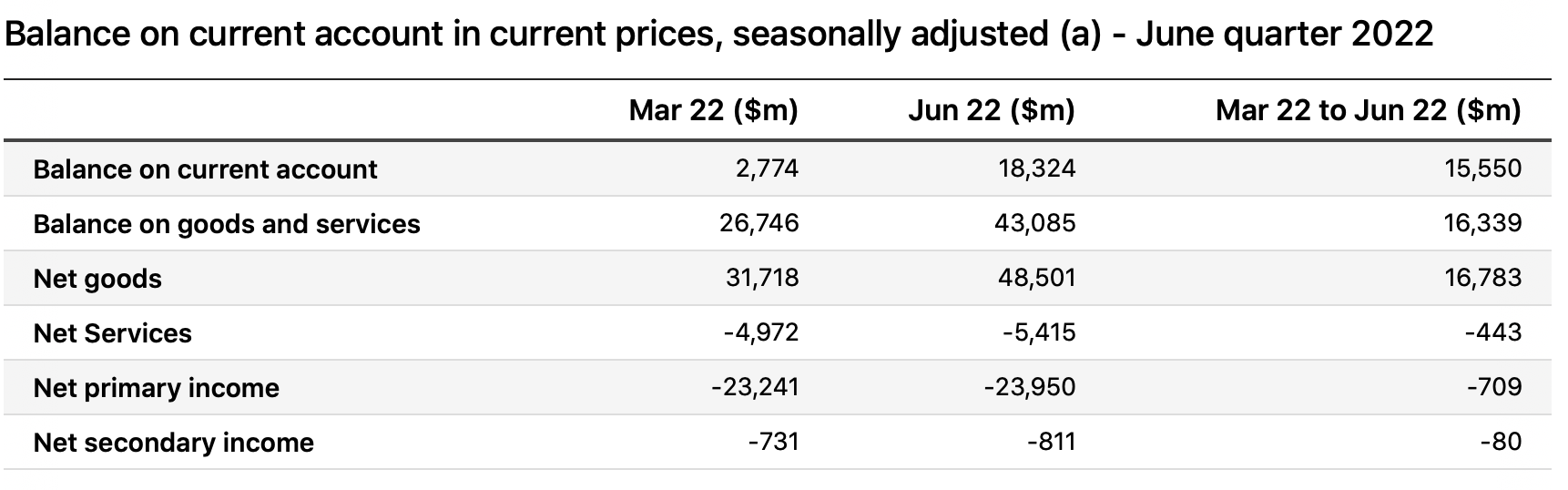

Meanwhile, Australia has posted a 13th consecutive current account surplus amid booming coal prices.

According to ABS data released on Tuesday, our current account surplus jumped from $2.8 billion to $18.3 billion in June, taking our total trade surplus to $43.1 billion.

The increase in exports in June far outweighed imports – 14.7% vs 4.6% – with most of the exports increase being driven by the 40% rise in coal prices.

Australian consumer confidence has also risen to its highest level since June, according to an ANZ and Roy Morgan survey released today.

ASX lithium stocks on a run

On the ASX, Energy and Tech sectors led, while Utilities dragged.

Lithium stocks rallied across the board reportedly driven by broker upgrades out of Jefferies. Last week, UBS also penned a sector-wide note on the ASX lithium space.

In M&A news, Rio Tinto (ASX:RIO) finalised its acquisition for Turquoise Hill Resources after Turquoise’s board voted in favour of Rio Tinto’s final offer of C$43 per share in cash.

Woolworths (ASX:WOW) has also completed its 80% acquisition of Mydeal (ASX:MYD) after MyDeal shareholders voted in favour of a scheme arrangement.

Across in China, the PRC has taken further steps to slow down the weakening Yuan after setting a stronger-than-expected FX fixing for a 10th straight day.

The People’s Bank of China set the fixing at 6.9096 per dollar on Tuesday, the weakest level in more than two years which is now poised to test the psychological milestone of 7.

“With the 20th National Congress of the Chinese Communist Party commencing on October 16th, and given the economic and geopolitical challenges that the government faces, we believe the authorities will want to ensure exchange rate stability in the lead-up to the event,” said Khoon Goh, head of Asia research at ANZ.

Looking ahead tonight, a couple of important data points will be released in the US – the S&P Global Composite PMI and the CB employment trends for August.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LKE | Lake Resources | 1.205 | 10% | 15,200,797 | $1,528,971,079.90 |

| CXO | Core Lithium | 1.48 | 9% | 20,894,658 | $2,362,585,684.16 |

| SYA | Sayona Mining Ltd | 0.275 | 8% | 49,840,197 | $2,116,189,713.96 |

| PLS | Pilbara Min Ltd | 3.94 | 6% | 27,088,490 | $11,031,205,666.90 |

| NHC | New Hope Corporation | 5.72 | 6% | 4,353,857 | $4,486,404,671.98 |

| YAL | Yancoal Aust Ltd | 6.68 | 6% | 4,599,777 | $8,331,972,847.47 |

| KAR | Karoon Energy Ltd | 2.235 | 5% | 4,103,075 | $1,183,140,946.24 |

| PDN | Paladin Energy Ltd | 0.88 | 5% | 15,946,636 | $2,486,695,966.67 |

| MP1 | Megaport Limited | 7.26 | 5% | 1,134,794 | $1,091,339,293.50 |

| LTR | Liontown Resources | 1.755 | 5% | 12,942,135 | $3,668,047,034.50 |

| SMR | Stanmore Resources | 2.43 | 5% | 2,114,147 | $2,091,205,539.36 |

| AKE | Allkem Limited | 14.065 | 4% | 2,990,867 | $8,595,630,999.28 |

| VUL | Vulcan Energy | 7.98 | 4% | 294,286 | $1,097,948,405.66 |

| DEG | De Grey Mining | 0.96 | 4% | 2,602,555 | $1,304,867,720.55 |

| INR | Ioneer Ltd | 0.6375 | 4% | 4,381,619 | $1,290,352,456.74 |

| WHC | Whitehaven Coal | 8.77 | 3% | 9,015,624 | $8,118,746,325.48 |

Seven West Media (ASX:SWM) rose 5% after securing the media rights to the AFL from 2025 to 2031. Seven says it will continue to broadcast AFL games on Channel 7 and 7mate.

Lithium stocks Pilbara Minerals (ASX:PLS), Core Lithium (ASX:CXO) and Allkem (ASX:AKE) were the major winners today, up around 6%-8% each.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SUL | Super Ret Rep Ltd | 9.68 | -6% | 423,415 | $2,326,012,950.00 |

| CDA | Codan Limited | 6.44 | -5% | 4,404,857 | $1,222,884,634.50 |

| BRG | Breville Group Ltd | 20.985 | -4% | 885,707 | $3,117,019,308.12 |

| SHL | Sonic Healthcare | 32.31 | -4% | 516,735 | $16,140,742,360.54 |

| OBL | Omni Bridgeway Ltd | 4.1 | -3% | 200,212 | $1,150,770,042.96 |

| ORG | Origin Energy | 5.93 | -3% | 2,715,685 | $10,560,443,223.23 |

| NIC | Nickel Industries | 0.895 | -3% | 10,361,223 | $2,526,427,984.73 |

| EVT | Event Hospitality | 14.35 | -3% | 33,293 | $2,384,081,755.59 |

| OCL | Objective Corp | 14.36 | -3% | 450,782 | $1,406,142,346.40 |

| CHN | Chalice Mining Ltd | 4.32 | -3% | 1,871,937 | $1,674,522,513.30 |

| GNC | GrainCorp Limited | 8.11 | -3% | 696,567 | $1,865,246,421.00 |

| REH | Reece Limited | 14.86 | -3% | 461,243 | $9,870,638,285.68 |

| MFG | Magellan Fin Grp Ltd | 12.105 | -3% | 1,177,982 | $2,298,088,957.16 |

| PSI | Psc Insurance Ltd | 5.09 | -3% | 15,475 | $1,827,755,400.60 |

| HTA | Hutchison | 0.073 | -3% | 12,400 | $1,017,938,143.28 |

| IPL | Incitec Pivot | 3.73 | -3% | 14,263,756 | $7,438,721,861.07 |

| MCY | Mercury NZ Limited | 5.36 | -3% | 22,286 | $7,601,321,310.00 |

| EVN | Evolution Mining Ltd | 2.195 | -2% | 7,398,808 | $4,127,328,843.75 |

| NUF | Nufarm Limited | 5.045 | -2% | 308,624 | $1,965,472,411.65 |

| IPH | IPH Limited | 8.96 | -2% | 117,152 | $2,015,602,394.58 |

| ORI | Orica Limited | 14.99 | -2% | 1,343,761 | $6,946,072,955.90 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.