ASX Large Caps: ASX falls on first trading day of October as US avoids government shutdown

ASX trips up on the first day of October trading. Pic: Getty Images

- ASX slips on first day of trading for October as US avoids government shutdown

- Megaport interim CFO Leticia Dorman appointed to the role ending global search

- Coal producer Coronado Global Resources falls after revising yearly forecast downward

Local shares have finished 0.22% lower on the first day of trading for October. In a topsy-turvy day of trade markets were flat at lunch after falling 0.43% earlier in the morning session.

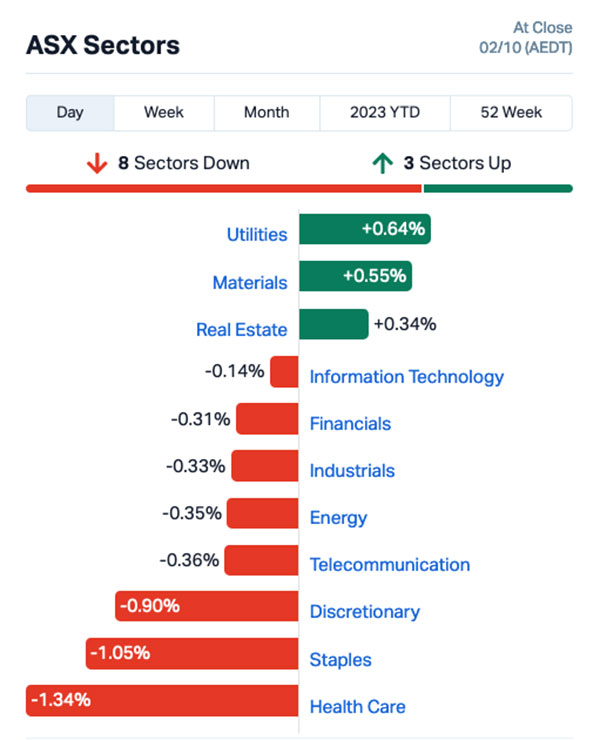

By 2.30pm (AEDT) markets had slumped again, falling 0.21% and continuing to lose steam throughout the afternoon. Eight of the 11 sectors were in the red today by the time the closing bell rang.

Utilities and materials topped the gainers, while healthcare and discretionary led the laggards.

Markets are awaiting the October rate decision of the RBA board tomorrow – the first under new governor Michele Bullock.

The cash rate is widely tipped to remain at 4.1% for the fourth time in a row as the RBA waits for the full effect of previous 12 rate rises to flow through the economy, despite inflation picking up in August.

The ABS CPI report shows that inflation in Australia increased to 5.2% YoY in August, in line with market expectations.

And while Bullock may not be keen to raise rates after just one month of inflation picking up , economists are warning elevated global oil prices and the potential for elevated food costs resulting from a hot, dry Aussie summer could put further pressure on the central bank as it works to bring inflation back to its 2-3% target.

In some positive news US futures have jump after Congress reached a deal over the weekend to temporarily avoid a government shutdown.

Asian stocks were mixed today as Japan’s stocks soared with the export heavy Nikkei 225 bolstered by the Yen’s drop to its lowest in nearly 18 months. The Topix also rose as investors started buying back stocks following relief the US Government had yet again avoided a shutdown.

There was a market holiday in Hong Kong today, while mainland China has been shut since Friday for the Golden Week holiday, which continues until the end of this week.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AZS | Azure Minerals | 2.82 | 4% | 1,355,119 | $1,177,989,853 |

| MAD | Mader Group Limited | 6.56 | 3% | 172,058 | $1,276,000,000 |

| S32 | South32 Limited | 3.48 | 3% | 11,143,609 | $15,408,952,426 |

| KAR | Karoon Energy Ltd | 2.71 | 3% | 1,802,329 | $1,495,398,002 |

| SNZ | Summerset Grp Hldgs | 9.16 | 3% | 1,862 | $2,092,132,741 |

| ASK | Abacus Storage King | 1.065 | 2% | 264,963 | $1,366,667,080 |

| WLE | WAM Leaders Limited | 1.515 | 2% | 615,391 | $1,860,850,064 |

| ZIM | Zimplats Holding Ltd | 23.7 | 2% | 4,890 | $2,497,193,457 |

| MEZ | Meridian Energy | 4.89 | 2% | 38,637 | $6,065,934,186 |

Megaport (ASX:MP1) has announced its global search for a new CFO has been finalised with interim replacement Leticia Dorman getting the job.

Dorman has been acting CFO since March 28 and was previously head of finance, joing the tech company in 2021 from Brisbane Airport Corporation.

Azure Minerals (ASX:AZS) is up today on no news. Its stablemates Core Lithium (ASX:CXO) Latin Resources (ASX:LRS) and Sayona Mining (ASX:SYA) are also rising today as investor appetite for lithium kicks off again.

Karoon Energy (ASX:KAR)has also risen today as the price of oil continues to be elevated, while South32 (ASX:S32) is enjoying higher coal prices, which are up 1.56% today.

Platinum miner Zimplats Holdings (ASX:ZIM) is also continuing to climb after dropping its annual report to shareholders which was mostly decent news . The company is also benefiting from the price of platinum, which is up 0.1% against the rest of the mainstream precious metals easing.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CRN | Coronado Global Resources | 1.855 | -5% | 3,732,669 | $3,260,702,505 |

| DMP | Domino Pizza Enterprises | 51.13 | -4% | 158,111 | $4,776,016,987 |

| GNC | GrainCorp Limited | 6.85 | -3% | 832,832 | $1,583,819,199 |

| PMV | Premier Investments | 24.28 | -3% | 203,641 | $3,981,865,975 |

| CKF | Collins Foods Ltd | 9.31 | -3% | 52,937 | $1,124,381,874 |

| DHG | Domain Holdings Australia | 3.9 | -3% | 84,450 | $2,526,628,612 |

| RMD | ResMed Inc. | 23.03 | -2% | 3,229,740 | $11,348,010,912 |

| AMP | AMP Limited | 1.2275 | -2% | 6,026,034 | $3,473,562,773 |

| DTL | Data#3 Limited | 6.93 | -2% | 115,891 | $1,095,304,773 |

| CDA | Codan Limited | 7.745 | -2% | 188,575 | $1,432,397,293 |

Coal producer Coronado Global Resources (ASX:CRN) has fallen today after announcing it had revised its yearly production forecast downward and indicated increased mining expenses due to recent setbacks at two of its coal mines.

CRN reported adverse operational conditions at its Buchanan mine in the US and unexpected downtime for repairs at the Curragh mining complex in Queensland.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.