ASX Large Caps: ASX sets record high to start 2024 as energy leads gains

Pic: Getty Images

- ASX closes higher on the first trading day of 2024 finishing at record high

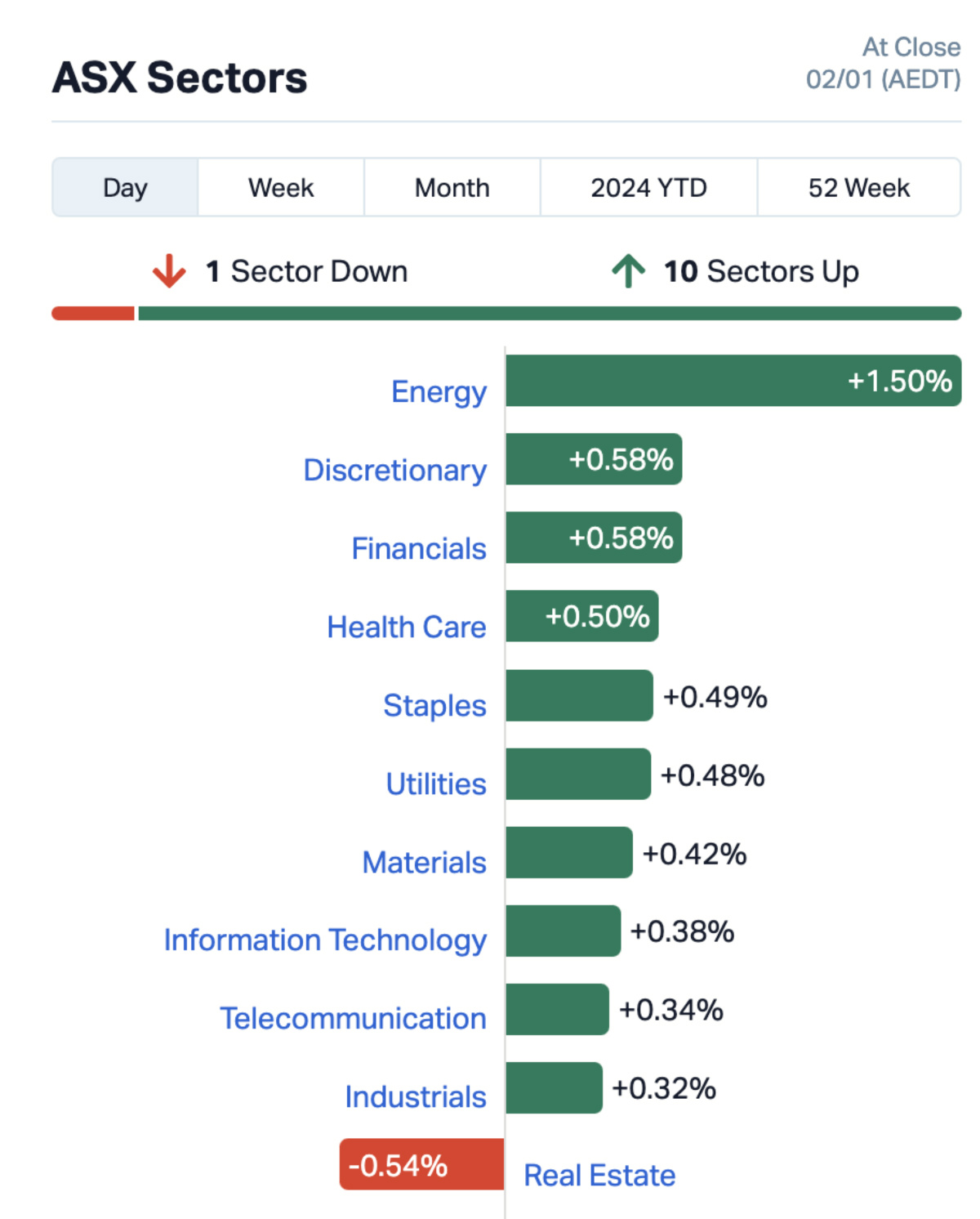

- Energy leads the markets higher with all sectors in green except real estate

- Energy stocks top big cap gainers including Boss Energy and Yancoal Australia

The S&P ASX200 is up for the first day of 2024 trading, closing 0.47% higher and setting a new 100-day high of 7,626.50 points. Over the past five trading days, the index has gained 1.66% and is currently 0.08% off its 52-week high.

The ASX was able to shake off a 0.3% drop in Friday’s S&P 500, buoyed by a modest uptick in US futures. While at lunch time all sectors were in the green, by close real estate had fallen into the red to end down 0.54%.

Commonwealth Bank (ASX:CBA) was up 1.4% today to set a new record high of $113.36, while Super Retail Group (ASX:SUL), Ventia Services (ASX:VNT) and Viva Energy (ASX:VEA) were also among stocks to hit record highs in trade today.

Energy was leading the market higher followed by discretionary and financials. Healthcare, staples and utilities were also off to a strong 2024 start.

The Aussie bourse was feeling optimistic following a weekend national address from China’s President Xi Jinping, who committed to boosting economic growth and employment following a challenging year.

Jinping emphasised China’s focus on reinforcing the progress in economic recovery and pursuing stable, sustained economic development.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BOE | Boss Energy Ltd | 4.27 | 6% | 1,908,703 | $1,631,564,312 |

| YAL | Yancoal Aust Ltd | 5.2 | 5% | 2,254,123 | $6,536,175,213 |

| WHC | Whitehaven Coal | 7.76 | 4% | 2,902,574 | $6,224,309,833 |

| AGL | AGL Energy Ltd | 9.8 | 3% | 1,817,644 | $6,377,643,769 |

| NHC | New Hope Corporation | 5.315 | 3% | 1,768,228 | $4,361,930,994 |

| NIC | Nickel Industries | 0.715 | 3% | 2,279,462 | $2,978,637,867 |

| CIA | Champion Iron Ltd | 8.625 | 3% | 675,947 | $4,348,153,048 |

| AIZ | Air New Zealand | 0.6 | 3% | 759,553 | $1,970,551,624 |

| PDN | Paladin Energy Ltd | 1.01 | 3% | 12,430,984 | $2,938,624,900 |

| JBH | JB Hi-Fi Limited | 54.35 | 2% | 381,214 | $5,797,981,012 |

| APM | APM Human Services | 1.255 | 2% | 1,035,118 | $1,123,547,884 |

| LTR | Liontown Resources | 1.69 | 2% | 4,347,073 | $3,996,274,846 |

| AWC | Alumina Limited | 0.925 | 2% | 3,906,625 | $2,626,021,682 |

| LNK | Link Admin Holdings | 2.225 | 2% | 1,040,341 | $1,125,724,709 |

Energy stocks were all higher as the sector rose today. Leading the gainers was Boss Energy (ASX:BOE), Yancoal Australia (ASX:YAL) and Whitehaven Coal (ASX:WHC).

AGL Energy (ASX:AGL), New Hope Corp (ASX:NHC) and Paladin Energy (ASX:PDN) were also on today’s winners list.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ABG | Abacus Group | 1.115 | -3% | 396,753 | $1,027,706,278 |

| ASK | Abacus Storage King | 1.0975 | -3% | 311,671 | $1,484,936,347 |

| BAP | Bapcor Limited | 5.385 | -3% | 511,475 | $1,880,345,250 |

| SQ2 | Block | 113.86 | -2% | 71,484 | $4,096,665,158 |

| GMD | Genesis Minerals | 1.7475 | -2% | 1,345,405 | $1,968,753,986 |

| EMR | Emerald Res NL | 2.94 | -2% | 1,091,566 | $1,877,427,189 |

| BWP | BWP Trust | 3.455 | -2% | 267,912 | $2,267,614,825 |

| IAG | Insurance Australia | 5.545 | -2% | 3,064,788 | $13,592,803,366 |

| LTM | Arcadium Lithium PLC | 10.99 | -2% | 221,953 | $7,202,474,974 |

| CHC | Charter Hall Group | 11.815 | -2% | 408,057 | $5,694,886,276 |

| MGF | Magellan Global Fund | 1.875 | -2% | 563,020 | $2,705,813,126 |

| WPR | Waypoint REIT | 2.4 | -2% | 354,072 | $1,639,232,375 |

| WGX | Westgold Resources. | 2.145 | -2% | 594,729 | $1,032,497,551 |

| MAQ | Macquarie Technology | 67.55 | -1% | 4,947 | $1,668,799,571 |

| IEL | IDP Education Ltd | 19.745 | -1% | 559,429 | $5,575,074,306 |

Abacus Group (ASX:ABG) and its spinoff Abacus Storage King (ASX:ASK) were both on the losers list today on no specific news.

However, ABG recently announced that seven investment properties, or 37% of the group’s portfolio by number, have been externally valued as at December 31 2023.

Preliminary draft valuations (including both internal and external valuations) resulted in a total estimated decrease of $140 million, being a 6.5% decrease on prior book values for the six months to 31 December 2023.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.