What just happened? War escalates, sanctions announced, oil pumps and gold shines

Getty Images

War… what is it good for? Absolutely not bloody much, for so many reasons. But how is today’s escalation of the conflict in Ukraine impacting some of the world’s major financial benchmarks? Let’s take a tentative look…

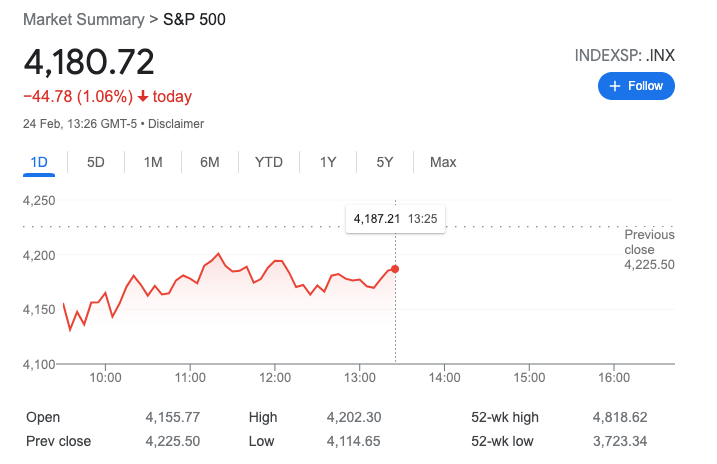

Wall Street – down, up, all over the shop

The morning after Russia’s president Vladimir Putin launched his military invasion of Ukraine, Wall Street’s main indices predictably tumbled, although not by quite as much as their counterparts in Europe. As you can see below, the SPX has been rollercoasting all day so far…

Update: at closing, all three major US benchmarks were up – the S&P 500 was up 1.59%. The Nasdaq was up 3.28%, while the Dow Jones was up 0.1%.

S&P 500 correction update: -14.6% from its high in early January, the largest decline since Feb-Mar 2020 and longest correction since 2018 (51 days). $SPX pic.twitter.com/O9HHhPw0Dw

— Charlie Bilello (@charliebilello) February 24, 2022

On Tuesday, US President Joe Biden announced the “first tranche” of financial sanctions targeting Russia in response to Putin’s deployment of troops in eastern Ukraine’s Donetsk and Luhansk and the move to recognise the independence of the two pro-Moscow separatist republics.

Biden is set to address the United States shortly, with more market volatility expected on the back of further details regarding the sanctions.

This morning, I met with my G7 counterparts to discuss President Putin’s unjustified attack on Ukraine and we agreed to move forward on devastating packages of sanctions and other economic measures to hold Russia to account. We stand with the brave people of Ukraine. pic.twitter.com/dzvYxj7J9w

— President Biden (@POTUS) February 24, 2022

US intelligence agencies offer Biden options for a "large-scale cyber attack" against Russia – NBC

— CaucasusWarReport (@Caucasuswar) February 24, 2022

Russia invading Ukraine is not the Black Swan event.

China invading Taiwan as Russia takes over Ukraine is the Black Swan.

— James Lavish (@jameslavish) February 24, 2022

European markets – battered

Meanwhile, over in London, the FTSE 100 closed for the day at -3.88%, Germany’s DAX was down 3.96%, in France, the CAC 40 was negative 3.83%, while the Italian borsa was the worst hit: -4.1%.

UKRAINE PRESIDENT SAYS IF YOU EUROPEAN LEADERS DON'T HELP UKRAINE TODAY, TOMORROW THE WAR WILL KNOCK ON YOUR DOOR

— *Walter Bloomberg (@DeItaone) February 24, 2022

And along with Biden, European leaders confirmed today they’re united on financial sanctions against Russia.

European Commission chief Ursula von der Leyen said that Putin was “responsible for bringing war back to Europe”. Sanctions, she said, would “weaken Russia’s economic base and its capacity to modernise”.

UK PM Boris Johnson said that Putin had “chosen a path of bloodshed and destruction” with an “unprovoked attack”, while German Chancellor Olaf Scholz said the Russian President would pay a “bitter price” for his “serious error”.

The UK has decided to immediately freeze the assets of all major Russian banks.

— Anthony Pompliano 🌪 (@APompliano) February 24, 2022

Meanwhile French President Emmanuel Macron expressed France’s solidarity with Ukraine, as did Italian Prime Minister Mario Draghi, who labelled Russia’s attack “unjustified and unjustifiable”.

#Ukraine: Footage reportedly showing a Russian jet fighter firing an air-to-ground missile into a civilian home. Exact location and casualties unknown.

(via @Kyruer) pic.twitter.com/NJvNmHDtmB

— POPULAR FRONT (@PopularFront_) February 24, 2022

https://twitter.com/Caucasuswar/status/1496868703899684867

At least 40 people have reportedly been killed after explosions were reported in multiple cities in Ukraine, according to an advisor of the Ukrainian President Volodymyr Zelenskyy. That tally may unfortunately be much higher than that by the time this is published.

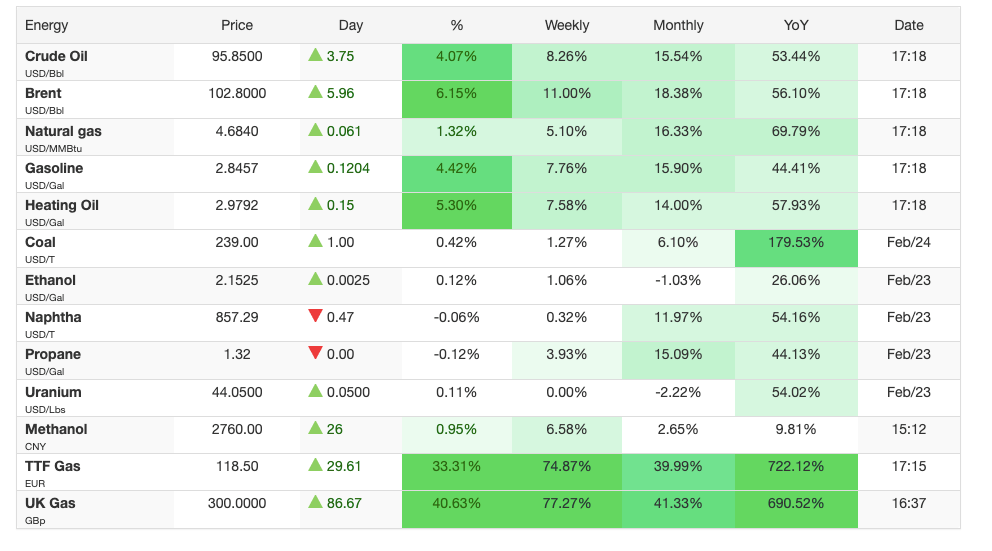

Commodities – energy surges, gold does its safe-haven thing

Anyone looking for green in the markets today, then here it is…

Sanctions imposed on Russia, the world’s third-largest producer of oil, are already having a broad effect on commodities, particularly energy stocks.

The global oil benchmark Brent crude at one point today moved above US$105 a barrel for the first time since August 2014.

Europe, already facing a supply crisis in this sector, is hugely reliant on Russia for its energy.

🔴Why Russia Might Want Sanctions

Russia produces 10 M + barrels of oil per day and have 2.3k+ tonnes of gold.

If oil goes up to $10 per barrel, Russia adds $3 B/mnth. If gold rises 10%, Russia adds $15 billion.

Russia might have no pain, only profits

— Mark Moss (@1MarkMoss) February 23, 2022

Gold led a precious metal surge today, and by a long way. Spot gold gained more than 3% at one stage to US$1,985 an ounce, and is now trading at $1,925 an ounce.

Platinum had also been pumping but at the time of writing has since pulled back 2.44%.

Safe haven: Gold or Bitcoin?

We found out today. pic.twitter.com/Z9smsr8pu6

— David Ingles (@DavidInglesTV) February 24, 2022

Aluminium meanwhile has risen 5% on the back of war-induced supply angst – a bit like oil. It hit a record high today of US$3,466 a tonne.

The effect of war on financial markets – surprising?

The world is understandably on edge about further escalation of a war the vast majority of people want nothing to do with. Which, of course, describes all wars. But here’s a question… how do financial markets tend to stack up in times of major conflict?

According to Investopedia, surprisingly okay: “While war and defence spending can be a sizeable portion of the US GDP, wars often have little sustained impact on stock markets or economic growth at home.”

The financial site does caveat that “a war between Russia, Ukraine, and NATO allies, however, may have a more severe impact, especially on commodity prices”.

Impact of war on markets.

Generally speaking, invasions mark bottoms.

However, the most recent wars on record were relatively small and did not involve a significant risk of potential escalation to a direct conflict between multiple major powers.

The Ukraine war could. pic.twitter.com/uUwlJr653F

— Charles Edwards (@caprioleio) February 24, 2022

https://twitter.com/PabloASXcobar/status/1496770087235186689

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.