ASX Large Caps: ASX 200 closes higher – ‘We’re back baby, we’re back’

Pic: Getty Images

- ASX closes higher as Wall Street rebounds and US bond yields retreat on weaker jobs data

- Lithium miners fall as J.P. Morgan downgrades sector after reviewing lithium price outlook

- Life 360 and Xero higher as tech sector rallies along with gold plays as price of precious metal moves higher

Remember how George Costanza in Seinfeld would exclaim “I’m back baby, I’m back!”? Well, “We’re back baby, we’re back”, or at least today the ASX is moving in the right direction… parts of it anyway.

After a downwards trajectory and closing at an 11-month low on Wednesday, the ASX has closed 0.51% higher for the first time this week and in October.

The Aussie bourse followed a relief rally in Wall Street overnight as the latest ADP jobs data came in weaker than expected. The Institute for Supply Management (ISM) also reported its non-manufacturing PMI slipped to 53.6 last month from 54.5 in August.

In a further relief of the pressure valve on US markets the price of crude oil dropped ~5.6% to below $85 a barrel. As a result of the positive news US treasury yields have fallen from multi-year highs.

But IG markets analyst Tony Sycamore told Stockhead “the current sense of calm can quickly be undone by the release of a hotter-than-expected Non-Farm Payrolls report in the US on Friday”.

“We’ve had a brighter day today but whether the interest rate storm clouds return next week will depend on the outcome of Friday night’s Non-Farm Payrolls Labour Market Report,” he says.

“We had the JOLTs job opening earlier this week in the US which was four standard deviations higher than the market was expecting, then we had last night’s ADP employment report which was cooler, so the deciding factor will be the Non-Farm Payrolls.

“If it fails to show signs of cooling it could make for a very rocky opening on Monday morning.”

Today wasn’t so positive for lithium miners falling following J.P. Morgan downgrading the sector after reviewing its lithium price outlook after a 30% fall in spodumene and a 45-50% fall in carbonate and hydroxide in the September quarter.

The broker has cut Pilbara Minerals (ASX:PLS) to neutral, Core Lithium (ASX:CXO) and IGO (ASX:IGO) to underweight. J.P Morgan maintains an overweight rating for Allkem (ASX:AKE) and Leo Lithium (ASX:LLL) due to valuation support.

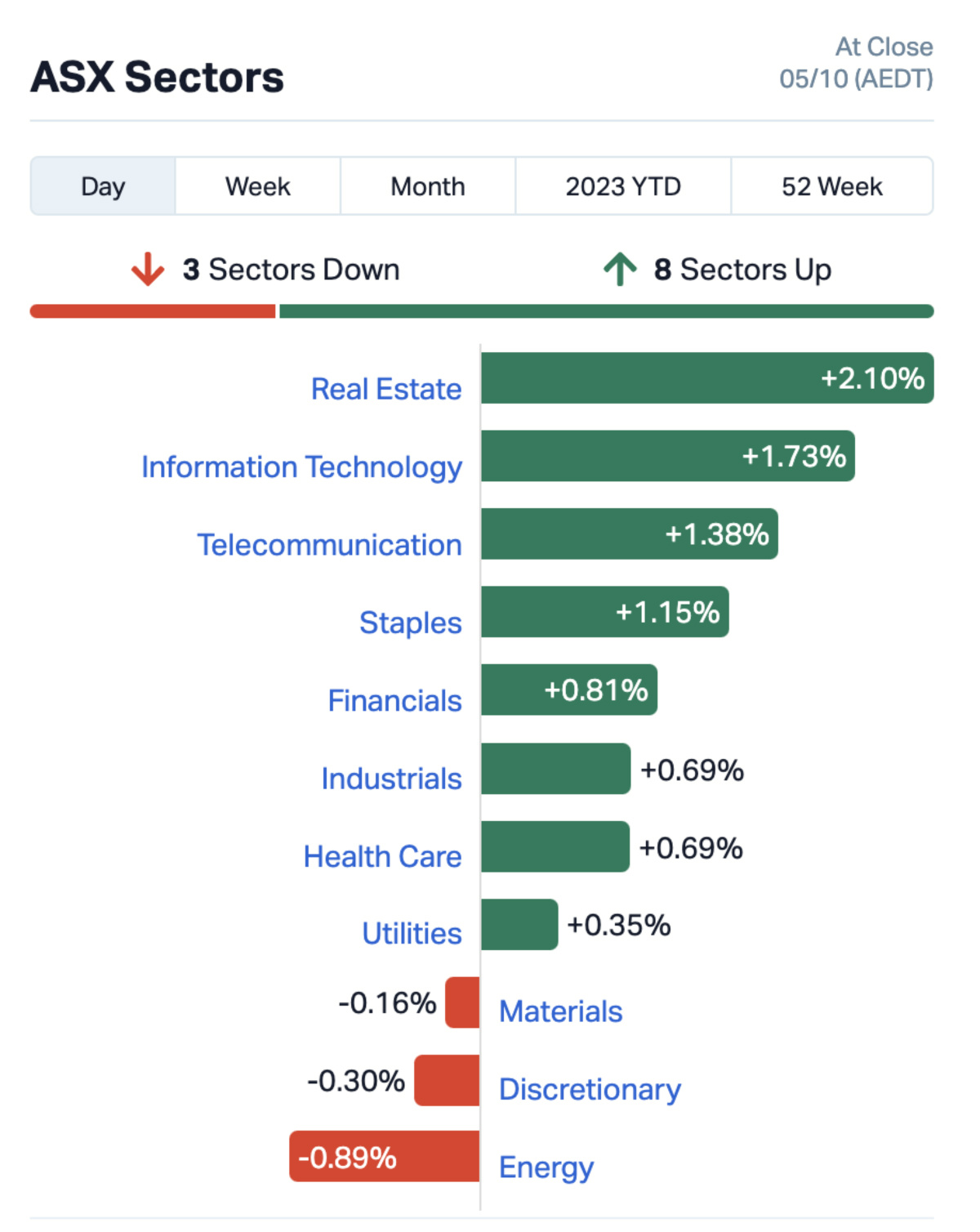

Eight of the 11 sectors were in the green today, with real estate leading the winners and energy topping the laggards.

Asian stocks were also up today buoyed by the Wall Street rally, a cheaper Japanese Yen, lower oil prices and retreating bond yields.

Benchmarks rose in Tokyo, Seoul and Hong Kong. Mainland China has been shut since Friday for the Golden Week holiday, which continues until the end of this week.

BIG CAP WINNERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| APM | APM Human Services | 1.905 | 5% | 750,594 | $1,669,271,142 |

| GMD | Genesis Minerals | 1.39 | 5% | 4,897,954 | $1,380,285,302 |

| NST | Northern Star | 10.635 | 4% | 2,515,162 | $11,686,772,126 |

| HDN | Homeco Daily Needs | 1.1675 | 3% | 1,385,969 | $2,346,982,804 |

| VCX | Vicinity Centres | 1.725 | 3% | 6,846,344 | $7,602,299,848 |

| BGL | Bellevue Gold Ltd | 1.3775 | 3% | 2,799,101 | $1,528,103,682 |

| 360 | Life360 Inc. | 8.25 | 3% | 383,866 | $1,604,693,568 |

| NEU | Neuren Pharmaceuticals | 11.81 | 3% | 570,867 | $1,451,708,304 |

| EVN | Evolution Mining Ltd | 3.26 | 3% | 4,916,552 | $5,823,872,862 |

| NXT | Nextdc Limited | 12.43 | 3% | 516,030 | $6,222,817,278 |

| DXS | Dexus | 7.35 | 3% | 1,923,926 | $7,690,291,509 |

| GPT | GPT Group | 3.84 | 3% | 2,095,409 | $7,164,259,588 |

| NHF | NIB Holdings Limited | 7.505 | 3% | 455,585 | $3,540,063,079 |

| XRO | Xero Ltd | 113.56 | 3% | 592,541 | $16,766,482,703 |

On the winners’ list today were those tracking sectors higher including family tracking app Life360 (ASX:360) and accounting software Xero (ASX:XRO), with the tech sector the second top performer today.

As the price of gold rallied so too did miners of the precious metal with Northern Star Resources (ASX:NST), Genesis Minerals (ASX:GMD)Bellevue Gold (ASX:BGL) and Evolution Mining (ASX:EVN).

The price of the precious metal is up 0.40% to US$1842 ounce.

BIG CAP LOSERS

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MAD | Mader Group Limited | 6.24 | -5% | 141,673 | $1,314,000,000 |

| IGO | IGO Limited | 11.52 | -4% | 2,452,216 | $9,125,077,147 |

| ALL | Aristocrat Leisure | 39.225 | -4% | 1,238,878 | $26,376,938,942 |

| ALD | Ampol Limited | 31.98 | -3% | 466,201 | $7,842,522,078 |

| VEA | Viva Energy Group | 2.78 | -3% | 5,523,738 | $4,416,315,466 |

| MIN | Mineral Resources | 61.68 | -3% | 650,620 | $12,361,156,485 |

| CIA | Champion Iron Ltd | 5.91 | -2% | 1,349,354 | $3,134,812,154 |

| PLS | Pilbara Minerals | 3.95 | -2% | 26,094,479 | $12,188,323,773 |

| ZIM | Zimplats Holding Ltd | 22.16 | -2% | 17,859 | $2,443,374,632 |

| LNW | Light & Wonder Inc. | 108.72 | -2% | 34,559 | $1,366,493,446 |

| KAR | Karoon Energy Ltd | 2.5 | -2% | 1,621,967 | $1,444,418,524 |

| IRE | IRESS Limited | 5.32 | -2% | 722,104 | $1,012,398,949 |

| IFL | Insignia Financial | 2.4 | -2% | 1,932,861 | $1,616,739,710 |

| MEZ | Meridian Energy | 4.82 | -2% | 19,422 | $6,205,235,388 |

| WHC | Whitehaven Coal | 6.735 | -2% | 3,861,628 | $5,722,349,363 |

| RIO | Rio Tinto Limited | 111.91 | -2% | 989,311 | $42,177,586,235 |

| SVW | Seven Group Holdings | 28.8 | -1% | 502,424 | $10,627,241,333 |

On the losers’ list today were energy stocks as the sector and price of oil retreated including Ampol (ASX:ALD), Viva Energy (ASX:VEA) and Karoon Energy (ASX:KAR).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.