ASX Large Caps: Gold now just US$30 shy of all-time high; Aussie shares up almost 2pc this week

Gold and lithium stocks lifted the ASX on Friday. Picture Getty

- Gold lithium stocks rallied, pushing the ASX 200 index higher on Friday

- Gold price is now only US$30 an ounce short of all-time high

- IGO received OK from the WA government for a battery material facility

Gold and lithium stocks rallied on Friday, taking the ASX 200 to a +0.50% gain. For the week, the index was up over 1.5%.

Lithium giants IGO Ltd (ASX:IGO) and Allkem (ASX:AKE) were up 4-5% despite analysts at Goldman and Barrenjoey warning that a correction in the lithium price has further to run.

Gold stocks Northern Star (ASX:NST), Regis Resources (ASX:RRL) and Silver Lake (ASX:SLR) jumped 4% ~ 7% after spot gold climbed to near record levels at US$2,042 an ounce – just US$30 shy of old time highs. Gold hit an all time high of US$2,074.60 on March 8, 2022.

Geoff Wilson’s listed investment company (or LIC), WAM Leaders (ASX:WLE), plunged 5% after it relaunched a fund raising, this time for $617m, after earlier abandoning a $732m raise earlier due to “market volatility”.

Bank of Queensland (ASX:BOQ) also dropped 1% after cutting its interim dividend, announcing a $200 million impairment of goodwill, as well as a $60 million in costs related to compliance failures.

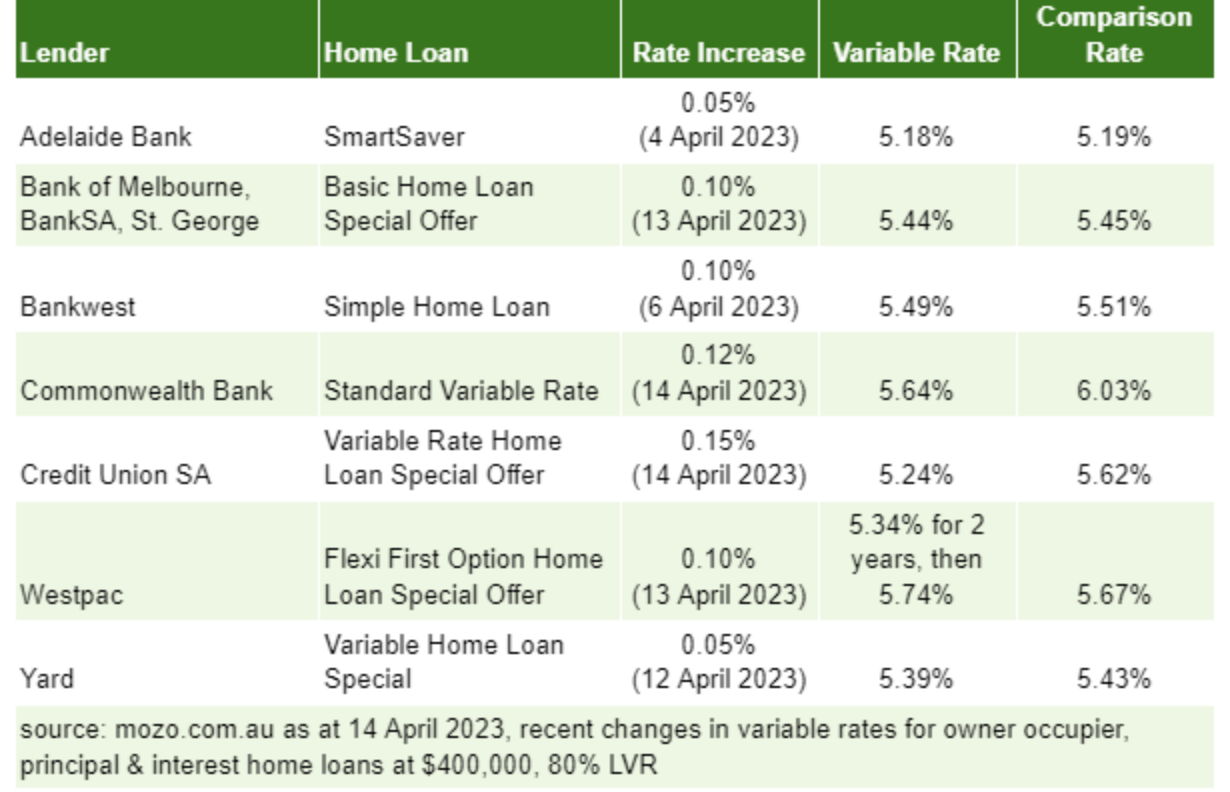

Comparison site Mozo dropped us an email and said that despite the RBA’s decision to hold rates earlier this month, we’ve seen some banks quietly raising their variable home loan rates.

Elsewhere today …

Fed Chairman Jerome Powell and People’s Bank of China’s Governor Yi Gang will meet in Washington this week at the IMF conference, for their first one-on-one talk since 2020.

US Ambassador to Tokyo Rahm Emanuel said the US is ready to coordinate with its allies against economic coercion by China.

Chinese electric vehicle maker Evergrande is looking to raise US$4.2bn in funds as it struggles to survive. In 2019, the company said its goal was to overtake Tesla as the world’s biggest maker of electric cars within 3-5 years.

London-based market intelligence company Airfinity told Bloomberg there is a 27.5% chance a pandemic as deadly as Covid-19 could emerge in the next 10 years as viruses emerge more frequently.

Looking ahead to tonight’s session on Wall Street, we expect to see the release of US retail report, and the import / export report.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SLR | Silver Lake Resource | 1.35 | 7.37 | 6,484,040 | $1,166,829,138 |

| IGO | IGO Limited | 13.46 | 5.53 | 2,334,521 | $9,655,164,616 |

| AKE | Allkem Limited | 11.62 | 5.25 | 2,609,106 | $7,039,745,269 |

| WAF | West African Res Ltd | 1.11 | 5.24 | 3,718,302 | $1,074,756,634 |

| RRL | Regis Resources | 2.43 | 4.74 | 5,522,727 | $1,751,660,146 |

| DMP | Domino Pizza Enterpr | 53.21 | 4.39 | 291,898 | $4,540,937,790 |

| NST | Northern Star | 14.40 | 4.31 | 6,294,714 | $15,869,247,348 |

| CDA | Codan Limited | 6.38 | 4.25 | 609,460 | $1,108,748,735 |

| RSG | Resolute Mining | 0.50 | 4.17 | 20,556,707 | $1,021,923,153 |

| PLS | Pilbara Min Ltd | 3.72 | 4.06 | 30,720,258 | $10,702,908,263 |

| RMS | Ramelius Resources | 1.51 | 3.97 | 6,143,200 | $1,266,210,573 |

| EMR | Emerald Res NL | 1.75 | 3.55 | 433,217 | $1,003,523,661 |

| EVN | Evolution Mining Ltd | 3.65 | 3.40 | 7,169,117 | $6,477,607,606 |

IGO rose 6% after announcing it has received approval from the WA government for a battery material facility in Kwinana-Rockingham. A feasibility study is planned by mid-2024.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CEN | Contact Energy Ltd | 7.18 | -10.25 | 18,057 | $2,036,369,872 |

| CTT | Cettire | 3.07 | -8.51 | 2,376,132 | $1,277,148,037 |

| LTR | Liontown Resources | 1.25 | -8.09 | 18,722,621 | $3,285,526,258 |

| CMM | Capricorn Metals | 4.47 | -8.02 | 2,609,627 | $1,827,156,731 |

| PLS | Pilbara Min Ltd | 3.28 | -7.08 | 49,752,832 | $10,623,403,190 |

| MMS | McMillan Shakespeare | 16.89 | -6.74 | 181,568 | $1,261,235,165 |

| EMR | Emerald Res NL | 2.70 | -6.25 | 1,551,126 | $1,794,427,857 |

| LFG | Liberty Fin Group | 3.85 | -6.10 | 6,307 | $1,245,595,879 |

| IGO | IGO Limited | 7.56 | -5.85 | 4,481,363 | $6,080,860,538 |

| RMS | Ramelius Resources | 1.66 | -5.43 | 3,687,423 | $1,989,363,213 |

| MCY | Mercury NZ Limited | 5.70 | -5.00 | 6,443 | $8,347,363,434 |

| SLR | Silver Lake Resource | 1.09 | -5.00 | 3,980,280 | $1,074,955,983 |

| PRU | Perseus Mining Ltd | 1.94 | -4.68 | 5,359,813 | $2,788,334,831 |

| IFL | Insignia Financial | 2.07 | -4.61 | 2,380,436 | $1,446,580,054 |

| RED | Red 5 Limited | 0.36 | -4.61 | 12,116,319 | $1,315,631,915 |

| MIN | Mineral Resources. | 57.35 | -4.29 | 908,699 | $11,695,570,766 |

| NST | Northern Star | 12.36 | -4.19 | 2,418,019 | $14,824,952,396 |

Nickel Industries (ASX:NIC) dropped 1% after announcing that it has raised $US400 million of 2028 unsecured notes in the US 144a market, with a coupon of 11.25% which will be listed on the Singapore stock exchange.

Karoon Energy (ASX:KAR) fell 5% after reporting that the suspension of its Baúna production in Brazil, including from the Patola field, is expected to be extended into May 2023.

Based on a resumption of safe and reliable production operations in early May, FY23 production is expected to be at the low end of the current guidance range (7.5 – 9.0 MMbbl), said the company.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.