ASX hybrid notes pay 2pc above TD and are deemed ‘less risky’ than bank shares – but there’s a catch

Aussies can buy Hybrid Securities on the ASX. Picture Getty

- Hybrid securities were put under the spotlight after the acquisition of Credit Suisse

- Australian investors could also buy hybrid securities on the ASX

- We look at the risk vs return for ASX banks’ Capital Notes

The sale of Credit Suisse to UBS last week has averted a systemic crisis, but it may also have inadvertently created an unwanted precedent for bondholders.

The market was spooked after holders of US$17 billion worth of Credit Suisse AT1 bonds were wiped out following a “complete writedown” of their values.

AT1 (or Additional Tier 1) bonds are a type of hybrid securities that banks are supposed to hold on their balance sheet as a safeguard against any potential bank run or credit event.

They’re designed to convert automatically into equity when the bank runs into trouble, in order to cushion and shore up the lender’s capital base.

On the credit totem pole, AT1 bonds are not guaranteed by the government and so rank below common deposits, but they’re above common equity because generally when a company goes bust, bondholders rank before shareholders.

In the takeover of Credit Suisse, however, CS shareholders were not wiped out completely, and were instead compensated by shares in UBS.

AT1 bondholders on the other hand were left with zero cents in the dollar, creating a precedent that could potentially push up the cost of AT1 bonds in the future.

Hybrid Notes – relevant for ASX investors?

Australian banks are also subject to tiered capital adequacy requirements under the Basel accord, and as a consequence our banks regularly issue hybrid securities called Capital Notes.

Following the introduction of ASIC’s DDO (design and distribution obligations) legislation in 2021, Capital Notes can now be traded on the ASX by retail investors who are receiving personal financial advice.

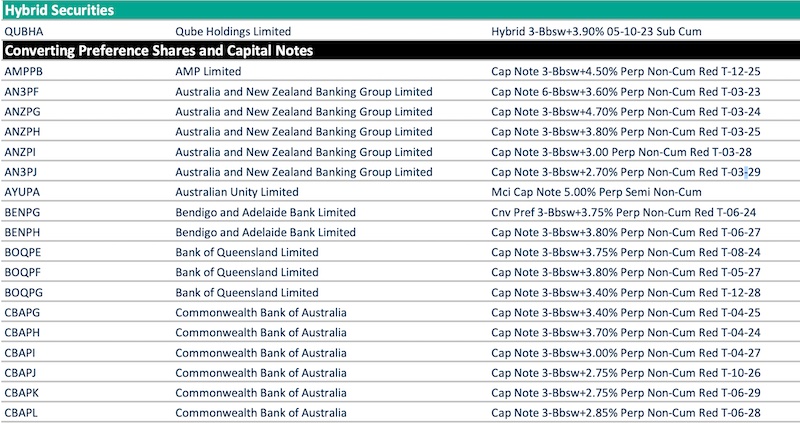

Here’s a list of some outstanding Capital Notes currently traded on the ASX (not exhaustive):

In Australia, Capital Notes are part of the broader hybrid securities cohort which also include Convertible Bonds and Preference Shares.

They’re generally perceived as less risky than ordinary shares, because coupons (called distributions) from Capital Notes must be paid in full before any ordinary share dividend can be paid.

Just like AT1 bonds, Capital Notes include trigger events which may cause them to be mandatorily converted to ordinary shares, and in some circumstances may even be written off and deemed worthless (as we saw in the CS collapse).

But here’s the biggest catch for investors:

“Missed distribution / coupon payments do not accumulate, meaning that failure to pay a distribution by the bank will not constitute an event of default.”

To compensate for that risk, Capital Notes pay higher rates than term deposits – currently a good 3% spread above the prevailing three-month BBSW (bank bill swap) rate.

At the time of writing, the three-month BBSW rate stands at around 3.70%, meaning that most Capital Notes pay well over 6% in annual coupons.

Quick Capital Note example

ANZ 2028 Capital Note (ASX:ANZPI) pays 3% spread over the the three-month BBSW rate.

This means that at the last fixing, the Note pays an effective annual coupon of 6.21%.

(BBSW gets reset every three months, so the effective coupon rate will fluctuate accordingly.)

Distribution Rate = (BBSW rate + Margin) x (1 – Tax Rate)

The 6.21% coupon on the Note is more than 2% higher than the current 5-year term deposit offered by ANZ, which is at 4.05%.

The other reason why Capital Notes pay a much higher coupon than term deposits is credit risk premium.

Bank depositors are guaranteed by the Australian government up to a cap of $250,000 per account-holder, whereas Capital Notes investors face a potential wipeout in a worst-case scenario.

Another thing to keep in mind before investing in ANZPI is that the Note could be converted into ANZ ordinary shares on September 20, 2030.

This conversion is subject to conditions or credit trigger events like ANZ’s insolvency, which may never be met. Accordingly, if the Note is not converted on that date, it could remain on issue indefinitely – making it a perpetual bond.

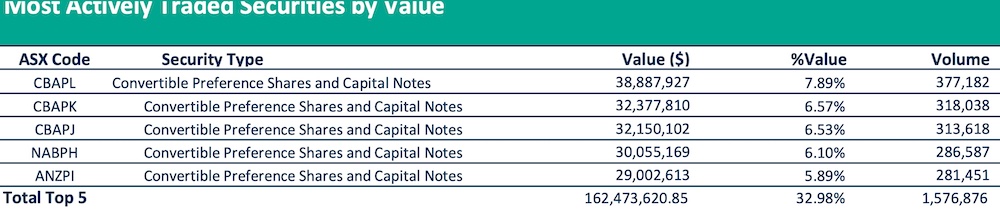

It’s also worth noting that liquidity on Capital Notes are usually low.

According to data from the ASX, ANZPI Note had 281,000 in transaction volumes for the whole month, which is only 5.89% of its outstanding issuance.

What this means is that it could be much more difficult to sell (or buy) Capital Notes in the market than the bank’s ordinary shares.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.