ASX August Winners Column: Cannabis could be making a comeback

Pic: 4x6 / iStock / Getty Images Plus via Getty Images

- August a solid month for stocks — despite 10 out of 11 sectors ending in the red

- Copper explorer Cobre kicks off drilling at Botswanan project

- Cannabis could be making a comeback with Cronos paying its first ever dividend

August was a fairly strong month for ASX stocks, despite 10 out of 11 sectors coming in lower along with the ASX200.

The sea of red came in hot towards the end of August, after Wall Street plunged when US Fed’s Jerome Powell said the Fed must continue to raise interest rates to stop inflation from becoming a permanent aspect of the US economy.

“We must keep at it until the job is done,” Powell said, twice, in his unusually short eight-minute speech.

“These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain,” he added.

In the UK, Citi Bank economists have forecast that UK inflation will hit 18% in early 2023 (from the current 10%), topping the Bank of England’s prediction of 13%.

The last time UK’s inflation is at 18% was in 1976 when the oil supply shock left the country seeking a bailout from the IMF.

And while most central banks were hiking rates, the Chinese Central Bank cut its 1-year loan prime rate to 3.65% from 3.70%.

Analysts reckon it shows the Chinese Communist Party is getting pretty concerned about the domestic property market and other indicators like retail sales, which fell to a 2.7% growth vs consensus of 5%.

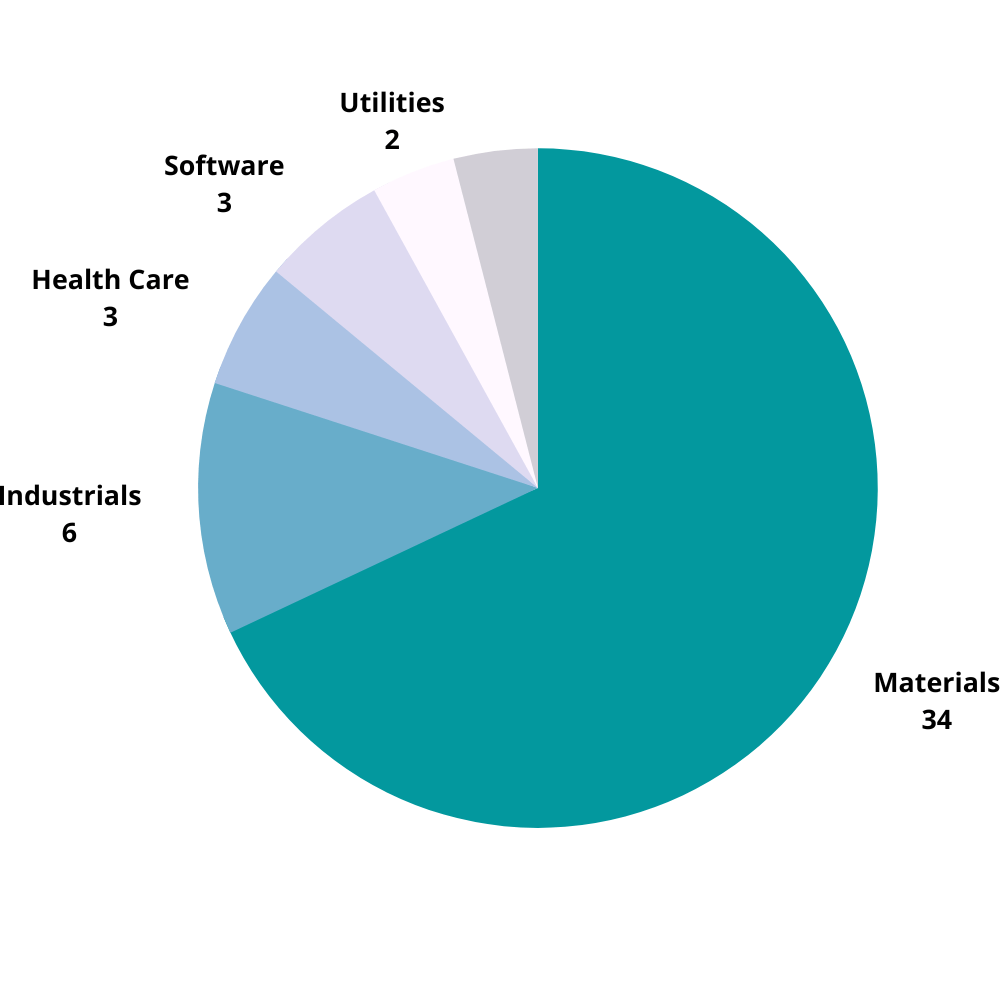

Which ASX sectors performed best in August?

Here are the top 50 performing ASX stocks for August:

Scroll or swipe to reveal table. Click headings to sort.

Code Company August Return % Last Share Price Market Cap Sector CBE Cobre 435% 0.46 $92,965,510.10 Materials AQC Auspaccoal Ltd 284% 0.365 $18,426,955.65 Materials RAS Ragusa Minerals Ltd 222% 0.245 $31,517,796.66 Materials IR1 Irismetals 197% 1.115 $67,870,050.00 Materials LNR Lanthanein Resources 188% 0.046 $44,289,976.22 Materials ASN Anson Resources Ltd 173% 0.355 $364,908,878.93 Materials MAG Magmatic Resrce Ltd 170% 0.17 $43,262,755.66 Materials ECG Ecargo Hldg 133% 0.028 $17,227,000.00 Industrials DRE Dreadnought Resources Ltd 115% 0.14 $425,744,697.14 Materials OSX Osteopore Limited 111% 0.285 $33,421,447.83 Healthcare KFM Kingfisher Mining 108% 0.5 $17,122,500.50 Materials AM7 Arcadia Minerals 107% 0.29 $13,542,388.68 Materials AHI Adv Human Imag Ltd 104% 0.245 $41,221,098.59 Software AMM Armada Metals 100% 0.13 $6,500,000.00 Materials NTL New Talisman Gold 100% 0.003 $9,381,676.09 Materials ODM Odin Metals Limited 100% 0.028 $16,305,641.38 Materials LIN Lindian Resources 96% 0.265 $224,811,958.45 Materials WC1 Westcobarmetals 95% 0.195 $5,996,264.63 Materials PG1 Pearl Global Ltd 92% 0.025 $25,056,182.93 Industrials TAS Tasman Resources Ltd 92% 0.023 $15,436,502.12 Materials CNJ Conico Ltd 90% 0.055 $79,877,789.42 Materials BRX Belararoxlimited 89% 0.69 $21,617,713.80 Materials PX1 Plexure Group 88% 0.32 $113,146,361.28 Software PPG Pro-Pac Packaging 87% 0.635 $51,505,110.35 Materials PGD Peregrine Gold 86% 0.78 $30,202,813.68 Materials CDD Cardno Limited 84% 0.59 $23,045,791.17 Industrials TPC TPC Consolidated Ltd 83% 2.77 $31,510,448.01 Utilities DXN DXN Limited 83% 0.011 $18,934,463.20 Software WCN White Cliff Min Ltd 82% 0.02 $13,072,067.24 Materials NYM Narryermetalslimited 80% 0.18 $5,024,250.00 Materials IMI Infinitymining 75% 0.21 $12,075,000.00 Materials PO3 Purifloh Ltd 72% 0.43 $13,555,104.14 Utilities MRL Mayur Resources Ltd 71% 0.12 $28,985,239.56 Materials DTM Dart Mining NL 71% 0.125 $16,907,520.00 Materials MMG Monger Gold Ltd 71% 0.41 $16,416,400.00 Materials SOP Synertec Corporation 71% 0.205 $73,258,914.80 Industrials ATR Astron Corp Ltd 70% 0.85 $104,105,516.30 Materials DAF Discovery Alaska Ltd 70% 0.078 $17,490,306.44 Materials RAP Resapp Health Ltd 70% 0.195 $167,640,930.02 Healthcare DCG Decmil Group Limited 68% 0.235 $36,522,286.71 Industrials MCT Metalicity Limited 67% 0.005 $17,293,530.03 Materials MOH Moho Resources 67% 0.04 $6,645,190.56 Materials RR1 Reach Resources Ltd 67% 0.005 $9,550,253.20 Materials BPH BPH Energy Ltd 63% 0.024 $18,727,988.78 Energy AL3 Aml3D 60% 0.125 $23,507,928.00 Industrials SPD Southernpalladium 59% 0.96 $41,355,193.92 Materials HAV Havilah Resources 58% 0.395 $125,072,487.95 Materials FHE Frontier Energy Ltd 58% 0.39 $89,459,235.45 Energy CAU Cronos Australia 55% 0.435 $240,338,332.59 Healthcare PBL Parabellumresources 55% 0.31 $12,909,175.31 Materials

Cobre kicks off copper exploration

The miner-heavy S&P/ASX 200 Materials [XMJ] index was one of the best performers last month with 14 out of 16 stocks tipping 100%+.

Standing tall was exploration minnow Cobre (ASX:CBE), up a massive 435% after kicking off Stage 1 infill diamond drilling at its Ngami copper project in Botswana.

The company swiftly followed up with announcements that the fourth diamond hole had intersected more copper mineralisation – one of the main commodities at the heart of most electrical technologies – extending the target footprint to over 4km as well as flagging mineralisation at depth to more than 315m.

Plus, Cobre nabbed renewals from the Botswanan Department of Mines for five exploration licences.

“The renewal of these exploration licences has come at a significant time for the company as we commence an aggressive exploration program in Botswana,” executive chairman and MD Martin Holland said.

“The renewal cements the belt-scale opportunity provided by our extensive land package in the Kalahari Copper Belt, and will support an additional exploration pipeline of targets for future drill testing.”

Cannabis makes a comeback

The Healthcare sector was down the least out of the losers this month, only dropping 1.43%.

And Cronos (ASX:CAU) might be partially to thank, sneaking into the top 50 for August after distributing the Aussie medicinal cannabis sector’s first ever dividend.

The 1.0 cent per ordinary share, a fully franked dividend is an exciting development for pot stocks, which have been sparse in the news department this year, and a bit stagnant really since the boom in 2016 when legalisation started kicking off in different countries around the world.

Following CAU’s merger with CDA Health in late 2021, the med-cannabis group has generated decent, even strong growth, resulting in gross revenues to June 30 of almost $67 million and a net profit after tax of more than $6m.

To ice the cake, the Cronos Australia board has also resolved to introduce a Dividend Reinvestment Plan (DRP). Participants in the DRP will be entitled to receive a discount of 3% to the company’s share price.

“Looking forward to 2023, we are confident Cronos Australia is positioned to deliver further growth and shareholder value,” CEO and executive director Rodney Cocks says.

“We believe the market for medicinal cannabis products will continue to grow and based on current sales and growth, revenue for FY23 is likely to exceed $100 million.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.