ASX Large Caps: Local shares take a breather from panic selling as Mining and Energy bounce back

ASX large caps roundup - 27 Sep 2022. Picture Getty

- The ASX 200 bounced back modestly on Tuesday

- Mining and Energy stocks led the bounce

- The Pound Sterling is volatile against the Dollar

The US Dollar is being a beast of a currency. It’s begun this week just like it finished last: taking no prisoners.

The greenback’s status as the last remaining safe-haven currency has only been enhanced by the more aggressive posture adopted by the US Federal Reserve.

The rally that started mid-September is gaining momentum, leaving also-ran punters like the Australian Dollar (which alone fell about three-quarters of a cent yesterday) in its wake.

It’s been most calamitous for the the British pound, which has now become a verb.

The GBP has been smashed down to a fresh all time low against the greenback, disassembled by the UK Chancellor who’s fuelled the bonfire of UK inflation with generous new tax cuts.

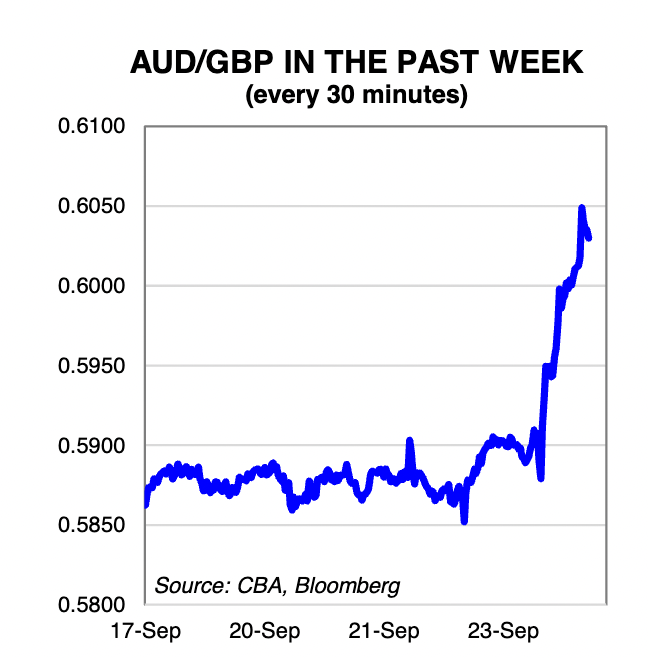

A day or two old now, but I do like the shape of this chart for its rarity:

On the local bourse today, it’s a rebound for the ASX 200 (up 0.35%) as Mining and Energy sectors bounced higher while Real Estate and Healthcare extended their retreat.

Coal miners in particular did well as New Hope Corporation (ASX:NHC) and Coronado Global (ASX:CRN) bounced back from yesterday’s losses to lead Tuesday’s charge.

Iron ore stocks also traded higher as BHP (ASX:BHP), Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) finished higher.

Virgin Money UK (ASX:VUK) meanwhile lost 4% as the Pound crumbled to its lowest level in almost 40 years.

The Yuan is at a multi decade low, and is on track for its biggest decline since 1994. The Chinese central bank has already made moves to stop traders speculating against the Yuan.

Taiwan is following suit as the island government mulled raising FX controls and banning short sales on Taiwanese stocks. The Taiwan Capitalization Weighted Stock Index is down by 25% this year.

Last night, Wall St investors were in ‘sell everything’ mood as they dumped pretty much most major asset categories.

The Dow is now officially in a bear market, which is defined as a 20% fall from the last high. The S&P 500 is at its lowest point in 2022.

The bond market also sold off, with the US 10 year yield soaring to 3.92%, the highest in 12 years.

Oil prices were down another 3% as the benchmark Brent crude tumbled to US$83.80 a barrel.

Gold broke a major support level and was down 1% to US$1634 an ounce.

Bitcoin however has gained 4% in the last few hours, trading now at US$20,083.

According to Bloomberg Intelligence senior commodity strategist Mike McGlone, Bitcoin and gold will outperform the market in the next 10 years.

“Lower commodity and risk-asset prices may be the only way out with deflationary implications, which should buoy the price of gold and its digital version, Bitcoin,” McGlone said.

Looking ahead to tonight’s session on Wall Street, several economic data points will be released in the US including: home prices, durable good orders, and consumer confidence index.

US Fed Chair Jerome Powell will also be speaking later tonight.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MP1 | Megaport Limited | 7.95 | 7% | 683,013 | $1,176,748,455.60 |

| WHC | Whitehaven Coal | 8.44 | 7% | 11,992,670 | $7,564,108,767.32 |

| BRN | Brainchip Ltd | 0.885 | 7% | 5,393,010 | $1,427,070,579.52 |

| NHC | New Hope Corporation | 5.75 | 6% | 5,889,707 | $4,497,610,390.20 |

| PLS | Pilbara Min Ltd | 4.675 | 6% | 26,721,658 | $13,162,681,910.07 |

| MIN | Mineral Resources. | 65.8 | 6% | 758,476 | $11,792,103,831.86 |

| FMG | Fortescue Metals Grp | 16.74 | 5% | 7,572,136 | $49,078,700,792.92 |

| SYA | Sayona Mining Ltd | 0.23 | 5% | 116,960,110 | $1,828,014,200.76 |

| IMU | Imugene Limited | 0.1875 | 4% | 20,582,872 | $1,128,301,510.32 |

| INR | Ioneer Ltd | 0.585 | 4% | 4,555,287 | $1,185,445,752.94 |

| AKE | Allkem Limited | 14.35 | 4% | 3,701,859 | $8,837,941,071.96 |

| PRU | Perseus Mining Ltd | 1.385 | 3% | 4,736,287 | $1,829,354,870.68 |

| LKE | Lake Resources | 0.935 | 3% | 12,608,302 | $1,257,926,206.65 |

Australian Agricultural Company (ASX:AAC) gained 1% after announcing a new CEO, David Harris. Harris has been with the company since 2016 and was COO since 2020.

Santos (ASX:STO) was up 1% after receiving an offer from Kumul Petroleum to acquire 5% of Santos’ PNG LNG project for a value of US$1.4 billion.

Kumul is PNG’s national oil and gas company, and is a partner of Santos in the PNG LNG project.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CXO | Core Lithium | 1.18 | -6% | 50,964,932 | $2,188,866,148.56 |

| CXL | Calix Limited | 6.355 | -6% | 248,906 | $1,089,256,792.00 |

| GNE | Genesis Energy Ltd | 2.38 | -4% | 25,085 | $2,614,391,904.12 |

| FPH | Fisher & Paykel H. | 16.49 | -4% | 473,646 | $9,964,685,301.00 |

| RHC | Ramsay Health Care | 57.2 | -3% | 970,994 | $13,522,331,131.40 |

| GOZ | Growthpoint Property | 3.035 | -3% | 353,437 | $2,415,326,771.35 |

| HMC | Homeco Limited | 4.5 | -3% | 254,822 | $1,393,174,244.80 |

| CCP | Credit Corp Group | 17.06 | -3% | 126,014 | $1,191,134,819.24 |

| PDL | Pendal Group Ltd | 4.44 | -3% | 1,605,758 | $1,750,993,169.30 |

| DXS | Dexus | 7.55 | -3% | 4,217,023 | $8,357,141,961.42 |

| INA | Ingenia Group | 3.79 | -3% | 426,465 | $1,589,574,729.60 |

| APM | APM Human Services | 2.965 | -3% | 1,959,964 | $2,797,404,935.30 |

| ABP | Abacus Property Grp. | 2.45 | -3% | 738,251 | $2,252,017,235.16 |

| CIP | Centuria I REIT | 2.59 | -3% | 985,522 | $1,688,915,489.10 |

| VUK | Virgin Money Uk PLC | 2.25 | -3% | 4,723,199 | $1,798,112,186.64 |

| HGH | Heartland Group | 1.5 | -3% | 4,499 | $1,086,194,937.52 |

| WPR | Waypoint REIT | 2.31 | -3% | 2,396,493 | $1,687,005,216.39 |

Core Lithium (ASX:CXO) fell 6% today despite news that high grade spodumene bearing pegmatite has been intersected in multiple holes at the BP33 prospect, up to 830 metres below surface.

The company also said its first lithium, Direct Ship Ore (DSO) shipment preparations are underway.

Private hospital giant Ramsay Healthcare (ASX:RHC) declined 3% after the acquisition deal with KKR was officially terminated. Meanwhile, Blackrock has also sold a chunk of its stake in Ramsay today.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.