ASX Large Caps: Aussie bourse continues 2024 tumble as oil heads higher

Pic: Getty Images

- ASX continues its downward trend after another lacklustre session on Wall Street

- Oil prices track higher after supply disruptions and increased tension in Middle East

- Dual NYSE listed BNPL play Block falls as the sell off in tech sector continues in US

Australian stocks closed lower on Thursday following the downward trend of Wall Street, which has been put down to extended profit taking after a strong end to 2023.

The S&P ASX 200 closed down 0.39% to 7494.10 points weighed down by losses in the consumer staples and materials sectors.

In the US, the S&P 500 experienced a 0.8% drop, the Dow closed 0.76% lower and the the tech heavy NASDAQ fell by 1.2% overnight. Shares in high-profile, interest rate-sensitive companies such as Nvidia, Apple, and Tesla all closed lower.

The decline on Wall Street in the the first two trading days of 2024 is in contrast to a robust last two months of 2023 as signs of cooling inflation had investors betting on the US Fed implementing rate-cuts sooner rather than later this year.

But investors now appear more cautious about just how quickly the central back will implement changes with no change expected at its first meeting of 2024 on January 30-31.

Minutes of the Fed’s December meeting released overnight showed nearly all officials anticipated policy rates would be lowered in 2024 they did maintain the prospect of higher rates.

“It was possible that the economy could evolve in a manner that would make further increases in the target rate appropriate,” the minutes say.

“Several also observed that circumstances might warrant keeping the target range at its current value for longer than they currently anticipated.”

In a speech on Wednesday, Richmond Fed president Tom Barkin cautioned on focusing too much on rate cuts in 2024.

“I would caution you to focus less on the rate path and more on the flight path,” Barkin said overnight.

“Is inflation continuing its descent and is the broader economy continuing to fly smoothly? Conviction on both questions will determine the pace and timing of any changes in rates.”

Also weighing on Wall Street is a range of new data showing the US labour market is cooling.

In commodities, the crude oil price is tracking higher with Brent crude up to near $US78/barrel following geopolitical tensions and tightening oil supplies in the Middle East.

Furthermore, a statement from OPEC affirming their commitment to stabilising oil prices has encouraged bullish sentiment in the market.

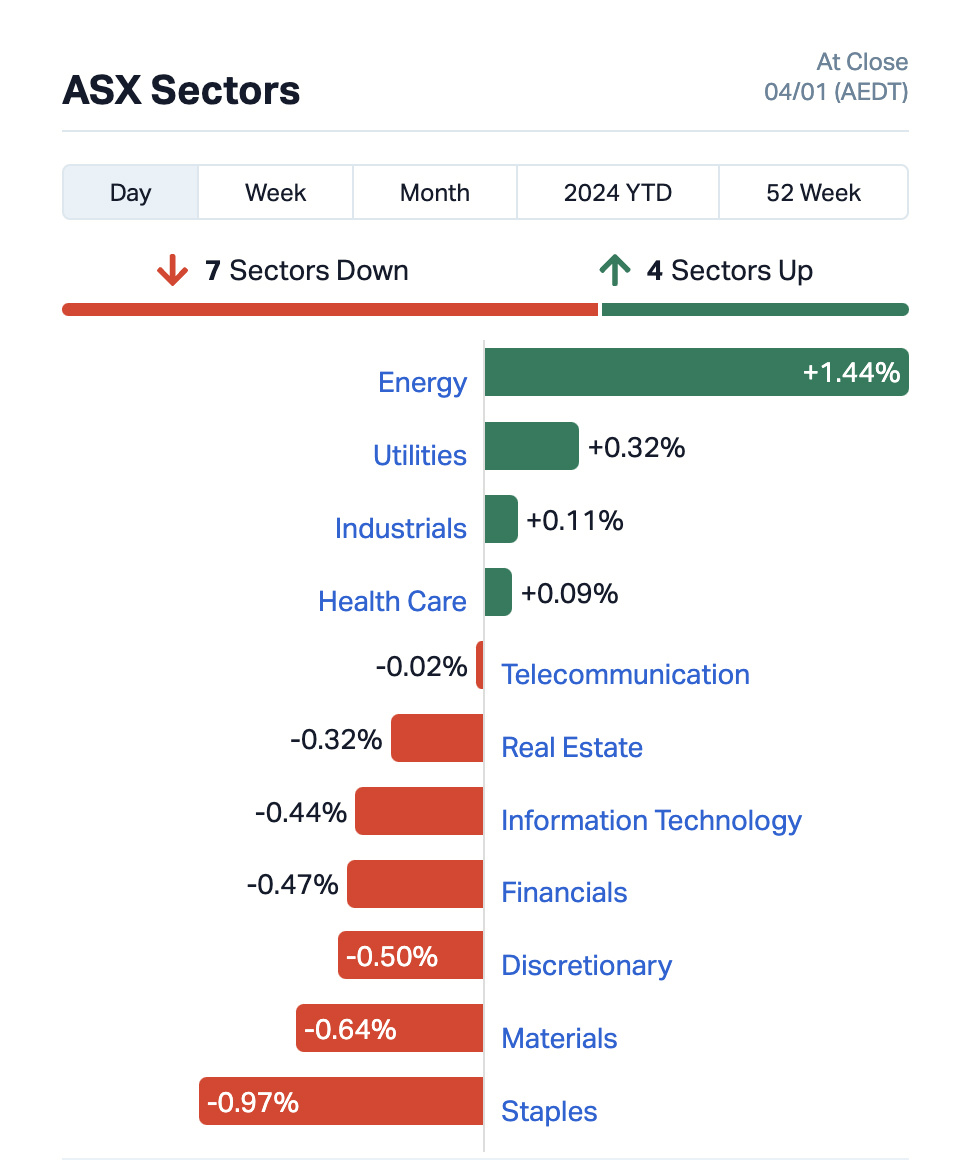

At home energy stocks lead the gainers today, followed by utilities and industrials, while staples, materials and discretionary topped the losers.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IFL | Insignia Financial | 2.49 | 6% | 1,546,930 | $1,566,572,870 |

| TUA | Tuas Limited | 3.34 | 5% | 216,320 | $1,483,222,148 |

| MEZ | Meridian Energy | 5.17 | 4% | 44,976 | $6,267,069,117 |

| JLG | Johns Lyng Group | 6.405 | 4% | 861,499 | $1,711,702,540 |

| AD8 | Audinate Group Ltd | 16.305 | 4% | 99,341 | $1,304,808,725 |

| IFT | Infratil Limited | 9.61 | 3% | 37,044 | $7,742,878,968 |

| AMP | AMP Limited | 0.955 | 3% | 9,390,683 | $2,535,499,836 |

| YAL | Yancoal Aust Ltd | 5.3 | 3% | 3,107,353 | $6,787,058,706 |

| IRE | IRESS Limited | 8.075 | 3% | 292,302 | $1,464,429,476 |

| MCY | Mercury NZ Limited | 6.26 | 3% | 27,346 | $8,472,573,886 |

| LFG | Liberty Fin Group | 4.18 | 2% | 4,072 | $1,239,519,802 |

| CIA | Champion Iron Ltd | 8.685 | 2% | 1,075,553 | $4,399,978,472 |

| FPH | Fisher & Paykel | 22.3 | 2% | 193,637 | $12,735,874,823 |

| ELD | Elders Limited | 7.525 | 2% | 580,773 | $1,158,243,406 |

| KAR | Karoon Energy Ltd | 2.085 | 2% | 2,461,040 | $1,634,517,515 |

| BGA | Bega Cheese Ltd | 3.49 | 2% | 402,579 | $1,041,450,791 |

| WHC | Whitehaven Coal | 7.84 | 2% | 4,739,831 | $6,433,460,029 |

Winning stocks followed winning sectors today including energy and utilities such as Meridian (ASX:MEZ), Karoon Energy (ASX:KAR), Yancoal Australia (ASX:YAL) and Whitehaven Coal (ASX:WHC)

Bucking the losing financials sector today to make the winners list was Insignia Financial (ASX:IFL) and Liberty Financial Group (ASX:LFG) .

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HGH | Heartland Group | 1.39 | -7% | 4 | $1,069,321,579 |

| LTM | Arcadium Lithium PLC | 10.13 | -7% | 748,734 | $6,984,023,458 |

| BGL | Bellevue Gold Ltd | 1.475 | -5% | 4,316,997 | $1,775,213,599 |

| SQ2 | Block | 101.6 | -4% | 130,009 | $3,724,911,225 |

| GMD | Genesis Minerals | 1.625 | -4% | 3,754,072 | $1,858,767,730 |

| PRU | Perseus Mining Ltd | 1.76 | -4% | 4,167,777 | $2,506,754,220 |

| LYC | Lynas Rare Earths | 6.715 | -3% | 2,035,999 | $6,496,125,635 |

| NST | Northern Star | 12.74 | -3% | 2,858,474 | $15,135,242,098 |

| GOR | Gold Road Res Ltd | 1.7225 | -3% | 2,812,991 | $1,924,538,207 |

| SIG | Sigma Health Ltd | 0.945 | -3% | 4,134,013 | $1,280,499,583 |

| PME | Pro Medicus Limited | 91.25 | -3% | 117,800 | $9,813,573,462 |

| RMD | ResMed Inc. | 24.47 | -3% | 1,641,950 | $14,971,591,851 |

| AWC | Alumina Limited | 0.9 | -3% | 8,059,836 | $2,684,055,311 |

| CMM | Capricorn Metals | 4.37 | -3% | 455,552 | $1,694,166,854 |

Shares in Block Inc (ASX:SQ2), which acquired Afterpay in January 2022, continued to fall following a sell-off of the dual NYSE-listed buy now, pay later (BNPL) stock in New York overnight.

SQ2 closed down more than 4% on the NYSE overnight following a sell-off in the US tech sector.

Resources companies also found themselves on the losers list today as the sector took a tumble including Arcadium Lithium (ASX:LTM), Bellevue Gold (ASX:BGL) and Genesis Minerals (ASX:GMD)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.