Are you an average Australian investor?

Pic: Getty Images

- Australians shy away from share market with Savvy survey showing 60% have no investment

- More than half of Aussies surveyed aged 45 to 54 not confident about having enough super by 65

- Women are falling behind men in both superannuation balances and share market investing

One of Australia’s largest online financial brokers has urged people to work towards investing goals or increasing their super balances, after the survey found rates of both were low.

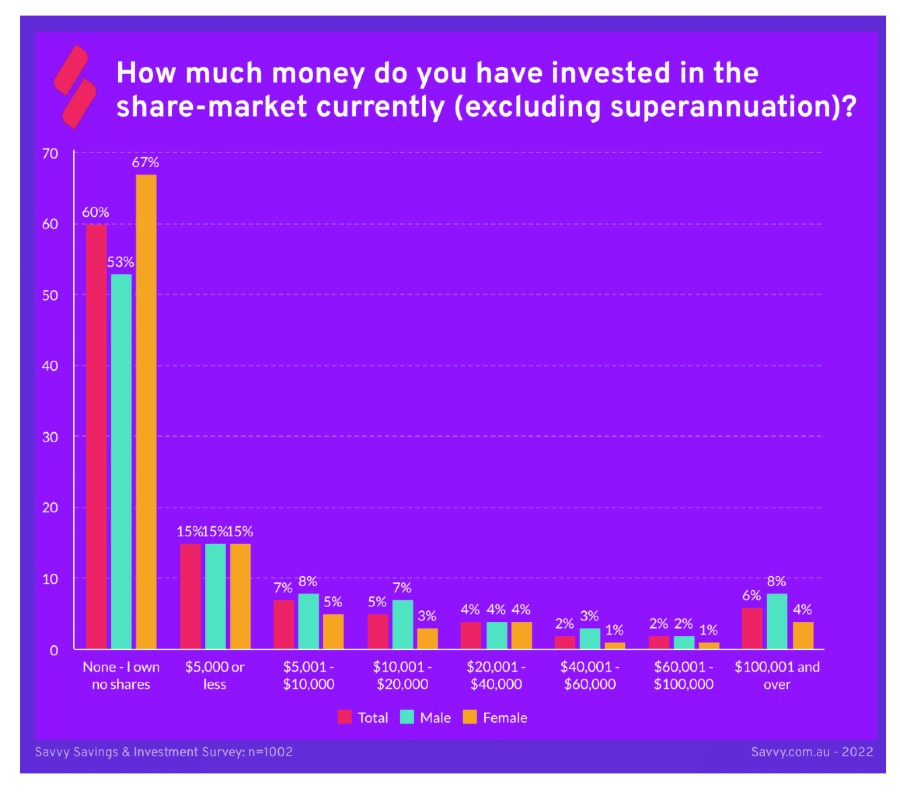

According to the Savvy Savings & Investment Survey for 2022 of 1002 Australians, 60% have no investments in the share market.

Furthermore, their superannuation outlooks are also looking grim with 52% of Australians aged 45-54 are feeling either unconfident or not confident at all in having enough in their super by the age of 65.

Share market investing

According to the survey 15% of Australians have somewhere between $1 and $5,000 invested in shares, 7% have between $5,001 and $10,000 and 6% more than $100,000.

The age cohort with the highest level of investments in shares is the 55–64-year-old demographic, with 13% reporting holdings of more than $100,000.

On the flipside, 64% of 18 to 24-year-olds reported they have no shares whatsoever.

When it comes to why they invest, responses varied including:

• 46% as it provides a “good return” on investment

• 34% for retirement

• 24% because savings rates are low

• 22% believed share investing offered superior returns against alternatives

• 11% reported that they’re investing as a hedge against inflation.

Savvy asked people how they invest their savings with 19% of people putting money in shares, 4% managed funds and 1% indexed funds. A slightly higher percentage were investing in Crypto and NFTs (6%).

Aussies worried about super

The survey found Australians are worried about having enough money to live out their golden years.

The percentage of people not investing in shares was similar to people not making any additional super contributions – 60% versus 57% respectively.

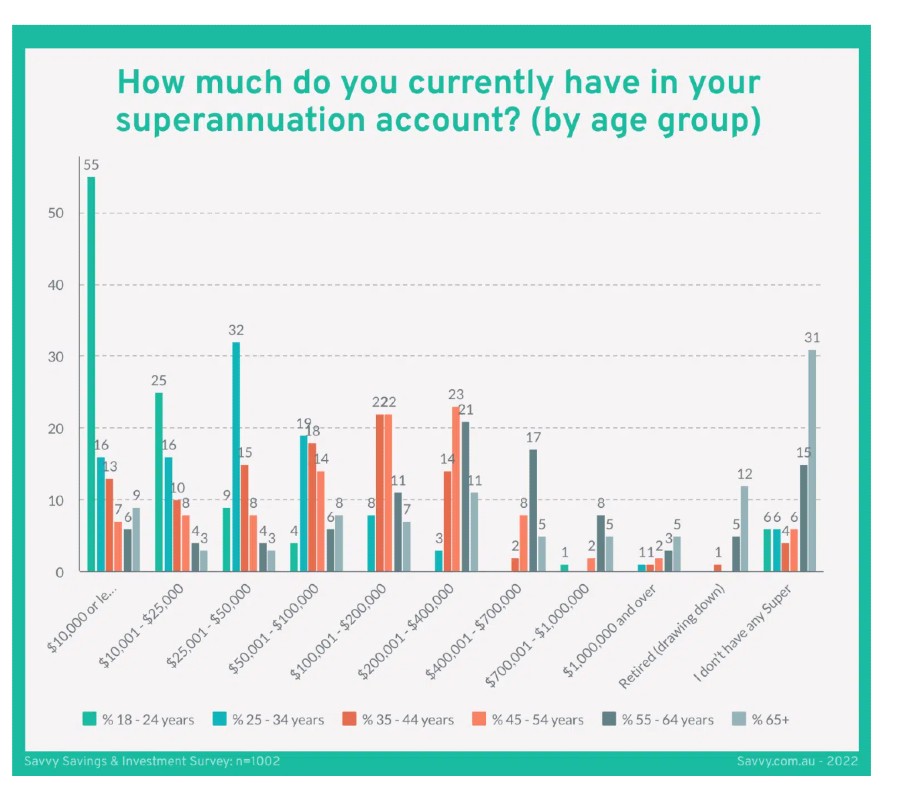

Analysing the differences between age groups showed that 18 to 24-year-olds represent the largest demographic with a balance of $10,000 or less at 55%, followed by 25 to 34-year-olds (16%) and 35 to 44-year-olds (13%).

Only 12% of 25 to 34-year-olds have a balance above $100,000, in comparison to 39% of 35 to 44-year-olds, 57% of 45 to 54-year-olds, 65% of 55 to 64-year-olds, and 33% of those 65 and over.

The survey found that 12% of Australians have no super at all, with respondents 65 and over making up the largest portion of this figure.

It also found 24% of Australian women currently have superannuation holdings of more than $100,000, much less than the 44% of men.

Furthermore, 16% of men have between $200,001 and $400,000 in their super, which is notably higher than the 9% of women within the same bracket.

The study also found 7% of Australian men have a balance of between $400,001 and $700,000 compared to 4% of women.

Men were also higher in the $700,001 to $1 million (4% to 1%) and $1 million and more (3% to 1%) brackets.

Women fall behind men in share investing

The survey found 67% of Australian women have not invested in shares compared to 53% of men.

When it comes to believing the share market provides a good return, 38% of women believe the sentiment compared to 52% of men.

And while 34% of respondents are investing for their retirement, the rates are higher with 36% for men compared to 31% for women.

Let’s add in inflation

Australian inflation, like that in much of the world, has been increasing. Inflation has jumped to 7.3% over the year to September, its highest level since 1990.

Trimmed-mean inflation, the RBA’s preferred measure that trims away large price movements, rose 1.8% in the quarter and 6.1% annually suggesting inflation throughout the economy is broad-based.

When asked how confident they felt about their investment returns continuing to outpace inflation, 43% said they were either unconfident or not confident at all.

The Savvy Cost of Living Survey for 2022 found 30% of respondents “extremely worried” about inflation outstripping income and 84% of Australians worried to some degree about flat wage growth.

Savvy spokesman Adrian Edlington told Stockhead the results of their survey were surprising.

“We see that the majority of everyday Australians aren’t investing in shares or other financial instruments to hedge against inflation and grow their wealth,” he said.

“I think it comes down to awareness and education and unless people study this on their own, then they’re not necessarily being taught how, where, and why to invest their money.”

Edlington said high inflation is eroding cash savings and people should be putting their savings in some form of investment that will protect their nest egg as prices rise and real purchasing power erodes.

“I think vastly more people are focused on saving a deposit and buying a house than in investing in shares,” he said.

“It begs the question, however, as to what they are doing with their deposit savings as they wait to accumulate enough to get into the market.

“Learning that there are intelligent ways to invest money while they save, that give decent returns, is imperative.”

Spare change and patience

Edlington said that despite the ease of holding shares compared to the years or decades previous, there are still a lot of myths to be busted around investing.

“We’ve seen people essentially gamble on shares when they should be thinking of investing as a long-term wealth creation strategy,” he said.

He said many people still think a lot of money is needed to invest in share markets.

“We’ve seen the rise of micro-investing apps which allow people to invest small amounts into Exchange Traded Funds (ETFs) and see returns that are significantly higher than keeping that money in a bank, or even a high-interest bank account,” he said.

“The barrier to entry is lower than ever and all people need now is a bit of spare change and patience to grow their wealth in shares.”

Putting a figure on retirement

Edlington said how much you need to retire will depend on your lifestyle. According to the Association of Superannuation Funds of Australia (ASFA), the figure for a comfortable retirement is around $545,000 for singles and $640,000 for couples, which assumes a partial age pension.

For a more lavish retirement, some analysts say $1 million to $1.5 million is required, especially if you wish to travel during retirement.

“How you get to live in retirement depends on the steps taken now and for many people investing in the share market, property, extra contributions to superannuation will make a difference in the long term,” Edlington said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.