ASX Large Caps: ASX closes flat to end first week of 2024 in red

Pic: Getty Images

- ASX closes flattish, actually down a fraction – 0.07% – on Friday to also finish the first week of trading lower for 2024, following the lead of Wall Street

- CEO of deVere Group says investors should “buckle up” as markets likely to be volatile in Q1 2024

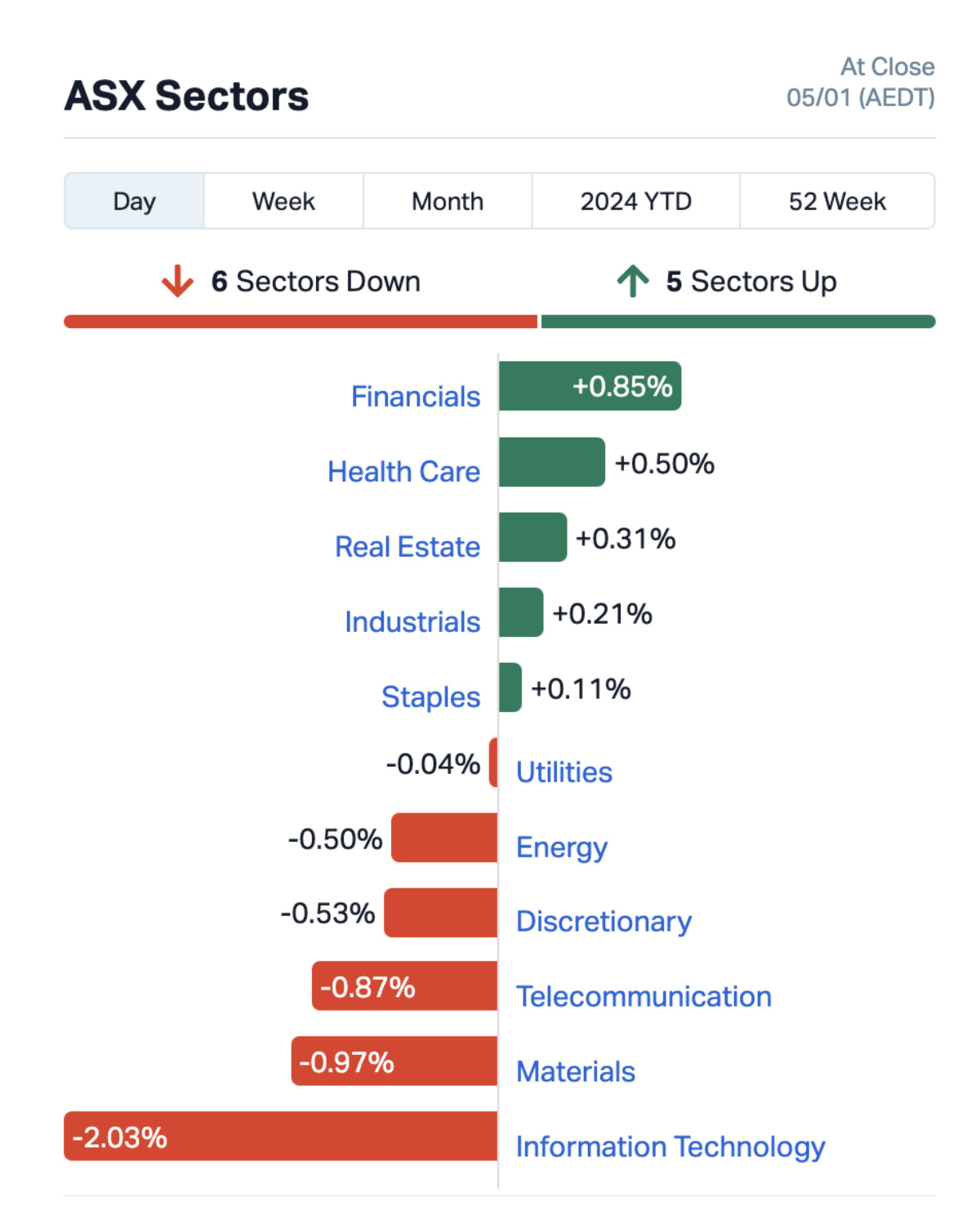

- Six sectors in green today with financials leading winners with five in the red as tech led laggards

Australian stocks ended a tad in the red on Friday. The S&P ASX 200 closed 0.07% down, to 7489.10 points, and has fallen 1.64% for the week.

It is the ASX’s worst first week of trade for a new year since 2021.

The Aussie bourse has been following the lead of Wall Street, which has also had a lacklustre start to the New Year. Overnight the S&P 500 fell 0.3% for its third day.

The index hasn’t fallen three days in a row to the start the year since 2015 and if it falls four days in a row again tonight that will be its worst yearly start since 1978.

“In the first five trading days of 1978, the market plunged 47 points and decisively broke through the psychological 800 barrier on the Dow which in the recent past had provided solid resistance,” The Washington Post wrote in January 1978 in an old article I managed to find.

Overnight, the Dow Jones ended flat after early gains while the tech-heavy NASDAQ fell 0.5%, its first five-day losing streak in more than a year.

Apple also hasn’t had a good start to 2024, either, falling for its fourth straight session, following its second downgrade this week.

After Barclays downgraded Apple to underweight from neutral, citing disappointing demand for its iPhone 15, Piper Sandler has also downgraded the stock for the same reason.

The two-year US Treasury yield, which is considered by economists and analysts to reflect interest rate outlook, remains above the 4% mark at 4.39%, while 10 year Treasury notes are also up 3.99%, which is ~15 basis points above its six month low in December as investors bet the US Fed may be slower to cut rates in 2024 than originally forecast.

The yield on Australian three-year bonds, indicative of anticipated interest rates, has moved up by 15.63 basis points to 3.72% in the past five days.

Time to ‘buckle up’

Meanwhile, CEO of deVere Group Nigel Green says investors should “buckle up” as markets are likely to be volatile in the first quarter of 2024 and could drop by up to 20% – but you could find there are more opportunities to make money.

“Global markets have been spooked since the start of 2024 and there’s little sign that volatility will be reduced any time soon amid uncertainty regarding central bank rate cuts,” says the CEO of one of the world’s largest independent financial advisory and asset management organisations.

“Arguably, the main trigger currently is minutes of the of the US Federal Reserve’s meeting in December showed interest rate cuts were possible this year, but they provided almost no definitive indication on when – of if even – that might happen.”

“With the ongoing lack of clarity from major central banks, including the Fed, we would not be surprised to see markets falling into correction territory this quarter. As such, investors should buckle up for more turbulence.”

Tonight, the December US jobs report will be released and watched closely by pundits as to how the US economy is faring. The report is widely tipped to show fewer jobs were created in line with forecasts for a cooling job market in 2024.

But let’s not start the weekend too glum. It’s not all bad news with the much of the this week’s selldown on markets also put down to profit taking after a robust end to 2023, where all three US indices ended the year with strong gains.

The S&P 500 ended 2023 up 24%, the Dow Jones ~14% and the NASDAQ climbed more than 44% as excitement around artificial intelligence built momentum for tech stocks in 2023.

On the lithium front Core Lithium (ASX:CXO) fell ~11% today after announcing it has temporarily suspended open-pit mining at its Finnis project in the Northern territory as falling lithium prices continue to put pressure on the sector.

Five sectors were in the green today and six in the red. Leading the winners was financials, followed by health care and real estate.

Following the lead of Wall Street tech topped the losing sectors, with materials and telcos also among the biggest losers to end the week.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort. Stocks highlighted had announcements.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MFG | Magellan Financial Group | 9.71 | 4% | 1,435,796 | $1,698,103,619 |

| BAP | Bapcor Limited | 5.41 | 3% | 808,806 | $1,778,521,500 |

| JDO | Judo Cap Holdings | 1.01 | 3% | 419,637 | $1,087,114,816 |

| CGF | Challenger Limited | 6.62 | 3% | 464,023 | $4,449,202,639 |

| AUB | AUB Group Ltd | 27.71 | 2% | 116,525 | $2,933,456,077 |

| EDV | Endeavour | 5.405 | 2% | 3,343,960 | $9,456,374,490 |

| CMM | Capricorn Metals | 4.45 | 2% | 453,047 | $1,641,342,052 |

| NWL | Netwealth Group | 15.71 | 2% | 176,300 | $3,748,244,859 |

| RMD | ResMed Inc. | 25 | 2% | 670,335 | $14,561,003,680 |

| QBE | QBE Insurance Group | 15.055 | 2% | 1,897,205 | $22,020,311,669 |

| PXA | Pexagroup | 10.97 | 2% | 136,981 | $1,907,033,510 |

| IAG | Insurance Australia | 5.74 | 2% | 3,765,127 | $13,520,756,705 |

| LTM | Arcadium Lithium PLC | 10.06 | 2% | 1,660,627 | $5,355,582,651 |

| BOQ | Bank of Queensland. | 6.145 | 2% | 2,029,461 | $3,977,898,934 |

| EMR | Emerald Res NL | 2.985 | 2% | 629,754 | $1,828,261,292 |

| BEN | Bendigo and Adelaide | 9.77 | 2% | 1,204,691 | $5,444,863,742 |

| VUK | Virgin Money Uk PLC | 3.085 | 2% | 1,003,858 | $1,985,615,785 |

As has been the case much of this week winning and losing stocks followed winning and losing sectors today.

Magellan Financial Group (ASX:MFG), Judo Capital Holdings (ASX:JDO), Challenger (ASX:CGF) and QBE Insurance (ASX:QBE) were among stocks in the finance sector to rise today.

Healthcare stocks were also on the up today, including leader in obstructive sleep apnoea (OSA) and other sleep-related respiratory disorders ResMed (ASX:RMD), which is due to report its Q2 FY24 results on January 24.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort. Stocks highlighted had announcements.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SGM | Sims Limited | 14.27 | -5% | 306637 | $2,917,465,972 |

| SFR | Sandfire Resources | 6.93 | -5% | 1096570 | $3,317,764,853 |

| VSL | Vulcan Steel | 7.54 | -4% | 36835 | $1,028,929,119 |

| WTC | Wisetech Global Ltd | 70.915 | -4% | 260170 | $24,517,268,067 |

| SUL | Super Ret Rep Ltd | 14.6 | -3% | 814815 | $3,409,980,150 |

| CTT | Cettire | 2.66 | -3% | 1946371 | $1,048,405,105 |

| CIA | Champion Iron Ltd | 8.4 | -3% | 867431 | $4,498,446,777 |

| BSL | BlueScope Steel Ltd | 22.08 | -3% | 496266 | $10,171,089,606 |

| IFT | Infratil Limited | 9.4 | -3% | 59476 | $8,067,580,344 |

| NIC | Nickel Industries | 0.665 | -3% | 2854998 | $2,935,779,768 |

| SIG | Sigma Health Ltd | 0.9175 | -3% | 2362867 | $1,241,099,596 |

| XRO | Xero Ltd | 105.65 | -3% | 217055 | $16,479,336,626 |

| OCL | Objective Corp | 11.94 | -3% | 10508 | $1,169,121,280 |

With the S&P All Technology index losing more than 2% in trade today big name tech stocks felt the fallout. Among the losers billionaire Richard White’s WiseTech Global (ASX:WTC) fell 4%, while accounting software Xero (ASX:XRO) dropped 3%.

Disclosure: The author held shares in ResMed at the time of publishing.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.