ASX July Winners: ASX 200 rose 2.36pc in July as healthcare rebounds 9pc

Investor sentiment lifted in July, pushing the ASX and global markets higher. Pic via Getty Images

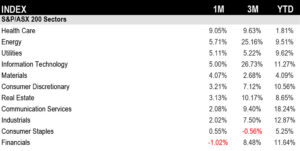

- Australia’s S&P/ASX 200 rose 2.36% in July, posting gains of almost 9% so far for CY25

- Health care had a dose of good medicine, rebounding 9% to be best performing sector for month

- Santa Fe Minerals jumps 739% in July after executing deal to acquire Eburnea project in Côte d’Ivoire

The start of FY26 was a solid month for the ASX which followed global equity markets higher in July, buoyed by easing inflation, strong corporate earnings and renewed investor confidence that central banks may soften their monetary policies.

The S&P/ASX 200 in Australia closed just below its recent all time high, achieving a 2.36% monthly return with all indices in the black, according to S&P Dow Jones Indices (S&P DJI).

Inflation falls fuelling optimism of August rate cut

In Australia, the June quarter inflation data came in below expectations, reinforcing hopes that the Reserve Bank of Australia (RBA) may further ease interest rates from 3.85% at its August meeting.

Figures released by the Australian Bureau of Statistics at the end of July showed CPI inflation fell to 2.1% in the June quarter, down from 3.8% in June 2024.

Globally, optimism grew as US inflation also showed signs of cooling. The Federal Reserve kept interest rates on hold, however, markets have increasingly priced in potential cuts in 2025, supporting a broad rally in US equities.

There was renewed enthusiasm around AI buoyed by tech-heavy Magnificent Seven where earnings results broadly beat expectations.

The S&P 500 rose 2.2% in July, marking its third consecutive month of gains. The tech-heavy Nasdaq Composite added 3.7% for the month, its fourth straight monthly increase. The Dow Jones Industrial Average edged up just 0.1% to maintain its third month of a winning streak.

In China, economic concerns were tempered by fresh stimulus hopes, helping shore up broader investor confidence across Asia-Pacific markets.

Healthcare finally catches a bid, leading gainers up 9% in July

Ten of the 11 sectors rose in July. Long-suffering healthcare, which remains the worst performer YTD, rose 9.05% to lead the gainers in July, much to the delight of Morgan’s senior healthcare analyst Scott Power.

Commodities also played a role in supporting local markets with iron ore, gold and copper prices all rebounding through the month, providing a lift for the heavyweight materials sector, which rose 4.07%. Energy prices also stabilised, offering a tailwind for oil and gas stocks with the sector, rising 5.71%.

Financials was the only sector in the red in July, falling 1.02% hit by delayed rate-cut expectations, stretched valuations and investor profit-taking after a strong run.

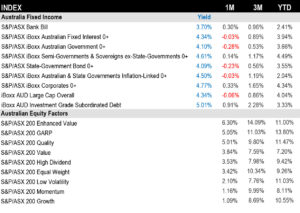

Equity volatility falls in mixed month for fixed income

Equity volatility decreased, reflecting positive market sentiment with the S&P/ASX 200 VIX closing near its YTD low of around 10, while the S&P 500’s VIX fell to a 15 handle, according to S&P DJI. Fixed income indices showed mixed results.

The 50 best performing ASX stocks in July

| CODE | COMPANY | LAST SHARE PRICE | JULY RETURN % | MARKET CAP |

|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.011 | 1000% | $18,769,299 |

| SFM | Santa Fe Minerals | 0.26 | 739% | $18,932,885 |

| FAL | Falcon Metals | 0.49 | 216% | $87,003,080 |

| RPG | Raptis Group Limited | 0.19 | 202% | $66,630,122 |

| OKJ | Oakajee Corp Ltd | 0.058 | 190% | $5,303,870 |

| PAB | Patrys Limited | 0.002 | 182% | $4,731,620 |

| LDX | Lumos Diagnostics | 0.073 | 170% | $54,642,181 |

| NSB | Neuroscientific | 0.235 | 170% | $78,155,291 |

| REY | REY Resources Ltd | 0.027 | 170% | $5,712,144 |

| BCA | Black Canyon Limited | 0.3225 | 169% | $42,883,795 |

| NHE | Noble Helium | 0.05 | 163% | $29,976,250 |

| ASN | Anson Resources Ltd | 0.12 | 161% | $166,408,385 |

| ALR | Altair Minerals | 0.005 | 150% | $21,483,721 |

| PLG | Pearl Gull Iron | 0.015 | 150% | $3,068,127 |

| DY6 | DY6 Metals | 0.26 | 136% | $23,759,499 |

| VMM | Viridis Mining | 1.11 | 136% | $95,704,572 |

| KPO | Kalina Power Limited | 0.0115 | 130% | $33,729,451 |

| EWC | Energy World Corporation | 0.048 | 129% | $147,788,220 |

| CMG | Critical Mineral Group | 0.18 | 125% | $16,297,985 |

| PEC | Perpetual Resources | 0.027 | 125% | $23,577,162 |

| CUF | Cufe Ltd | 0.011 | 120% | $14,812,324 |

| MPA | Mad Paws | 0.135 | 118% | $54,842,705 |

| G50 | G50 Corp Ltd | 0.29 | 115% | $46,573,321 |

| NXS | Next Science Limited | 0.14 | 109% | $40,967,551 |

| I88 | Infini Resources Ltd | 0.17 | 105% | $8,902,903 |

| CMB | Cambium Bio Limited | 0.425 | 102% | $7,770,133 |

| HCT | Holista CollTech Ltd | 0.099 | 102% | $33,169,816 |

| AOA | Ausmon Resorces | 0.002 | 100% | $2,622,427 |

| AS2 | Askari Metalsl | 0.011 | 100% | $4,445,878 |

| CR9 | Corellares | 0.004 | 100% | $4,029,079 |

| CT1 | Constellation Tech | 0.002 | 100% | $2,949,467 |

| GLL | Galilee Energy Ltd | 0.011 | 100% | $7,779,122 |

| QXR | Qx Resources Limited | 0.004 | 100% | $5,241,315 |

| WEL | Winchester Energy | 0.002 | 100% | $2,726,038 |

| PUA | Peak Minerals Ltd | 0.063 | 97% | $183,161,241 |

| NOX | Noxopharm Limited | 0.105 | 94% | $30,684,985 |

| EVG | Evion Group NL | 0.033 | 94% | $14,352,359 |

| AUG | Augustus Minerals | 0.042 | 91% | $7,137,750 |

| BHM | Broken Hill Mines | 0.4 | 90% | $43,037,158 |

| PPK | PPK Group Limited | 0.615 | 89% | $55,849,686 |

| BDG | Black Dragon Gold | 0.086 | 87% | $27,345,081 |

| LAT | Latitude 66 Limited | 0.043 | 87% | $6,166,230 |

| DVL | Dorsavi Ltd | 0.028 | 87% | $25,513,515 |

| FTI | Fortifai Ltd | 0.14 | 87% | $20,536,301 |

| AIV | Activex Limited | 0.013 | 86% | $2,801,534 |

| ICR | Intelicare Holdings | 0.013 | 86% | $6,320,446 |

| TOU | Tlou Energy Ltd | 0.024 | 85% | $31,166,024 |

| RRR | Revolver Resources | 0.057 | 84% | $15,747,633 |

| PGD | Peregrine Gold | 0.275 | 83% | $23,333,129 |

| NVQ | Noviqtech Limited | 0.042 | 83% | $10,564,535 |

Affiliate marketing platform, iSynergy Group (ASX:IS3) rocketed 1000% higher in July after a series of announcements, including that it inked a non-binding memorandum of understanding (MOU) with Malaysian-based technology solutions provider Treasure Global Inc (Nasdaq:TGL) “to explore a proposed strategic collaboration focused on artificial intelligence (AI) infrastructure development”.

The MOU outlines a preliminary deal between IS3 and for the sale and purchase of advanced AI-based GPUs, as well as potential joint initiatives to design, develop, and deploy AI cloud infrastructure in Malaysia.

Santa Fe Minerals (ASX:SFM) jumped 739% in July to a three-year high of 26 cents after executing a deal to acquire the Eburnea project in Côte d’Ivoire from Turaco Gold (ASX:TCG) .

Binding share purchase agreements will give SFM 100% of the Satama permit covering 168.7km2 and up to 90% of the Bouake North application covering 380.8km2 once granted.

Satama has delivered encouraging results, including 26m at 4.82g/t gold, and lies on a 2km mineralised zone with strong potential for growth, supported by geophysical and historical data pointing to multiple repeat parallel zones.

Pet stock Mad Paws (ASX:MPA) rose 118% in July after inking a $62 million takeover deal with US pet care giant Rover, with shareholders set to receive 14 cents a share in cash, an 87% premium to its last closing price.

As part of the deal, MPA will offloading its Pet Chemist business to VetPartners for around $13m and shut down its Sash and Waggly brands. The board’s backing the deal, and so are major holders.

The 50 worst performing ASX stocks in July

| CODE | COMPANY | LAST SHARE PRICE | JULY RETURN % | MARKET CAP |

|---|---|---|---|---|

| AQC | Auspaccoal Ltd | 0.009 | -84% | $6,304,208 |

| CDE | Codeifai Limited | 0.02 | -71% | $9,438,019 |

| BOE | Boss Energy Ltd | 1.74 | -63% | $721,963,429 |

| MHK | Metalhawk | 0.17 | -59% | $20,976,736 |

| LOC | Locate Technologies | 0.087 | -59% | $20,460,167 |

| BYH | Bryah Resources Ltd | 0.005 | -58% | $5,142,663 |

| BOT | Botanix Pharma Ltd | 0.15 | -53% | $294,168,996 |

| 1TT | Thrive Tribe Tech | 0.01 | -50% | $1,015,864 |

| PNT | Panther Metals | 0.009 | -44% | $2,708,141 |

| RIM | Rimfire Pacific | 0.014 | -42% | $35,362,515 |

| SMM | Somerset Minerals | 0.014 | -42% | $9,031,127 |

| CGR | CGN Resourcesl | 0.048 | -40% | $4,357,353 |

| IMU | Imugene Limited | 0.27 | -39% | $77,894,281 |

| LIC | Lifestyle Communities | 4.44 | -37% | $540,525,840 |

| AUZ | Australian Mines Ltd | 0.007 | -36% | $11,977,085 |

| MPP | Metro Performance Glass | 0.042 | -36% | $7,785,880 |

| VIG | Victor Group Hldgs | 0.049 | -36% | $31,959,107 |

| ZMI | Zinc of Ireland NL | 0.007 | -36% | $4,074,075 |

| CYQ | Cycliq Group Ltd | 0.002 | -33% | $921,033 |

| ECT | Env Clean Tech | 0.002 | -33% | $8,030,871 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | $3,253,779 |

| IVT | Inventis Limited | 0.01 | -33% | $764,244 |

| AR9 | Archtis Limited | 0.155 | -33% | $52,584,833 |

| UBI | Universal Biosensors | 0.024 | -31% | $7,153,618 |

| UCM | Uscom Limited | 0.011 | -31% | $2,861,618 |

| R8R | Regener8 Resources NL | 0.093 | -31% | $3,032,033 |

| HMC | HMC Capital Limited | 3.59 | -30% | $1,481,290,474 |

| VHL | Vitasora Health Ltd | 0.028 | -28% | $48,119,228 |

| AQD | Ausquest Limited | 0.043 | -27% | $59,877,115 |

| NMR | Native Mineral Resources | 0.135 | -27% | $132,118,024 |

| HYT | Hyterra Ltd | 0.019 | -27% | $31,686,448 |

| KAI | Kairos Minerals Ltd | 0.022 | -27% | $57,880,068 |

| AII | Almonty Industries | 5.32 | -27% | $61,497,955 |

| REM | Remsense Tchnologies | 0.034 | -26% | $5,685,956 |

| BB1 | Blinklab Limited | 0.43 | -25% | $37,522,297 |

| AM5 | Antares Metals | 0.006 | -25% | $3,089,117 |

| CHM | Chimeric Therapeutic | 0.003 | -25% | $9,747,370 |

| EDEDA | Eden Innovations | 0.03 | -25% | $6,164,822 |

| KLR | Kaili Resources Ltd | 0.006 | -25% | $884,402 |

| M4M | Macro Metals Limited | 0.006 | -25% | $23,864,505 |

| NIM | Nimy Resources | 0.06 | -25% | $14,428,847 |

| RGL | Rivers Gold | 0.003 | -25% | $5,051,138 |

| RLG | Roolife Group Ltd | 0.003 | -25% | $4,778,344 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| ESR | Estrella Res Ltd | 0.039 | -25% | $80,194,018 |

| SX2 | Southgold Consol | 5.42 | -25% | $764,254,889 |

| AGR | Aguia Res Ltd | 0.025 | -24% | $36,981,833 |

| GEM | G8 Education Limited | 0.9 | -24% | $694,402,880 |

| QEM | QEM Limited | 0.029 | -24% | $6,855,610 |

| CTT | Cettire | 0.26 | -24% | $99,121,937 |

| VTX | Vertexmin | 0.195 | -24% | $42,920,366 |

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.