As tide turns for BNPL stocks, Butn and these ASX lenders could be the new breed

Butn’s B2B invoice financing business is booming. Picture Getty

- BNPL stocks are rebounding in the past month

- The B2B segment is booming

- Stockhead reaches out to Butn’s co-CEO, Rael Ross

Many have written off the Buy Now Pay Later (BNPL) space, but over the past month the sector has rebounded in a big way.

Sector leader Block Inc (ASX:SQ2) is up 20% in the last 30 days despite disappointing results from Afterpay.

Zip’s (ASX:ZIP) share price has surged by almost 30% in the same period as the company delivered a 19% increase in revenue to $163m in the last quarter.

Smaller players like Sezzle (ASX:SZL) and Humm (ASX:HUM) have also lifted in the past month, rounding up possibly the best month for BNPL stocks this year.

| Code | Name | Price | % 1-Month Change | % 1-year change | Market cap |

|---|---|---|---|---|---|

| SPT | Splitit | 0.165 | 10% | -49% | $87,782,236 |

| ZIP | ZIP Co | 0.785 | 27% | -86% | $553,958,528 |

| SZL | Sezzle | 0.615 | 26% | -86% | $126,793,240 |

| HUM | Humm | 0.57 | 14% | -30% | $285,224,248 |

| LBY | Laybuy | 0.062 | 5% | -86% | $15,907,972 |

| SQ2 | Block | 107.59 | 20% | 0% | $3,920,061,877 |

| OPY | Openpay | 0.215 | 13% | -82% | $50,060,658 |

| LFS | Latitude Group | 1.325 | 2% | -34% | $1,376,962,310 |

| DOU | Douugh | 0.02 | -5% | -79% | $16,950,289 |

| PYR | Payright | 0.07 | -4% | -70% | $5,474,995 |

| IOU | Ioupay | 0.049 | -13% | -77% | $27,146,591 |

| FFG | Fatfish Group | 0.02 | -13% | -64% | $19,686,468 |

| CI1 | Credit Intelligence | 0.145 | 21% | -48% | $12,524,874 |

| NOV | Novatti | 0.265 | 43% | -33% | $89,179,263 |

Several factors are at play here, all of which are converging at once to provide the much needed tailwinds for the sector.

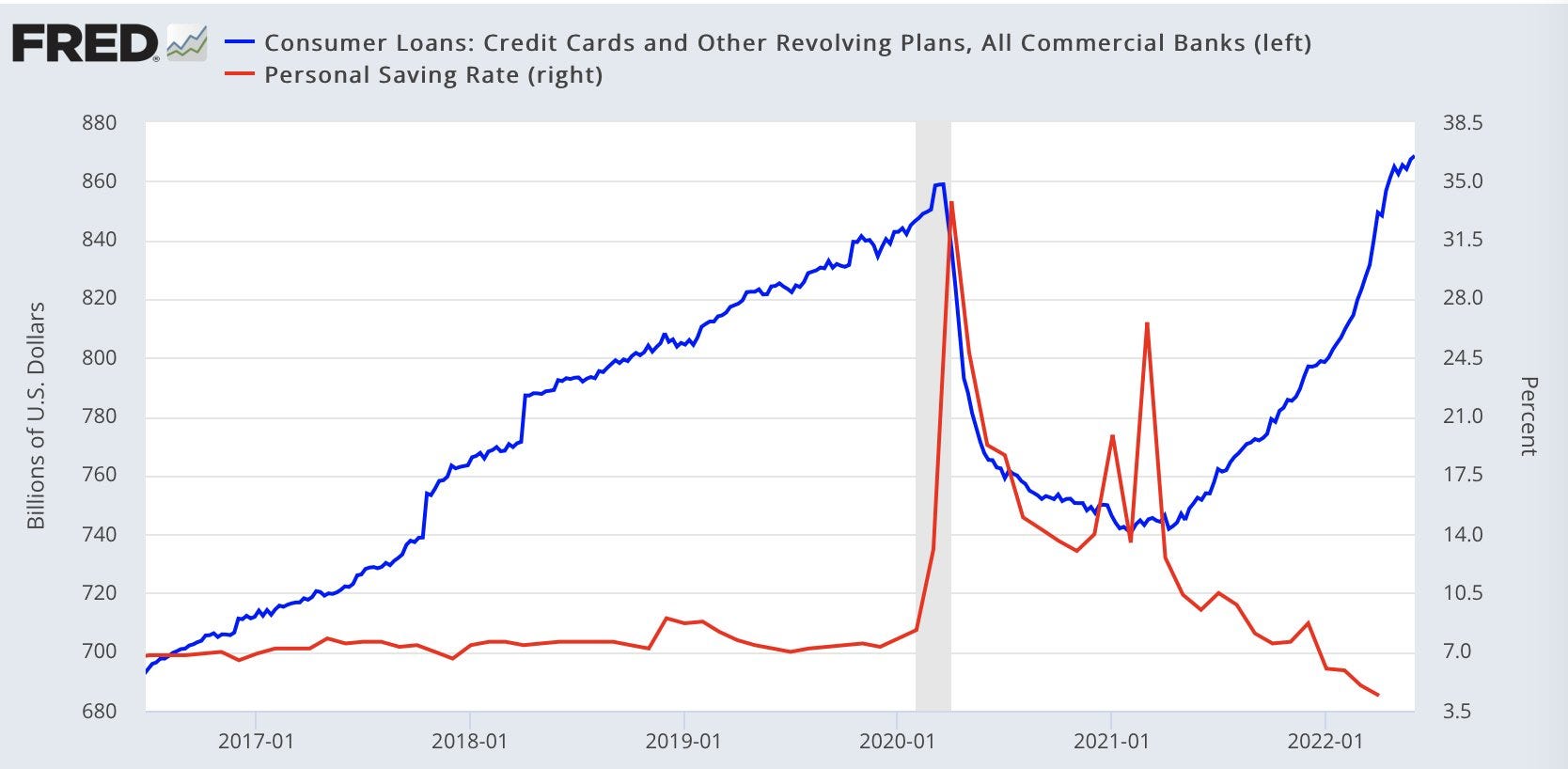

Firstly, households’ debts across the globe have continued their upward climb, while personal savings have dwindled.

This can be put down to the twin effect of higher rates and inflation, forcing more households turn to services like BNPL to pay for daily necessities like groceries.

Here’s a chart from the US highlighting this very problem:

The second tailwind is that the BNPL industry has been highly saturated and continues to consolidate rapidly.

The name of the game is scale, and consolidation has allowed bigger (and sometimes better) players to take more of the market share, leaving the weaker ones to fall by the wayside.

Despite the abortion of a couple of marquee deals in Australia this year (Zip cancelling its acquisition for Sezzle, and Latitude breaking off a deal with Humm), BNPL merger deals worldwide represented 50% of the value of all payment deals in 2021.

The industry however is facing an uphill battle. Regulation is coming and will shift the entire consumer BNPL space, likely leaving a bigger void in the market.

Butn’s rise

The good news is that there’s a segment within the industry which has boomed and largely been overlooked.

The B2B (or business to business) segment has gone up by leaps and bounds, overtaking growth metrics in the consumer segment.

And due to its market focus, the B2B segment is expected to steer clear from any impending regulation that’s likely to focus more on consumer protection.

ASX-listed Butn (ASX:BTN) is one such company that’s growing rapidly in this space.

Technically not a pure BNPL play, Butn provides small medium businesses (SMEs) with invoice and trade financing.

The company has delivered six consecutive record months of originations, and in the last quarter increased its originations by 63% to $102.2 million.

Butn’s process is simple and fast. After a 10-minute registration process, SMEs can get an advance from Butn against their outstanding invoices, and have their hands on the funds in as little as 24 hours.

“That’s our secret sauce and our go-to market,” Butn co-founder and co-CEO, Rael Ross told Stockhead.

Butn’s model is a fixed fee per transaction, where the average margin on one transaction is anywhere between 2.5% and 5%.

As an example, if an SME had an invoice to Woolworths of say $100, Butn would pay the SME 80 cents or 95 cents in the dollar immediately, then collect the Woolworths invoice at a later point in time.

“So it’s very easy for a client to understand that for every $100 they borrow, they’re paying a fixed fee and there are no other fees like monthly fees etc,” said Ross.

“We believe that’s one of the reasons why we’re seeing the tremendous growth month on month.”

The MYOB partnership

Butn’s business flow is underpinned by its strategic partnership with MYOB, one of the biggest tax and accounting software platforms in the world.

MYOB is a 19.9% shareholder in Butn and has integrated Butn’s invoice finance offering on its platform, enabling its 1.2 million business clients to sign up easily with Butn.

“If you look at the distribution networks of other fintechs, they’re paying away millions, probably billions of dollars to brokers throughout the year. We don’t do anything like that,” said Ross.

“Our partnership with MYOB is a game changer, we do one integration, and we serve those businesses within that ecosystem.”

“Our cost of acquisition is therefore negligible due to this integration.”

The MYOB integration allows Butn to retain loyal clients, in contrast to the B2C segment where customers would easily jump from one BNPL platform to another.

“These clients (on the MOYB platform) have access to our technology, our button and our funding. No one else has that distribution, and so we’re just continuing to drive that origination growth,” Ross told Stockhead.

Ross explained that Butn’s partnership with MYOB has allowed the company’s cost base to remain stable since its IPO 18 months ago, while enabling originations to grow exponentially.

At the moment, the company is yet to make a profit but Ross believes the growth trajectory is in the right direction.

“Because we’re in this B2B space, we’re somewhat swimming in our own lane. And that allows us to go hard and fast, where others are still trying to catch up,” says Ross.

Butn share price today:

Other players in the B2B space

Earlypay provides invoice finance as well as asset and equipment financing.

The business is tailored towards SMEs who have supply contracts with larger Australian companies.

The stock has been listed on the ASX since 2010, and has a long history of paying dividends.

In 2020, the company reverted its name back from CML Group to Earlypay, a name it had used previously from 2012 to 2015.

In FY22, the company has 3,000+ SMEs in its books, funding a total of $10bn since 2015.

The company recorded NPATA of $14.7m, up 69% on last year and paid 3.2c fully franked dividends.

Splitit is another B2B operator.

Since coming on board in January, Splitit CEO Nandan Sheth has refocused Splitit’s business model to become the pick and axe for the industry, offering its technology as a white label, merchant-branded Installments-as-a-Service platform.

Splitit logos are no longer seen on merchant’s windows or checkout counters. Instead, customers can use their exisiting credit cards and choose to pay in instalments powered by the Splitit technology at the point of sale.

“Splitit is now a pure B2B company; we’re not selling to the consumer, we’re only selling to the merchant,” explained Sheth.

“But instead of acquiring merchants one by one, we’re going one to many. For example, our deal with WorldPay gives us immediate access to thousands of merchants.”

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.