ASX April winners and losers: ASX shows resilience to rally 3.62% despite Trump blows

The ASX performed well in April to ease post-Liberation Day jitters. Pic: Getty Images

- Australia’s S&P/ASX 200 rallies 3.62% in April, showing resilience to global geopolitical and economic uncertainty

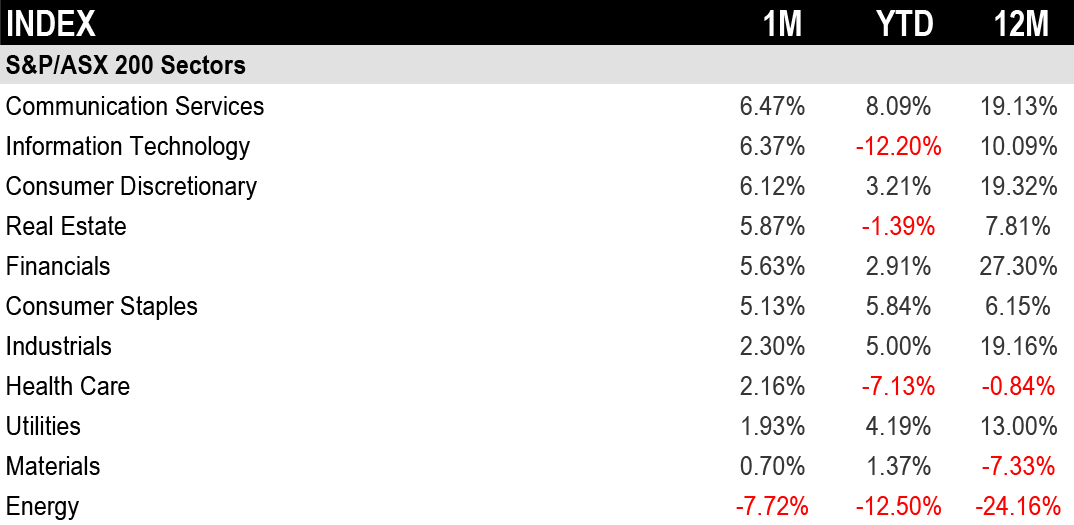

- Ten out of 11 sectors post gains in April, led by communications up 6.47% followed by a 6.37% comeback from tech

- DY6 Metals soars 371% higher in April after review of historical drill results identifies high-grade gallium at Tundulu project in Malawi

Australia’s S&P/ASX 200 rallied 3.62% in April following a 3.39% fall in March and 3.79% decline in February, showing resilience to global geopolitical and economic forces and recouping all its losses from last month, according to S&P Dow Jones Indices (S&P DJI).

US President Donald Trump softened his stance on tariffs that threatened to tank markets at the start of April, dulling a brewing trade war with China.

That wasn’t the only market ruction, with Trump continuing to take aim at US Federal Reserve chairman Jerome Powell for not cutting rates fast enough.

The Don dubbed Powell a “major loser”, before walking back language that suggested he would try to fire America’s top banker.

Then came this from the US Prez:

“He should reduce interest rates,” he said.

“I think I understand interest a lot better than him, because I’ve had to really use interest rates.” No wonder markets are a little jumpy.

They have see-sawed in recent months. US stocks just recorded their worst first 100 days under a president since Richard Nixon’s second term in 1973, while the dollar index has fallen nearly 10% over the same period and US treasury bonds have also seen large swings.

The S&P 500 ended April with a ~0.8% loss, while the Dow was down 3.2% for the month. It was the third straight losing month for US both. The tech-heavy Nasdaq managed to advance nearly 0.9% in April.

Back home, Australia’s latest inflation data came out this week and came in a little hotter than expected. Headline inflation rose 0.9% in the March quarter, exceeding the 0.8% forecast, while annual CPI remained steady at 2.4%.

However in some good news, for the first time since 2021 core inflation – the RBA’s preferred measure – has narrowly come back in the target range of 2 to 3% at 2.9% year-on-year.

Aussie midcaps rose 3.35% in April, while small caps rose 1.84%. Emerging companies was in the red, falling 0.38% in April.

Communication services tops winning sectors

Ten out of 11 sectors posted gains in April led by communication services, up 6.47%. Unlike March, where it sustained a 9.66% loss, technology rose by 6.37%.

S&P DJI reported energy was the only sector to report a loss, as oil prices plummeted. The S&P GSCI Crude Oil fell by 18% over concerns of a economic slowdown, reportedly the largest monthly loss since November 2021.

Momentum recovers, while fix income indices advance

All reported Australian factor indices remained in positive territory. Momentum – the best-performing factor in 2024 – recovered after ending March in correction, declining by 7% for two consecutive months.

Momentum and growth were among the best performing factors, while enhanced value and equal weight lagged.

S&P DJI reported volatility remained elevated, especially in US equities, with the VIX (known as the fear index) closing near 25 after soaring above 50 earlier in the month.

In contrast, the S&P/ASX 200 VIX came back down quickly, closing below 12 from 14.9 at the end of April.

Most fixed income indices advanced as rates declined on weaker economic growth expectations. The S&P/ASX iBoxx Australian Government 0+ was among the best performers, rising by 2% for the month, with the index’s yield falling to 4%.

Without further ado here are …

The 50 best performing ASX stocks in April

| CODE | COMPANY | LAST SHARE PRICE | APRIL RETURN % | MARKET CAP |

|---|---|---|---|---|

| DY6 | DY6 Metals | 0.165 | 371% | $8,317,787 |

| JLL | Jindalee Lithium Ltd | 0.565 | 176% | $30,172,658 |

| NMR | Native Mineral Res | 0.185 | 113% | $159,001,115 |

| ZEO | Zeotech Limited | 0.097 | 102% | $166,836,276 |

| DTR | Dateline Resources | 0.01 | 100% | $24,890,118 |

| RDS | Redstone Resources | 0.006 | 100% | $5,552,271 |

| TKL | Traka Resources | 0.002 | 100% | $4,251,580 |

| SRL | Sunrise Energy Metals | 0.525 | 94% | $53,234,224 |

| WHK | Whitehawk Limited | 0.015 | 88% | $9,354,933 |

| ADN | Andromeda Metals Ltd | 0.014 | 75% | $48,002,188 |

| ASM | Ausstrat Materials | 0.635 | 74% | $120,591,554 |

| NTU | Northern Min Ltd | 0.034 | 70% | $284,143,298 |

| KNB | Koonenberry Gold | 0.076 | 69% | $63,043,928 |

| BNR | Bulletin Resources | 0.07 | 67% | $19,965,706 |

| ERL | Empire Resources | 0.005 | 67% | $5,935,653 |

| WOA | Wide Open Agriculture | 0.0355 | 61% | $14,409,538 |

| GUL | Gullewa Limited | 0.077 | 60% | $16,351,663 |

| FLG | Flagship Minerals | 0.07 | 59% | $14,862,378 |

| KCC | Kincora Copper | 0.036 | 57% | $9,397,719 |

| HTG | Harvest Tech Group | 0.02 | 54% | $16,127,041 |

| BDT | Birddog | 0.049 | 53% | $7,589,843 |

| GHM | Golden Horse Mineral | 0.41 | 52% | $45,661,457 |

| ASP | Aspermont Limited | 0.006 | 50% | $14,820,070 |

| EAT | Entertainment Rewards | 0.006 | 50% | $9,161,502 |

| GGE | Grand Gulf Energy | 0.003 | 50% | $7,351,161 |

| MOM | Moab Minerals Ltd | 0.0015 | 50% | $1,733,666 |

| PSL | Paterson Resources | 0.012 | 50% | $5,016,417 |

| TTI | Traffic Technologies | 0.003 | 50% | $3,771,441 |

| STM | Sunstone Metals Ltd | 0.012 | 50% | $77,580,797 |

| MEI | Meteoric Resources | 0.105 | 50% | $245,370,592 |

| RNU | Renascor Res Ltd | 0.07 | 49% | $190,733,664 |

| R8R | Regener8 Resources NL | 0.12 | 48% | $3,900,300 |

| SVG | Savannah Goldfields | 0.025 | 47% | $18,263,918 |

| UBN | Urbanise.Com Ltd | 0.805 | 45% | $51,929,748 |

| WMG | Western Mines | 0.145 | 45% | $12,649,468 |

| FRS | Forrestania Rsources | 0.039 | 44% | $10,235,724 |

| MTM | MTM Critical Metals | 0.23 | 44% | $110,082,702 |

| ICR | Intelicare Holdings | 0.01 | 43% | $4,861,881 |

| RLG | Roolife Group Ltd | 0.005 | 43% | $7,480,156 |

| MKR | Manuka Resources. | 0.037 | 42% | $27,566,101 |

| JAT | Jatcorp Limited | 0.54 | 42% | $44,963,997 |

| DRO | Droneshield Limited | 1.34 | 41% | $1,166,910,362 |

| BGD | Barton Gold Holdings | 0.47 | 40% | $106,178,468 |

| HE8 | Helios Energy Ltd | 0.014 | 40% | $37,423,647 |

| NWM | Norwest Minerals | 0.014 | 40% | $5,821,434 |

| PGY | Pilot Energy Ltd | 0.007 | 40% | $13,881,525 |

| T3D | 333D Limited | 0.007 | 40% | $1,233,284 |

| TM1 | Terra Metals Limited | 0.028 | 40% | $11,821,417 |

| EL8 | Elevate Uranium Ltd | 0.285 | 39% | $111,828,585 |

| OZM | Ozaurum Resources | 0.093 | 39% | $22,572,185 |

DY6 Metals (ASX:DY6) rocketed 371% higher in April after a review of historical drill results identified high-grade gallium at the Tundulu project in Malawi. The company struck broad intersections of up to 74m at 93.26 g/t gallium, as well as 1.56% total rare earth oxides, with grades peaking at 310.46 g/t gallium and 5.68% TREO over about a metre.

DY6 Metals also announced in April it was acquiring two highly prospective rutile and heavy mineral sands projects in Cameroon.

Jindalee Lithium (ASX:JLL) surged 176% in April, buoyed by the US Government’s critical minerals policy and solid progress at its 100%-owned McDermitt lithium project, straddling the Oregon and Nevada border as outlined in a positive quarterly report.

McDermitt was named one of just 10 resource projects under the US FAST-41 framework, streamlining federal permitting and enabling faster, more predictable approvals.

Sunrise Energy Metals (ASX:SRL), backed by mining billionaire Robert Friedland, jumped 100% in April after receiving high-grade scandium assays from its Syerston project in central NSW.

Assays of drill pulps from 1997 that were not previously assayed for scandium returned up to 6m at 553ppm Sc from 4m, including 2m at 760ppm from 8m, and 12m at 458ppm from 12m. SRL is now planning a new drill campaign to expand the high-grade zones and also announced a $7.5 million capital raise.

Redstone Resources (ASX:RDS) was also up 100% in April after announcing diamond drilling had resumed at the Tollu copper project over in WA’s remote West Musgrave region.

RDS has exploration incentive scheme co-funding from the WA Government up to $220,000 to drill a single 1200m diamond hole at Tollu, where high-grade copper has already been struck in results stretching down to around 400m below the surface.

The 50 worst performing ASX stocks in April

| CODE | COMPANY | LAST SHARE PRICE | APRIL RETURN % | MARKET CAP |

|---|---|---|---|---|

| HCF | H&G High Conviction | 0.05 | -93% | $1,067,356 |

| BRX | Belararox | 0.087 | -71% | $12,991,355 |

| IVT | Inventis Limited | 0.01 | -58% | $1,222,790 |

| SUM | Summit Minerals | 0.036 | -52% | $3,746,503 |

| SOP | Synertec Corporation | 0.022 | -52% | $12,983,360 |

| BLZ | Blaze Minerals Ltd | 0.002 | -50% | $3,917,370 |

| ICU | Investor Centre Ltd | 0.001 | -50% | $609,023 |

| TMS | Tennant Minerals Ltd | 0.006 | -50% | $8,603,014 |

| SPD | Southern Palladium | 0.215 | -48% | $20,463,750 |

| CTT | Cettire | 0.45 | -48% | $177,275,772 |

| I88 | Infini Resources Ltd | 0.1 | -47% | $5,237,002 |

| ADO | Anteotech Ltd | 0.007 | -46% | $24,347,703 |

| EV1 | Evolution Energy | 0.011 | -45% | $3,989,155 |

| LMS | Litchfield Minerals | 0.1075 | -44% | $3,485,527 |

| MEM | Memphasys Ltd | 0.005 | -44% | $9,917,991 |

| ASR | Asra Minerals Ltd | 0.002 | -43% | $6,765,117 |

| CRN | Coronado Global Resources | 0.195 | -43% | $377,202,089 |

| GRE | Greentech Metals | 0.045 | -42% | $5,046,411 |

| ADR | Adherium Ltd | 0.007 | -42% | $6,823,667 |

| FUL | Fulcrum Lithium | 0.078 | -42% | $5,889,000 |

| EXL | Elixinol Wellness | 0.019 | -41% | $4,195,583 |

| ENL | Enlitic Inc | 0.048 | -41% | $27,629,578 |

| EMU | EMU NL | 0.021 | -40% | $3,872,028 |

| MEG | Megado Minerals Ltd | 0.009 | -40% | $3,357,466 |

| FBR | FBR Ltd | 0.006 | -40% | $39,449,423 |

| PEB | Pacific Edge | 0.075 | -40% | $60,893,698 |

| TNC | True North Copper | 0.2 | -40% | $30,201,364 |

| DAI | Decidr Ai Industries | 0.45 | -39% | $76,991,522 |

| SMX | Strata Minerals | 0.017 | -39% | $4,150,525 |

| SRJ | SRJ Technologies | 0.017 | -39% | $11,505,984 |

| ANX | Anax Metals Ltd | 0.005 | -38% | $4,414,038 |

| CDT | Castle Minerals | 0.057 | -37% | $6,728,555 |

| FDR | Finder | 0.038 | -37% | $11,087,244 |

| ATV | Activeportgroupltd | 0.009 | -36% | $6,164,794 |

| KAL | Kalgoorlie Gold Mining | 0.045 | -36% | $16,539,380 |

| NPM | Newpeak Metals | 0.009 | -36% | $3,220,717 |

| BDM | Burgundy D Mines Ltd | 0.036 | -36% | $54,010,626 |

| CAN | Cann Group Ltd | 0.016 | -36% | $9,642,432 |

| IR1 | Iris Metals | 0.16 | -36% | $26,731,204 |

| CAE | Cannindah Resources | 0.048 | -36% | $39,316,317 |

| CRS | Caprice Resources | 0.055 | -36% | $26,512,200 |

| CR3 | Core Energy Minerals | 0.011 | -35% | $4,670,553 |

| CCX | City Chic Collective | 0.083 | -34% | $32,738,412 |

| WNX | Wellnex Life Ltd | 0.315 | -34% | $21,815,747 |

| AMN | Agrimin Ltd | 0.049 | -34% | $17,163,139 |

| NVQ | Noviqtech Limited | 0.031 | -34% | $7,546,097 |

| CCO | The Calmer Co International | 0.003 | -34% | $9,372,107 |

| HIQ | Hitiq Limited | 0.025 | -34% | $9,189,061 |

| BDG | Black Dragon Gold | 0.042 | -34% | $13,059,791 |

| C7A | Clara Resources | 0.004 | -33% | $2,558,021 |

At Stockhead, we tell it like it is. While DY6 Metals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.