ASX Large Caps: Local shares up as coal miners lead; Aussie bitcoin miner listed on Nasdaq near collapse

ASX large caps roundup 22 Nov. Picture Getty

- The ASX rose 0.6% higher on Tuesday

- Coal stocks lead

- NASDAQ listed Aussie bitcoin miner Iris Energy faces bankruptcy

Local shares closed 0.6% higher on Tuesday, defying losses on Wall St overnight.

Coal shares were the best performers amid rising coal prices, as sector leaders Whitehaven Coal (ASX:WHC) and New Hope (ASX:NHC) jumped 8% each.

Newcastle coal futures listed on ICE has risen by over 3% overnight as we near the Russian crude ban.

“It seems the physical markets are already showing most of the effects of those sanctions,” said OANDA analyst, Edward Moya.

“Europe has been quickly erasing its dependence with Russian crude, and that will continue as we approach the oil price cap deadline.”

Lithium stocks also surged today with the likes of IGO (ASX:IGO) and Mineral Resources (ASX:MIN) lifting 3%.

Meanwhile, the cryptocurrency market continues to suffer from the post-FTX fallout.

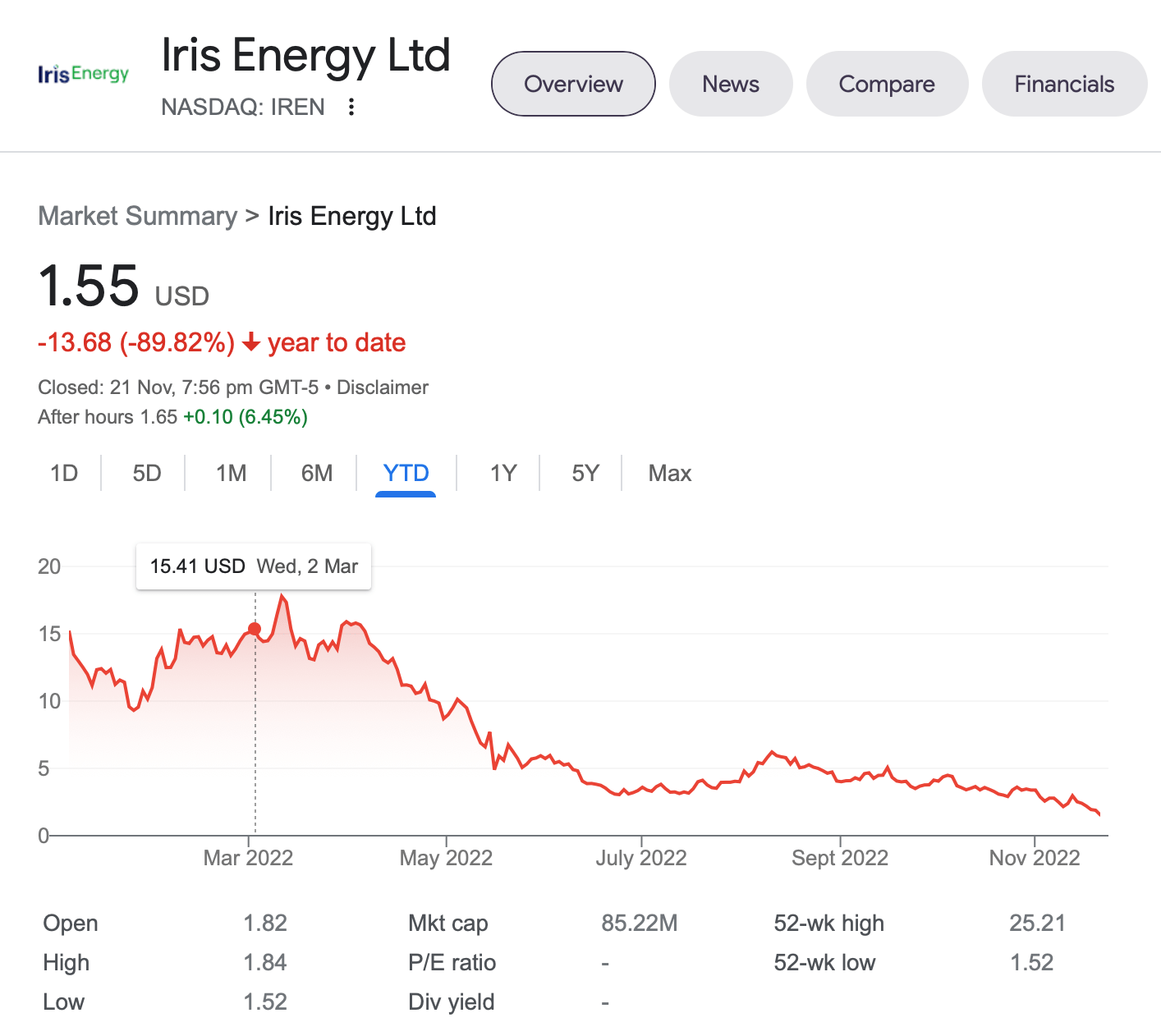

Aussie bitcoin miner Iris Energy, which is listed on Nasdaq, is facing wipeout and bankruptcy as its US creditors demand that it repay debts immediately.

The market is eagerly awaiting a speech from RBA governor Philip Lowe at a dinner event in Melbourne in a few hours from now.

The speech is entitled: “Price Stability, the Supply Side and Prosperity”.

Meanwhile, the ANZ-Roy Morgan Consumer Confidence index rose 0.8pts to 81.6, the first consecutive weekly increases since late September.

The gain in consumer confidence is well timed as the Black Friday/Cyber Monday sales will start this Friday.

The Australian Retailers Association-Roy Morgan has forecast sales to reach a record $6.2 billion over the four-day period.

Looking ahead to tonight’s session, the US weekly chain store sales data will be released, along with the EU current accounts and consumer confidence.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VUK | Virgin Money Uk PLC | 2.82 | 11% | 6,564,164 | $1,952,359,857 |

| WHC | Whitehaven Coal | 9.07 | 7% | 13,282,088 | $7,853,259,386 |

| NHC | New Hope Corporation | 5.755 | 7% | 5,942,735 | $4,745,358,845 |

| YAL | Yancoal Aust Ltd | 5.2 | 7% | 3,959,954 | $6,443,744,453 |

| TNE | Technology One | 12.99 | 5% | 886,780 | $3,993,567,828 |

| BSL | BlueScope Steel Ltd | 16.98 | 5% | 1,545,391 | $7,499,161,495 |

| SYA | Sayona Mining Ltd | 0.22 | 5% | 31,750,107 | $1,784,673,332 |

| SGM | Sims Limited | 12.79 | 4% | 528,529 | $2,367,959,159 |

| TLX | Telix Pharmaceutical | 7.435 | 4% | 1,006,617 | $2,243,465,637 |

| BRN | Brainchip Ltd | 0.65 | 4% | 4,097,269 | $1,079,288,840 |

| CRN | Coronado Global Res | 1.995 | 4% | 2,986,807 | $3,218,791,162 |

| IGO | IGO Limited | 16.07 | 4% | 2,340,416 | $11,745,223,780 |

| SMR | Stanmore Resources | 2.515 | 3% | 976,853 | $2,190,357,526 |

| HLS | Healius | 3.29 | 3% | 1,222,656 | $1,846,780,516 |

| WDS | Woodside Energy | 38.48 | 3% | 2,884,007 | $70,937,291,445 |

| NAN | Nanosonics Limited | 4.14 | 3% | 1,158,886 | $1,214,152,074 |

Virgin Money UK (ASX:VUK) rose 13% after reporting its FY22 earnings.

The company generated a 43% increase in profits after tax on pcp to $1 billion. Virgin announced also an $89.5 million share buyback.

Technology One (ASX:TNE) rose 5% after reporting an 18% increase in revenue to $369.4 million.

Bottom line net profit before tax also grew 15% to $112.3 million.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CEN | Contact Energy Ltd | 6.75 | -5% | 11,065 | $1,777,280,357 |

| 360 | Life360 Inc. | 6.42 | -5% | 2,033,045 | $1,257,524,196 |

| SNZ | Summerset Grp Hldgs | 8.75 | -3% | 1,716 | $2,102,979,060 |

| SQ2 | Block | 94.45 | -3% | 150,152 | $3,561,903,979 |

| MND | Monadelphous Group | 13.4 | -3% | 487,718 | $1,320,176,793 |

| KAR | Karoon Energy Ltd | 2.275 | -3% | 2,820,490 | $1,316,679,053 |

| 29M | 29Metalslimited | 2.415 | -3% | 723,962 | $1,193,763,126 |

| DEG | De Grey Mining | 1.2475 | -3% | 2,671,841 | $1,996,213,652 |

| ARB | ARB Corporation. | 27.83 | -2% | 131,864 | $2,335,374,360 |

| MCY | Mercury NZ Limited | 5.2 | -2% | 11,242 | $7,373,562,358 |

| HGH | Heartland Group | 1.65 | -2% | 878 | $1,188,466,539 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.