ASX Large Caps: ASX rebounds to new high; Strike Energy to enter ASX200 next Friday, Costa out

ASX claims new record high, after rising above 1pc again. Picture Getty

- ASX claims new record high, after rising 1.4pc

- Aussie home values continue to rise

- Strike Energy to be included in S&P 200 next Friday

The ASX 200 regained its losses yesterday and climbed to another record high after closing the day +1.5% higher. For the week, the index was up by almost 2%.

Local traders took cues from New York overnight, where tech stocks rebounded ahead of Big Tech updates.

Meta rose +15% after the bell as the company forecast revenue growth in the current quarter that beat analysts’ expectations.

Apple fell -3% in extended trading after its China revenue missed estimates. At group level, however, Apple reported a profit and revenue beat for Q1.

“Clearly, there is work for Tim Cook and his team to do in 2024, with what seems to be one of the most challenging periods for Apple in the last decade,” said Josh Gilbert, market analyst at eToro.

Amazon meanwhile rose +7% post market after crushing analysts’ expectations for Q4 earnings and revenue.

On the ASX today, the Real Estate sector led all other sectors after surging over 3% on the back of a 6% rise in sector giant Goodman Group (ASX:GDG).

Meanwhile, across the region, most Asian stock markets rose. Nikkei hobbled briefly after Japan’s Azora Bank tanked 15% on higher losses tied to commercial real estate office exposure in the US.

The market’s eyes will now turn to the keenly anticipated US January workforce date later tonight.

Aussie home values continue to rise

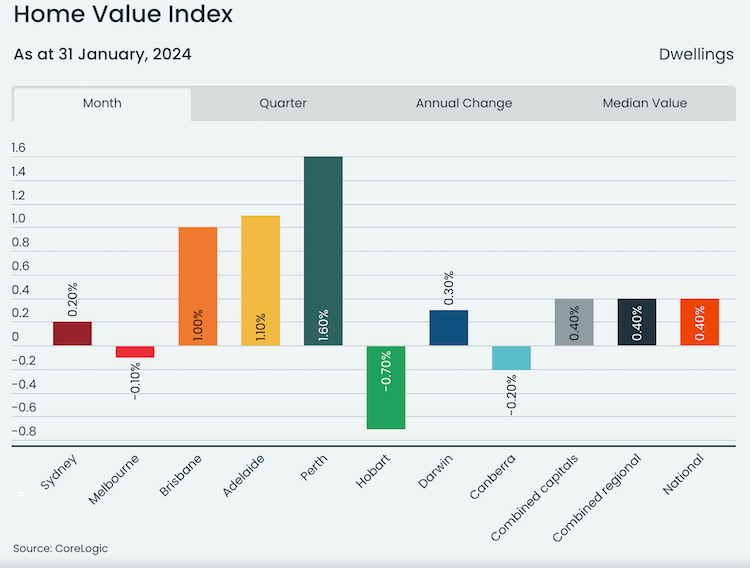

Traders also jumped on real estate stocks today after a CoreLogic report released last evening showed that Australia’s housing upswing continued through the first month of 2024.

CoreLogic’s national Home Value Index (HVI) rose 0.4% in January, up from 0.3% increases seen in November and December – marking the 12th straight month of value rises.

“Since the commencement of the upswing, capital city house values have surged 11.0% higher while unit values are up 6.9%,” said CoreLogic’s research director, Tim Lawless.

“It seems that most Australians are willing to pay a higher premium than ever for a detached home,” Mr Lawless said.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DYL | Deep Yellow Limited | 1.68 | 12.75 | 16,123,071 | $1,139,365,538 |

| PNI | Pinnacle Investment | 11.04 | 10.62 | 1,399,749 | $2,025,227,877 |

| BOE | Boss Energy Ltd | 6.09 | 7.60 | 4,953,182 | $2,312,972,261 |

| SKC | Skycity Ent Grp Ltd | 2.00 | 6.67 | 777,633 | $1,425,384,767 |

| ERA | Energy Resources | 0.06 | 6.67 | 2,990,844 | $1,328,897,951 |

| GMG | Goodman Group | 26.99 | 6.22 | 4,555,515 | $48,258,216,424 |

| PDN | Paladin Energy Ltd | 1.37 | 6.20 | 25,454,593 | $3,848,554,438 |

| TLX | Telix Pharmaceutical | 11.98 | 5.18 | 681,473 | $3,689,873,328 |

| SLR | Silver Lake Resource | 1.26 | 5.00 | 4,488,451 | $1,121,693,200 |

| GMD | Genesis Minerals | 1.68 | 4.83 | 3,165,258 | $1,765,279,412 |

| EMR | Emerald Res NL | 3.21 | 4.74 | 1,494,182 | $1,913,393,453 |

| SLX | Silex Systems | 5.17 | 4.66 | 1,106,721 | $1,165,573,611 |

| SGR | The Star Ent Grp | 0.57 | 4.59 | 17,558,868 | $1,563,431,078 |

| ALU | Altium Limited | 51.80 | 4.44 | 272,229 | $6,543,571,165 |

| PNV | Polynovo Limited | 1.95 | 4.41 | 1,657,796 | $1,290,735,244 |

| PME | Pro Medicus Limited | 104.99 | 4.32 | 244,947 | $10,512,379,279 |

| CMM | Capricorn Metals | 4.69 | 4.11 | 1,796,682 | $1,697,940,054 |

Fund manager Pinnacle Investment (ASX:PNI) rose 10% after reporting H1 FY24 NPAT of $30.2 million, compared to $30.5 million in the pcp.

Basic earnings per share (EPS) was 15.4 cents, compared to 15.7 cents in the pcp, while fully franked interim dividend per share was maintained at 15.6 cents.

Importantly, Pinnacle’s net inflows for H1 was +$4.5 billion, compared with net outflows of -$1.5 billion in the pcp.

Bank of Queensland (ASX:BOQ) rose almost 1% after announcing the sale of its New Zealand portfolio of assets to UDC Finance.

The sale was done at 91% of book value, and as at 31 January, the portfolio size was NZ$238 million (around $221 million).

“This transaction is another step in our strategic simplification program, exiting a non-core business and reducing our operational complexity,” said BOQ’s CEO, Patrick Allaway.

Strike Energy (ASX:STX) rose +1.6% after S&P announced that it will include the stock as part of the S&P/ASX 200 at the open of trading on Friday, February 9.

STX will replace Costa Group (ASX:CGC) after the company was acquired by Paine Schwartz Partners and the rest of its consortium.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| WGX | Westgold Resources. | 2.11 | -5.80 | 2,135,313 | $1,060,914,915 |

| AGL | AGL Energy Limited. | 8.20 | -3.98 | 3,907,301 | $5,745,261,370 |

| LTM | Arcadium Lithium PLC | 7.27 | -3.26 | 1,250,104 | $4,075,017,802 |

| NIC | Nickel Industries | 0.76 | -2.88 | 3,560,892 | $3,342,931,706 |

| MEZ | Meridian Energy | 5.13 | -2.10 | 26,911 | $6,634,230,742 |

| WHC | Whitehaven Coal | 8.19 | -1.50 | 3,804,826 | $6,952,152,515 |

| AFI | Australian Foundat. | 7.39 | -1.34 | 740,875 | $9,336,655,343 |

| LTR | Liontown Resources | 0.98 | -1.26 | 14,875,803 | $2,398,973,912 |

| CCP | Credit Corp Group | 17.98 | -1.05 | 410,762 | $1,236,774,774 |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.