Another green shoot appears for the Australian economy, but global challenges remain

(Getty Images)

Amid the turmoil caused by COVID-19, Australia’s economy got another glimmer of good news this morning.

Data from UBS showed the volume of job ads rose to 55,000 for the week ended May 13.

That’s up from 48,000 in the week prior — evidence of a possible turnaround in activity on the back end of an eight-week economic lockdown.

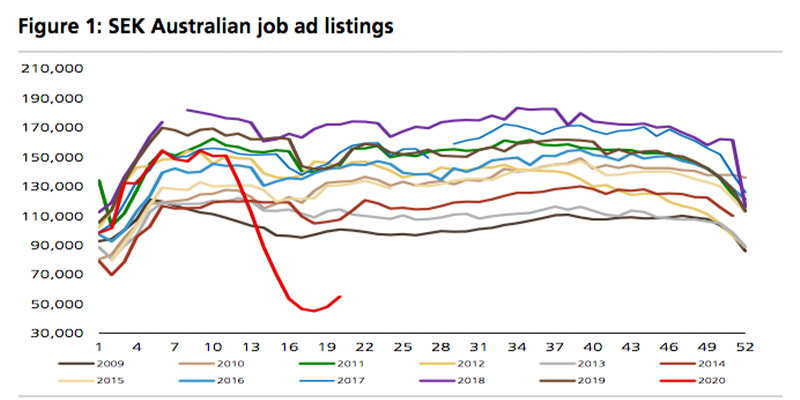

While job ad volumes have now returned to mid-April levels, they are still well below the March average of 150,000. This chart shows the scale of the fall:

UBS flagged that the data is only captured at a point in time, so it’s not technically measuring the weekly change in new listing volume.

“Nevertheless we have generally seen a week-on-week improvement in inventories across most sectors,” UBS said.

In percentage terms, some of the biggest weekly improvements were real estate, retail and hospitality — sectors that have been hardest hit by the crisis.

Admittedly though, those gains were “coming off a low base”, UBS said. The largest nominal pickups were seen across transport and logistics, healthcare and trade services.

While positive data points provide a glimmer of hope for a turnaround, Australia’s trade-linked economy is also heavily dependent on global factors as well.

On that front, there’s been lots of speculation about what shape the global economic rebound will take. But overnight, two senior voices poured cold water on the idea of a “V-shaped” (quick recovery) turnaround.

Firstly, BHP chief Mike Henry said such an outcome was unlikely, in comments made at the Bank of America Global Metals, Mining and Steel Conference.

According to The Australian, Henry said BHP’s base case was that COVID-19 would give rise to a 4 per cent decline in global economic growth, through to the end of 2021.

He said BHP was preparing for a decline in demand for steel and copper globally, while it would likely take 18 months for global oil demand to return to pre-crisis levels.

In view of that, he said the only country with a shot at a quick turnaround was China, where a “V-shaped recovery appeared to be underway”.

Also weighing in on the outlook overnight was billionaire US investor Stan Druckenmiller, who told Bloomberg that the prospect of a V-shape turnaround for the US economy was a “fantasy”.

Druckenmiller flagged a potential liquidity crunch in the wake of the Trump administration’s huge fiscal stimulus measures, if the weight of US government borrowing crowds out efforts from the Federal Reserve to prop up the financial system via asset purchases.

He also said the US government’s response to the health crisis could be viewed as the “poster child for the worst public policy decisions ever made from a cost-benefit analysis.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.