Earnings Season: Just about anything could Appen in the next few hours

It could Appen to anyone. Via Getty

The ASX-listed Artificial intelligence tech firm Appen (ASX:APX) reports its half year numbers in a moment.

This stock is a potential Tech Sector forward-looking bellwether. A local tech innovator with global chops.

The outlook isn’t handsome, but shareholders will be praying for a turn around after some grim signs and a hope deflating update.

Before we hit the panic button, let’s do a quick run through and see who’s on the money.

Appen’s been developing high-quality datasets which it uses to build (and improve upon) artificial intelligence (AI) systems. It’s no mug at this. With a good track record, almost 30 years experience in the AI space and a recognised global player in a fast expanding AI universe.

At the moment they do all sorts of data types – speech and natural language data, image and video data, text and alphanumeric stuff and OFC the growing importance of relevance data which can improve search and social media functions.

But a few weeks ago APX offered up an ugly trading update and a less on the nose full-year outlook, which is what one recommends ahead of an official result release which may not go down how the shareholders want it to.

The company’s first half FY22 underlying earnings margin crashed to 4.6% (from 14.3%) for the same time last year.

While there was a wee negative impact from currency, the brokers at Macquarie Bank said the key driver was -7% decline in revenue YoY following a 3.2% increase in operating expenditure.

The update reflected lower margins, lower growth, more investment and less certainty over the conversion of forward orders to sales compared to prior years, Macquarie said.

Where’s my MTV and digital advertising demand?

But the underlying issue is a drop-off in digital advertising demand.

All the more disappointing really because back in February APX reported a FY 8% increase in revenue to over US$447mn, but with the first signs of the current challenges as underlying NPAT bleeding out value, down 20% to $28.5m.

APX also flagged an underlying NPAT loss of $3.8 million, compared to a $12.5 million net profit after tax in 1H FY21, again due to weaker digital advertising demand and a slowdown in spending from some of its largest customers.

Then came Apple

Tony Sycamore at City Index told Stockhead the market had been expecting a hit to Appen’s earnings after a canny, possibly evil move by US giant Apple to allow its iOS users to block the app tracking technology that allowed Facebook and other tech giants to target advertising.

“But that didn’t stop the share price plunging by 28.7% to $6.11 on the day of the report,” Tony says.

And that sour flavour of business has continued into the first half of 2022.

After missing the broader equity rallies which marked July, the heads up news of early August and the first-half revenue hit of (down 7% to $182.9mn) briefly tore a new hole in the APX share price. That was the 3rd of August (by memory) and the APX share price shed over -25% in one session.

Management said they’re reviewing all APX investments and are seeking to accelerate productivity improvements and margin expansion.

But beyond this – no one at APX could provide any details as to how they planned to actually do this. No clear time frame, no clear targets or even who’s running the review process.

“With such scant detail on how management would turn this around, the market sent the share price 27% lower from $5.71 to close at $4.15,” Tony said with more assuredness and accuracy.

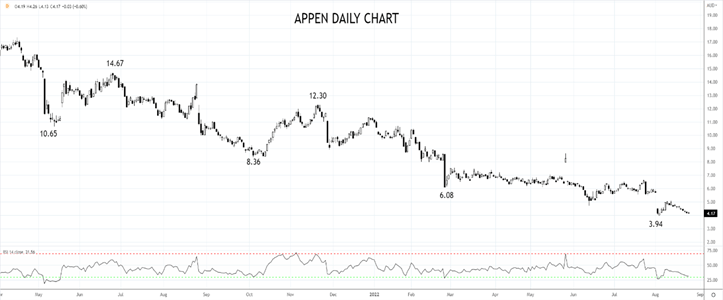

Appen Share Price Chart

After falling from a high of $43.66 in August 2020, the share price of Appen is trading back at levels it last traded in 2017, just above $4.00, Tony says.

The share price has now spent the past three weeks delicately poised, range trading between $4.00 on that downside and $5.00 on the upside.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.