Almost 60% of Australian Equity General funds underperformed the S&P ASX 200 in 2022

Via Getty

- Latest SPIVA scorecard reveals 58% of active managed funds underperformed the S&P ASX 200 in 2022

- Just 23.4% of Australian equity mid and small cap funds beat the index in 2022

- Active managers in the Australian Equity A-REIT category were the best performers with 41.2% underperforming

The 2022 school report for Australian fund managers is in and it’s not looking too good with 58% of actively managed Australian equity general funds underperforming the benchmark S&P ASX 200 during the full year of 2022.

The school report being referred to is the SPIVA Australia scorecard produced by the S&P Dow Jones Indices, measuring the performance of actively managed Australian funds against their respective benchmarks over various time horizons.

The scorecard covers large, mid and small-cap equity funds, real estate funds and bond funds, and provides stats on outperformance rates, survivorship rates and fund performance dispersion.

Promising start to year but didn’t last

Just like a child who wants to put in more effort during the next school year, fundies got off to a promising start.

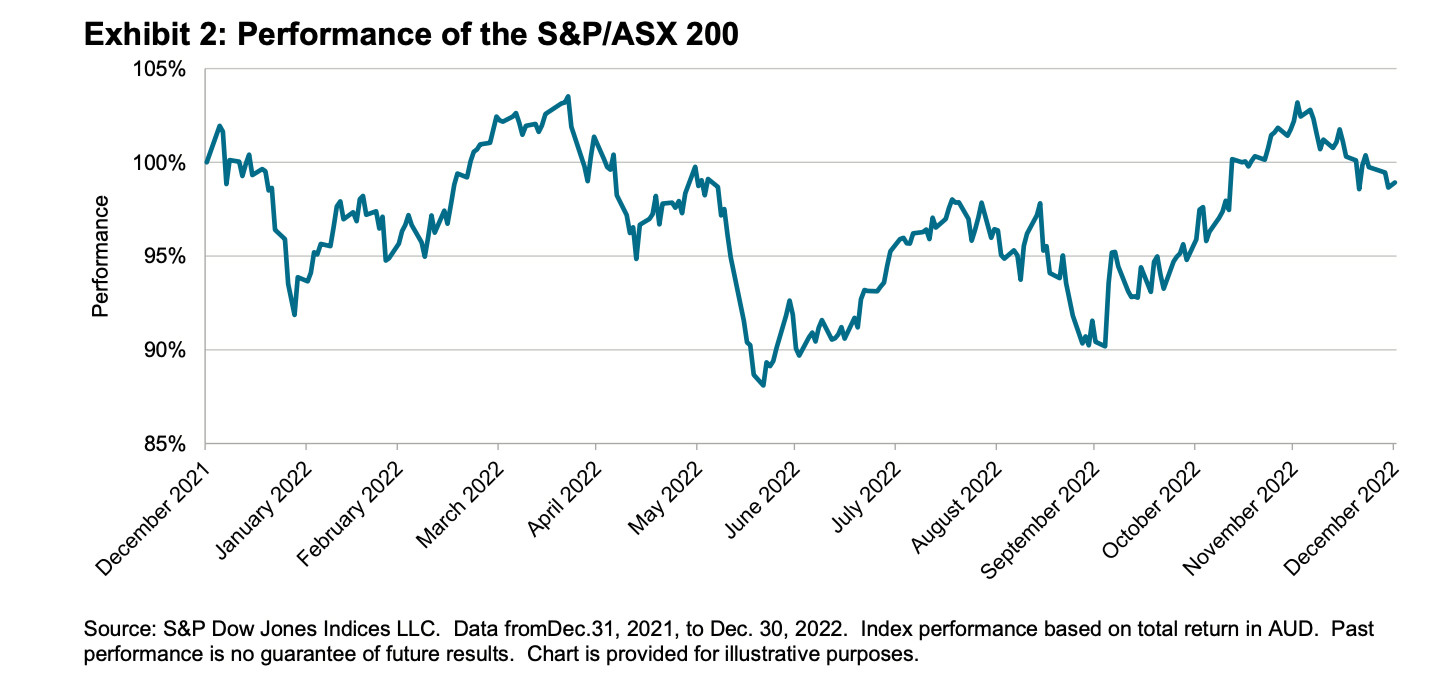

Having dropped 9.9% in the first six months of 2022, the S&P/ASX 200 rose 9.8% in H2 2022 to close the year down 1%.

While fundies had a promising start to the year beating the falling index, it was a challenging second half, with 78.5% underperforming the benchmark, bringing the full year underperformance rate to 57.6%.

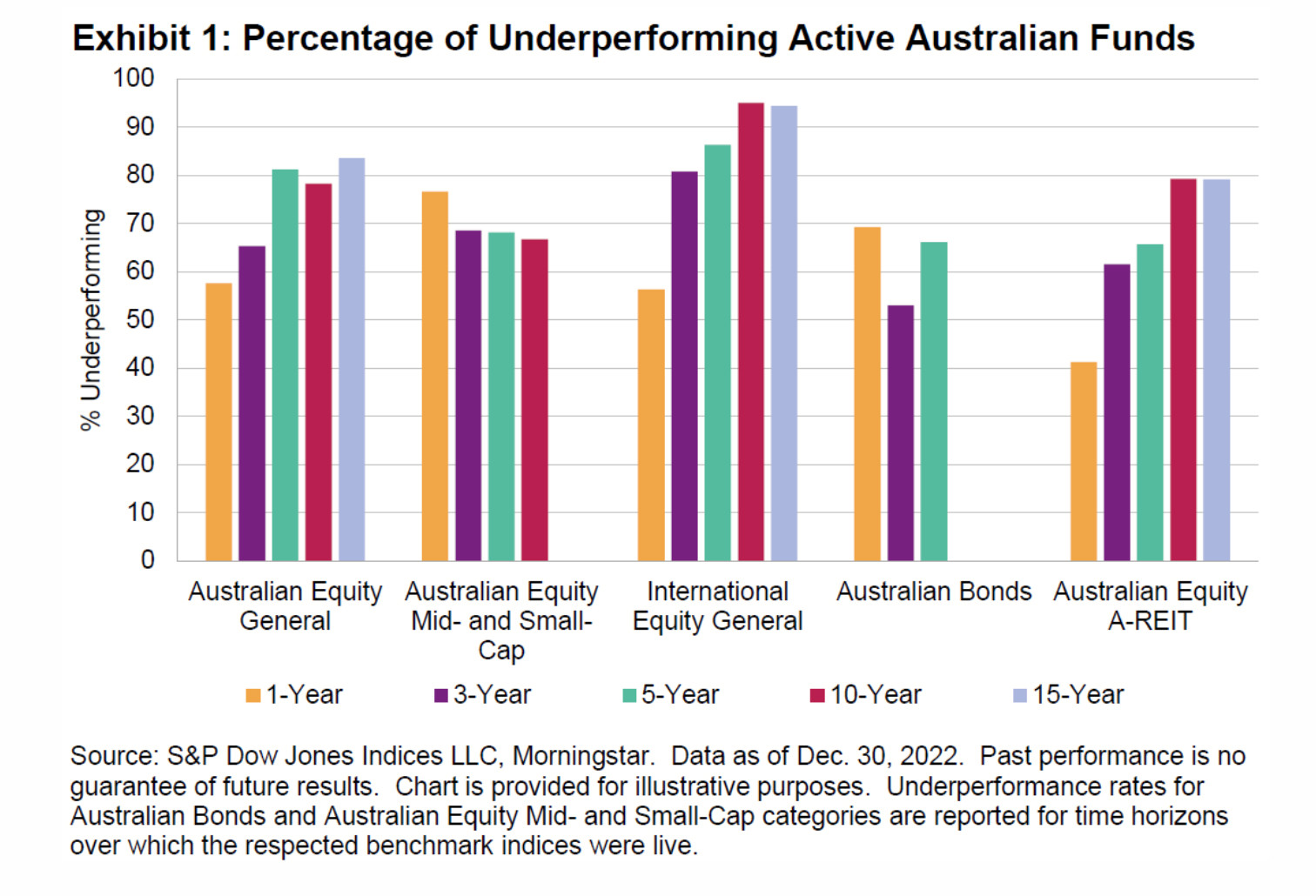

Over the longer term, underperformance rates were even higher, with 81.2%, 78.2% and 83.6% of funds underperforming the S&P/ASX 200 over the five, 10 and 15-year horizons, respectively.

Avoiding villains and searching for heroes

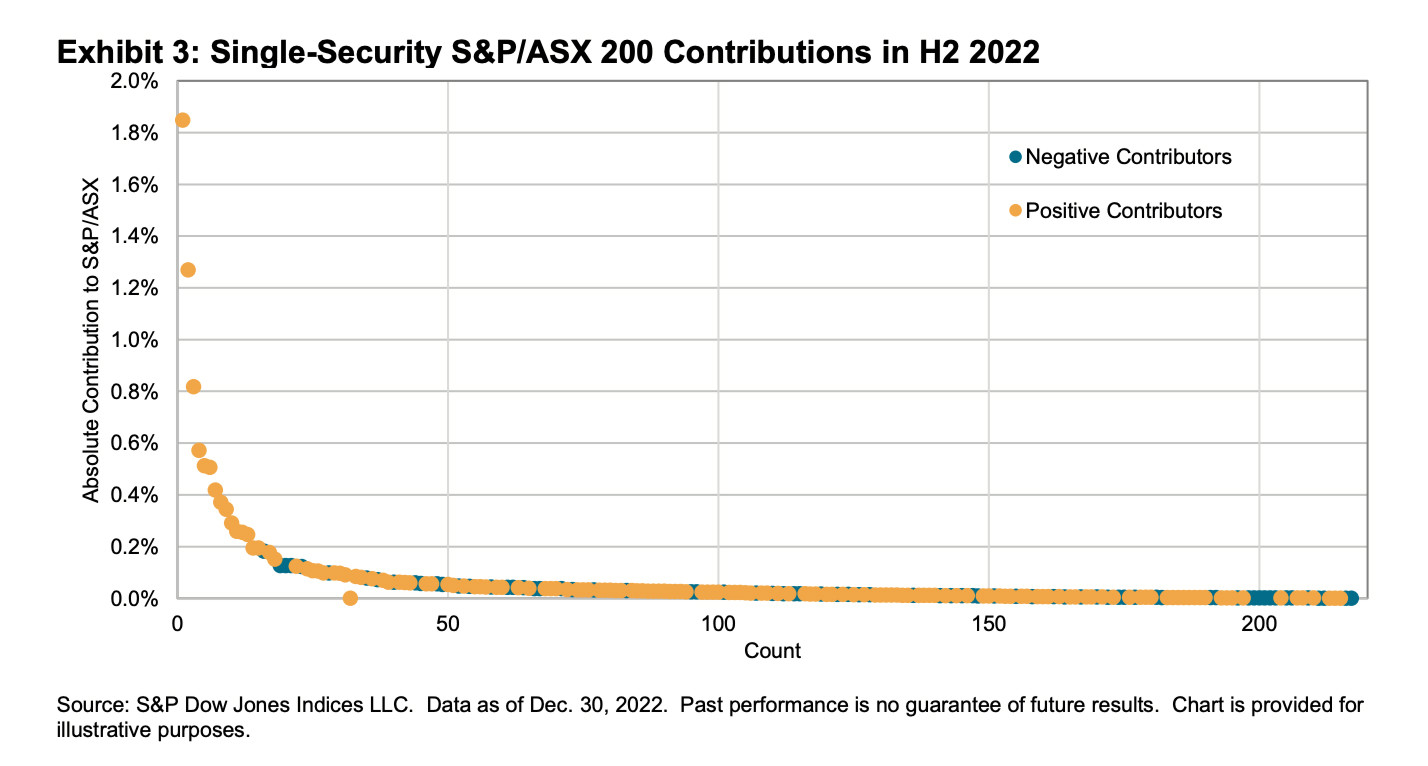

According to the SPIVA report active managers would have been best off “avoiding villains, rather than searching for heroes” in H1 2022.

However, S&P said the second half of the year offered plenty of routes to glory among single stock choices with 15 largest absolute contributors to the S&P/ASX 200’s performance all having positive returns.

Together they accounted for around 80% of the Australian bellwether’s market capitalisation gains in H2.

“Accordingly, for those with the skills to identify them in advance, there were plenty of heroes to be found,” the report said.

So just like you might get a report on different subjects, let’s see how Aussie fundies went in different categories. Where were their strengths and weaknesses?

1. Australian equity mid and small cap funds

The S&P/ASX mid-small index (ASX:AXMSA) rallied 10.1% in the second half of 2022 to close the year down 12.2%.

However, just 23.4% of Australian equity mid and small cap funds beat the index in 2022, while over 80% underperformed on a risk-adjusted basis.

So you don’t have to Google ‘risk adjusted return’, it is the calculation of the return (or potential return) on an investment above the risk free rate.

In most markets, the risk free rate is the government bond rate. So, if a government bond yield is 4%, and the return on stock is 5%, then the risk adjusted return is 1%.

In other words, what reward will you get for taking risk as opposed to playing it safe?

But the longer-term record within the small and mid cap category was relatively stronger, with just 54.7% underperforming over a 15-year period.

2. International equity general funds

International equity funds fell 13.9% and 3.2% on equal- and asset-weighted bases in 2022, with 56.3% of funds failing to keep up with the S&P Developed Ex-Australia LargeMidCap in 2022.

Over the five and 10-year periods, more than 86% and 95% of funds underperformed, respectively.

3. Australian bond funds

While inflation and associated interest rate rises saw a broad sell-off in equity markets in 2022, there was also a broad sell-off in bond markets at the same time pushing yields higher.

It is an unusual phenomenon to see both bonds and equities fall simultaneously. When there’s prolonged price declines in equities, bond prices generally rise as investors seek a safe haven, but that didn’t happen during the latest market drawdown.

The S&P ASX Australian Fixed Interest 0+ Index slumped 10.1% in 2022 in what was a tough year for bonds with 69.2% of funds in the Australian Bonds category underperforming the benchmark.

Active funds had a similar record over the longer term with 66.1% and 79.3% underperforming over 5 and 10-year periods, respectively.

4. Good news for Australian equity A-REIT funds

Some better news for active managers in the Australian Equity A-REIT category posting their lowest underperformance rate since the launch of the SPIVA Australia Scorecard in 2013, with just 41.2% of funds underperforming the benchmark.

Fundies’ outperformance came in one of the toughest years for the segment in recent memory with the S&P/ASX 200 A-REIT dropping 20%, its worst annual performance since 2008.

However, underperformance rates rose over longer time frames, reaching 79.1% over the 15-year horizon.

Fund survivorship

According to the SPIVA report, liquidation rates for most active fund categories were moderate over the one-year period ending December 30, 2022.

Australian Equity General funds recorded the highest liquidation rate, at 7.4%. In contrast, only 2.0% of Australian Equity A-REIT funds failed to survive.

Over the longer term, survivorship rates were significantly lower, with over 50% of funds merged or liquidated over a 15-year horizon in all but one reported category.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.