ASX copper stocks took off yesterday — can prices keep climbing?

17 ASX copper stocks posted double-digit gains yesterday as the outlook remains bullish. (Pic: Getty)

Copper prices have been flying for some time, and ASX investors kicked off the week with another round of strong demand for copper stocks yesterday.

From a cohort of around 90 companies with copper operations, 17 stocks posted an intraday return of at least 10 per cent to start the week.

Gains were led by Hammer Metals (ASX:HMX) which climbed by 23.8pc and is up by more than 1,400pc over the past 12 months.

A number of themes have underpinned the move; strong demand out of China, the prospect of a global growth recovery as economies emerge from the pandemic, and the prevalence of copper as a key input in electric vehicles and renewable energy.

“Around four times more copper is used in an electric vehicle than a regular internal combustion engine (ICE) automobile,” CBA analyst Vivek Dhar notes.

It’s a similar story for renewable energy systems, which around five times as much copper as traditional power sources.

Like iron ore, copper prices have also been supported by the post-COVID boom in industrial production activity out of China, which accounts for around 55-60 per cent of global copper demand.

And since the first positive vaccine news in November, that outlook has extended to other major economies such as the US, where the Biden administration has flagged big infrastructure spending plans to help kickstart activity.

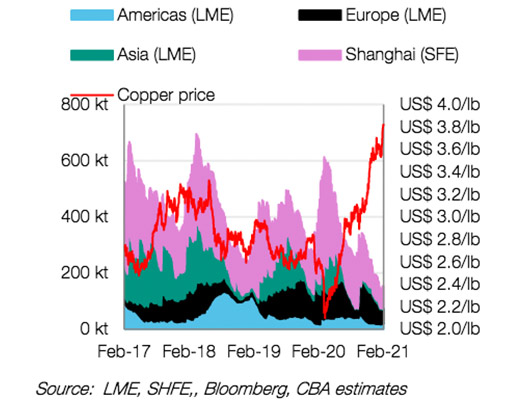

In light of the above, copper prices can be explained by simple economics. This CBA chart tells the story:

The chart shows that copper stockpiles at the Shanghai Futures Exchange (SHFE) warehouse have plummeted over the past year.

Global warehouse stockpiles for the London Metals Exchange (LME) have also fallen.

Taken in aggregate, the shift “likely indicates that current demand is robust (or at the very least that current demand is outpacing supply)”, Dhar said.

For ASX copper stocks, where prices are headed next is now the key question.

Dhar expects prices to peak at $US3.90 per pound in the June quarter, before easing back to $US3.60/lb by the end of the year.

Based on the chart above, that still represents a material premium to the multi-year average.

In the near-term, Dhar said the bulk of the price action will be driven by activity out of China.

For prices to continue climbing above $US4/lb, China will have to maintain its torrid pace of construction activity into the second half of this year.

However, indications suggest that the pace of activity may be slowing down.

“Manufacturing PMIs have slipped (but still remain expansionary) and steel mill margins are negative,” Dhar said.

Over the medium term, Dhar said he expects the pace of refined copper supply to catch up to demand through 2023.

“That should eventually ease the physical deficit in copper markets and ultimately keep a lid on copper prices,” Dhar said.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.