ASX Large Caps: ASX up 1.25pc, Treasury Wines surges as China agrees to review tariffs, BTC above US$30k

ASX surges over 1 percent on Tuesday. Bictoin above US$30k. Picture Getty

- Local shares lifted over 1 per cent today as all 11 sectors rose

- Newcrest Mining and Treasury Wines led their respective sectors

- Bitcoin surged past US$30k, first time since June 2022

The ASX 200 advanced 1.2% today, with all 11 sectors in the green. Mining, agricultural and retail stocks led, while real estate wasn’t far behind.

Gold miner Newcrest Mining (ASX:NCM) was the best performer, up over 5% after US rival Newmont made an improved all-scrip takeover offer equivalent to $32.87 per share, a 16% improvement from the previous offer.

Newmont has requested exclusivity during the due diligence period as a condition of the revised proposal, and Newcrest says it intends to grant this exclusivity.

Wine producer Treasury Wine Estates (ASX:TWE) rose 4.5% after Foreign Minister Penny Wong and Trade Minister Don Farrell said Australia would suspend its WTO appeal against Chinese tariffs for three months in return for China conducting a review of the ban on Aussie products.

China said it will review its tariffs on Australian barley, but that could also expand to Australian wines, said the ministers.

A report released by the Australian Strategic Policy Institute showed that China made 73 coercive actions between 2020 and 2022 against Australia.

Bitcoin above US$30k

Bitcoin has surged past US$30k in the past few hours, the first time it has done so since June 2022.

BTC is now trading at US$30,123 as investors grow more optimistic about Fed monetary policy.

“It seems many traders are also convinced the dollar’s days are numbered, as it will slowly lose some of that preferred reserve currency status and that crypto will be one of the beneficiaries,” said Oanda analyst, Edward Moya.

Bitcoin Hodlers also remain unfazed that the Fed will likely deliver one more rate hike in May, and that the US economy is headed towards a recession this year.

“BTC is now properly starting to be perceived as a risk-off asset,” said Richard Mico, CEO and chief legal officer of Banxa.

In other news…

The Super Mario Bros movie has set the record for an animated film in its global debut, generating worldwide box office sales of US$376 million over the weekend.

Geopolitical tensions continue as the US and the Philippines kicked off their first flagship military exercise in more than 30 years today.

China’s consumer inflation eased to its lowest level in more than a year in March, according to data released today.

Back home, online grocery delivery start-up Milkrun is shutting down and has made all its staff redundant.

Looking ahead this week, Aussie unemployment report for March will be released on Thursday. In February, unemployment came through at 3.5%, near decade lows and much lower than the RBA would like.

The most watched number however will be released on Wednesday, with US inflation expected to decline for the 9th consecutive month.

“Ultimately, inflation is moving in the right direction, but it may not be falling as fast as the Federal Reserve would like,” said Josh Gilbert, a market analyst at eToro.

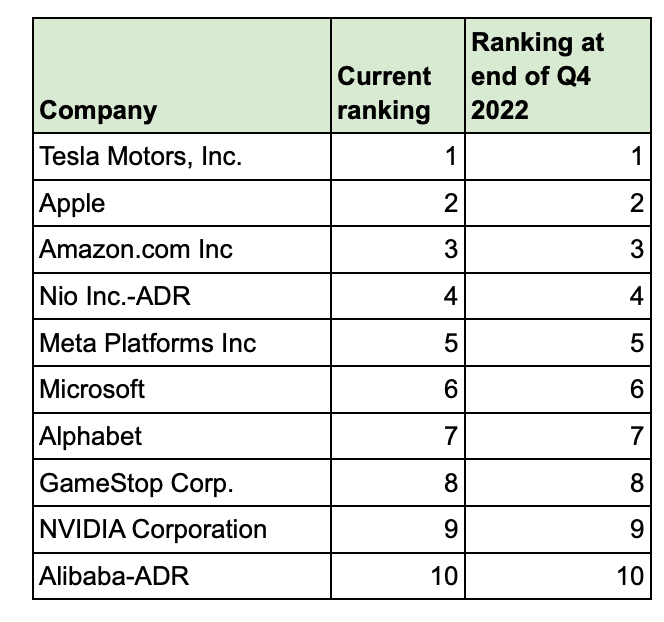

eToro has also published its report showing which stocks are most widely held by eToro users in Australia and their position last quarter.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| STX | Strike Energy Ltd | 0.46 | 7.56 | 6,609,106 | $1,079,666,239 |

| NIC | Nickel Industries | 0.91 | 7.10 | 6,622,780 | $2,555,497,396 |

| PDN | Paladin Energy Ltd | 0.64 | 6.25 | 4,443,341 | $1,788,058,623 |

| NCM | Newcrest Mining | 29.76 | 5.23 | 6,177,023 | $25,288,845,101 |

| SFR | Sandfire Resources | 6.62 | 5.17 | 1,777,273 | $2,873,850,227 |

| RMS | Ramelius Resources | 1.44 | 5.11 | 7,337,544 | $1,196,350,679 |

| TWE | Treasury Wine Estate | 13.76 | 4.72 | 1,623,572 | $9,485,085,033 |

| DOW | Downer EDI Limited | 3.38 | 4.64 | 1,400,268 | $2,169,182,983 |

| KAR | Karoon Energy Ltd | 2.38 | 4.63 | 3,131,242 | $1,277,552,820 |

| CRN | Coronado Global Res | 1.68 | 4.04 | 2,184,607 | $2,699,090,505 |

| CHN | Chalice Mining Ltd | 7.85 | 3.97 | 1,316,665 | $2,842,176,315 |

| NWH | NRW Holdings Limited | 2.45 | 3.81 | 767,154 | $1,060,096,731 |

| ILU | Iluka Resources | 11.49 | 3.70 | 1,359,996 | $4,720,221,890 |

| BGL | Bellevue Gold Ltd | 1.42 | 3.65 | 5,089,932 | $1,546,919,170 |

| ARU | Arafura Rare Earths | 0.50 | 3.65 | 18,395,899 | $1,014,271,596 |

Ramelius Resources (ASX:RMS) rose 5% after its Board unanimously recommended that shareholders accept the offer to acquire all of the Breaker Resources (ASX:BRB) shares on the basis of 1 RMS share for every 2.82 BRB shares.

Arafura Rare Earths (ASX:ARU) lifted 2% after signing a 5-year offtake agreement with Siemens Gamesa Renewable Energy A/S to supply NdPr from the Nolans Project. The annual contract quantities of NdPr metal will increase to 400 tonnes per annum (an NdPr Oxide equivalent of 520 tpa) when the Nolans Project achieves nameplate production capacity.

Now read: Arafura signs NdPr offtake deal with global wind turbine manufacturer

Nickel Industries (ASX:NIC) was up 6% after announcing proposed issuance of new senior unsecured notes and concurrent tender offer for existing US$325m 2024 notes.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HGH | Heartland Group | 1.48 | -3.27 | 284 | $1,085,777,046 |

| IFT | Infratil Limited | 8.57 | -2.50 | 12,546 | $6,363,815,686 |

| DTL | Data#3 Limited | 7.41 | -2.50 | 249,122 | $1,174,953,798 |

| YAL | Yancoal Aust Ltd | 5.78 | -2.36 | 1,843,342 | $7,817,001,467 |

| MCY | Mercury NZ Limited | 5.80 | -2.19 | 2,100 | $8,223,681,778 |

| SLR | Silver Lake Resource | 1.25 | -2.16 | 4,630,487 | $1,185,424,025 |

| FPH | Fisher & Paykel H. | 25.08 | -1.45 | 148,084 | $14,745,104,515 |

| SGR | The Star Ent Grp | 1.39 | -1.42 | 7,680,819 | $2,282,340,037 |

| AIZ | Air New Zealand | 0.72 | -1.38 | 342,548 | $2,442,136,628 |

| AIA | Auckland Internation | 8.05 | -1.17 | 303,651 | $11,986,566,255 |

| NEU | Neuren Pharmaceut. | 12.86 | -1.15 | 253,516 | $1,646,619,445 |

At Stockhead we tell it like it is. While Arafura Rare Earths is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.