ASX December Winners: The best 50 stocks as optimism for 2024 pushes markets near record high

The S&P ASX 200 finished 2023 with

- The S&P ASX 200 rose more than 7% in December to finish up 12% for the year, just short of a record high

- Real estate and health care had the biggest December gains, while all sectors finished the year up

- Resources stocks top the winners board in December, including Arrow Minerals and Battery Minerals

Easing inflation and potential for lower interest rates in 2024 saw Australia’s S&P ASX 200 soar to its best monthly return in three years by adding more than 7% in December.

The benchmark finished 2023 with a gain of 12%, closing just 0.3% away from a record high.

Small and mids caps had a strong end to the year, with the S&P ASX small ordinaries up more than 7% and the S&P ASX MidCap 50 up 6.88%.

The S&P ASX Emerging Companies index also rose 6.47% for the year, however was just short of ending 2023 in positive territory, according to S&P Dow Jones Indices.

The final two months of 2023 was a welcome reversal in sentiment with the S&P ASX 200 looking like finishing the year in the red by October’s end.

End of year rally after tough 2023

After a challenging 2023, the Aussie bourse and global financial markets finally hit a turning point in November which continued into December.

Despite ongoing conflicts, including the war in Ukraine and tensions between Israel and Hamas, there were signs macroeconomic conditions were improving with overall market sentiment more optimistic in the last two months of the year.

S&P reported a strong end to 2023 on Wall Street with the the S&P 500 finishing with an impressive 26% return for the year and nine consecutive weeks of gains.

“The relentless strength of the Magnificent Seven powered those gains throughout, pushing the mega-cap S&P 500 Top 50 up a stonking 38%,” S&P says.

In more positive news to end the year the US Federal Reserve’s December forecast of three interest rate cuts in 2024 was more aggressive than what officials had been indicating.

In its 2024 market outlook report Macquarie Asset Management(MAM) says it believes that the small cap end of the stock market could be ripe for buying,

MAM says listed equities may face headwinds in 2024 from the more volatile economic backdrop, while bonds may become a worthwhile alternative again.

“While US large-cap stock valuations look stretched, opportunities may remain in small-caps and listed real assets,” wrote MAM.

Real estate lead sectors, all equity factors up

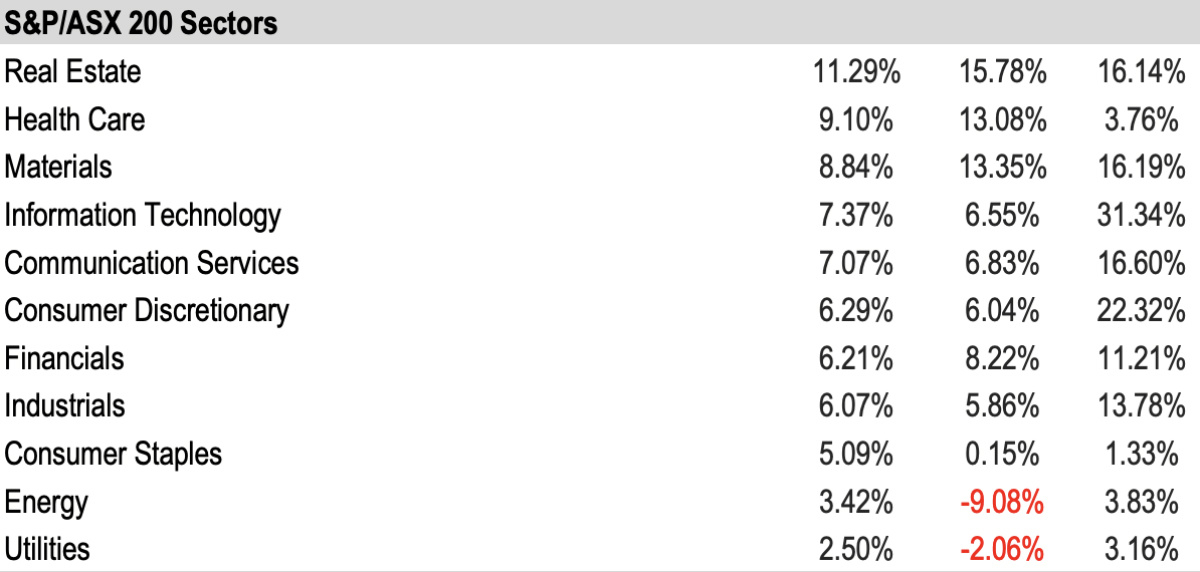

All sectors in the S&P ASX 200 rose in December with real estate and health care continuing to lead the pack, rising 11% and 9% respectively, following over 10% gains in November.

Defensive sectors including utilities and consumer staples continued to lag with the least gains, along with energy accompanied by weak oil prices. All sectors finished 2023 in positive territory.

All equity factor indices were in positive territory in December. The S&P ASX 200 Quality was the best performing factor with a more than 9% gain in December and ~21% in 2023, while Momentum barely closed the year in the green.

The thematically-targeted S&P/ASX All Technology index offered the highest annual return among reported indices, with a total return of ~36%.

Fixed income up in December

Fixed income indices also remained in positive territory again in December after being down in September and October. While all reported fixed income indices generated positive returns in 2023, inflation-linked government bonds topped the winners with 8-9% gains.

Here are the 50 best performing ASX stocks for December:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | DECEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| AMD | Arrow Minerals | 0.005 | 233% | $17,368,825 |

| BAT | Battery Minerals Ltd | 0.12 | 216% | $17,923,740 |

| ETR | Entyr Limited | 0.018 | 200% | $35,695,870 |

| FHS | Freehill Mining Ltd | 0.006 | 200% | $17,099,007 |

| MTM | MTM Critical Metals | 0.068 | 143% | $6,761,722 |

| TTT | Titomic Limited | 0.043 | 115% | $39,247,893 |

| AWJ | Auric Mining | 0.12 | 107% | $15,703,151 |

| ATP | Atlas Pearls Ltd | 0.185 | 103% | $79,336,417 |

| RIM | Rimfire Pacific | 0.02 | 100% | $44,404,895 |

| WZR | Wisr Ltd | 0.048 | 100% | $65,501,499 |

| SZL | Sezzle Inc. | 27.94 | 95% | $59,041,662 |

| BLY | Boart Longyear | 2.75 | 94% | $813,781,139 |

| MIL | Millennium Grp Ltd | 1.08 | 85% | $50,936,320 |

| ST1 | Spirit Technology | 0.08 | 82% | $58,955,043 |

| AD1 | AD1 Holdings Limited | 0.009 | 80% | $8,087,835 |

| EYE | Nova EYE Medical Ltd | 0.24 | 78% | $45,750,934 |

| ATH | Alterity Therap Ltd | 0.007 | 75% | $19,616,523 |

| MKR | Manuka Resources | 0.077 | 71% | $43,514,245 |

| BIO | Biome Australia Ltd | 0.205 | 71% | $43,457,058 |

| FLX | Felix Group | 0.16 | 70% | $32,719,954 |

| 8IH | 8I Holdings Ltd | 0.017 | 70% | $6,075,052 |

| ZIP | ZIP Co Ltd | 0.635 | 67% | $617,210,251 |

| BGE | Bridge SaaS Ltd | 0.05 | 67% | $5,969,853 |

| ENV | Enova Mining Limited | 0.015 | 67% | $9,613,940 |

| NGY | Nuenergy Gas Ltd | 0.033 | 65% | $48,871,531 |

| KNB | Koonenberrygold | 0.051 | 65% | $6,107,203 |

| LNR | Lanthanein Resources | 0.0115 | 64% | $14,832,837 |

| AGR | Aguia Res Ltd | 0.018 | 64% | $9,098,656 |

| LNK | Link Admin Holdings | 2.18 | 62% | $1,125,724,709 |

| CMP | Compumedics Limited | 0.28 | 60% | $49,605,625 |

| ATG | Articore Group Ltd | 0.69 | 59% | $195,076,954 |

| KCC | Kincora Copper | 0.041 | 58% | $8,193,237 |

| MTC | Metalstech Ltd | 0.22 | 57% | $41,570,010 |

| M24 | Mamba Exploration | 0.05 | 56% | $3,049,167 |

| IMB | Intelligent Monitor | 0.44 | 54% | $106,237,057 |

| TBN | Tamboran | 0.225 | 53% | $443,604,960 |

| EOF | Ecofibre Limited | 0.16 | 52% | $60,619,824 |

| DXB | Dimerix Ltd | 0.205 | 52% | $87,346,959 |

| MME | Moneyme Limited | 0.083 | 51% | $66,406,514 |

| ARN | Aldoro Resources | 0.125 | 51% | $16,827,968 |

| WA1 | WA1 Resources | 12.4 | 50% | $527,306,280 |

| AYM | Australia United Mining | 0.003 | 50% | $5,527,732 |

| BFC | Beston Global Ltd | 0.009 | 50% | $17,973,422 |

| FAU | First Au Ltd | 0.003 | 50% | $4,985,980 |

| GGE | Grand Gulf Energy | 0.0105 | 50% | $22,000,094 |

| LRS | Latin Resources Ltd | 0.285 | 50% | $796,234,767 |

| SPA | Spacetalk Ltd | 0.0265 | 47% | $12,361,613 |

| PVT | Pivotal Metals Ltd | 0.025 | 47% | $17,001,395 |

| TSI | Top Shelf | 0.22 | 47% | $45,644,689 |

| CU6 | Clarity Pharma | 1.9 | 46% | $498,255,599 |

Resources stocks topped the winners list in December with Arrow Minerals (ASX:AMD) topping the leader board. AMD announced in December that it had appointed iron ore executive and previous MD of Atlas Iron David Flanagan as its new MD to unlock the potentially significant value of its Simandou North iron project in Guinea, West Africa.

Flanagan also subscribed to $175k of a $3.5 million placement at 1 cent/share.

Battery Minerals (ASX:BAT) also had a good end to the year with its share price surging 216% in December. The company announced reprocessing of historic induced polarisation (IP) geophysical data had “upgraded the Spur and Spur South Prospects, defining a strongly resistive, southerly plunging anomaly away from existing mineralisation, including 86m @ 1.56g/t Au, 536ppm Cu”.

Furthermore, BAT says assay and screen fire results had been received from the Stawell Project, upgrading the prospectivity of the Frankfurt Prospect for large scale IRG mineralisation.

Results from the latter looked like this: 118.9m @ 0.1g/t Au, 11.8ppm Mo from 17.1m, including 16.1m @ 0.34g/t Au from 108.4m.

BAT was issued with a please explain from the ASX on December 14 after strong share price movements. The company responded it was unaware of any news the market didn’t know about but pointed to a placement at a premium price of 38 cents/share to strategic resources investors on December 8, followed by subsequent substantial shareholder notices from those investors over the following days as the possible reason for share price growth.

Tyre recycling co Entyr (ASX:ETR) rose 200% after announcing an offtake deal with Trafigura, which could earn it ~$18 million a year.

Based on early market feedback, ETR says it anticipates “acceptable” market prices of ~$200/t for recovered carbon black and $750/t for oil.

Here are the 50 worst performing ASX stocks for December:

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | LAST SHARE PRICE | DECEMBER RETURN % | MARKET CAP |

|---|---|---|---|---|

| NPM | Newpeak Metals | 0.016 | -84% | $1,599,228 |

| PBL | Parabellum Resources | 0.07 | -80% | $4,361,000 |

| JAV | Javelin Minerals Ltd | 0.002 | -70% | $2,176,231 |

| NFL | Norfolk Metals | 0.155 | -65% | $5,475,374 |

| SHN | Sunshine Metals Ltd | 0.014 | -62% | $17,136,118 |

| TG6 | TG Metals | 0.385 | -57% | $20,823,174 |

| KGD | Kula Gold Limited | 0.015 | -55% | $6,290,487 |

| MSG | Mcs Services Limited | 0.01 | -50% | $1,980,997 |

| ICU | Investor Centre Ltd | 0.035 | -48% | $10,611,931 |

| STK | Strickland Metals | 0.095 | -47% | $155,018,447 |

| GTG | Genetic Technologies | 0.135 | -46% | $15,581,328 |

| BME | Black Mountain Energy | 0.012 | -45% | $4,598,690 |

| PHL | Propell Holdings Ltd | 0.011 | -45% | $1,323,911 |

| FME | Future Metals NL | 0.031 | -43% | $13,708,811 |

| NHE | Noble Helium | 0.105 | -43% | $32,781,365 |

| HCD | Hydrocarbon Dynamic | 0.004 | -43% | $2,598,664 |

| WNX | Wellnex Life Ltd | 0.023 | -43% | $24,908,439 |

| RIE | Riedel Resources Ltd | 0.0035 | -42% | $7,783,425 |

| NIS | Nickelsearch | 0.073 | -42% | $15,588,599 |

| OEQ | Orion Equities | 0.068 | -41% | $1,064,148 |

| KLI | Killi Resources | 0.045 | -39% | $2,680,878 |

| LBT | LBT Innovations | 0.011 | -39% | $13,856,447 |

| NKL | Nickelx Ltd | 0.037 | -38% | $3,249,161 |

| NSB | Neuroscientific | 0.044 | -38% | $6,362,614 |

| T88 | Taiton Resources | 0.093 | -38% | $5,001,033 |

| CHR | Charger Metals | 0.165 | -38% | $11,997,871 |

| HTG | Harvest Tech Grp Ltd | 0.015 | -38% | $10,589,450 |

| ERW | Errawarra Resources | 0.094 | -37% | $9,016,543 |

| VMS | Venture Minerals | 0.007 | -36% | $15,470,091 |

| FG1 | Flynn Gold | 0.052 | -36% | $7,577,661 |

| NOX | Noxopharm Limited | 0.071 | -35% | $20,748,894 |

| CI1 | Credit Intelligence | 0.155 | -35% | $13,647,008 |

| RGL | Riversgold | 0.011 | -35% | $10,644,276 |

| HMD | Heramed Limited | 0.024 | -35% | $7,710,341 |

| VML | Vital Metals Limited | 0.0065 | -35% | $38,317,935 |

| GTE | Great Western Exploration | 0.026 | -35% | $7,382,651 |

| IND | Industrial Minerals | 0.755 | -34% | $51,913,800 |

| ADS | Adslot Ltd | 0.002 | -33% | $6,448,991 |

| AMM | Armada Metals | 0.028 | -33% | $5,824,000 |

| CLE | Cyclone Metals | 0.001 | -33% | $10,471,172 |

| NIM | Nimy Resources | 0.14 | -33% | $19,343,372 |

| PEC | Perpetual Res Ltd | 0.01 | -33% | $6,300,294 |

| SNT | Syntara Limited | 0.02 | -33% | $16,620,127 |

| XPN | Xpon Technologies | 0.02 | -33% | $6,072,163 |

| SPQ | Superior Resources | 0.013 | -32% | $26,015,865 |

| SCL | Schrole Group Ltd | 0.2 | -31% | $7,191,010 |

| MXC | MGC Pharmaceuticals | 0.475 | -31% | $17,333,525 |

| LRV | Larvotto Resources | 0.07 | -30% | $14,874,940 |

| MXR | Maximus Resources | 0.035 | -30% | $11,221,202 |

| RNX | Renegade Exploration | 0.007 | -30% | $6,998,066 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.